ASX Small Caps Lunch Wrap: Wall Street says ‘jump’, ASX says ‘how high?’

Pic via Getty Images

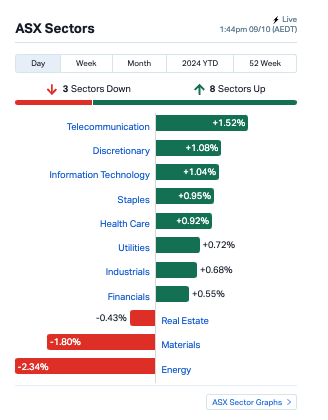

- ASX 200 in the green at lunch on the back of decent Wall Street performance

- The local Teclos, Discretionary and Utilities stock sectors get gold stars for effort

- Commodities and Energy sectors, though… yeah not so much

The ASX kicked off the day on a positive note, and was up by as much 0.5% at midday, driven by a solid rally in consumer and utilities stocks that helped offset some weaker commodity stocks.

The benchmark has since pulled back a tad at the time of writing.

Overnight, a strong rally on Wall Street pushed the S&P 500 to near record highs. US mega tech stocks gained, led by a 4% jump in market darling Nvidia.

On the ASX, the consumer discretionary sector are having a good run on Tuesday, with Wesfarmers (ASX:WES) up by 1.7%.

The APA Group (ASX:APA) led the Utilities sector, rallying by 3.5% after the Australian Energy Regulator decided that the company’s South West Queensland Pipeline wouldn’t be fully price-regulated, keeping the current light regulation in place.

Fellow utility stock, Origin Energy (ASX:ORG) also ticked up by over 1% on the news.

However, these gains were offset by losses in the commodity sector, with energy stocks trading lower today after a 5% crash in the price of crude oil overnight.

The plunge was partly due to China’s disappointing stimulus plans announced yesterday, along with news of a potential ceasefire between Hezbollah and Israel.

As Hezbollah expresses a readiness to negotiate, the situation is evolving, but oil traders remain cautious.

The mining sector is also under pressure this morning, mirroring a sharp decline in iron ore prices in Singapore. Both BHP (ASX:BHP) and Rio Tinto (ASX:RIO) both dropped around 1%.

NOT THE ASX

Over the pond, the New Zealand Reserve Bank has made a bold move this morning by slashing the cash rate by 50 basis points, bringing it down to 4.75% – as per market expectations.

Elsewhere, hopes for a major stimulus from China were dashed yesterday when no new measures were announced, leaving investors disappointed.

But overnight, US investors seemed to have brushed aside that disappointment. The S&P500 rose by 0.97% to near all-time highs, the blue chips Dow Jones was up by 0.3%, and the tech heavy Nasdaq surged by 1.45%.

Big Tech stocks lifted with Nvidia taking charge, up 4% and notching its fifth day of gains after analysts from KeyBanc, Citi, Bernstein, and a few other firms re-iterated their Buy ratings.

KeyBanc bumped up its sales forecast for Nvidia in 2025 from US$128.5 billion to US$130.6 billion, and expects the company’s new Blackwell AI chips to bring in an extra US$7 billion in Q4.

Analysts from Wedbush are also excited about Nvidia after a fresh wave of funding for AI startups. They cite OpenAI’s recent US$6.6 billion funding round, which could spark more investments in the AI space and drive up demand for Nvidia’s AI chips.

And Trump Media & Technology (NASDAQ:DJT) jumped another 18% on Tuesday (that’s an almost 30% pop in the last two days), after a surprise appearance by Elon Musk at Donald Trump’s rally in Butler, Pennsylvania, on the weekend. Trump maintains a roughly 60% stake in DJT.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUH | Austchina Holdings | 0.002 | 100% | 3,834,534 | $2,100,384 |

| AXP | AXP Energy Ltd | 0.002 | 50% | 20,007 | $5,824,681 |

| NES | Nelson Resources. | 0.003 | 50% | 100,000 | $1,277,189 |

| SMM | Somerset Minerals | 0.004 | 33% | 658,597 | $3,092,996 |

| SHP | South Harz Potash | 0.012 | 33% | 3,733,143 | $8,497,601 |

| GRX | Greenx Metals Ltd | 0.870 | 28% | 371,026 | $190,060,702 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 419,936 | $6,338,594 |

| NAE | New Age Exploration | 0.005 | 25% | 11,360,790 | $7,175,596 |

| TMK | TMK Energy Limited | 0.003 | 25% | 40,274 | $13,843,224 |

| LMS | Litchfield Minerals | 0.155 | 24% | 378,668 | $3,445,312 |

| AZ9 | Asianbatterymet PLC | 0.036 | 20% | 577,760 | $9,066,449 |

| BP8 | Bph Global Ltd | 0.003 | 20% | 271,340 | $991,604 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 751,039 | $3,532,015 |

| LML | Lincoln Minerals | 0.006 | 20% | 606,725 | $10,281,298 |

| PUR | Pursuit Minerals | 0.003 | 20% | 205,000 | $9,088,500 |

| WML | Woomera Mining Ltd | 0.003 | 20% | 166,666 | $5,137,686 |

| CAN | Cann Group Ltd | 0.057 | 18% | 763,790 | $22,613,673 |

| POL | Polymetals Resources | 0.400 | 18% | 582,525 | $66,218,626 |

| 1AI | Algorae Pharma | 0.007 | 17% | 1,618,707 | $10,124,368 |

| G88 | Golden Mile Res Ltd | 0.014 | 17% | 293,859 | $4,934,674 |

| LU7 | Lithium Universe Ltd | 0.014 | 17% | 1,243,135 | $7,126,963 |

| SP8 | Streamplay Studio | 0.007 | 17% | 100,286 | $6,903,743 |

| T3D | 333D Limited | 0.007 | 17% | 701 | $716,670 |

| RIM | Rimfire Pacific | 0.064 | 16% | 12,652,899 | $129,547,059 |

| PL3 | Patagonia Lithium | 0.115 | 15% | 60,000 | $5,029,330 |

Polymetals Resources (ASX:POL) is growing increasingly confident in its decision to restart the prolific Endeavor mine near Cobar in NSW after it cropped up some exceptional results from geotechnical drilling at the Upper North Lode area of the project.

The junior believes the intercepts of up to 13.5g/t gold, 1410g/t silver, 12.5% zinc & 34.0% lead are evidence that a significant portion of Upper North Lode can support accelerated mining rates, especially after hitting into a nice thick 67m at 517g/t silver and 2.01g/t gold mineralised zone.

The Endeavor mine is on track for an imminent restart with first cashflows in H1 2025 after an optimised mine plan demonstrated the mine could produce 260,000t zinc, 90,000t lead and 10.6Moz silver to generate a whopping $1.85 billion in revenue over an initial 10-year Stage 1 mine life.

Junior explorer Patagonia Lithium (ASX:PL3) has announced it’s been granted exploration rights for three years on 830154/2024, which is one claim in a group of seven covering 12,032 hectares.

Exec chairman Phillip Thomas noted: “We now have a major component of our exploration concessions granted and are actively assessing the potential for other minerals in addition to lithium, such as antimony, niobium and gold where the granites and ultramafic rocks are present.”

Medicinal cannabis company Cann Group (ASX:CAN) is trading up on capital raising news. The company is seeking to raise, through a non-renounceable rights issue, approximately $6.25 million (before associated costs) in order to fund increased production at its Mildura facility.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 9 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LPD | Lepidico Ltd | 0.002 | -33% | 1,000,000 | $25,767,375 |

| CCZ | Castillo Copper Ltd | 0.006 | -25% | 1,124,749 | $10,396,043 |

| EXL | Elixinol Wellness | 0.004 | -20% | 2,907,402 | $6,605,912 |

| GTR | Gti Energy Ltd | 0.004 | -20% | 300,000 | $13,358,133 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 12,078,700 | $16,439,627 |

| VML | Vital Metals Limited | 0.002 | -20% | 1,030,345 | $14,737,667 |

| KAL | Kalgoorlie Gold | 0.021 | -18% | 2,315,123 | $6,757,710 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 40,926,032 | $86,801,436 |

| SFG | Seafarms Group Ltd | 0.003 | -17% | 200,000 | $14,509,798 |

| ATC | Altech Batt Ltd | 0.044 | -15% | 6,738,393 | $97,962,311 |

| LEG | Legend Mining | 0.011 | -15% | 1,325,727 | $37,823,203 |

| ROG | Red Sky Energy. | 0.006 | -14% | 350,568 | $37,955,590 |

| HPC | Thehydration | 0.020 | -13% | 480,780 | $7,013,001 |

| NYR | Nyrada Inc. | 0.087 | -13% | 960,121 | $18,220,870 |

| ADY | Admiralty Resources. | 0.007 | -13% | 40,000 | $13,035,792 |

| SPQ | Superior Resources | 0.007 | -13% | 5,201,225 | $17,358,910 |

| SPA | Spacetalk Ltd | 0.022 | -12% | 208,208 | $13,664,353 |

| DAL | Dalaroometalsltd | 0.023 | -12% | 100,000 | $6,457,750 |

| ODA | Orcoda Limited | 0.160 | -11% | 12,554 | $30,448,272 |

| ORP | Orpheus Uranium Ltd | 0.040 | -11% | 355,028 | $8,542,594 |

| AZL | Arizona Lithium Ltd | 0.016 | -11% | 14,345,080 | $80,528,662 |

| JAY | Jayride Group | 0.008 | -11% | 110,437 | $2,126,782 |

| PXX | Polarx Limited | 0.008 | -11% | 5,222,954 | $21,379,509 |

| OD6 | Od6Metalsltd | 0.034 | -11% | 13,414 | $4,890,227 |

IN CASE YOU MISSED IT

Bailador Technology Investments (ASX:BTI) has completed a $3m investment in Rosterfy, a leading software as a service platform that allows not-for-profit organisations, government bodies and mass-scale sports and events to recruit, screen, train, and schedule their volunteer communities.

This has resulted in a 14% uplift to the valuation of the company’s existing $12.4m investment in Rosterfy, which is now worth $17.1m.

BTI managing partner David Kirk said the funding will allow Rosterfy to expand their global go-to-market teams, and further accelerate their product roadmap to extend their product leadership.

Far East Gold (ASX:FEG) has executed a conditional agreement to acquire the high-grade Idenburg project in Indonesia’s Papua province from PT Iriana Mutiara Idenburg.

Subject to the satisfaction of conditions precedent, the conditional share purchase plan enables the company to secure an initial 51% ownership of the project.

Idenburg covers 952.8km2 and is known for high-grade lode gold occurrences characteristic of orogenic gold systems and sits within the same province that hosts world class Grasberg (>70Moz gold), Porgera (>7Moz gold), Frieda River (20Moz gold) and Ok Tedi (20Moz gold) projects.

It has been previously explored by major companies such as Barrick, Newmont, Newcrest and Placer Dome.

PharmAust (ASX:PAA) has received a $887,129 R&D tax rebate from the Australian Government in relation to eligible Australian or local expenditure incurred in the 2023-24 financial year.

The company has also submitted an Advance Overseas Finding Application to AusIndustry in respect of eligible overseas expenditure incurred during the same period, which is expected to result in an additional $655,274 rebate.

“We continue to appreciate the support that the Federal Government provides for our programs,” managing director Dr Michael Thurn said.

“The R&D Tax Incentive Rebate strengthens PharmAust’s cash position and will be primarily applied toward preparations for the adaptive Phase 2/3 HEALEY ALS Platform Trial, GMP grade MPL manufacturing, preclinical models for other neurodegenerative diseases, regulatory filings, and general working capital.”

At Stockhead, we tell it like it is. While Bailador Technology Investments, Far East Gold and PharmAust are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.