ASX Small Caps Lunch Wrap: The ASX is bleeding amid fears that the US is hurtling towards recession

Pic via Getty Images

- Local markets have fallen heavily this morning on fears of a looming US recession

- Just 6 of the ASX 200 stocks were up today, with InfoTech hardest hit among the sectors

- There are some decent wins today, mostly from goldies announcing new finds

Late last night, I had one of those “just before falling asleep” moments, when precisely how today was going to pan out flashed – clear as day – through my mind. The jobs data in the US on Friday was going to spell trouble, that much was already clear.

But even my feverish pessimism before bed last night didn’t quite extend as far as a 2.5% shellacking for local stocks this morning. I was thinking 1.5%, maybe as far as 1.7% – certainly a slide, but nothing like what we’ve seen so far today.

Because the benchmark is being brutalised, and it’s a lot like how I imagine it would be to go and see a Nicolas Cage movie with six people who were also Nicolas Cage – an unrelenting, confusing horror in every direction that you look.

Think happy thoughts… think happy thoughts… think happy thoughts…

TO MARKETS

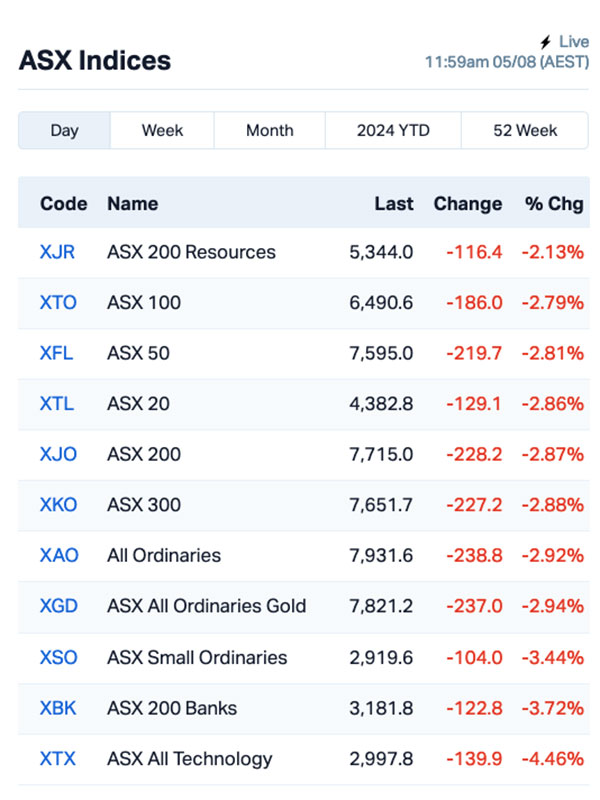

The ASX 200 benchmark has started the week with a precipitous fall from grace, chasing Friday’s steep losses with even more worries and woes, to be down more than 2.8% within an hour of opening the doors.

By 11:15, the benchmark had fallen to 7,708 points, down from Friday’s close at 7,943 – a 3.0% plunge that has hit every sector of the market. Everything was falling – well, almost everything. There are some winners, but the positive pickin’s are slim at best.

First, though, the bad news.

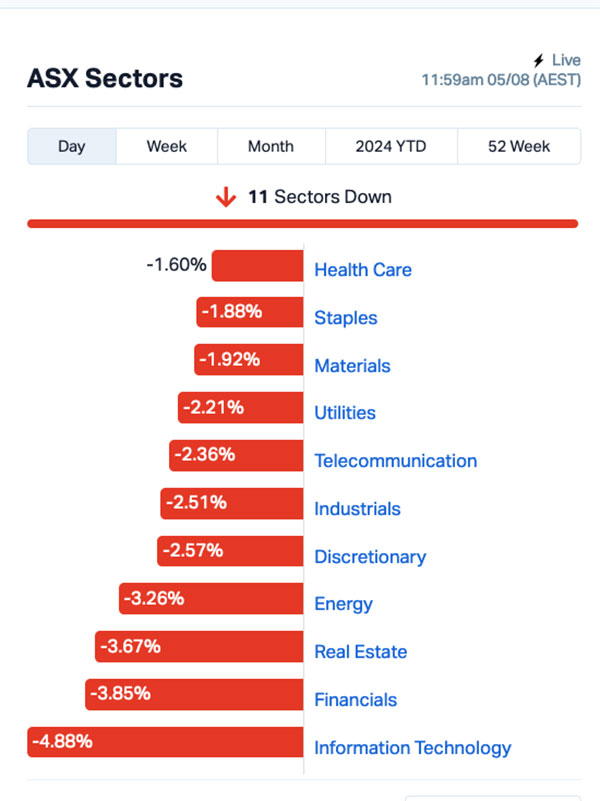

In the run up to lunch, this is how the sectors were looking.

The sell-off has touched every sector, with InfoTech hit hardest at -4.6% for the day.

There were some companies moving through the chaos with a sense of purpose, though. Med tech big gun Resmed was up 2.7% after the company delivered a stellar quarterly on Friday, explaining that it had managed to grow revenue by 9% to $1.2 billion, and announced that it was going to pay a dividend of $0.05 and change per share.

And, in what is surely a sign of the times, Domino’s Pizza has managed to forge ahead this morning, climbing 1.32% amidst the bloodbath.

There’s no actual news to hang that price improvement on for the fast food chain, but the reason is pretty obvious when you think about it – with all this talk of recession floating around, those piping hot $5 slabs of cardboard, pineapple and cheese are looking like an inexpensive source of essential grease and lactose for families that are going to be doing it tough in a few weeks’ time.

Those two companies are among the 6 out of 200 that make up the benchmark that aren’t losing ground today.

The two ASX 200 companies that are being smashed by the selloff today tell another salient story – Zip Co and Block Inc, two big companies that offer short-term finance options to people who otherwise cannot control themselves when they’re shopping online, are bleeding heavily, down 10.2% and 9.4% respectively.

A look at the ASX indices tells a broadly similar story to the headlines – there’s very little in the way of positive news, with Resources doing the best on -2.13%, and the rest of the market staggering in like a beaten forward pack, with InfoTech hurting the most at -4.88%.

There are some winners among the Small Caps, which I will get to shortly – but before I go there, it’s probably best if I try and explain why the ASX appears to be missing a limb or two today.

NOT THE ASX

It’s America’s fault. There, I said it.

It’s no secret the ASX takes its lead from what’s been happening in the US throughout the previous session, and this is no different.

On Friday, after the ASX weathered it’s own big sell-down and the benchmark dropped 2.1%, Wall Street had a shocker.

The S&P 500 banked its worst day since October 2022, down by 1.84%, the blue chips Dow Jones index tumbled by 1.51%, and the tech-heavy Nasdaq crashed another 2.43%.

The reason for that was US unemployment data, which has risen sharply enough to trigger something called the Sahm Rule – named after former US Federal Reserve economist Claudia Sahm, who noticed a pattern and coined the following “rule”.

“A recession is underway when the three-month average of the unemployment rate jumps more than half a percentage point in a year,” the Sahm Rule says.

And guess what? US unemployment moved from 3.8% in March to 4.3% in June – 0.5% in a single quarter – and all of a sudden US investors have hit the panic button.

Now, it’s worth noting that the eponymous Sahm has come out saying that while her rule has, technically, been satisfied, a recession is not exactly a done deal this time around, pointing to how wonky the US labour market has been thanks to the effects of the pandemic in recent years.

But Ms Sahm may as well be screaming about precise wind speeds into the maelstrom of a tornado, because barely anyone’s listening to her today… they’re too busy dumping their portfolios and stocking up on non-perishable food.

The finger pointing, it should be noted, has already begun in the search for a scapegoat. How did unemployment jump so far, so quickly?

… Did the US Fed wait too long to cut rates?

… Has the abundance of caution around interest rates and inflation become an albatross around the Fed’s neck?

That’s not entirely clear, but there’s a growing chorus of people who know about such things who are doing their best to lay the blame at Jerome Powell’s feet.

There’s an interesting side note to all of this, though – and that’s been the moves made by a certain Warren Buffett, whose uncanny ability to predict things well in advance is the stuff of legend.

Notorious for having the most diamond hands of them all, Buffett has been shedding stocks steadily for a while now, moving a lot of his capital into cold, hard cash.

Buffett’s Berkshire Hathaway has sold a mind-numbingly massive number of stocks over the past three months – $US75 billion worth, or thereabouts – leaving the organisation hoarding an apparent $US277 billion in folding money.

To put that in perspective, Berkshire Hathaway has publicly, for a long time, said that its ideal cash status would rest at about US$30 billion – around 10.8% of where it’s currently sitting, which sets Buffett’s position way outside of the norm.

In US stock news from Friday, chipmaker Intel crashed by 26% after reporting a loss in Q2, along with plans to slash dividends and cut more than 15,000 jobs or 15% of its massive workforce.

Amazon fell nearly 9% after it gave sales forecasts that were lower than Wall Street expected. In contrast, Apple rose by 1% despite reporting a decline in iPhone sales but beating earnings expectations.

Nvidia also slid 2% as negative sentiment on chip stocks contributed to a broader slide in the tech sector.

In other markets, oil prices fell more than 3%, mirroring the broader market decline.

Looking further afield, the US and local markets aren’t the only ones suffering at the moment.

In Asian markets, Japan’s Nikkei is off by 4.6%, but the Hang Seng and Shanghai markets are holding reasonably firm, down 0.8% and 0.35% respectively.

Canada, Croatia and Iceland have picked a fantastic day to have a market holiday today, but they’re likely going to wake up with a monster hangover tomorrow.

And just in case you were thinking about packing it all in on the ASX and gambling on crypto for a while, take heed: Bitcoin has slumped 6.32% to US$54,463.90 per imaginary coin, so things are getting a little frosty over there as well.

I don’t know about you, but I’m really in the mood for some good news… and here it is!

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 05 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap E33 East 33 Limited. 0.0205 70.8 2,338,032 $9,302,207 SMM Somerset Minerals 0.003 50.0 950,000 $2,061,997 MTL Mantle Minerals Ltd 0.002 33.3 435,631 $9,296,169 RMX Red Mount Min Ltd 0.002 33.3 532,683 $5,135,366 RNE Renu Energy Ltd 0.004 33.3 1,785,505 $2,178,402 MHK Metalhawk. 0.07 32.1 548,741 $5,335,510 KLI Killiresources 0.12 29.0 2,803,952 $11,180,808 AVE Avecho Biotech Ltd 0.0025 25.0 175 $6,338,594 CAV Carnavale Resources 0.005 25.0 12,000 $13,694,207 TTI Traffic Technologies 0.005 25.0 610,491 $3,891,541 ABE Ausbondexchange 0.031 24.0 99,999 $2,816,703 TEM Tempest Minerals 0.011 22.2 1,791,500 $4,890,387 GES Genesis Resources 0.006 20.0 100,000 $3,914,206 OCN Oceanalithiumlimited 0.04 17.6 1,502 $2,804,932 ADG Adelong Gold Limited 0.0035 16.7 217,817 $3,353,967 FTC Fintech Chain Ltd 0.007 16.7 9,276 $3,904,618 MKL Mighty Kingdom Ltd 0.0035 16.7 1,000,000 $9,647,829 MAUCA Magnetic Resources 1.2 16.5 7,595 $21,031,428 NGY Nuenergy Gas Ltd 0.022 15.8 34,840 $28,138,154 LCL LCL Resources Ltd 0.008 14.3 255,777 $6,754,146

East 33 (ASX:E33) was moving rapidly on Monday after news broke that the company, along with Yumbah Aquaculture, has entered a Bid Implementation Deed that would see an off-market takeover of 100% by Yumbah, for cash of $0.022 per East 33 share – a premium that is well above East 33’s previous close at $0.012 a pop.

Red Mountain Mining (ASX:RMX) was up on Monday morning on news that the company has acquired four exploration licences that are prospective for gold in the Yilgarn‘s Murchison Domain southeast of Mount Magnet. The Project covers 111km2 of the Kiabye Greenstone Belt, an underexplored gold belt adjacent to the Narndee Igneous Complex, where shallow historical exploration has found evidence of gold mineralisation before.

Carnavale Resources (ASX:CAV) was up on news that its ongoing metallurgical testwork for its headline Swiftsure Deposit within the Kookynie gold project in Western Australia has produced some great results, with high overall gold recovery rates ranging from 98.9% to 99.5%, with recovery of gravity gold averaging 87.1% and recovery from carbon in Leach (CIL) test 99.7%.

Metal Hawk (ASX:MHK) joined the growing list of goldies announcing discoveries today, revealing that it has rock chip and soil samples from the new Siberian Tiger prospect at Leinster South which have returned significant high grade gold assays over a broad area. MHK says the best of the results include 20.2 g/t Au with a total of 16 samples grading above 1.0 g/t Au.

Killi Resources (ASX:KLI) says that its hunt for gold at its 100% owned Mt Rawdon West project in Queensland, where pole-dipole Induced Polarisation (IP) geophysical survey showed a strong spatial association with gold-copper mineralisation that have helped the company identify new, discrete chargeable targets in line with earlier surface sampling that showed copper-gold mineralisation of 238g/t Au and 5.4% Cu.

Spirit Telecom (ASX:ST1) was one of a handful of tech companies doing well on Monday morning, after announcing that it is expecting to do better than expected for FY25, saying that the company is confident that its strategy of selling combined Cyber Security, Managed Services and Collaboration platforms will improve its profitability and deliver uEBITDA of between $9.5 million and $10.5 million and revenue of between $150 million and $160 million in FY25.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap APC Aust Potash Ltd 0.001 -50.0 98,963,758 $8,140,379 CNJ Conico Ltd 0.001 -50.0 1,004,985 $4,403,055 RPG Raptis Group Limited 0.008 -38.5 390,551 $825,323 AIV Activex Limited 0.005 -37.5 300,034 $1,724,021 1TT Thrive Tribe Tech 0.002 -33.3 1,848,963 $1,411,865 EEL Enrg Elements Ltd 0.002 -33.3 1,234,712 $3,029,895 RIL Redivium Limited 0.002 -33.3 46,684 $8,192,564 VPR Voltgroupltd 0.001 -33.3 2,058,555 $16,074,312 NRZ Neurizer Ltd 0.0035 -30.0 37,752,000 $9,512,153 T3D 333D Limited 0.007 -30.0 97,162 $1,194,449 AAU Antilles Gold Ltd 0.003 -25.0 1 $5,845,711 JAV Javelin Minerals Ltd 0.0015 -25.0 20,000,000 $8,553,692 ME1 Melodiol Glb Health 0.0015 -25.0 179,740 $1,578,840 MOM Moab Minerals Ltd 0.003 -25.0 751,616 $3,175,257 SLZ Sultan Resources Ltd 0.006 -25.0 15,781 $1,580,692 8IH 8I Holdings Ltd 0.009 -25.0 13,022 $4,177,930 PLC Premier1 Lithium Ltd 0.009 -25.0 534,876 $2,094,889 1MC Morella Corporation 0.035 -20.5 1,382,888 $10,874,737 ASQ Australian Silica 0.024 -20.0 10,721 $8,455,811 CCZ Castillo Copper Ltd 0.004 -20.0 1,786,916 $6,497,527

ICYMI – AM EDITION

Future Battery Minerals (ASX:FBM) has expanded its landholding in highly prospective zones of the Goldfields region in WA, extending its existing Kangaroo Hills and Miriam lithium projects.

The company has submitted applications for the newly named Kangaroo Hills West and Kangaroo Hills North projects as well as the Kalgoorlie North project.

It also applied for P15/6813 and P15/6681, which are contiguous to its Kangaroo Hills lithium project, increasing both further prospectivity for LCT pegmatites and a larger land holding for optimal future development of the project.

“We are pleased to have identified and pegged this attractive ground holding so close to our existing footprint in the region. Its prospectivity lies squarely within our core skillset and focus areas of lithium whist also having gold exploration potential,” managing director Nick Rathjen said.

Lumos Diagnostics (ASX:LDX) has received a cash refund of $140,777 in relation to its research and development activities for the 2023 financial year.

The Research and Development Tax Incentive relates to the continued R&D it conducted on its benchtop and disposable proprietary reader technology platform, which enables testing of a greater range of clinical biomarkers, facilitating the reading and interpretation of results from point-of-care diagnostic tests and enabling them to seamlessly interface with electronic medical record systems.

This reader platform has been a highly valued element of the company’s service offering to clients and has been instrumental in recent contract wins with Hologic and the Burnet Diagnostics Initiative of the MacFarlane Burnet Institute for Medical Research and Public Health.

QMines (ASX:QML) has raised $5m through a two-tranche private placement priced at 4.7c per share to accelerate exploration and development of the Mt Chalmers and Develin Creek projects.

At Stockhead, we tell it like it is. While Future Battery Minerals, Lumos Diagnostics and QMines are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.