ASX Small Caps Lunch Wrap: Which artist paid dearly for their 15 minutes of fame this week?

Justine might not know much about art, but she knows plenty about what makes her go weak in the knees. Pic via Getty Images.

Local markets opened with a thud this morning, with the ASX 200 shedding close to 100 points in a matter of minutes when the session kicked off at 10am.

The bulk of the damage seems to be stemming from a shocker on Wall Street overnight, on the heels of a hotter than expected CPI result for February that gave New York a burdensome case of the rate cut willies, and spooked all the cows into giving sour milk.

I’ll dig into the details of all that shortly, but first let’s head to Germany, where an artist in search of a breakthrough moment in his career has made a dreadful boo-boo that’s cost him his job.

Management at Munich’s Pinakothek der Moderne museum have revealed that one of the venue’s technical staff took it upon himself to hang one of his own artworks in the middle of an Andy Warhol exhibition, hoping it would get noticed and his career as an artist would blossom.

It certainly did get noticed, but it was other staff who spotted the imposter and reported it to management, who – bafflingly – decided to leave the painting in place for an entire day before removing it from public view.

In a low-key diss to the media, a spokesperson for the museum said: “The employee considers himself as an artist and most likely saw his role in the museum’s installation team as a day-job to support his true calling.”

Sadly, the stunt has cost the artist that very day-job – one that was probably the only thing standing between them and a career much like most of the artists I know, which appears to mainly involve sitting around in paint-spattered clothes, drinking black instant coffee laced with cough syrup and arguing with each other about why they’re “feeling tired” all the time.

The real kicker is that museum staff appear to be taking the whole thing way, waaaay too seriously. While installing his artwork, the technician drilled two small holes in an otherwise blank wall to put some hooks in.

The museum wants him charged with wilful damage to property, which is really strange because I simply cannot imagine how a group of turtleneck skivvy-clad German modern art devotees could be so prissy that they’d get the police involved over damage that would take less than two Euros to fix.

If only they had a technician on staff who was handy with a paintbrush…

TO MARKETS

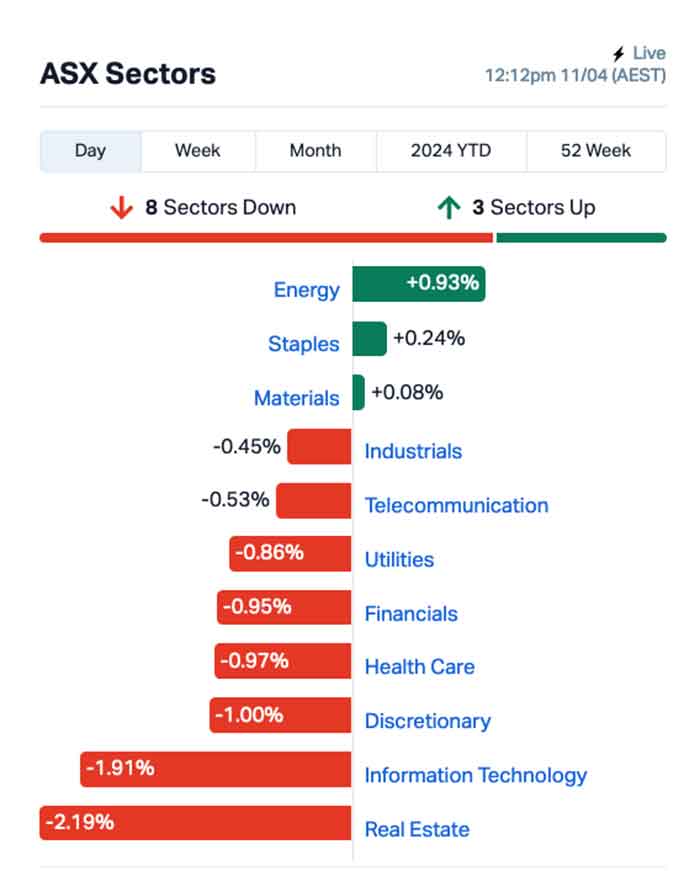

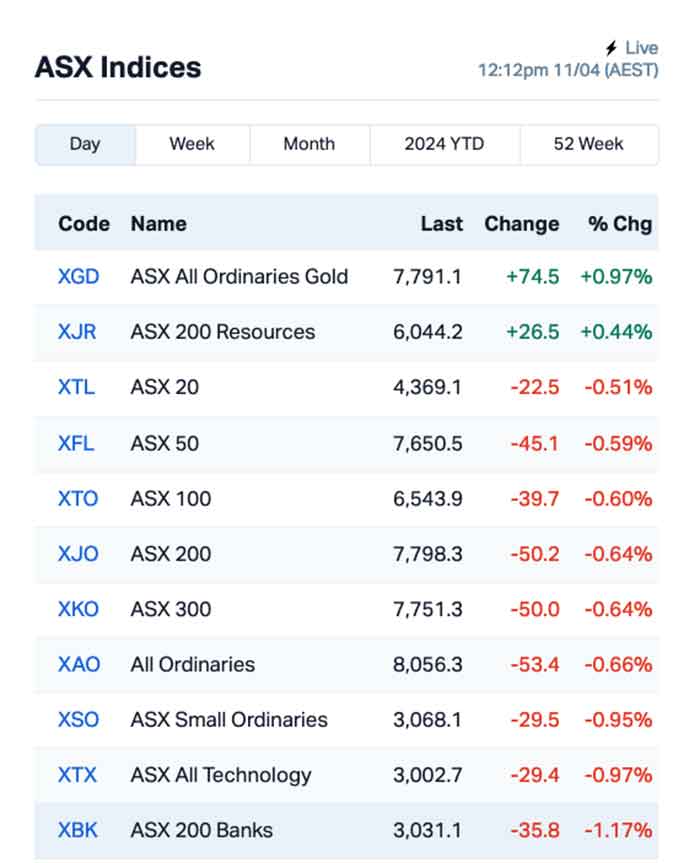

Aussie markets dipped rapidly this morning, following a Wall Street shocker overnight that knocked the wind out of everyone’s sails, and left the ASX 200 down a shade over -1.2% within minutes of opening the doors.

There’s been something of a rally between then and lunchtime, but as we’re unwrapping our PB&Js (with the crusts cut off), the benchmark is still down 0.66%.

The bulk of the bleeding is coming from the Real Estate sector this morning, with a perplexing number of major players losing more than -2.0% since the market sprang to life at 10:00am, including GPT Group (-3.27%), Scentre Group (-2.55%) and Stockland (-2.53%).

There is some good news, though, coming via the Energy sector, with heavyweights on that roster posting decent gains, including Woodside (+1.94%) and Whitehaven (+1.19%).

And, as is often the case when bricks and mortar Real Estate isn’t holding its value, there’s been a lurch towards the goldies, helped along by the precious metal’s recent surge to record highs (and despite a minor 0.8% retreat to $US2332.79/oz overnight).

Up in the nosebleed seats, APM Human Services is rising rapidly today, up +4.36% as bargain hunters swooped on its recent – and rapid – form slump after CVC Asia Pacific was unable to structure a buyout deal to suit both parties at the start of the week.

NOT THE ASX

Wall Street was in a stroppy old mood last night, after US CPI data came in with the brakes ablaze and no one at the wheel.

The data wasn’t super terrible – analysts were expecting 0.3% for the month to drag the YoY total to 3.4% – but instead, got +0.4% and 3.5%, leading the already-twitchy Fed-watchers to loudly hammer more nails into the US rate cut coffin for 2024.

The spectre of no immediate rate cut has been hanging heavily over New York for months, made worse by the bubble-like speculation in January that rate cuts were just around the corner – however, last night’s data has many analysts now talking about only two rate cuts for 2024, and even that is many months away.

The resulting pie fight left the S&P 500 down by -0.95% , the blue chips Dow Jones index down by -1.09%, and the tech-heavy Nasdaq fell by -0.84%.

In US stock news, Meta Platforms climbed +0.6% after announcing the deployment of a homegrown chip to help power its AI services.

Apple fell -1% despite reporting that it assembled US$14 billion worth of iPhones in India last fiscal year, doubling its production in the country.

And Taiwan Semiconductor Manufacturing (TSMC) fell -0.5% despite quarterly revenue growing at its fastest pace in more than a year.

In Asian markets, the big news yesterday was the outright implosion of a little known Chinese company listed in Hong Kong, called China Tianrui Group Cement, which fell 99% in a matter of minutes, before regulators hit the panic button and suspended trade.

See if you can spot the moment it all went wrong:

In broader Asian market news, Shanghai markets are going their own way, up +0.42%, while Hong Kong’s Hang Seng is down -0.99% and Japan’s Nikkei has dropped -0.53%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP KTA Krakatoa Resources 0.02 150% 44,209,167 $3,776,858 CLE Cyclone Metals 0.0015 50% 111,235,169 $10,471,172 RNX Renegade Exploration 0.008 33% 2,606,512 $6,022,018 TKL Traka Resources 0.002 33% 275,962 $2,625,988 PSC Prospect Res Ltd 0.165 27% 4,177,788 $60,233,155 ENT Enterprise Metals 0.0025 25% 662,493 $1,603,942 KPO Kalina Power Limited 0.005 25% 250,131 $8,840,512 HASR Hastings Tech Met - Rights 17-Apr-24 0.017 21% 119,088 $861,252 C1X Cosmosexploration 0.053 20% 819,339 $2,528,900 SIX Sprintex Ltd 0.018 20% 937,441 $7,148,712 CR1 Constellation Res 0.15 20% 71,392 $7,410,053 BPP Babylon Pump & Power 0.006 20% 1,424,909 $12,497,745 EPM Eclipse Metals 0.006 20% 2,288,718 $11,048,278 ENX Enegex Limited 0.025 19% 79,800 $7,747,236 WWI West Wits Mining Ltd 0.019 19% 9,515,739 $38,886,266 RCR Rincon 0.032 19% 2,885,956 $5,971,087 IMI Infinitymining 0.07 17% 34,600 $7,125,203 1MC Morella Corporation 0.0035 17% 756,327 $18,536,398 LNR Lanthanein Resources 0.0035 17% 3,496,471 $5,864,727 BTH Bigtincan Hldgs Ltd 0.18 16% 6,498,735 $95,519,229 CYM Cyprium Metals Ltd 0.0255 16% 6,849,000 $33,543,671 K2F K2Fly Ltd 0.093 15% 71,676 $15,141,102 GMN Gold Mountain Ltd 0.004 14% 211,610 $10,414,270 HHR Hartshead Resources 0.008 14% 1,271,063 $19,660,775 VN8 Vonex Limited. 0.016 14% 32,000 $5,065,601

Krakatoa Resources (ASX:KTA) was way out in front on Thursday morning, banking a +150% gain after it announced that recon work has uncovered a new copper-gold prospect on Turon project defined with rock-chip assays to 1.24g/t Au and 10.45% Cu, with anomalous molybdenum and tin as an added bonus.

The Turon project is located 30km north of Bathurst and 10km east of the high-grade Hill End Gold Mine in NSW.

Prospect Resources (ASX:PSC) was continuing its boost for the heavens from yesterday, building on Tuesday’s announcement that the company has acquired an 85% interest in the large-scale Mumbezhi copper project, located in the Zambian Copperbelt, a prized geological jurisdiction.

Cyclone Metals (ASX:CLE) jumped this morning after announcing an upgraded Indicated and Inferred Mineral Resource of 16.6 billion tonnes containing 29.3% total Fe and 18.2% magnetic Fe, cut-off grade 12.5% magnetic Fe at Project Iron Bear.

The Indicated portion of the Mineral Resource is 2.15 billion tonnes containing 28.68% total Fe and 19% magnetic Fe.

Renegade Exploration (ASX:RNX) announced that its found a very large magnetic anomaly just north of the Mongoose prospect at its flagship Cloncurry Project, which it now plans to drill in May, with the help of a $300,000 Collaborative Exploration Initiative (CEI) grant from the Queensland Government.

And Cosmos Exploration (ASX:C1X) says that high-grade rock chip assays up to 2.20% TREYO (33% NdPr) have been received from its Leatherback L1 mineralised trend, and the results significantly surpass previous high of 1.09% TREYO previously collected from the L2 trend.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.001 -33% 200,000 $3,264,346 AXP AXP Energy Ltd 0.0015 -25% 173,469 $11,649,361 CMB Cambium Bio Limited 0.011 -21% 508,363 $8,580,234 PIL Peppermint Inv Ltd 0.011 -21% 8,894,645 $29,629,017 ICG Inca Minerals Ltd 0.004 -20% 50,000 $4,023,694 8IH 8I Holdings Ltd 0.009 -18% 10,000 $3,930,916 OLY Olympio Metals Ltd 0.05 -18% 268,432 $4,285,966 ASV Assetvisonco 0.014 -18% 799,255 $12,339,222 CCA Change Financial Ltd 0.05 -17% 176,179 $37,659,683 ADY Admiralty Resources. 0.005 -17% 40,000 $9,776,844 NTM Nt Minerals Limited 0.005 -17% 1,070,076 $5,159,417 RR1 Reach Resources Ltd 0.0025 -17% 559,876 $9,836,169 TMR Tempus Resources Ltd 0.005 -17% 77,744 $4,385,992 CGR Cgnresourceslimited 0.285 -16% 849,081 $30,864,585 GGE Grand Gulf Energy 0.006 -14% 191,000 $14,666,729 GTR Gti Energy Ltd 0.006 -14% 156,219 $14,349,630 HXL Hexima 0.012 -14% 956,058 $2,338,555 TMK TMK Energy Limited 0.003 -14% 828,151 $23,645,002 SRL Sunrise 0.78 -13% 119,016 $81,204,748 AEV Avenira Limited 0.007 -13% 3,373,589 $18,792,272 ATS Australis Oil & Gas 0.014 -13% 33,790 $20,429,849 STM Sunstone Metals Ltd 0.014 -13% 3,252,413 $56,010,425 ZMI Zinc of Ireland NL 0.014 -13% 779 $3,410,308 IMC Immuron Limited 0.11 -12% 526,072 $28,499,793 OPL Opyl Limited 0.02 -11% 20,000 $3,810,210

ICYMI – AM EDITION

West Wits Mining (ASX:WWI) expects a new prospecting right to be granted soon after an appeal contesting its application was dismissed by the South African Minister of Forestry, Fisheries and the Environment.

PR 10730 is adjacent to the company’s granted mining right at its Witwatersrand Basin project. This is expected to be a significant step toward a material updating of the company’s existing 4.28Moz resource.

At Stockhead, we tell it like it is. While West Wits Mining is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.