ASX Small Caps Lunch Wrap: Which 81-year-old’s balls have landed him in jail this week?

Pic via Getty Images.

Local markets were a bit directionless this morning, in a morning of contrasts on the bourse that saw the benchmark ASX 200 wobble to an extremely mediocre -0.23% around lunchtime.

There’s a bit to unpack this morning, but before I do, there was some news from Los Angeles this morning that should help set more than a few minds at ease.

For nearly a decade, the LA neighbourhood of Asuza has been terrorised by an ongoing string of slingshot attacks, that has resulted in countless car windscreens and other windows being senselessly and brutally shattered.

While no one has reported being injured, the random onslaught of high-speed ball-bearings has made local residents really, really cross, and left police red-faced as their search for the culprit bore zero fruit.

But the Asuza police department is doggedly determined when it wants to be, and after almost 10 years and countless hours of budget-busting overtime, detectives have finally cracked the case.

Officers swooped on the home of 81-year-old Prince Raymond King (no, really…) overnight, and arrested a suspect after the raid turned up a slingshot, and a box of ball bearings.

Police Lieutenant Jake Bushey told local media that the investigation began when the first attack was reported, noting that it took nearly a decade to make an arrest “because we just didn’t identify who the suspect was”.

It shouldn’t have been all that difficult, as the San Gabriel Valley Tribune reported that the vast majority of the ball bearings appear to have been launched from the old man’s backyard – but he did occasionally venture out to a different location to smash a few windows from time to time.

Bushey went on to tell local media that Prince King hasn’t spilled the beans on why he went on his window-breaking rampage, but did go out on a limb to suggest that “malicious mischief” is likely to blame.

King is being held without bail, and is set to appear in court on Tuesday, LA time – and, for now, Asuza residents can breathe a little easier, knowing that their precious windows are finally safe, now that the alleged perp is behind bars.

TO MARKETS

Local markets opened slightly higher this morning, with the ASX 200 enjoying a 12-point bump when the bell went this morning.

But the good times were over about 15 minutes later, and the benchmark meandered below break-even, like a lost child wandering round a shopping centre looking for mum or dad, but not in a panicky way.

It’s an apt analogy, because two of the major markets the ASX tends to look to for hints on which way to jump each day went dark yesterday – the UK enjoying a very British bank holiday, while the US celebrated Memorial Day by drinking heavily and trying very hard to forget.

The market was hampered this morning by fresh data from the Australian Counting Stuff Collective (ABS), when one of the organisations Action Groups produced its monthly retail spending report, annnnd… it’s a bit s..t.

In seasonally adjusted terms, Australian retail turnover rose by a pathetic 0.1% in April, and from the looks of things, that doesn’t seem to have made investors very happy at all.

It’s far too small to make up for the shellacking retail spending took in March (it fell -0.4% that month), and the failure to recover is yet another symptom of just how rocky the terrain that the Australian economy is trying to navigate really is.

Callam Pickering, APAC economist at global job site Indeed, summed it up quite neatly, pointing out that this is “one of the weakest retail markets we have seen in Australia for generations”.

While it could be interpreted – if you squint while you’re looking at it – as a signal that the RBA’s efforts to get inflation under control are working, it’s still unlikely to be enough to get rate cut hawks to start making any more noise.

Early in the session, one other thing became evident – the big uranium players were getting their butts kicked by investors, with the likes of Paladin Energy (ASX:PDN) losing -3.2%, Boss Energy (ASX:BOE) falling -8.52% and Deep Yellow (ASX:DYL) down -3.87% early in the session.

With the price of uranium basically sitting on its hands for the past few days – it’s up around +0.77% for the week – the only likely culprit for the sell-off appears to be the unravelling of Opposition Leader Peter Dutton’s grand plan to make nuclear power a thing in Australia.

Dutton has been banging the drum about Australia’s need to go nuclear for power generation for ages, but in the past week, the CSIRO produced a report that appears to have had a chilling effect on the Coalition plan.

The report said, in a nutshell, if Australia was to build a 1,000MW nuclear power plant, it would probs cost around $8.6 billion, which is quite a bit of money – and, even if we started construction tomorrow (or at least before the weekend), I’ll almost certainly be dead before the nation sees a single nuclear-powered light bulb flickering to life, in 2040.

Now, far be it from me to editorialise, but it appears that nuclear power and trees finally have something in common – because, as with the planting of trees, it looks like the best time to build a nuclear power plant was probably 20 years ago.

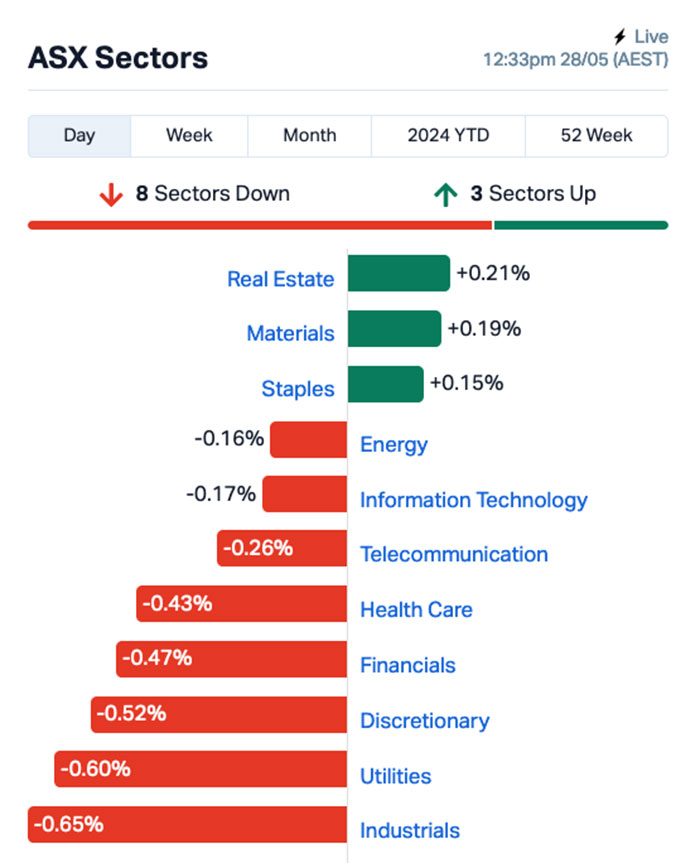

Anyway – by midday, the sectors looked like this:

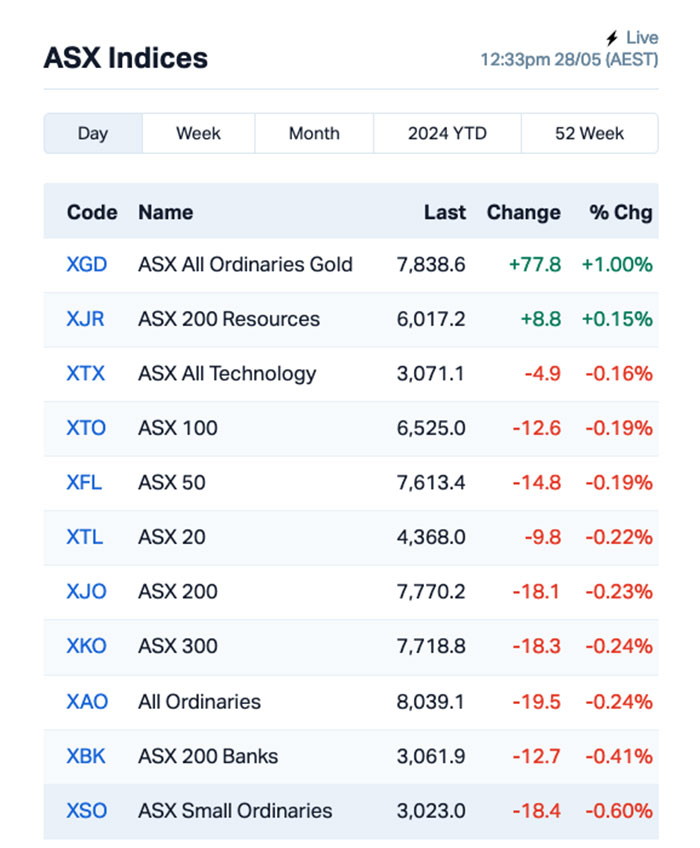

And the ASX indices looked like this:

NOT THE ASX

Both the US and UK markets were closed overnight, leaving local markets a little directionless because we’re not used to being left home by ourselves while mum and dad go out to party.

In the absence of stuff to flex our reportage muscles about from those two exchanges, it makes sense then to move on to the next most crucial markets to see what happened there.

That’s right, we’re off to Tunisia, so I can report on what’s been happening on the all-important and delightfully-named Tunindex – which I can only assume operates alongside the Turnondex and the Dropoutdex made famous by late ’60s guru Timothy Leary.

So… the Tunindex gained 1.19% in the previous session, largely off the back of a sharp turnaround for the country’s earthenware and concrete sector.

Societe Moderne De Ceramique topped the chart with a +5.56% gain, with the overall markets also getting an assist from Carthage Cement (+4.81%), while the rest of the Tunisian bourse’s 78 companies performing in a largely more muted fashion.

The overall market gains were held back by a sell-off for Banque De Tunisie Et Des Emirats, which was down -4.50%, despite recent news that the bank had signed an agreement with start-up Insight Plus, which should see the bank further adopting the Exsys system to streamline its operations on global Forex markets by opening up on-demand trading.

I think that’s what it says… the whole thing’s in French, and I am most definitely not.

In Asian market news this morning, not much has changed. The Hang Seng was up 0.71%, Shanghai markets were subdued at +0.11% and Japan’s Nikkei was down 0.22%, with pundits there blaming the weekend’s sumo wrestling action for being a distraction.

That seems entirely reasonable, as 24-year-old komusubi Onosato stunned followers of the sport by defeating sekiwake Abi on Sunday to win the Summer Grand Sumo Tournament.

I am baffled, but I just can’t look away… it’s like watching two lava lamps get into a bar fight.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap FRS Forrestania Resources 0.06 216% 46,183,650 $3,073,929 1MC Morella Corporation 0.003 50% 3,370,213 $12,357,599 VPR Volt Power Group 0.0015 50% 601,419 $10,716,208 FAL Falcon Metals 0.235 47% 2,069,570 $28,320,000 CAQ CAQ Holdings Ltd 0.044 47% 240,000 $21,533,588 PPY Papyrus Australia 0.016 45% 2,667,824 $5,419,619 KCC Kincora Copper 0.052 44% 460,551 $7,378,901 AQD Ausquest Limited 0.018 38% 1,508,537 $10,726,940 SIS Simble Solutions 0.004 33% 2,468,750 $2,097,117 MQR Marquee Resource Ltd 0.017 31% 4,983,937 $5,373,997 BGE Bridge SaaS 0.026 30% 34,139 $2,387,941 HFY Hubify Ltd 0.013 30% 5,002,549 $4,961,363 RBX Resource B 0.038 27% 92,913 $2,480,535 88E 88 Energy Ltd 0.0025 25% 3,322,507 $57,785,344 ADG Adelong Gold Limited 0.005 25% 136,592 $4,471,956 IVX Invion Ltd 0.005 25% 90,000 $25,698,129 NRZ Neurizer Ltd 0.0025 25% 93,000 $3,804,841 TAS Tasman Resources Ltd 0.005 25% 400,000 $2,850,677 TIG Tigers Realm Coal 0.005 25% 2,226,600 $52,266,809 BCC Beam Communications 0.155 24% 247,532 $10,802,740 BIO Biome Australia Ltd 0.39 22% 722,368 $68,104,986 CDT Castle Minerals 0.006 20% 200,000 $6,122,465 KOR Korab Resources 0.006 20% 28,571 $1,835,250 HMY Harmoney Corp Ltd 0.405 19% 13,278 $34,667,810 A8G Australasian Metals 0.125 19% 150,331 $5,472,652

Tuesday’s early winner was Forrestania Resources (ASX:FRS), which hurtled past +260% before lunch on news that it has signed an option to acquire 100% of Netley Minerals, the holder of one exploration licence and holder of the rights to explore and mine iron ore on two other granted contiguous exploration licences in Western Australia’s Yilgarn region, immediately adjacent to Minerals Resources’ (ASX: MIN) Koolyanobbing Iron Ore operations.

Falcon Metals (ASX:FAL) was also soaring early, on news that the company has made a significant mineral sands discovery at its Farrelly prospect in Victoria.

The company says that of the 91 holes drilled in this campaign, 33 holes contained intersections >10% THM, with 11 holes containing intersections >20% THM – grades significantly higher than surrounding deposits in the region at that scale.

Papyrus Australia (ASX:PPY), which makes fibre, fertiliser and food packaging out of banana waste, made tidy gains on news that it has signed two contracts worth US$1.7m with the Egyptian Government’s National Authority for Military Production (MP).

Kincora Copper (ASX:KCC) has signed a definitive multiple-phase Earn-in and Joint Venture Agreement with a wholly owned subsidiary of AngloGold Ashanti, which gives the latter the right to spend up to A$50 million to earn an 80% interest in the project.

Meanwhile, AusQuest (ASX:AQD) gained ground on news that it has begun drilling three holes to test a recently identified copper-gold target at the Cerro de Fierro Project in southern Peru.

And Marquee Resources (ASX:MQR) inked an option to buy a gold and silver project in Sardinia, Italy, called Sa Pedra Bianca, which covers a large portion of the old Osilo project that boasts a non-JORC resource of 1.65Mt @ 7.06g/t gold and 29.7g/t silver for a total of 376,140oz gold and 1.58Moz silver.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 28 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap HCT Holista CollTech Ltd 0.004 -60% 2,546,683 $2,788,001 GCR Golden Cross 0.002 -33% 32,000 $3,291,768 RIE Riedel Resources Ltd 0.002 -33% 1,600,000 $6,671,507 SIH Sihayo Gold Limited 0.002 -33% 250,000 $36,612,769 WEL Winchester Energy 0.002 -33% 15,125 $3,061,266 CTN Catalina Resources 0.003 -25% 113,009 $4,953,948 SKN Skin Elements Ltd 0.003 -25% 546,468 $2,357,944 ADY Admiralty Resources. 0.008 -20% 1,824,913 $16,294,739 AUK Aumake Limited 0.002 -20% 1,515,000 $4,786,017 BP8DD BPH Global Ltd 0.004 -20% 157,367 $1,954,116 ICU Investor Centre Ltd 0.008 -20% 424,553 $3,045,113 MTL Mantle Minerals Ltd 0.002 -20% 125,000 $15,493,615 ROG Red Sky Energy 0.004 -20% 20,383 $27,111,136 YAR Yari Minerals Ltd 0.004 -20% 375,300 $2,411,789 AAJ Aruma Resources Ltd 0.018 -18% 1,405,680 $4,331,613 BMG BMG Resources Ltd 0.009 -18% 600 $6,971,769 DY6 DY6 Metals 0.135 -18% 1,890,949 $6,667,787 BCT Bluechiip Limited 0.005 -17% 3,716 $6,604,601 CTO Citigold Corp Ltd 0.005 -17% 675,591 $18,000,000 KNB Koonenberry Gold 0.02 -17% 958,188 $6,906,899 QXR Qx Resources Limited 0.01 -17% 490,000 $13,320,934 LDR Lode Resources 0.11 -15% 185,737 $13,881,939 AAU Antilles Gold Ltd 0.006 -14% 15,960,446 $6,975,745 CMB Cambium Bio Limited 0.006 -14% 22,000 $5,362,646 ERL Empire Resources 0.003 -14% 171,712 $5,193,696

ICYMI – AM EDITION

Lithium Universe (ASX:LU7) has established a “same equipment, same supplier” strategy for its Bécancour lithium refinery as it seeks to replicate the procurement success demonstrated by the Jiangsu lithium carbonate plant in China.

By using proven equipment and dealing with the same well-known and reliable suppliers used by the Galaxy team, it will reduce the engineering work required for the definitive feasibility study while minimising the cost and time associated with repeated detailed engineering by tapping into the original supplier’s design and construction experience.

Many Peaks Minerals (ASX:MPK) has started a 6500m reconnaissance drilling campaign to test juicy targets at its recently acquired Odienné project in northwest Côte d’Ivoire.

Miramar Resources (ASX:M2R) has received Programme of Work approval to carry out drilling at its Trouble Bore nickel-copper-cobalt-PGE project in WA’s Gascoyne region.

The approval paves the way for the company to carry out drilling, which is co-funded by the WA state government’s Exploration Incentive Scheme, at the Trouble Bore and Mount Vernon projects to test Norilsk-style targets associated with Kulkatharra Dolerite sills and highlighted by airborne and ground electromagnetic surveys.

This drilling seeks to show “proof of concept” of its Bangemall nickel-copper-cobalt-PGE deposit model by identifying nickel-copper sulphide mineralisation.

It will now work towards obtaining heritage approvals and planning for the maiden drill program.

Sun Silver (ASX:SS1) has started investigations into project grants and alternative funding via various USA government departments including, the Department of Energy (DOE) and the Inflation Reduction Act (IRA) mechanism.

Summit Minerals (ASX:SUM) has received overwhelming interest for a $2m placement that will help to fund an aggressive exploration campaign on its Brazilian niobium and rare earth projects.

At Stockhead, we tell it like it is. While Lithium Universe, Many Peaks Minerals, Miramar Resources, Summit Minerals and Sun Silver are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.