ASX Small Caps Lunch Wrap: Traders eye China’s “bazooka” as Antilles Gold shines

Trader await China’s “bazooka stimulus”. Pic: Getty Images

- ASX 200 flat midday with mixed gains and losses

- Mining stocks lift ASX as traders await China news

- RBA releases meeting minutes

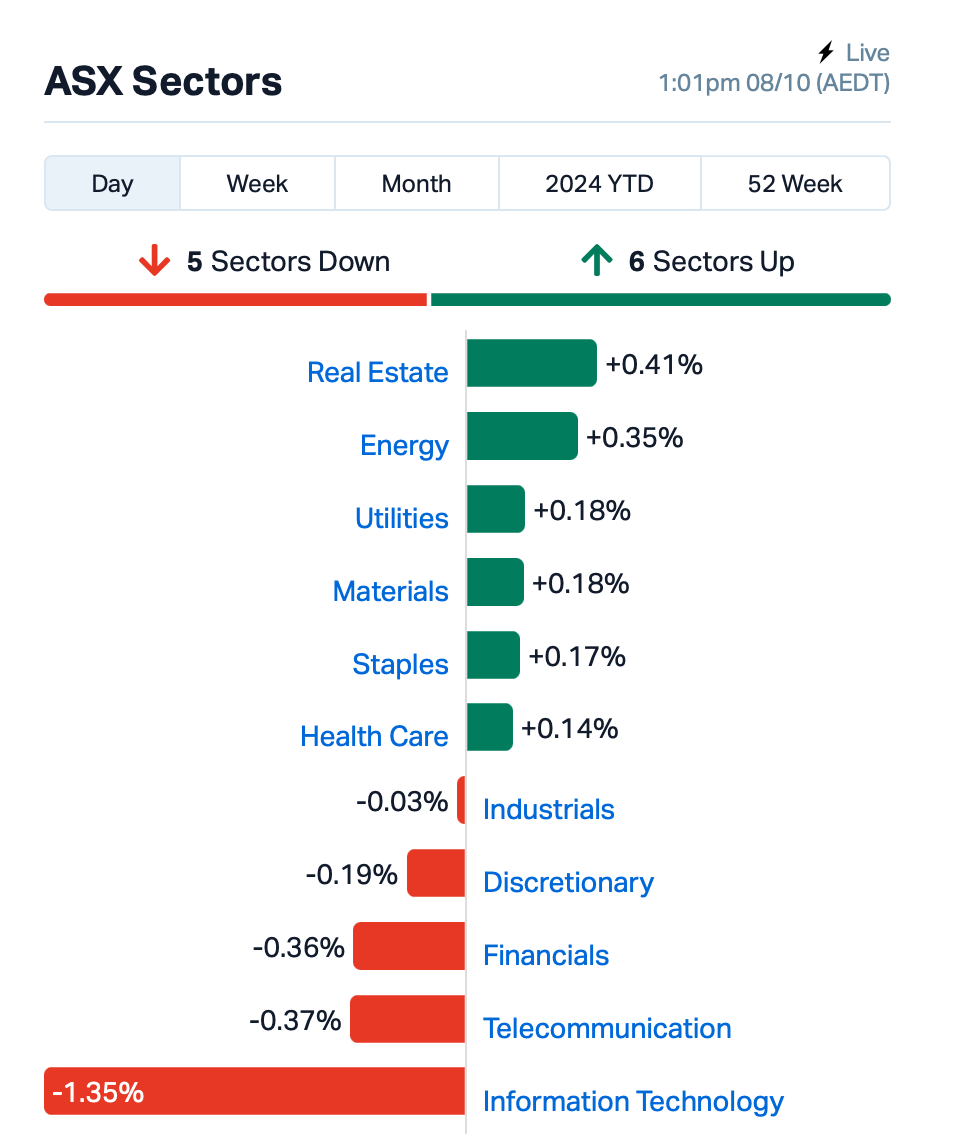

Six of 11 ASX sectors rose at midday as traders wait for (hopefully) some big news on China’s stimulus plans.

But overall, the ASX 200 index was trading flattish, as gains in Real Estate, Energy and Mining were offset by losses in Tech.

Overnight, big tech stocks dragged Wall Street lower as traders adjusted their expectations for a smaller rate cut from the Fed Reserve next month.

At the moment, there’s an 85% chance of a 25 basis point cut at the Fed’s November meeting, but the odds of no-cut has jumped to 15% from zero just a week ago.

Top Chinese economic leaders are expected to announce some new policies today, aimed at boosting growth following last month’s stimulus measures that sparked a massive rally in the Chinese stock market.

Beijing is facing a tough challenge to get the economy to grow by 5% this year, and the market is now hoping for some type of “bazooka stimulus”.

But some experts are skeptical.

“If the measures are not proven to be effective … it will be even worse, because it means that not even the stimulus works,” said Alicia Garcia Herrero at Natixis.

Iron stocks rallied ahead of the announcement and energy stocks were also on the rise, with Brent crude hitting over $US81 a barrel last night—the highest since August.

In the large caps space this morning, fertiliser and explosives maker Incitec Pivot (ASX:IPL) said its chief financial officer, Paul Victor, will be leaving the company. He’ll stay on as CFO until February 15. IPL’s share price fell 0.2%.

NRW Holdings (ASX:NWH) has landed a $360 million deal with Evolution Mining (ASX:EVN) for surface mining at Castle Hill in WA. Work is set to start in November and should wrap up by mid-2030. NRW’s shares climbed by 0.5%.

And the RBA has this morning released minutes from its September board meeting, where it decided to keep the cash rate steady at 4.35%.

The board members stressed that future decisions will depend on economic data. They also discussed scenarios where interest rates might need to stay high or be tightened further, particularly if consumer spending picks up due to rising household incomes.

The minutes noted: “Monetary policy could need to be tightened…should present financial conditions turn out to be insufficiently restrictive to return inflation to target.”

“Returning inflation to target remains the Board’s highest priority.”

NOT THE ASX

Overnight, Wall Street mostly tumbled as traders adjusted their expectations for a smaller rate cut from the Fed Reserve next month.

The S&P500 fell by 0.96% after notching a four-week winning run, the blue chips Dow Jones was down by 0.94%, and the tech heavy Nasdaq tumbled by over 1%.

Wall Street’s go-to measure of market volatility, the VIX, soared by 18% to its highest level in two months.

The yield on the US 10-year note climbed 7 basis points to 4.03%.

Brent crude surged by 4% to above US$81 a barrel as tensions in the Middle East escalated.

A selloff in Big Tech companies pulled down stock prices, fuelled by concerns the Fed will choose a smaller rate cut next month after Friday’s blowout jobs report.

Stocks like Amazon, Meta, and Tesla fell between 2%-3%, while Nvidia climbed by 2% as the lone gainer among ‘Mag 7’ stocks.

Alphabet sank 2% after a judge decided the company must remove restrictions that stop developers from creating competing marketplaces to its Google Play Store.

Apple also fell over 2% after Jefferies analyst Edison Lee downgraded the stock from Buy to Hold, citing concerns about overly optimistic expectations for the new AI-enabled iPhones.

“Near-term expectations for iPhone 16 and even 17 are too high,” Lee said in a note.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 8 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap RIM Rimfire Pacific 0.059 48% 14,163,797 $91,809,376 AAU Antilles Gold Ltd 0.004 33% 19,033,558 $5,567,228 RNE Renu Energy Ltd 0.002 33% 1,001,664 $1,206,201 PNT Panthermetalsltd 0.026 30% 24,582,307 $4,706,973 88E 88 Energy Ltd 0.003 25% 19,383,146 $57,867,624 NTM Nt Minerals Limited 0.005 25% 250,000 $4,069,612 PUR Pursuit Minerals 0.003 25% 1,152,630 $7,270,800 PIQ Proteomics Int Lab 0.800 21% 2,257,887 $86,461,794 AHK Ark Mines Limited 0.230 21% 40,427 $10,534,818 MKR Manuka Resources. 0.054 20% 3,733,035 $35,089,545 BMR Ballymore Resources 0.150 20% 82,442 $22,091,323 CUL Cullen Resources 0.006 20% 30,492 $3,467,009 MEL Metgasco Ltd 0.006 20% 588,652 $7,287,934 AU1 The Agency Group 0.021 17% 72,015 $7,714,379 LNR Lanthanein Resources 0.004 17% 259,999 $7,330,908 OVT Ovanti Limited 0.004 17% 865,587 $4,669,045 PAB Patrys Limited 0.004 17% 422,740 $6,172,342 PTR Petratherm Ltd 0.053 15% 1,041,160 $12,250,713 AQX Alice Queen Ltd 0.008 14% 397,000 $8,028,230 NSX NSX Limited 0.032 14% 152,886 $12,817,867 HPR High Peak Royalties 0.072 14% 57,726 $13,107,762 EME Energy Metals Ltd 0.105 14% 125,571 $19,290,865 BCA Black Canyon Limited 0.065 14% 68,503 $4,660,061 PLL Piedmont Lithium Inc 0.205 14% 5,186,711 $73,877,760 TMG Trigg Minerals Ltd 0.034 13% 18,702,201 $15,920,421

Antilles Gold (ASX:AAU) has set an ambitious production target of around 4500 tonnes per annum (tpa) for antimony from its La Demajagua mine in Cuba. Recent metallurgical tests conducted have led to revised production estimates. The mine is expected to produce approximately 50,000 tpa of a gold-arsenopyrite concentrate, along with around 5560tpa of a gold-silver-antimony concentrate.

Following alkaline leaching, about 3980tpa of antimony precipitate with an estimated 48% antimony content will be produced. When blended with the gold-silver-antimony concentrate, the final product will yield roughly 9540tpa, containing significant amounts of gold, silver, and antimony.

With current metal prices, Antilles said the projected annual revenue from the gold-silver-antimony concentrate could reach around US$84 million over the first nine years of operation.

Panther Metals (ASX:PNT) jumped after announcing that numerous gold nuggets were discovered at the Comet Well and Comet Well South project areas, including a striking gold in quartz specimen. These initial finds occurred during drill preparations, and subsequent detecting activities near the upcoming drill sites revealed even more nuggets. Additional detecting is currently ongoing across both project areas.

Also, assays have now been submitted for Burtville East, following up on a previous 600m RC programme conducted in 2022, which yielded impressive results. One drill hole, BVE006, showed 15m at 53.94g/t Au from 27m, with a standout intercept of 1m at 478g/t from 28m.

Ark Mines (ASX:AHK) has submitted a mining lease application for its Sandy Mitchell rare earths and heavy minerals project in northern Queensland. The application covers the acreage that forms the basis of the recently reported high certainty measured resource of 71.8Mt grading 1732.7 parts per million monazite equivalent. This resource underpins the completion of a scoping study, supports the application for this Mining Licence, and accelerates ongoing strategic partnership and offtake discussion

Ballymore Resources (ASX:BMR) announced a promising new gold-copper target at its Dittmer Project, near Proserpine in north Queensland. A recent high-resolution magnetic and radiometric survey revealed significant anomalies, including a large 1200m x 800m magnetic body beneath the historic Dittmer mine. 3D magnetic modelling suggests that this area sits above a copper-gold system, supporting earlier findings of elevated copper in the soil. Preparations are now underway to drill and test this exciting new target.

Uranium play, Energy Metals (ASX:EME) , has reported impressive results from its drilling campaign at the Bigrlyi Project, with multiple drillholes hitting high-grade uranium in the A2, A4, and A15 sub-deposits. Notable findings include 5.1 metres at 4,500 ppm eU3O8 from the A2 sub-deposit, and 1.1 metres at 8,600 ppm eU3O8 from the A15 sub-deposit.

The 2024 drilling program has now wrapped up, with all samples sent to the lab for chemical assays. The Bigrlyi Project, located about 350 km northwest of Alice Springs, is a joint venture project that aims to expand its current resource of 6.32 million tonnes at an average grade of 1,530 ppm for a total of 9.66 kilotonnes of U3O8.

Black Canyon (ASX:BCA) has announced promising results from its W2 prospect in Wandanya, located 80 km south of the Woodie Woodie Manganese Mine. Significant assays include 5m at 33.2% Mn and notable higher-grade intervals of up to 48.7% Mn. The mineralisation shows impressive thickness and grade consistency over 240m and remains open for further exploration. The W2 area is thought to represent a new model for hydrothermal manganese enrichment in the Oakover Basin. Plans for metallurgical testing aim to produce a high-grade manganese concentrate.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 8 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EXR Elixir Energy Ltd 0.072 -56% 38,916,089 $197,473,782 HCD Hydrocarbon Dynamic 0.002 -33% 119,602 $2,425,747 VPR Voltgroupltd 0.001 -33% 9,951 $16,074,312 IVX Invion Ltd 0.003 -25% 1,057,882 $27,066,367 YAR Yari Minerals Ltd 0.003 -25% 816,630 $1,929,431 RIL Redivium Limited 0.004 -20% 4,769,052 $13,734,274 TYX Tyranna Res Ltd 0.004 -20% 1,050,000 $16,439,627 IMI Infinitymining 0.035 -19% 344,182 $5,836,998 AKN Auking Mining Ltd 0.005 -17% 1,000,000 $2,115,421 BP8 Bph Global Ltd 0.003 -17% 15,409 $1,189,924 FHS Freehill Mining Ltd. 0.005 -17% 7,088,416 $18,471,167 OMA Omegaoilgaslimited 0.250 -15% 1,444,491 $84,501,852 KOB Koba Resources 0.115 -15% 21,222 $21,405,818 HTM High-Tech Metals Ltd 0.125 -14% 20,000 $3,588,966 SBR Sabre Resources 0.013 -13% 1,174,967 $5,894,429 IR1 Irismetals 0.200 -13% 708,814 $31,995,296 PV1 Provaris Energy Ltd 0.020 -13% 314,786 $14,512,249 ATH Alterity Therap Ltd 0.004 -13% 225,000 $21,281,344 CRR Critical Resources 0.007 -13% 6,143,992 $15,709,469 NAG Nagambie Resources 0.014 -13% 834,962 $12,746,171 8CO 8Common Limited 0.035 -13% 67,980 $8,963,796 SPX Spenda Limited 0.011 -13% 526,222 $55,243,151 COD Coda Minerals Ltd 0.080 -11% 98,228 $15,776,330 ALM Alma Metals Ltd 0.008 -11% 596,048 $13,883,936

Elixir Energy (ASX:EXR) dropped over 50% following the conclusion of operations at the Daydream-2 well, where the stabilised gas flow rate was lower than expected.

Although five out of six stimulated zones flowed gas, the final stabilised rate was only 1.0 MMCFPD, down from a maximum of 2.6 MMSCFD. This reduction was due to issues like condensate or water banking around the wellbore, which are common in early-stage gas plays and could be resolved with improved operational management.

Elixir, however, reported that all licence commitments for ATP 2044 have been met and the well will be retained for future production.

ICYMI – AM EDITION

Elevate Uranium (ASX:EL8) and its operating partner Energy Metals (ASX:EME) have struck more high-grade uranium at their Bigrlyi project about 350km northwest of Alice Springs in the Northern Territory.

The drilling to grow the current resource of 6.32Mt grading 1530ppm U3O8 – 21.3Mlbs contained U3O8 – returned outstanding results in excess of 1% eU3O8 from the A2, A4 and A15 sub-deposits.

BRC2430 returned 5.1m at 4500ppm eU3O from 129m at A2, BRD2415 returned 5m at 3,400ppm eU3O8 at A4 and BRC2428 returned 1.1m at 8600ppm eU3O8 from 129m at A15. All samples from the now completed drill program have been submitted to the laboratory for assaying.

Lumos Diagnostics (ASX:LDX) has completed the retail component of its 1 for 1.82 pro rata entitlement offer, adding about $6.9m to its coffers.

Along with the institutional component of the offer, which raised ~$3.1m, the company now has an additional $10m to drive growth of its business. The company was recently awarded US$3m in non-dilutive funding via a US Government grant to support a CLIA waiver study and US FDA regulatory submission for its test to differentiate a bacterial versus non-bacterial etiology (cause of) respiratory infection.

Peel Mining (ASX:PEX) has a pep in its step following the encounter of oxide and supergene copper, gold, and silver mineralisation during recent drilling at the Wagga Tank-Southern Nights deposit in the south-central part of Cobar, NSW.

Stand out oxide results include 24m at 5.09g/t gold, 89g/t silver from 15m while sulphide assays include 66m at 6.01% lead, 3.73% zinc, 0.26% copper, 32g/t silver and 0.47g/t gold from 100m.

Nearly all mineralised intercepts sit outside the existing 6.83Mt indicated-inferred resource, which remains open along strike. PEX reckons the results pave the way for further drilling which is set to take place later this quarter.

At Stockhead, we tell it like it is. While Ark Mines, Elevate Uranium and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.