ASX Small Caps Lunch Wrap: Which blabbermouth killed the ASX winning streak last night?

The market's taken a tumble, little Robbie here has lost his glasses and – by the looks of things – is suffering the indignity of a well-soiled nappy as well. Pic via Getty Images.

Local markets are down this morning, plunging decisively for the first 30 minutes of the session to be on the canvas to the tune of -1.00% and showing a noticeable lack of inclination to dust itself off and “do better”.

To be fair, we were – for the most part – kind of expecting this one. The ASX 200 benchmark got to the end of yesterday’s session with a new all-time high under its belt, and clearly proud of thundering to the eighth straight victorious day.

Investors were smiling. Children were playing happily in the street. Even my meth-addled neighbour Kevin had taken time away from guarding the box of door knobs and window locks he keeps in his backyard, to ride his kid-sized BMX bike to the Red Rooster drive-through around the corner.

So, things had been running pretty hot, and something had to give – and last night, the lips that have sunk a thousand bull runs were hard at work, driving a stake through the heart of investor goodwill in the US.

The Federal Reserve Bank had just wrapped up its talk-fest and, in the face of many competing expert voices, those responsible for making the call on interest rates showed true grit and strong resolve… by keeping things precisely the way they were before the meeting.

This was not unexpected – and, if I’m being fair neither was a public appearance by the only, the only, Jerome Powell, to do what he does best: Slowly half-explain what the Fed’s been doing behind closed doors since the start of the week.

He tried his very best – I’ll give him that much – but in the space of a few short minutes, J-Pow managed to wreak havoc on Wall Street’s grip on the Good Times, which was already tenuous at best before he started talking.

Powell said while the Fed’s interest rate target is “likely at its peak for this tightening cycle”, “we are not declaring victory, we think we still have a way to go.”

“I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting,” Powell added.

“If we get very strong inflation data, and it kicks back up then we’ll go slower or later.”

… Just looking at those words on the screen, they don’t look all that bad.

But, for how things pretty much immediately played out, Jerome could’ve chosen this as his post-meeting press conference, and Miley’d his way into the hearts and minds of all investors aboard the J-Pow Wrecking Ball express.

As Earlybird Eddy put it this morning, Powell’s comments “tore through interest rates-sensitive stocks, leading to a big selloff in the tech heavy Nasdaq.”

One of the things I adore about working with Eddy is that he has the wonderful gift of gentle understatement, especially when things have gone bad.

Because I would’ve said something more like Powell’s comments ripped through rate-sensitive stocks “like gastro through a cruise ship”, or – Jesus, forgive me – “like a bull shark through an influencer”.

So… that’s why sh.t’s a bit rough today – and here are the details, brought to you by the letter J, the letter P, and a solid argument that old people shouldn’t be allowed to have important jobs anymore.

TO MARKETS

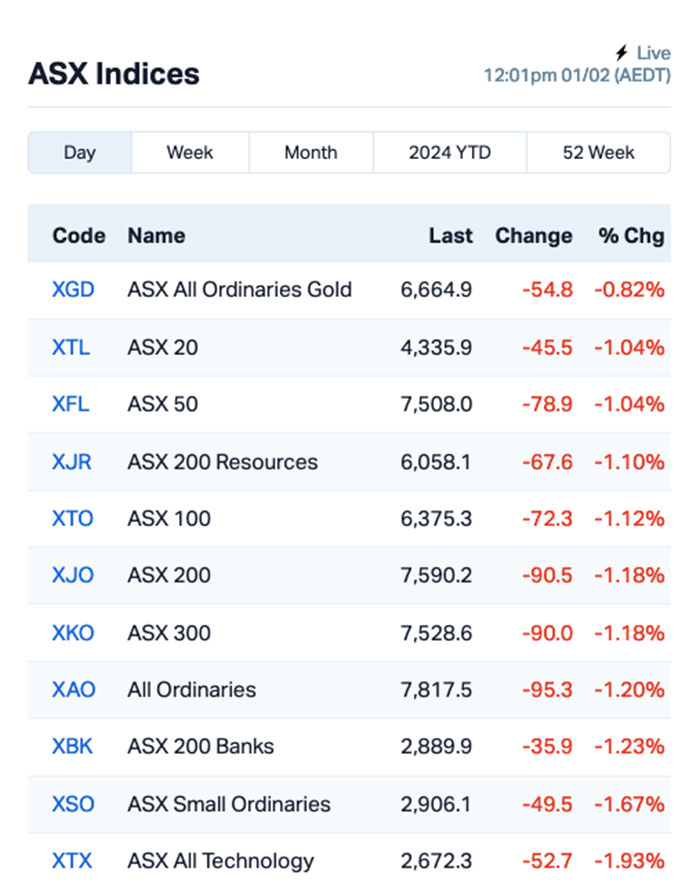

The benchmark’s winning streak is over. Fresh from an eight-session run of gains, including oh-so-briefly setting a new record yesterday, the ASX 200 has been hammered to the tune of 1.18% by the middle of the day.

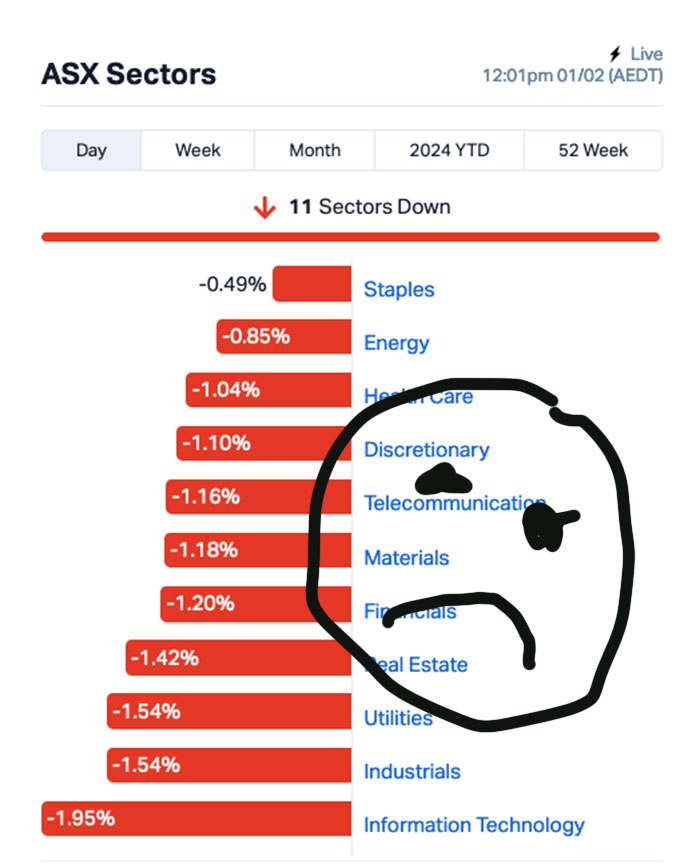

Looking at the sectors, and you could be forgiven for asking “Are you there, God? It’s me… markets” as the bloodletting unfolded, leaving no sector unharmed.

(That gag’s a pretty deep cut, definitely not for everyone… if you’re upset by it, my contact details are at the bottom of the page, and I look forward to your angry emails).

Here’s what the sectors looked like at lunchtime.

You can tell from my use of the Bert Newton Memorial Sadface that it’s unhappy news today – just in case the sight of every single sector deep into the red wasn’t enough of a giveaway.

InfoTech has been hit hardest, because that’s what got hammered in the US overnight – I’ll dig into those details shortly – but the end result is another drubbing that local tech stocks just didn’t need.

InfoTech has had a lengthy spell in the bad books. It’s down a shocking 5.9% since the start of 2024, is by far the worst performing sector on the market, and it won’t surprise you to learn that it’s among the most easily influenced whenever tech comes off the boil in New York.

At the ‘happy’ end of the scale, Energy stocks are proving to be somewhat more buoyant, thanks largely to the whims and wild swings in commodity prices in recent days, and Consumer Staples is the best performer, largely because Woolies and Coles are bracing for a day of heavy stress eating among market-watchers.

Even the safe-haven goldies are taking a pasting today – it’s the best performer among the more granular indices, but it’s only the precious metal’s firm grip on territory above US$2,000 an ounce that’s keeping heads cooler than most today.

Up the big end of town, Chalice Mining (ASX:CHN) has taken a hit this morning, shedding 5.4% after its announcement of cost-cutting set some alarm bells ringing for investors.

And Nufarm’s (ASX:NUF) bold prediction that it’s going to miss forecasts has put a black mark next to its name this morning as well – it sank dramatically in the opening minutes of the session, but has rallied somewhat to only be down a couple of percentage points by the middle of the day.

NOT THE ASX

Most of the background for Wall Street’s unpleasantness have already been explained, but for the sake of being thorough, here’s how it panned out after Jerome Powell opened his mouth in public, having failed to learn his lesson time and time again from similar episodes over the past 18 months.

Basically, the Fed kept rates on hold at 5.25%-5.55% overnight – we all knew that was coming, and the early-January hopefuls had shifted their gaze from a possible March rate cut to a more likely spot of rate relief in May.

Then Jerome said some stuff and now everyone’s second-guessing whether May could be the new target at all – and so, the sell-off began.

The S&P 500 slumped by -1.61%, the blue chips Dow Jones index was down by -0.82%, but it was the tech-heavy Nasdaq that copped the worst of the beating, falling 2.23% by the end of the session.

Alphabet, already in a perilous spot after missing estimates yesterday, fell another 7.5% which is just brutal. Microsoft, which came out of quarterlies yesterday smelling like comparative roses, got hit to the tune of -2.7%.

Earlybird Eddy reports that the biggest mover last night was New York Community Bancorp, which sank -38% after the bank reported a surprise loss for the quarter, and cut its dividend payment.

38%!

In Asian markets, Japan’s Nikkei is down 0.63%, while Shanghai and Hong Kong haven’t opened for the day yet, so you’ll need to look them up yourself.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 1 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Mineral Commodities is out in front on the Small Caps ladder this morning, on the heels of an upbeat quarterly yesterday that painted a picture of a little digger that’s happy in its own skin and doing pretty good.

The company recently completed a Rights Issue, raising $8.8 million to help fund its core activities, which currently revolve around recommencement of operations at the Skaland Graphite mine, and meeting payment obligations as the company works towards 100% ownership of the project.

Singular Health Group added a 48% jump to its bag of tricks this morning, coming out of a trading halt with the announcement that it has locked in a purchase order for 50 3Dicom R&D licences and 5,000 3Dicom Patient licences, for total value of approximately $152,000, via the Roseman University of Health Sciences in Las Vegas, Nevada.

“While the $152k contract is not huge, the purchase means that Roseman University has become the first US College to adopt Singular’s 3Dicom R&D software as a medical education tool, in a market forecast to be worth USD$17.6 billion by 2027,” Eddy reported this morning.

BPM Minerals is in the headlines this morning with a healthy 37.5% gain, following a cheerful quarterly yesterday and news that the company has kicked off a 10,000m drilling program along strike of Capricorn Metals’ (ASX:CMM) 3.24Moz Mt Gibson Gold Project, just 500m from Capricorn’s recent intersection of 16m @ 17.16g/t from 32m.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

ICYMI – AM Edition

Nothing to see here this morning… move along, please.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.