ASX Small Caps Lunch Wrap: US Fed says ‘it’s time’ to cut rates, uranium stocks go flying

Pic via Getty Images

Local markets opened higher this morning, and then kept on climbing for the first 90 minutes of the session, heading steadily to +0.7% before levelling off before lunch.

The reason for the market’s upbeat mood this morning is (mostly) to do with US Fed Chair Jerome Powell, who used his annual appearance at Jackson Hole to foreshadow imminent rate cuts in the US, and predict another six weeks of winter, after he was spooked by his own shadow.

A US rate cut is grand news, but Powell’s comments – however positive – were a tad nebulous.

“The time has come,” Powell intoned, without saying when things would change… only that it’s time they did, and the rest of the hype is now divided into two camps… those who reckon the Fed’s got a 50 basis points round in the chamber, and those who think it’s 25 basis points at best.

Either way, it’s put some vim and vigour in the step of global markets this morning, and the ASX is no different.

Here’s how it’s all panning out.

TO MARKETS

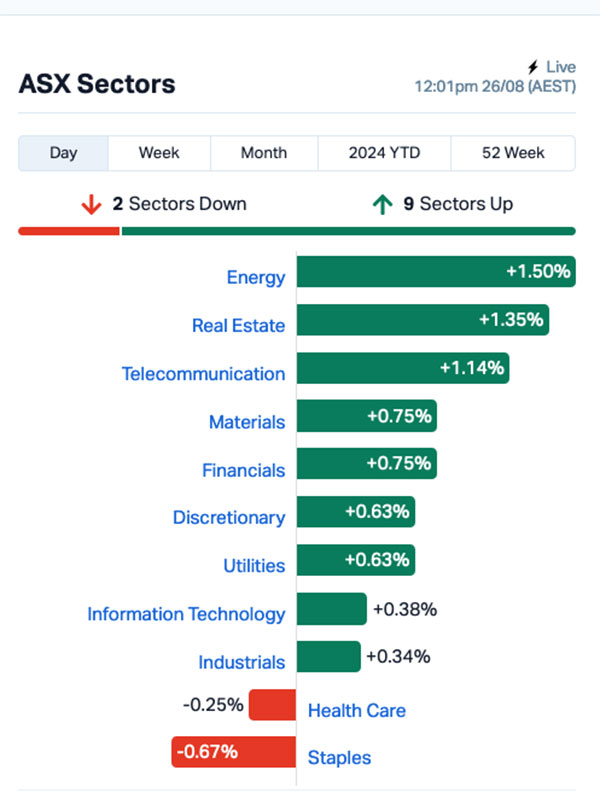

At lunchtime today, the ASX 200 benchmark had stabilised around +0.7%, with the bulk of the gains shared across 9 of the 11 sectors – only Healthcare and Consumer Staples were lagging, and that’s got more to do with some wonky earnings and a local market that clearly isn’t afraid to punish stocks when they don’t behave as expected.

On the plus side of the ledger, Real Estate stocks were leading the charge, up more than 1.5% after Charter Hall (ASX:CHC) and HMC Capital (ASX:HMC) both broke through 3.0% gains for the morning.

The Energy sector was certainly… energetic this morning, with some big winners and some divided sentiment across the group.

Deep Yellow (ASX:DYL) was one big gun that did well, up nearly 17% for the morning, alongside fellow yellowcake diggers Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) – up 12.4% and 11.0% respectively – and basically every other uranium stock on the bourse.

The reason for that is a radical outlook cut from the world’s largest uranium producer, Kazatomprom, which has signalled that 2025 is going to be anything but a bumper year for the company, thanks to shortages of sulphuric acid and other project delays.

Kazatomprom, which supplies about 20% of the global uranium supply, says production will be down by at least 17% for 2025 – and that has sent local uranium stocks soaring.

On the wrong side of the line, though, Healthcare stocks have tumbled this morning, mostly thanks to downward pressure from market heavyweights like Cochlear (ASX:COH) and ProMedicus (ASX:PME), both of which fell between 1.3% and 1.6%.

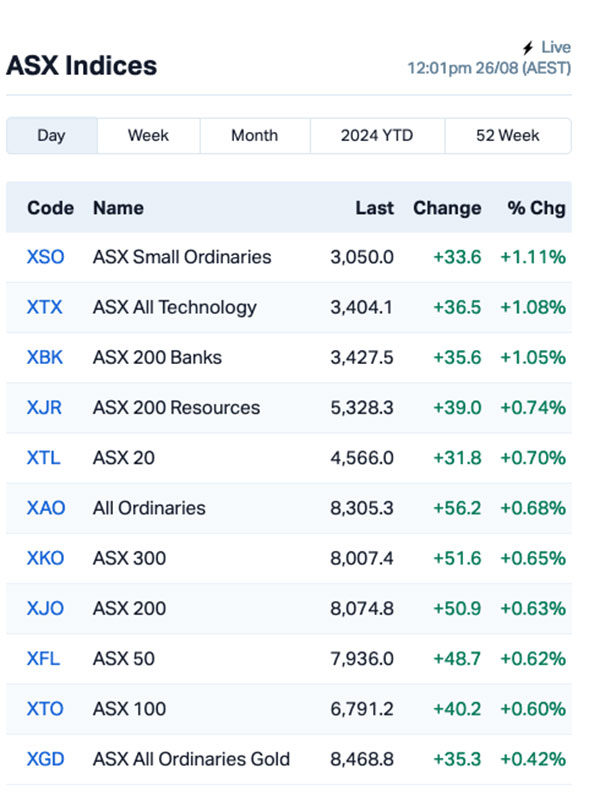

A rapid look at the ASX indices shows investors have been heaping the love on the Small Ordinaries this morning, pushing that group to the top of the ladder on +1.11%, with Tech stocks and the banks in hot pursuit above +1.0% each.

Resources were also performing well, and even the goldies are putting on a bit of a show today as well. What a thrill to have a happy Monday morning.

NOT THE ASX

On Friday, the S&P 500 rose by 1.15%, the blue chips Dow Jones lifted by 1.15%, and the tech heavy Nasdaq climbed by 1.47%.

European shares also closed higher as Jerome Powell said “the time has come” for officials to cut interest rates… without saying precisely when things would start to happen, so it’s a classic J-Pow “hurry up and wait” scenario.

But it had an electrifying effect on US stocks, including Norwegian Cruise and Carnival. Both were both up almost 8%, because nothing quite says “rate cuts” like a crook prawn buffet off the coast of New Caledonia.

Nvidia rallied by 4.5% ahead of its earnings release this Wednesday (US time).

Warner Bros. Discovery rose 7% after news broke about the company’s plans to overhaul its cable network strategy.

Intuit, the owner of QuickBooks fell 7% after the company reported an unexpected quarterly loss and gave weak profit forecasts for the year.

And, shares of memory and data storage company, Micron Technology, dropped 1.4% after Susquehanna lowered its price target for the stock.

In Asian market news, reaction to the US talking up a rate cut has been mixed. Japan’s Nikkei is down 1.03%, the Hang Seng is up 1.01% and Shanghai markets have dipped 0.1% in early trade.

Looking ahead, London markets are closed for a bank holiday tonight, and Ukrainian investors are off celebrating independence day.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 26 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ACW Actinogen Medical 0.002 100.0 88,827,941 $65,082,682 CNJ Conico Ltd 100.0 680,000 $2,201,528 KPO Kalina Power Limited 0.008 60.0 13,434,241 $12,431,970 GCM Green Critical Min 0.003 50.0 9,258,029 $2,937,085 SFG Seafarms Group Ltd 0.003 50.0 369,890 $9,673,198 FTZ Fertoz Ltd 0.036 44.0 7,880 $6,256,222 CT1 Constellation Tech 0.002 33.3 645,562 $2,212,101 ENT Enterprise Metals 0.004 33.3 292 $3,309,952 G6M Group 6 Metals Ltd 0.033 32.0 662,539 $25,100,571 POS Poseidon Nick Ltd 0.0045 28.6 16,167,619 $12,997,372 ADG Adelong Gold Limited 0.005 25.0 433,378 $4,471,956 CRB Carbine Resources 0.005 25.0 70,000 $2,206,951 ECT Env Clean Tech Ltd. 0.0025 25.0 201,178 $6,343,621 EEL Enrg Elements Ltd 0.0025 25.0 258,197 $2,019,930 ICG Inca Minerals Ltd 0.005 25.0 140,000 $3,242,146 IVX Invion Ltd 0.0025 25.0 254,696 $13,275,731 JAV Javelin Minerals Ltd 0.0025 25.0 2,980,997 $8,553,692 NRZ Neurizer Ltd 0.005 25.0 343,000 $8,684,477 SMM Somerset Minerals 0.005 25.0 14,831,195 $4,123,995 VML Vital Metals Limited 0.0025 25.0 3,453,833 $11,790,134

Actinogen Medical (ASX:ACW) was also climbing early on Monday after it announced ongoing analysis of the XanaCIDD phase 2a depression trial data “found a consistent benefit of Xanamem treatment on symptoms of depression in a variety of different endpoints”, which the company says supports the conclusion that a 10 mg dose of the drug is clinically active in controlling brain cortisol and has clinically significant antidepressant activity.

Kalina Power (ASX:KPO), a clean energy focused company, was up Monday morning on news that is has signed an MOU with a major US data centre developer to build AI-focused data centres in Alberta, Canada using natural gas with carbon capture. Kalina aims to capitalise on Alberta’s data centre boom and meet the growing electricity demand. The company says its low-CO2 power projects are well-suited to meet this demand.

Constellation Resources (ASX:CR1) was up after delivering its annual report, which is essentially a whole lot of ‘thumbs up’ for the company which is in the process of diversifying into helium, and is currently enjoying “preferred applicant” status with the WA government for six Special Prospecting Authorities with an Acreage Option (“SPA-AO”) applications covering 56,192km2. “These first mover applications capture two basin scale opportunities that are considered highly prospective for natural hydrogen and helium,” the company says.

Critical minerals and base metals explorer Iltani Resources (ASX:ILT) was up on news that it is commencing follow-up exploration at its high-grade Antimony Reward deposit, part of the Herberton project in Northern Queensland, where historic drilling has already delivered intercepts such as 3m @ 3.49% Sb from 62m including 2m @ 5.51% Sb from 62m downhole.

Poseidon Nickel (ASX:POS) was rising after a rock chip sampling program across its Black Swan and Lake Johnson projects firmed up gold prospectivity at both sites. At Black Swan, chip samples with grading up to 1.25g/t Au have come back from the lab, while soil results have successfully extended the Billy Ray Cu-Au soil anomaly into the largely untested Mantis tenement at Lake Johnson.

And Javelin Minerals (ASX:JAV) is celebrating a major boost to the Mineral Resource Estimate for its Coogee gold-copper project in Western Australia, which has ballooned by 158% to 3.65Mt @ 1.08 g/t Au for 126,685 ounces of gold and 1.01Mt @ 0.41% Cu containing 4,133t copper metal.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 26 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap FGH Foresta Group 0.004 -33.3 4,839,240 $14,132,274 HMG Hamelingoldlimited 0.09 -28.0 165,769 $19,687,500 KLS Kelsian Group Ltd 3.695 -26.2 3,494,708 $1,351,591,743 EXL Elixinol Wellness 0.003 -25.0 173,384 $5,284,729 GMN Gold Mountain Ltd 0.003 -25.0 134,452 $15,629,893 BCB Bowen Coal Limited 0.012 -20.0 9,617,590 $42,737,687 88E 88 Energy Ltd 0.002 -20.0 2,896,687 $72,334,530 RML Resolution Minerals 0.002 -20.0 10,391,026 $4,025,055 IMI Infinitymining 0.022 -18.5 324,404 $3,206,342 CLG Close Loop 0.26 -17.5 2,905,930 $167,532,708 AKN Auking Mining Ltd 0.01 -16.7 437,339 $3,824,244 AVE Avecho Biotech Ltd 0.0025 -16.7 1,056,476 $9,507,891 FHS Freehill Mining Ltd. 0.005 -16.7 111,500 $18,471,167 ROG Red Sky Energy. 0.005 -16.7 941,238 $32,533,363 NHF NIB Holdings Limited 6.135 -15.6 3,267,804 $3,526,516,086 PVT Pivotal Metals Ltd 0.011 -15.4 1,195,552 $9,153,538 AUQ Alara Resources Ltd 0.034 -15.0 661,415 $28,723,502 G11 G11 Resources Ltd 0.017 -15.0 783,774 $18,632,442 TMK TMK Energy Limited 0.003 -14.3 1,797,794 $24,225,642 DY6 Dy6Metalsltd 0.053 -13.1 85,000 $3,075,061

ICYMI – AM EDITION

Nothing to see here for the morning, so go and enjoy your lunch!

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.