ASX Small Caps Lunch Wrap: Super Special Extra-Spooky Friday the 13th edition

Pic via Getty Images.

Local markets opened higher this morning, thanks to a surge from Energy stocks and the goldies, helped along by some decent US data overnight and news that the ECB has cut rates by 25 basis points overnight.

Also, it’s Friday the 13th, so here’s a picture of a ghost.

So spooky.

Righto – let’s get on with it, shall we?

TO MARKETS

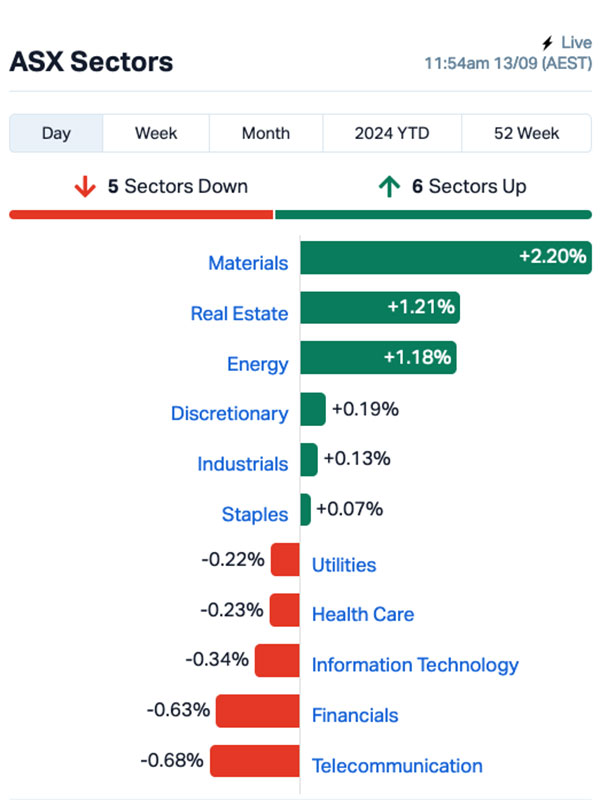

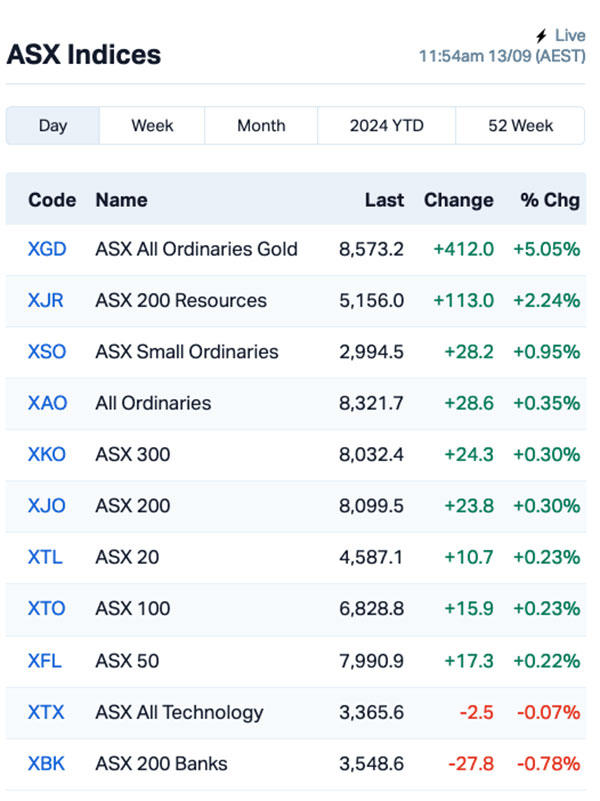

The ASX 200 benchmark is working pretty hard this morning, veering wildly after jumping 57 points in the first 30 minutes of the session, to be around +0.4% on the way into lunch.

The main factors driving that were a surge in oil prices overnight and a sharp spike in gold prices as well, both of which have lent support to a couple of sectors that have been doing it tough in recent weeks.

The Energy sector is up about 1.3% this morning, after crude oil prices shot up to take US crude up 2.72% to $69.14 a barrel and Brent higher by 2.21%, to $72.17 per barrel.

Meanwhile, spot gold added 1.85% to $2,558 an ounce overnight, and has continued to climb throughout the session this morning as well, reaching new records highs. At the time I wrote this, the price was at US$2,562.21 per ounce, and ticking upwards at a steady pace.

That’s lit a fire under the goldies this morning, which are up more than 5.0% on the way towards lunch.

Losing ground this morning, however, is the Financials sector, which was down by about 0.7% at lunchtime, with the big banks all off by between 0.71% and 0.85%.

The big news from around the place has been an interest rate cut by the European Central Bank overnight, as inflation in the region continues to slow amid signs that the economy may be faltering.

The ECB took 25 basis points off to bring the rate to 3.5%, adding even more weight to the foregone conclusion that the US Fed will follow suit next week – which I’ll mention more about shortly.

Up the fancy end of town, shares in Nine Entertainment have continued to slide, despite Nine boss Mike Sneesby falling on his sword yesterday.

But among the big movers with big bottom lines were Fortescue (ASX:FMG) – up by 5.5% – along with 11 other Billion-Dollar-Plus companies, including an 8.85% jump for West African Resources (ASX:WAF), and a 7.9% boost for Evolution Mining (ASX:EVN).

NOT THE ASX

Overnight, Wall Street rallied after the US producer price (PPI) data solidified expectations for a small rate cut by the Fed next week.

The S&P 500 closed 0.75% higher, the Dow Jones rose by 0.58% and the tech heavy Nasdaq lifted by 1%.

The PPI for August came in at 2.4%, falling short of the 2.5% forecast and matching the figure from July.

Following the release, spot gold touched a new all-time high of US$2,559 during the US session, while the US dollar weakened.

“We are headed towards a lower interest rate environment so gold is becoming a lot more attractive,” said Alex Ebkarian at Allegiance Gold.

Right now, markets are betting there’s an 85% chance the Fed will cut rates by 25 basis points at its meeting on September 17-18. There’s only a 15% chance of a bigger 50 basis point-cut, according to the CME FedWatch tool.

In US stock news, Adobe tumbled 9% in post-market after releasing disappointing revenue outlook.

Supermarket chain Kroger rose 8% after raising its full-year sales forecast.

And, American Airlines rose 1% after its flight attendants approved a new labour contract, which helped avoid a potential strike.

In Asian markets this morning, the mood is mixed. Hong Kong markets are up 1.6%, and Shanghai markets are up 0.34% – however, Japan’s Nikkei is down 0.65% in morning trade.

Markets in Asia are gearing up for a swathe of holidays next week, which will see many markets closed for two or more days due to traditional, seasonal days off.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap EXL Elixinol Wellness 0.005 66.7 1,367,893 $3,963,547 DOU Douugh 0.004 33.3 500,000 $3,246,207 NES Nelson Resources 0.004 33.3 1,420,000 $1,840,783 NRZ Neurizer 0.004 33.3 39,686,138 $6,543,358 RML Resolution Minerals 0.002 33.3 500,000 $2,415,033 DXN DXN 0.083 27.7 2,240,232 $12,147,808 MEG Megado Minerals 0.014 27.3 259,839 $2,799,011 EMT Emetals Limited 0.005 25.0 12,518,659 $3,400,000 LPD Lepidico 0.0025 25.0 9,286,736 $17,178,250 WML Woomera Mining 0.0025 25.0 96,681 $3,036,278 OSM Osmond Resources 0.235 20.5 563,219 $14,305,728 CUL Cullen Resources 0.006 20.0 250,000 $3,467,009 MTH Mithril Silver Gold 0.125 19.0 765,255 $10,823,003 ASO Aston Minerals 0.014 16.7 200,587 $15,540,771 CTQ Careteq 0.014 16.7 1,007,218 $2,845,425 MOH Moho Resources 0.007 16.7 72,142 $3,235,069 OAU Ora Gold 0.007 16.7 60,009,790 $42,846,958 TMK TMK Energy 0.0035 16.7 1,652,649 $20,764,836 LRL Labyrinth Resources 0.022 15.8 9,961,241 $25,144,164 AAM Au Megametals 0.052 15.6 279,208 $23,677,638

DXN (ASX:DXN) has released its FY24 results, and they’re excellent – the company is reporting that it has achieved a statutory EBITDA of $644,000 – the first positive EBITDA result in DXN’s history – on FY24 revenue of $10.8 million. Managing Director Shalini Lagrutto says the year has been “transformational”, following the company’s exit from its unprofitable data centre in Sydney.

eMetals (ASX:EMT) has delivered an update to its exploration in Uganda, revealing that a total of 40 soil samples and 77 rock-chip samples were taken on the Bukuya target within the Mubende Gold Project as part of the first phase of field activities. Numerous high grade rock chip samples were returned including 29.1g/t Au, 9.2g/t Au and 3.1g/t Au, with soil sampling confirmed gold mineralisation extends beyond current artisanal workings and has defined an anomalous zone across a strike of approximately 1,200m which remains open along strike in both directions.

Labyrinth Resources (ASX:LRL) was rising on news that the company has been reviewing the historical Vivien data base in the lead up to the company’s EGM and completion of the Distilled Acquisition. LRL says that the historical data shows “significant exploration upside and underexplored nature of Vivien and Comet Vale”. Both the Comet Vale and Vivien Projects are located close to existing infrastructure and linked via major access ways to the Goldfields, and the existing drilling shows that there is ample untested prospectivity at both projects.

And Mithril Resources (ASX:MTH) was up after delivering an investor presentation this morning.

Earlier, Mount Burgess Mining (ASX:MTB) was climbing on news that local officials have finally let the company to move forward, after the Botswanan Department of Environmental Protection (DEP) confirmed it had approved a Scoping Report and requested a Final EIA be lodged following MTB’s receipt of DEP’s comments. The timeframe to the completion of the EIA review period is estimated to be in the region of four to six weeks, after which MTB should be able to begin infill drilling at its Nxuu Project.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap FAU First Au 0.001 -50.0 214,309,429 $3,623,987 VPR Volt Group 0.001 -50.0 250,000 $21,432,416 1TT Thrive Tribe Tech 0.001 -33.3 491 $917,432 AL8 Alderan Resources 0.002 -33.3 17,334 $3,818,584 BNL Blue Star Helium 0.0035 -30.0 15,715,990 $9,724,426 ENV Enova Mining 0.011 -26.7 17,631,808 $14,773,940 EDE Eden Inv 0.0015 -25.0 188,023 $8,216,419 RNE Renu Energy 0.0015 -25.0 6,500,000 $1,528,268 WTN Winton Land 1.55 -22.5 499 $593,227,472 CRB Carbine Resources 0.004 -20.0 250,000 $2,758,689 JAV Javelin Minerals 0.002 -20.0 28,493 $10,692,115 LIO Lion Energy 0.02 -16.7 1,082,932 $10,487,466 ODE Odessa Minerals 0.0025 -16.7 50,000 $3,129,848 SLZ Sultan Resources 0.005 -16.7 35,000 $1,185,519 STM Sunstone Metals 0.005 -16.7 51,565,231 $23,111,422 ADR Adherium 0.011 -15.4 444,763 $9,861,540 MCTDB Metalicity 0.017 -15.0 1,596,022 $9,392,132 AUK Aumake 0.006 -14.3 4,890,742 $13,497,687 SRN Surefire Resources 0.006 -14.3 3,500,000 $13,904,155 PSL Paterson Resources 0.019 -13.6 255,000 $10,032,833

ICYMI – AM EDITION

Nothing to mention here for this morning. Check back with us again for Closing Bell.

At Stockhead, we tell it like it is. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.