ASX Small Caps Lunch Wrap: Which former world leader made the most laughably bad predictions for 2023?

Your future is murky, Dimitry – but I can see you falling out of a window if you're not nice to your boss... Pic via Getty Images.

Local markets are down at lunchtime today – not by a lot, but it’s more than just a “that’ll buff out – don’t worry about it” scratch on the ASX paintwork.

Shortly after 12pm, the needle was pointing to a “wait ‘til your father gets home” 0.14%, after dipping in early trade and then rallying to flirt with breaking even, and then sinking gently again as investors got hangry before lunch.

Before I get into that, there’s a quick topic I’d like to touch on, and that’s the trend at this time of year to do a spot of crystal ball gazing and make bold predictions about what’s going to happen in the new year ahead.

In a lot of ways, it can be a fairly easy system to game – pick a bunch of no-brainer predictions, and keep them as vague as possible.

Stuff like “There will be a lot of action around Bitcoin early in 2023”, or “It will be less than 2 weeks into the new year before gregor turns up at work late with another piss-poor excuse for sleeping through his morning alarms”.

The problem arises when high profile people make a very specific guess at what’s likely to happen – and when they do so in a very public way, it leaves them open to criticism at best, and outright mockery when they get it badly wrong.

CNBC’s sentient melting waxwork Jim Cramer is often the target of such criticism, so much so that several people have set up ETFs that specifically make contrary trades to Cramer’s screeching predictions on TV.

The granddaddy of them all, however, belongs to a former Russian President, Dimitry Medvedev, who in late 2022 took to Twitter to make some very sweeping predictions about how 2023 was going to pan out.

On the New Year’s Eve, everybody’s into making predictions

Many come up with futuristic hypotheses, as if competing to single out the wildest, and even the most absurd ones.

Here’s our humble contribution.

What can happen in 2023:

— Dmitry Medvedev (@MedvedevRussiaE) December 26, 2022

I don’t have time to individually pick apart all 10 of his wild predictions, but – as you could probably guess – all 10 of them turned out to be laughably bad calls.

The predictions start with a banger – the prediction that oil prices would top $150 a barrel… and, spoiler alert, it did not. Brent crude flirted with $95 a barrel in September – but that’s about as far as it got.

At this point, Medvedev’s channelling of Nostradamus heads off the rails with alarming speed.

Prediction 2 has the UK re-joining the EU, while prediction 4 says “Poland and Hungary will occupy western regions of the formerly existing Ukraine”. Yikes.

After some drivel about civil war breaking out in the United States because everyone cracked the shits at Texas (which, to be fair, nearly happened…), Medvedev predicted that “All the largest stock markets and financial activity will leave the US and Europe and move to Asia”.

Presumably to spend their ill-gotten retirement money opening up titty bars in the seedy tourist sections of Bali, but you never know…

But it was Prediction 10 that was the icing on the cake: “The Bretton Woods system of monetary management will collapse, leading to the IMF and World Bank crash. Euro and Dollar will stop circulating as the global reserve currencies. Digital fiat currencies will be actively used instead.”

You can check out the rest of the predictions that were 100% incorrect from the Twitter link above – but fair warning… Ol’ Medvedev’s English-language feed is a wild, wild ride.

TO MARKETS

Local markets are weaker this morning, but not in terrible shape by any reasonable measure, with the ASX 200 benchmark meandering around -0.15% as lunch time descends upon the bourse.

The decline is largely due to local and overseas markets reacting to – deep breath – inflation data, after recent numbers out of the US had investors pumping the brakes on their heady predictions about a rate cut arriving sooner rather than later.

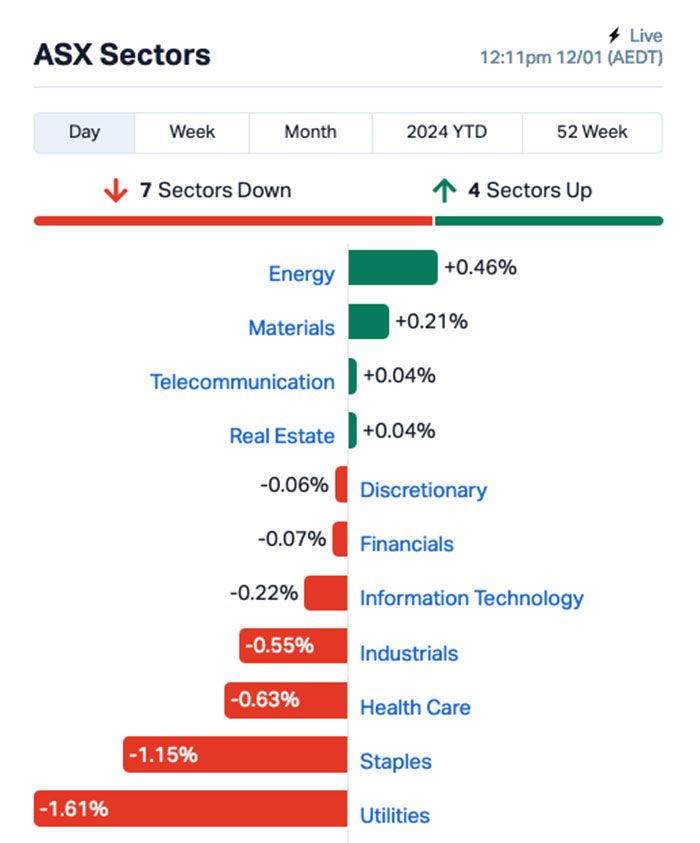

Locally, though, the early running was dominated by Energy and Resources stocks lifting on the back of a few key commodities surging overnight – namely oil, which saw a rise of jut over 2.0% overnight for Brent crude, and a continuing burst of interest in local uranium stocks helped out as well.

That’s put the Energy sector out in front for the day so far, not quite off-setting losses elsewhere that have left Utilities and Consumer Staples languishing below -1.6% and -1.2% respectively.

Interestingly, Tech stocks looked headed for a shocker in early trade, but that sector has managed to rally sharply on the run up to lunch to be a smidgen in front of the rest of the market.

NOT THE ASX

In New York overnight, the S&P 500 fell by -0.66%. The blue chips Dow Jones index was up by +0.04%, and the tech-heavy Nasdaq closed flat, as US investors digested the news that US CPI data wasn’t quite what everyone was expecting.

Earlybird Eddy reported this morning that consumer prices in the US picked up again in December to 3.4% (from 3.1% in November), driven by increase in costs for housing, dining out and car insurance.

“Not bad numbers, but they do show that disinflation progress is still slow and unlikely to be a straight line down,” said Seema Shah, chief global strategist at Principal Asset Management.

“Certainly, as long as shelter inflation remains stubbornly elevated, the Fed will keep pushing back at the idea of imminent rate cuts.”

Despite that little mood killer, there was some positive news… the US weekly jobless claims were also released and showed no signs of a weakening in the US job market – coming in at 202,000 which were lower than forecast.

In US stock news, car rental company Hertz fell -4% after pulling back from its EV push, selling around 20,000 of its EV fleet to buy more internal combustion engine cars, citing maintenance costs.

Cryptocurrency related stocks were mainly lower – with Coinbase down -6.7% and Marathon Digital by -12.6%, as the first US spot Bitcoin ETFs began trading.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ME1 Melodiol Global Health 0.001 -50% 130,000 $9,457,648 MHC Manhattan Corp Ltd 0.003 -25% 50,500 $11,747,919 EDE Eden Innovations 0.002 -20% 25,158 $9,167,534 MCT Metalicity Limited 0.002 -20% 34,000 $11,212,634 NTM NT Minerals Limited 0.008 -20% 14,850 $8,599,029 FOS FOS Capital Ltd 0.2 -17% 49,936 $12,913,473 HOR Horseshoe Metals Ltd 0.005 -17% 163,871 $3,878,872 TMR Tempus Resources Ltd 0.005 -17% 23,218 $2,399,861 YRL Yandal Resources 0.13 -16% 393,031 $36,382,554 RCR Rincon 0.037 -16% 9,488,278 $7,817,167 VAL Valor Resources Ltd 0.003 -14% 900,000 $14,606,672 KAL Kalgoorlie Gold Mining 0.025 -14% 267 $4,596,521 RC1 Redcastle Resources 0.013 -13% 273,300 $4,924,262 HAW Hawthorn Resources 0.087 -13% 15,750 $33,501,561 T88 Taiton Resources 0.069 -13% 8,412 $4,248,189 GCM Green Critical Minerals 0.007 -13% 80,000 $9,092,680 RIE Riedel Resources Ltd 0.0035 -13% 4,000 $8,895,343 SRZ Stellar Resources 0.007 -13% 125,000 $9,192,212 GLH Global Health Ltd 0.105 -13% 544 $6,965,944 HYD Hydrix Limited 0.021 -13% 144,342 $6,101,252 LDX Lumos Diagnostics 0.092 -12% 16,308,780 $50,536,505 ERW Errawarra Resources 0.079 -12% 1,211,438 $8,632,860 1TT Thrive Tribe Tech 0.015 -12% 360,088 $5,042,566 PNM Pacific Nickel Mines 0.07 -11% 113,333 $33,041,995 NXL Nuix Limited 1.87 -11% 2,573,283 $675,287,319

As mentioned earlier, a lot of the day’s leaders are making headway thanks to market conditions and commodity price movement, leaving Lodestar Minerals (ASX:LSR) out in front on a no-news Friday for the company.

However, in amongst the winners list there are a handful of noteworthy mentions, including Duketon Mining (ASX:DKM) with a 16% lift off the back of an upbeat quarterly delivered this morning, showing that the company is still beavering away at its Tate Prospect, located north of the Duketon Greenstone Belt – and that there’s still money in the bank to keep the hunt going for a while yet.

And 88 Energy (ASX:88E) dropped a flow-test update on the market news list this morning, letting everyone know that things are full steam ahead for the Hickory-1 discovery well next month.

There’s still the small matter of building an ice road, well pad and getting the rig out to the site to deal with, but the company sounds pretty positive that things are all on track.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ME1 Melodiol Global Health 0.001 -50% 130,000 $9,457,648 MHC Manhattan Corp Ltd 0.003 -25% 50,500 $11,747,919 EDE Eden Innovations 0.002 -20% 25,158 $9,167,534 MCT Metalicity Limited 0.002 -20% 34,000 $11,212,634 NTM NT Minerals Limited 0.008 -20% 14,850 $8,599,029 FOS FOS Capital Ltd 0.2 -17% 49,936 $12,913,473 HOR Horseshoe Metals Ltd 0.005 -17% 163,871 $3,878,872 TMR Tempus Resources Ltd 0.005 -17% 23,218 $2,399,861 YRL Yandal Resources 0.13 -16% 393,031 $36,382,554 RCR Rincon 0.037 -16% 9,488,278 $7,817,167 VAL Valor Resources Ltd 0.003 -14% 900,000 $14,606,672 KAL Kalgoorlie Gold Mining 0.025 -14% 267 $4,596,521 RC1 Redcastle Resources 0.013 -13% 273,300 $4,924,262 HAW Hawthorn Resources 0.087 -13% 15,750 $33,501,561 T88 Taiton Resources 0.069 -13% 8,412 $4,248,189 GCM Green Critical Minerals 0.007 -13% 80,000 $9,092,680 RIE Riedel Resources Ltd 0.0035 -13% 4,000 $8,895,343 SRZ Stellar Resources 0.007 -13% 125,000 $9,192,212 GLH Global Health Ltd 0.105 -13% 544 $6,965,944 HYD Hydrix Limited 0.021 -13% 144,342 $6,101,252 LDX Lumos Diagnostics 0.092 -12% 16,308,780 $50,536,505 ERW Errawarra Resources 0.079 -12% 1,211,438 $8,632,860 1TT Thrive Tribe Tech 0.015 -12% 360,088 $5,042,566 PNM Pacific Nickel Mines 0.07 -11% 113,333 $33,041,995 NXL Nuix Limited 1.87 -11% 2,573,283 $675,287,319

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.