ASX Small Caps Lunch Wrap: (Super)markets fall on Aussie inflation data; goldies still gleaming

Pic: Getty Images

- ASX 200 stumbles on fresh local inflation data

- Supermarket duopoly backing away from that cliff (see above) as we type

- Goldies in good form thanks in part to precious metal’s continued surge

The ASX has pared gains after better-than-expected inflation numbers. At lunch time, the ASX/S&P 200 index was down around 0.55%.

Australia’s year-on-year, inflation has cooled to 2.8%, which is below consensus forecast which expected it to stay at 2.9%.

This data is crucial as it will help guide the Reserve Bank’s upcoming monetary policy decisions when they meet next week. There’s been a lot of speculation about potential interest rate cuts.

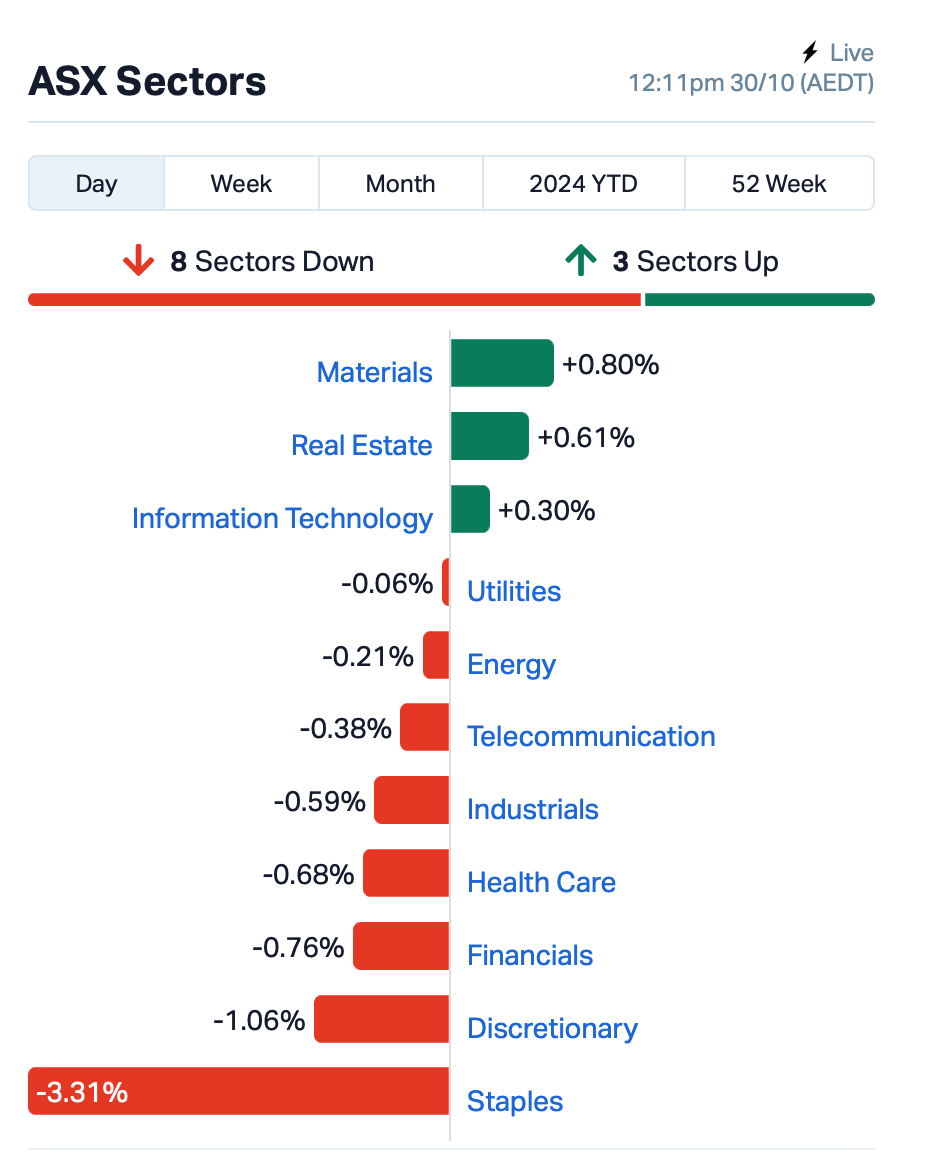

Sectors wise, materials (mostly miners) led today while staples dragged.

Staples was pulled down heavily by slumps in Woolworths (ASX:WOW) and Coles Group (ASX:COL). Woolworths tumbled by 5% after issuing a profit warning, while Coles was down almost 2%.

In mining, gold stocks traded higher after gold prices hit a new record this morning, reaching $US2775.47 an ounce.

“The concerns around the upcoming US presidential election, combined with the escalating conflicts in the Middle East, are also major factors as they push investors into safe haven assets like gold,” said Datt Capital’s Emanuel Datt.

Leading mining giants like BHP (ASX:BHP), Fortescue (ASX:FMG), and Rio Tinto (ASX:RIO) were also doing well this morning, gaining about 1% each due to rising iron ore prices.

Still in large caps, Pilbara Minerals (ASX:PLS) was up 5% despite cutting its guidance for FY25 and putting its Ngangaju plant on hold due to the falling lithium price. That will trim output by 100,000t of spodumene concentrate this year.

And, Star Entertainment Group’s (ASX:SGR) shares plunged by 12% after reporting an 18% revenue decline, resulting in a loss of $18 million.

Not the ASX

Overnight on Wall Street, a rally in tech stocks pushed the Nasdaq to a record high. The S&P 500 rose slightly, while the Dow Jones dipped a bit.

Alphabet, Google’s parent company, saw its stock jump 1.6% during regular trading and another 6% after hours, after reporting strong earnings driven by digital ads and cloud services.

Chipmaker Broadcom rose 4% on news of a partnership with OpenAI.

Reddit’s stock soared 22% after it reported strong sales; and VF Corp, which owns brands like Vans and North Face, jumped 27% after exceeding earnings expectations.

Bitcoin was also rallying aggressively, trading now at above US$72,000. Its previous high was US$$73,737 achieved in March this year.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCM | Green Critical Minerals | 0.0065 | 160% | 59,897,402 | $3,815,107 |

| OD6 | Od6 Metals | 0.059 | 103% | 7,317,096 | $3,732,015 |

| AMD | Arrow Minerals | 0.002 | 100% | 6,222,266 | $13,023,628 |

| RMX | Red Mount Minining | 0.014 | 56% | 10,671,114 | $3,486,220 |

| CLE | Cyclone Metals | 0.0015 | 50% | 61,500 | $12,738,964 |

| PUR | Pursuit Minerals | 0.003 | 50% | 2,679,693 | $7,270,800 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | 250,000 | $3,295,156 |

| TYP | Tryptamine Ltd | 0.034 | 48% | 43,709,622 | $25,048,118 |

| AKN | Auking Mining Ltd | 0.004 | 33% | 1,200,000 | $1,174,051 |

| ATH | Alterity Therapeutics | 0.004 | 33% | 789,253 | $15,961,008 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 1,370,221 | $1,189,924 |

| LNR | Lanthanein Resources | 0.004 | 33% | 200,250 | $7,330,908 |

| TKL | Traka Resources | 0.002 | 33% | 2,185,000 | $2,918,488 |

| GHY | Gold Hydrogen | 0.945 | 29% | 679,848 | $56,347,322 |

| KNI | Kuniko | 0.185 | 28% | 347,227 | $12,581,544 |

| PHL | Propell Holdings Ltd | 0.015 | 25% | 100,000 | $3,340,057 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 10,913,857 | $11,730,481 |

| VML | Vital Metals Limited | 0.0025 | 25% | 5,785,367 | $11,790,134 |

| EBG | Eumundi Group Ltd | 1.56 | 24% | 18,777 | $62,707,390 |

| KRR | King River Resources | 0.011 | 22% | 9,267,123 | $13,753,987 |

| THR | Thor Energy PLC | 0.018 | 20% | 826,536 | $3,469,099 |

| EPM | Eclipse Metals | 0.006 | 20% | 1,129,785 | $11,254,278 |

| SRN | Surefire Rescs NL | 0.006 | 20% | 160,000 | $9,931,539 |

| LRV | Larvotto Resources | 0.695 | 19% | 3,715,887 | $186,357,434 |

| BEO | Beonic Ltd | 0.032 | 19% | 88,367 | $17,169,628 |

Green Critical Minerals (ASX:GCM) is moving straight into the pilot stage of proving up its graphite tech after entering into a binding technology purchase agreement with Cerex, which produces saleable graphite blocks from graphite powder.

The technology mixes graphite with pre-cursors and heating, resulting in very high-density graphite blocks (‘VHD Graphite’) which can be used in a wide variety of applications. Given the unique properties of VHD Graphite, it is expected that the final product will be produced in a mould, allowing a large variety of graphite shapes and blocks to be manufactured.

Notwithstanding the proposed acquisition, GCM will continue to be a mineral exploration and development company with its flagship asset – the Mcintosh project in WA – boasting 30.2Mt in WA following a substantial 26% grade upgrade in July.

Tryptamine Therapeutics (ASX:TYP), a clinical stage biotech, was surging earlier after having secured firm commitments from new and existing professional, sophisticated, and institutional investors to raise $6 million to accelerate development of its novel IV-infused psilocin formulation TRP-8803.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for October 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SI6 | SI6 Metals Limited | 0.001 | -33% | 1,001,927 | $4,150,938 |

| ICR | Intelicare Holdings | 0.01 | -23% | 2,158,673 | $6,320,446 |

| VAR | Variscan Mines Ltd | 0.01 | -23% | 3,914,990 | $5,759,005 |

| TOU | Tlou Energy Ltd | 0.014 | -22% | 4,517,885 | $23,374,518 |

| PNT | Panther Metals | 0.0295 | -20% | 15,654,775 | $8,707,900 |

| PPG | Pro-Pac Packaging | 0.025 | -19% | 1,199,459 | $5,632,319 |

| LU7 | Lithium Universe Ltd | 0.013 | -19% | 2,590,163 | $9,502,617 |

| WIN | WIN Metals | 0.027 | -18% | 7,141,117 | $10,941,318 |

| CUF | Cufe Ltd | 0.007 | -18% | 9,710,297 | $11,361,736 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 84,166 | $6,584,090 |

| QXR | Qx Resources Limited | 0.005 | -17% | 119,607 | $6,660,467 |

| LIS | Lisenergy | 0.215 | -16% | 2,829,011 | $163,251,059 |

| PPK | PPK Group Limited | 0.53 | -15% | 163,639 | $56,757,811 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 2,293,832 | $10,798,617 |

| BTE | Botala Energy | 0.06 | -14% | 25,000 | $15,900,337 |

| INF | Infinity Lithium | 0.03 | -14% | 766,055 | $16,190,723 |

| LML | Lincoln Minerals | 0.006 | -14% | 9,209,690 | $14,393,817 |

| TMX | Terrain Minerals | 0.003 | -14% | 1,043,000 | $6,300,101 |

| CXL | Calix Limited | 0.86 | -14% | 1,029,057 | $181,293,554 |

| SPQ | Superior Resources | 0.0065 | -13% | 3,503,815 | $16,273,978 |

| RDM | Red Metal Limited | 0.1175 | -13% | 1,058,016 | $40,453,638 |

| ASR | Asra Minerals Ltd | 0.0035 | -13% | 15,378,700 | $8,926,232 |

| C7A | Clara Resources | 0.007 | -13% | 32,150 | $2,001,112 |

| M2R | Miramar | 0.007 | -13% | 788,758 | $3,174,586 |

| PAB | Patrys Limited | 0.0035 | -13% | 130,000 | $8,229,789 |

ICYMI – AM EDITION

Lithium Universe (ASX:LU7) has received binding commitments from sophisticated and professional investors to raise $2.14m at $0.0125 per share to fund completion of the Definitive Feasibility Study (DFS) for its Bécancour lithium refinery in Quebec.

The DFS is on track for release in the March 2025 quarter, with the refinery expected to help close a lithium conversion gap in North America, which has millions of tonnes of lithium carbonate equivalent resources but a yawning chasm when it comes to chemical conversion capacity.

The company also intends to undertake a non-renounceable entitlement offer of 1 share for every 10 Shares held by eligible shareholders at the same issue price to raise up to ~$1.024m

“We are pleased with the outcome of the Placement in a challenging market, which reaffirms support for the Company’s strategy to complete the Definitive Feasibility Study for the Bécancour Lithium Refinery,” executive chairman Iggy Tan said.

“The board and management team remains dedicated to engaging with our existing shareholders and delivering against our strategy.

“If fully subscribed, proceeds from the placement and entitlement offer will strengthen our balance sheet, bringing us closer to establishing an operational lithium conversion plant in Bécancour, Québec.”

Regener8 Resources (ASX:R8R) has been awarded a co-funded drilling grant for up to $180,000 under the WA Governments’ Exploration Incentive Scheme (EIS) for the Hatlifter prospect at its East Ponton project.

The company is currently undertaking its maiden drilling campaign, testing the Hatlifter paleochannel-hosted nickel-cobalt target, where historical drilling returned a high-grade, end-of-hole intersection of 3m at 1.26% nickel and 0.6% cobalt from 57m.

This grant will be used towards follow up drilling campaigns.

“The EIS grant enables Regener8 to amplify exploration at the Hatlifter prospect over the next 12 months,” managing director Stephen Foley said.

“We’re continuing to be encouraged through the technical merit of the opportunity and thank the WA Gov EIS in providing support to this exciting project”.

Renascor Resources (ASX:RNU) says its Battery Anode Material (BAM) project in South Australia is progressing through advanced planning stage with early contractor involvement and long-lead upstream work streams.

The company is advancing work to mature the engineering design and minimise the construction period of its proposed graphite mine and processing operation, the upstream portion of the project.

On-going work includes site geotechnical testing, incorporation of vendor design, equipment pricing and preparation of final designs and estimates, along with upgrades to the electrical infrastructure to allow site connection with SA Power Network’s existing electricity grid network.

In parallel, Renascor continues to progress its planned Purified Spherical Graphite (PSG) manufacturing facility, the downstream portion of the BAM project.

Recent activities include completing an environmental impact statement for the proposed Bolivar PSG site and awarding the design contract for proposed Australian government co-funded PSG demonstration facility.

“In addition to further de-risking the BAM project, we expect these programs to provide opportunities to improve upon the process design and to minimise the planned construction time of the upstream operation to coincide with projected graphite supply shortfalls,” managing director David Christensen said.

At Stockhead, we tell it like it is. While Lithium Universe, Regener8 Resources and Renascor Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.