ASX Small Caps Lunch Wrap: Synlait settles its beef with A2 Milk and Twiggy got a new truck

Pic via Getty Images.

Local markets opened higher this morning, after Wall Street pumped out its sixth win on the trot, lurching far enough to put the US S&P 500 within sniffing distance of recent all time highs again.

The ASX 200 was up around 1.3% in the time it took my 10:00am coffee to get cold this morning, and as we head into lunch, that’s pretty much where the benchmark has stayed.

It’s been a relatively quiet morning news-wise, though, with a smattering of earnings coming in today that are best described as “mixed”.

Elsewhere, Michelle Bullock is earning her pay cheque today, with yet another trip to Canberra to sit in a room with politicians and bat off their feeble attempts to score cheap points off her while they comb through the RBA’s recent annual reports.

Before we get too far into things now, here’s a piece of music that bobbed up on my radar at about 2:30am last night.

There… now it’s stuck in your head, too.

Let’s move on.

TO MARKETS

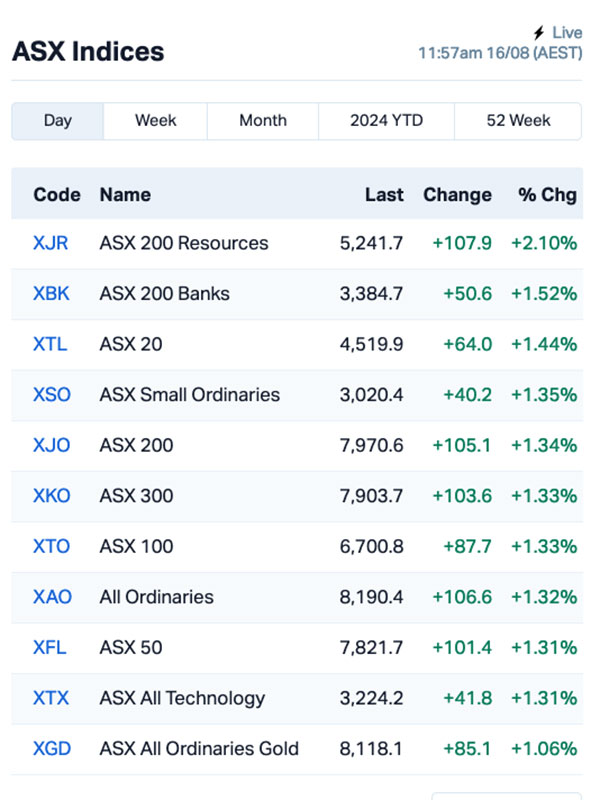

A belter on Wall Street overnight paved the way for the ASX to climb nicely out of bed this morning, sending the benchmark 1.3% higher in a matter of minutes, where it’s been hovering all morning since.

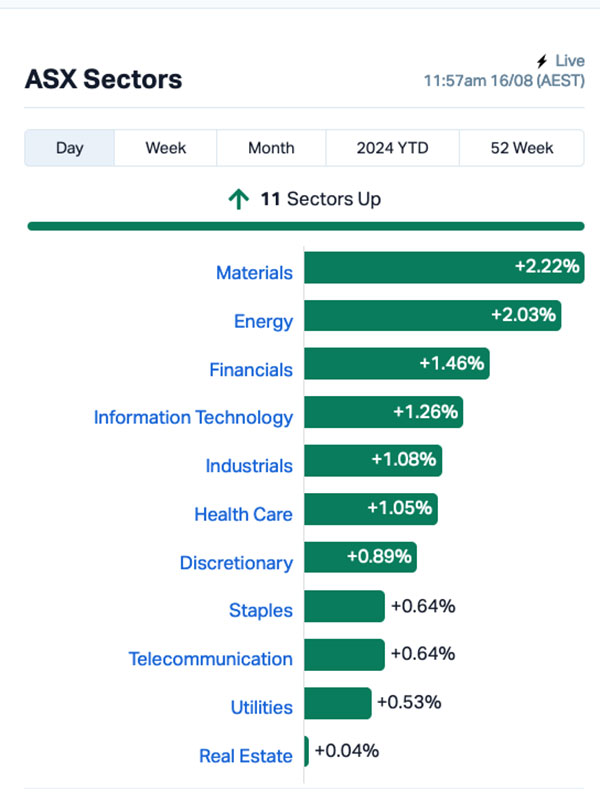

The climb has been led by a generous boom in Resources, with the Materials sector up 2.22% at midday, supported by… actually, at a glance it’s a little hard to tell. There’s no obvious surge among the commodities, other than a 2.9% coal price spike this morning.

The drive among the Materials crowd seems to be coming from a combination of decent gains among the majors – Fortescue (ASX:FMG) is up 2.6%, BHP (ASX:BHP) is up 1.8%, yada yada yada – and that’s despite the recent dip in iron ore that’s taken the price below US$100/t again. 3

For those that missed the memo, iron ore is at $99.20/t, down 2.5% this week and more than 9.9% this month – with steel prices faring even worse, down 16.3% this month as China’s economy goes from glacial to ‘lost in space’.

Fortescue’s jump could be because Twiggy was on the box this morning showing off his new toy – a liquid hydrogen powered truck called Europa, and the ceremonial shovelling of the first sod at FMG’s green iron plant in WA.

Hard to believe that it’s been almost exactly a month since FMG abandoned its green hydrogen plans and tossed 700 people out of work.

How the time flies.

Anyhoo… the ASX indices this morning looked like this:

There were a couple of big names with earnings reports this morning, which I mention because it’s apparently the done thing when they take the time to write up their reports.

National Australia Bank (ASX:NAB) posted a statutory net profit of$1.9 billion, but its underlying cash profit of $1.75 billion was down 8% year on year.

Domain’s (ASX:DHG) statutory net profit was $42.4 million, up a fancy-lookin’ 62.5% on pcp.

Elsewhere, RBA Governor Michelle Bullock is in Canberra taking part in more performative parliamentary hearings, this time appearing before the standing committee on economics to swat away insistent questions from members of parliament, who are doing a bang up job of proving the theory that politics is just show business for ugly people.

Really, the only thing of note that Bullock said this morning was a firm reiteration that we are definitely not getting a rate cut any time soon.

NOT THE ASX

Overnight, the S&P 500 continued to rise for a sixth consecutive day, up by 1.61% to within a whisker of its record levels. The blue chips Dow Jones lifted by 1.39%, while the tech heavy Nasdaq surged by 2.24%, Eddy Sunarto reported this morning.

Eddy also said “better-than-expected US retail spending and jobless claims gave a boost to market confidence last night.”

According to data, sales at US retailers unexpectedly jumped 1% in July, much higher than the 0.3% increase economists were expecting. This follows a small drop of 0.2% in June.

The number of Americans filing for unemployment benefits also dropped to a one-month low last week.

“We’re back to an environment where good news is good news and bad news is bad news,” said Bret Kenwell at eToro.

Aditya Bhave at Bank of America Corp added,” What hard landing? The July retail sales data were consistent with our soft-landing economic outlook.”

US Treasury yields surged (bond prices lower) after the release alleviated fears of a hard landing and prompted traders to move out of safe haven assets.

To stock news, giant retailer Walmart, a stock often used as a barometer for the US economy, jumped by 6.5% after beating revenue and profit forecasts and raising its full-year outlook.

Nike Inc jumped 5% after fund manager Pershing Square revealed it had acquired a new stake in the company.

Dell Technologies also surged 7% after being added to JPMorgan’s analyst focus list, which noted the stock price is at an “attractive entry point.”

Thank you, Eddy. Stellar work, as always.

In Asian markets today, the overarching mood seems to be positive as well. Japan’s Nikkei is up 2.95%, the Hang Seng is up 1.75% and Shanghai markets are 0.24% higher as well.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 16 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap IEC Intra Energy Corp 0.002 100.0 430,000 $1,690,782 HLX Helix Resources 0.003 50.0 5,187,759 $6,528,387 BCT Bluechiip Limited 0.004 33.3 250,000 $3,546,119 JAV Javelin Minerals Ltd 0.002 33.3 700,000 $6,415,269 RIL Redivium Limited 0.004 33.3 16,583,754 $8,192,564 RGT Argent Biopharma Ltd 0.22 33.3 157,521 $7,986,924 JAY Jayride Group 0.012 33.3 100,000 $2,126,782 LRV Larvottoresources 0.165 32.0 5,896,535 $38,494,308 ARV Artemis Resources 0.0155 29.2 18,287,152 $23,002,589 1TT Thrive Tribe Tech 0.0025 25.0 356,636 $1,223,243 EEL Enrg Elements Ltd 0.0025 25.0 1,503,898 $2,019,930 EMT Emetals Limited 0.005 25.0 106,000 $3,400,000 VML Vital Metals Limited 0.0025 25.0 45,048 $11,790,134 KOB Kobaresourceslimited 0.14 21.7 166,692 $18,234,586 APX Appen Limited 1.09 20.4 12,095,280 $201,816,487 SM1 Synlait Milk Ltd 0.33 20.0 285,419 $60,109,957 AMD Arrow Minerals 0.003 20.0 1,051,018 $26,348,413 DTR Dateline Resources 0.006 20.0 3,257,020 $11,087,566 KPO Kalina Power Limited 0.006 20.0 5,571,358 $12,431,970 BOA Boadicea Resources 0.02 17.6 50,000 $2,096,998

Synlait Milk (ASX:SM1) was up at lunchtime on Friday, on news that the company has settled its beef with A2 Milk (ASX:A2M), after both sides agreed to conditionally resolve all disputes subject to arbitration, including those regarding exclusivity, pricing, and other issues.

There’s a bit to unpack here, but the upshot is that Synlait has agreed that the exclusivity it has under the Nutritional Powders Manufacturing and Supply Agreement (NPMSA) for a2 Platinum and other nutritional products will end on 1 January, 2025.

The rest of the stoush was over Chinese regulatory State Administration for Market Regulation (SAMR) registrations. Synlait is holding on to those that cover The A2 Milk’s Chinese labelled 至初 Infant Formula, and production of that will continue at Synlait’s Dunsandel facility for the time being.

Synlait will also make available to The a2 Milk Company an additional SAMR registration slot at Dunsandel for a potential new China label registered product, co-developed by the two companies… and A2 has to give Synlait $24.75 million.

Earlier, Miramar Resources (ASX:M2R) was the only company in the top 10 on Friday morning with news, after the company announced the commencement of the maiden drilling campaign within the Company’s 100%-owned Bangemall Project portfolio in the Gascoyne region of WA, co-funded through the WA Government’s Exploration Incentive Scheme (EIS) to test several airborne +/- ground EM anomalies at Mount Vernon and Trouble Bore highlighted by Miramar’s exploration programs.

Poseidon Nickel (ASX:POS) was climbing after the company refiled news of gold mineralisation, “very similar to nearby gold mines including Kanowna Belle and Gordon Sirdar”, at the company’s Black Swan prospect in the WA Goldfields. Poseidon refiled the announcement after it tripped over the rules around announcing visual gold during early exploration while showing off some of the 52 gold nuggets with a combined weight of 17.9g the company has picked up.

Elixir Energy (ASX:EXR) was also up Friday after delivering an update on its Daydream-2 program in the 100%-owned Grandis Project in Queensland’s Taroom Trough. Elixir says the flow test of the Lorelle Sandstone post stimulation is complete, with work moving on to the stimulation of the 5 upper zones. Lorelle Sandstone flows gas at stabilised flow rates of 2.1 and 2.5 MMSCFPD, which is approaching requirements for the entire project to clear the modelled pre-production economic hurdle.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTB Mount Burgess Mining 0.001 -33.3 237,500 $1,947,220 MTL Mantle Minerals Ltd 0.001 -33.3 391,667 $9,296,169 AUH Austchina Holdings 0.003 -25.0 5,452,030 $8,401,535 ENT Enterprise Metals 0.003 -25.0 100,000 $4,413,269 ICU Investor Centre Ltd 0.003 -25.0 1,853 $1,218,045 LPD Lepidico Ltd 0.0015 -25.0 671,615 $17,178,250 TIG Tigers Realm Coal 0.003 -25.0 29,400 $52,266,809 8IH 8I Holdings Ltd 0.007 -22.2 86,040 $3,133,448 CRB Carbine Resources 0.004 -20.0 2,070 $2,758,689 CTO Citigold Corp Ltd 0.004 -20.0 875,000 $15,000,000 EVR Ev Resources Ltd 0.004 -20.0 180,800 $6,981,357 MVL Marvel Gold Limited 0.008 -20.0 1,359,845 $8,637,907 PUR Pursuit Minerals 0.002 -20.0 62,941 $9,088,500 RML Resolution Minerals 0.002 -20.0 250,000 $4,025,055 SFG Seafarms Group Ltd 0.002 -20.0 125,000 $12,091,498 SRJ SRJ Technologies 0.0575 -19.0 1,668,396 $11,309,905 MCM Mc Mining Ltd 0.115 -17.9 52,783 $57,961,869 SVG Savannah Goldfields 0.024 -17.2 13,334 $8,151,463 FGL Frugl Group Limited 0.025 -16.7 120,000 $3,147,259 MHI Merchant House 0.125 -16.7 44,214 $14,139,974

ICYMI – AM EDITION

Uvre (ASX:UVA) has completed an initial passive seismic program at the Frome Downs uranium project in South Australia to identify potential lithological and structural features which provide ideal trap sites for uranium accumulation.

The company says these features will be priority targets for a maiden drilling program once a native title heritage agreement has been executed.

Finder Energy’s (ASX:FDR) non-underwritten pro-rata non-renounceable entitlement offer is now open with the company’s major shareholder, Longreach Capital Investment, investing its full entitlement of $3.2m.

The entitlement offer allows shareholders to subscribe for 1 new share for every 1.26 shares held on the record date on Tuesday, 13 August at the offer price of $0.049 per new share. FDR’s executive management also intends to fully take up their entitlement.

Golden Mile Resources (ASX:G88) has completed a detailed review of all projects in its current portfolio including Marble Bar and the Murchison projects and has made the decision to relinquish both.

This entails the surrender of granted exploration licences E45/6210, E45/6211 and E20/1005, and the withdrawal of exploration licence application ELA45/6709, allowing G88 to focus on its projects which have the greatest potential including the recent joint venture-acquisition of the highly prospective Pearl copper asset in Arizona, USA.

At Stockhead we tell it like it is. While Uvre, Finder Energy, Miramar Resources and Golden Mile Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.