ASX Small Caps Lunch Wrap: Which Kentucky fried gentleman is all about ‘family values’ today?

Close up of some red velvet theatre curtains

Before this morning’s exciting Bureau of Forbidden Numbers jobs data drop, the ASX200 was keeping the trading floor in laughs with it’s widely lauded headless chook routine.

Short by about 60 points or almost 0.8%, (the market equivalent of an adult chicken head) and with no distracting impetus on the run sheet, the Aussie benchmark was playing for cheap giggles and that’s it.

However, by midday, the ASX200 was down just 38 points or 0.5% at 7355.

ASX200 (XJO)

We’ll get into the details of that shortly, but first we’re off to Kentucky – birthplace of the fast food phenomenon referred to as “Dirty Bird”, and home to America’s premiere horse race, which is so appallingly low-rent that the track is made from gross old dirt.

It’s also home to one state lawmaker, who – having looked out at the political landscape that is slowly dragging America to its own slow, self-inflicted death – has decided to push for legislation he hopes will solve a lot of his home state’s problems once and for all.

Republican (because of course he is) state rep Nick Wilson has introduced a bill to make the practice of having gross, incestuous sex with your First Cousin legal.

Data from 2022 showed that about 16.5% of Kentucky’s population were living beneath the official poverty line, and the state ranks 45th out of 50 for ‘Fiscal Stability’, and has the fifth-worst healthcare infrastructure in the nation.

It has the 14th-highest rate of gun homicides and gun assaults in the US, averaging just under 300 gun homicides every year, and fully 21.9% of the state’s population is considered functionally illiterate.

So it makes perfect sense that Rep. Wilson is devoting his time and energy to making it legal to while away the idle hours by banging your cousins in the dirt – because it sounds like there’s not that much else to do.

For what it’s worth, Wilson rode his fame as a reality TV star to a place within the state legislature – so that’s another neon-green tick in the box for putting famous people into positions of political power.

Maybe they’ll learn, and things will change… but in the meantime, Kentucky is no doubt bracing for an even larger number of seven-toed children should Wilson’s yearning for some down-home cousin bangin’ action make it back onto the right side of the law this year.

TO MARKETS

That spike at about 11.30am is jobs data which has effectively halved the chicken head and, according to Tony Sycamore at IG markets, the punters can hope for more on the back of the rather Reserve Bank rate cut-shaped employment numbers.

The Australian economy lost a sizeable 65.1k jobs in December vs. the 15k gain expected.

The unemployment rate remained unchanged at 3.9% due to a significant drop in the participation rate from 67.1% to 66.8%.

David Taylor, ABS head of labour statistics, said: “With employment dropping by 65,000 people, along with a small fall in the number of unemployed people (1,000), the unemployment rate remained steady at 3.9 per cent in December.

“The fall in employment in December followed larger than usual employment growth in October and November, a combined increase of 117,000 people, with the employment-to-population ratio and participation rate both at record highs in November.”

Tony says he expects to find some support in the afternoon session from the soft jobs data and rising prospects of RBA rate cuts.

“Make no mistake, the labour market is cooling, and following a recent run of softer inflation data, RBA rate cuts are coming. Q4 inflation data, scheduled for release on the 31st of January, will determine whether expectations of two 25bp RBA rate cuts become three in 2024.” Tony says.

I for one, thnk that’s terrific news, because trade on Thursday morning has been far from exemplary.

In random corporate news, APM Human Services (ASX:APM) stock has carved off a 40% chunk of itself after the international HR provider warned of dire 1H results.

And in lithium blues – Liontown Resources (ASX:LTR) is down about 12% following news that jilted takeover keen bean Albemarle sold its circa $121m stake overnight.

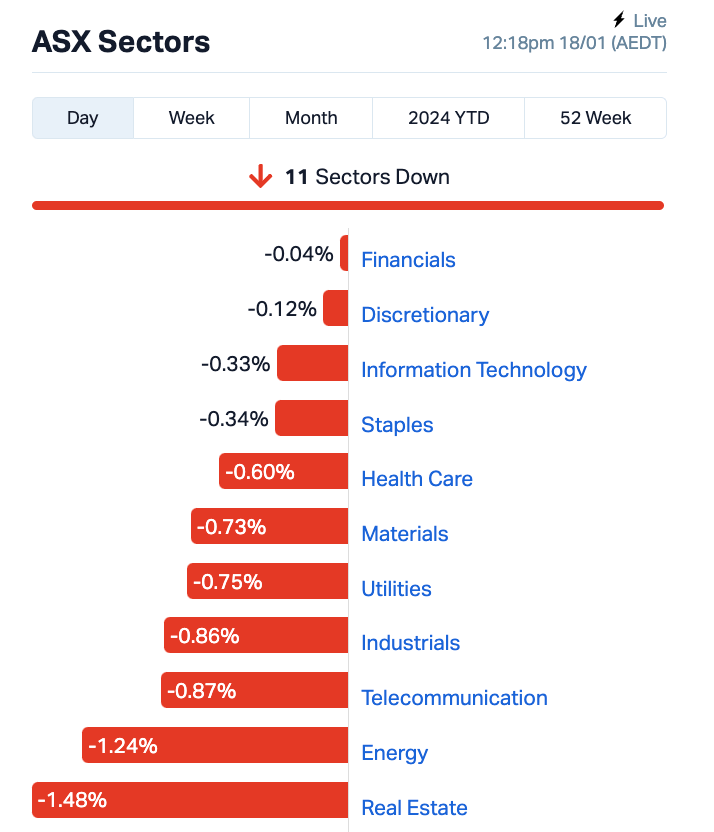

If all 11 ASX Sectors were currently watching highly regarded indie cinema from the 90’s it would be Krzysztof Kieślowski’s Three Colours: Red.

If it was an evening of crackers, wine and ironic post-modern UK pop: it’d be buckets of Burgandy to the Greatest Hits of Simply Red.

If they were a crack team of spies cut loose and operating on the fringes with only seconds to correctly choose which wire to cut before detonation: They CHOOSE RED.

ASX SECTORS AT LUNCH ON THURSDAY

Not the ASX

Yes it’s not true. China is running out of people.

The news about China’s falling population is indeed the start of a demographic trend. Deaths are outpacing births. Life is not a race, but if it were death is now winning as far as the ruling Chinese Communist Party goes.

Beijing has rolled out about 30tn yuan (US$4.1tn) worth of ineffective ideas to build the so-called Silver Economy, and which by 2035 the CCP hopes should account for about 10% of GDP.

Right now, all it does is calls into question the very Chinese Dream president Xi Jinping has been boasting about these last years – in China you might just have to accept that you’ll get old before you get rich.

Young people, (16 – 25) have a 13.9% jobless rate as of official data on Wednesday. It’s worse on the ground than the data suggests.

At least, it’s going to when these jobless youngsters get called on to pay for the early retirement of China’s badly skewed ageing population.

Wall Street

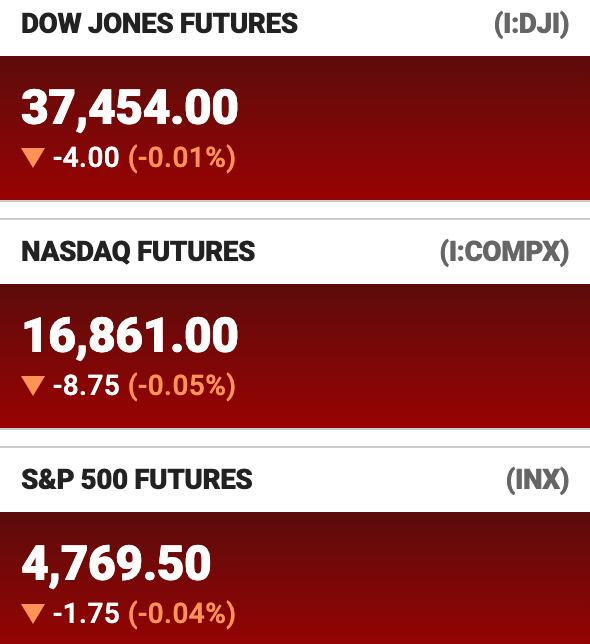

US markets struggled again overnight, all three majors in the red as investors weighed cautious statements from central bankers over the pace of any upcoming interest rate decreases as U.S. economic data remains resilient.

The Dow fell 94 points to 37266, the S&P 500 and the Nasdaq lost 0.6%.

In commodity markets, Brent crude oil fell 0.4% to US$77.96 a barrel while gold was down 1.1% to around US$2,006.

Here’s US Futures’ favourite Game of Thrones Episode, the Red Wedding:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 18 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WML | Woomera Mining Ltd | 0.0105 | 50% | 62,026,395 | $8,526,973 |

| HLX | Helix Resources | 0.0045 | 50% | 1,763,000 | $6,969,438 |

| ME1 | Melodiol Glb Health | 0.0015 | 50% | 1,112,438 | $4,916,618 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | 315,000 | $6,807,236 |

| NGS | NGS Ltd | 0.017 | 31% | 64,800 | $3,265,956 |

| XPN | Xpon Technologies | 0.026 | 30% | 63,392 | $6,072,163 |

| OSM | Osmond Resources | 0.09 | 29% | 870,526 | $3,282,723 |

| CAV | Carnavale Resources | 0.005 | 25% | 4,550,000 | $13,694,207 |

| EML | EML Payments Ltd | 0.91 | 22% | 9,277,809 | $279,314,944 |

| ID8 | Identitii Limited | 0.017 | 21% | 274,999 | $6,023,332 |

| LML | Lincoln Minerals | 0.006 | 20% | 50,000 | $8,520,226 |

| IOD | Iodm Limited | 0.275 | 20% | 13,887 | $137,233,923 |

| SOC | Soco Corporation | 0.235 | 18% | 261,573 | $27,650,053 |

| WCN | White Cliff Min Ltd | 0.0175 | 17% | 7,354,594 | $19,152,890 |

| OPN | Oppenneg | 0.007 | 17% | 200,000 | $6,775,078 |

| WTM | Waratah Minerals Ltd | 0.086 | 15% | 45,751 | $11,202,337 |

| H2G | Greenhy2 Limited | 0.008 | 14% | 12,500 | $2,931,291 |

| VMS | Venture Minerals | 0.008 | 14% | 987,949 | $15,470,091 |

| SPN | Sparc Tech Ltd | 0.4 | 14% | 107,272 | $29,975,986 |

| SBR | Sabre Resources | 0.033 | 14% | 16,758,967 | $10,500,574 |

| FG1 | Flynngold | 0.059 | 13% | 195,028 | $7,577,661 |

| BMG | BMG Resources Ltd | 0.018 | 13% | 8,704,817 | $10,140,755 |

| RNX | Renegade Exploration | 0.009 | 13% | 3,044,305 | $8,013,790 |

| LGM | Legacy Minerals | 0.145 | 12% | 100,000 | $12,163,781 |

Osmond Resources (ASX:OSM) has joined the growing list of mining minnows to come screaming out of the woodwork with news about a uranium find, after the company undertook “a review of historical exploration results” for its South Australian Fowler project, which has identified “the potential for large-scale uranium (U3O8) mineralisation.

Osmond had, at the time of writing, piled on a 29% gain on the strength of that release which – just so we’re clear – basically says that the company has cracked open the spreadsheets from long-finished exploration, and now there’s “potential” for uranium in there somewhere.

Meanwhile, Helix Resources (ASX:HLX) is leading the ladder for the day so far, up around 50% despite having no fresh news to titillate investors with today – the last we heard from Helix was on 15 January, when the company announced that it has hit decent, very shallow copper mineralisation at its Bijoux prospect in teh Cobar-Nyngan area of central NSW.

Melodiol Global Health (ASX:ME1) has also lurched round 50% today, again on no fresh info since the company dropped news of a 51% spike in revenue YoY, and that it had raised a handy $215,000 following a placement at $0.001285 per share.

And a bumpy day for Woomera Mining (ASX:WML) yesterday appears to have been re-routed into something of a happy ending, with the company up 50% as well.

Wednesday was not an ideal day for Woomera, after it got shoved into a trading pause, which then blossomed into a full-blown trading halt a couple of hours later – which wasn’t lifted until quite late in the day, once Woomera revealed that it did, in fact, have news.

The news was that Woomera had completed a 26-hole / 2813m RC drill program at its Ravensthorpe projects located in SE Western Australia, and spotted peggies from eight of those holes to boot.

Someone’s gone and bought a bunch of Liron Fendell’s Nutritional Growth Solutions (ASX:NGS) stock – NGS does the nutritional supplements “scientifically formulated by paediatric doctors, patented, and clinically proven to support growth development in children.”

The stock, and perhaps the kids using the stock’s product, are up over 30% at lunch.

Some good news at last for forlorn EML Payments (ASX:EML) investors with the Ireland entrenched payments company sharing the news that it’s winding down its failed PFS Card Services Ireland business.

EML says that PCSIL is now closed to new business and will be wound down in ‘a professional and orderly manner.’

“The PCSIL Board considered a number of strategic options and ultimately concluded that, although presently solvent, the PCSIL business was no

longer commercially viable and sustainable and that it should seek the appointment of a provisional liquidator.”

EML’s remaining cash exposure to the Irish venture is limited to $20m of intercompany debt, with an expected one-off non-cash impairment charge of about $25m to be recognised in the FY24 financial statements arising from the liquidation.

It’s not expected to impact on EML’s previously-stated FY24 guidance and thusly the shares have popped about 22%.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| APM | APM Human Services | 0.835 | -37% | 11,228,389 | $1,215,266,078 |

| EDE | Eden Inv Ltd | 0.002 | -33% | 2,350,000 | $11,034,813 |

| LNU | Linius Tech Limited | 0.002 | -33% | 1,250,000 | $14,817,722 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 1,127,503 | $6,605,136 |

| MHK | Metalhawk | 0.09 | -25% | 715,240 | $11,929,734 |

| FTZ | Fertoz Ltd | 0.043 | -22% | 311,040 | $14,180,915 |

| CDT | Castle Minerals | 0.006 | -20% | 11,099,749 | $9,183,697 |

| NRZ | Neurizer Ltd | 0.01 | -20% | 10,587,270 | $17,224,321 |

| PIM | Pinnacle Minerals | 0.16 | -20% | 1,302,394 | $6,932,623 |

| 1MC | Morella Corporation | 0.004 | -20% | 1,157,447 | $30,893,997 |

| AN1 | Anagenics Limited | 0.016 | -20% | 172,106 | $7,575,557 |

| PNX | PNX Metals Limited | 0.004 | -20% | 3,040,000 | $26,903,124 |

| IND | Industrial Minerals | 0.425 | -19% | 637,109 | $36,099,000 |

| KAU | Kaiser Reef | 0.125 | -17% | 81,456 | $25,656,584 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 7,800 | $7,361,248 |

| TMX | Terrain Minerals | 0.005 | -17% | 200,000 | $8,120,567 |

| EEL | Enrg Elements Ltd | 0.011 | -15% | 4,596,588 | $13,129,545 |

| GTR | Gti Energy Ltd | 0.011 | -15% | 12,047,138 | $26,649,312 |

| TSL | Titanium Sands Ltd | 0.011 | -15% | 348,561 | $25,918,493 |

| SLS | Solstice Minerals | 0.094 | -15% | 4,398 | $11,031,549 |

| ASR | Asra Minerals Ltd | 0.006 | -14% | 800,000 | $11,455,470 |

| TMK | TMK Energy Limited | 0.006 | -14% | 401,570 | $42,858,055 |

| CXU | Cauldron Energy Ltd | 0.039 | -13% | 10,690,481 | $50,977,758 |

| SHG | Singular Health | 0.065 | -13% | 231,413 | $10,598,270 |

| CYQ | Cycliq Group Ltd | 0.0035 | -13% | 3,223,785 | $1,430,067 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.