ASX Small Caps Lunch Wrap: No rest for ASX on Labour Day as benchmark inches higher

Pic via Getty Images

- Long weekend? Not for the local bourse

- ASX 200 inches up more than 0.5% at lunch time

- Arcadium Lithium turns heads on Rio Tinto interest

The ASX edged higher by more than 0.5% at midday on Monday, with banks leading the way, while investors remained cautious about escalating conflicts in the Middle East and the potential impact on oil supply.

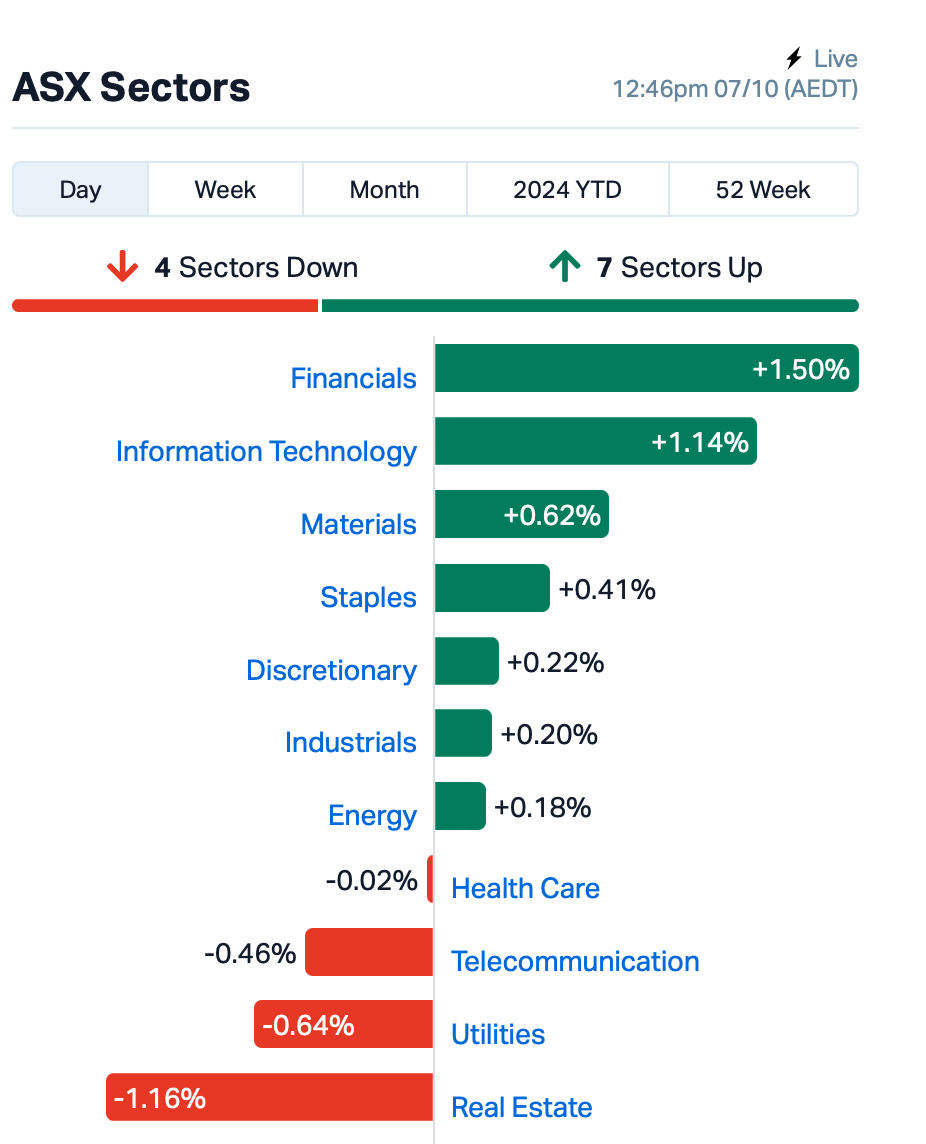

Among the 11 sectors, seven showed gains, with financials and technology leading the pack.

Arcadium Lithium (ASX:LTM) was the standout performer, soaring 44% after Rio Tinto (ASX:RIO) confirmed it was in talks for a takeover.

This marked Arcadium’s largest one-day gain since its formation in January from the merger of Allkem and Livent, while Rio Tinto dipped 1%.Energy stocks slipped as oil prices eased after a 10% rally last week.

On the mining front, heavyweights BHP (ASX:BHP) and Fortescue (ASX:FMG) gained, buoyed by a 2% rise in iron ore futures in Singapore today following the reopening of China’s share market after a week-long holiday.

Meanwhile, BMI, part of Fitch Solutions, has released its updated outlook for nickel prices.BMI has lowered its nickel price forecast for 2024 from US$18,000 to US$17,300 per tonne due to a significant surplus in the market.

This downgrade, BMI said, is largely expected because of increased global refined nickel production, particularly from Indonesia and mainland China.

In other stocks news, Pro Medicus (ASX:PME) rallied 2% after securing an 8-year contract renewal worth at least $98 million with Mercy Health, covering the Visage 7 Viewer and Visage 7 Open Archive. The renewal includes a higher per transaction fee.

NOT THE ASX

On Friday, a blowout jobs report in the US suggested robust health of the US labour market, boosting stocks and hitting bonds.

The S&P500 rose by 0.90%, the blue chips Dow Jones was up by 0.81% to a new record, and the tech heavy Nasdaq surged by 1.22%.

The payroll report showed the US added 254,000 jobs in September, far exceeding expectations by over 100,000. Also, the US unemployment rate unexpectedly fell to 4.1%.

“With the Fed already starting to reduce rates, that’s going to take further pressure off the economy. A soft landing is our base case going forward,” said Matthew Bush at Guggenheim Investments.

In stocks news, Boeing rose by 3% after its joint venture with Lockheed Martin and United Launch Alliance successfully completed the second launch of its new Vulcan rocket.

Boeing and Lockheed are competing against Elon Musk’s SpaceX and Jeff Bezos’s Blue Origin to become the US government’s preferred contractor for national security space missions.

The US Space Force has recently selected these three companies to bid for contracts worth US$5.6 billion from 2025 to 2029.

Investors eager to see that Tesla is more than just a car company will get a reality check on Thursday, October 10, when the company plans to unveil its ambitious robotaxi concept vehicle at Robotaxi Day.

“We continue to believe Tesla is the most undervalued AI name in the market, and we expect Musk & Co. to unveil some ‘game changing’ autonomous technology at this event,” said Tesla bull analyst, Dan Ives.

Shares in another electric vehicle manufacturer, Rivian, dropped as much as 7% after the company reduced its production forecast for the year and missed delivery expectations.

Meanwhile, Spirit Airlines plummeted 25% amid reports that the budget airline may be close to bankruptcy.

According to the Wall Street Journal, Spirit has been negotiating with bondholders about a possible bankruptcy filing. Bloomberg added that talks to secure a rescue deal to restructure its debt have stalled.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 7 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RHY | Rhythm Biosciences | 0.12 | 58% | 4,158,856 | $18,893,353 |

| KM1 | Kali Metals | 0.18 | 50% | 757,878 | $9,219,315 |

| SI6 | SI6 Metals Limited | 0.0015 | 50% | 100,000 | $2,368,859 |

| LTM | Arcadium Lithium PLC | 6.01 | 44% | 6,984,622 | $1,441,850,132 |

| CR9 | Corellares | 0.012 | 33% | 512,324 | $4,185,832 |

| GLN | Galan Lithium Ltd | 0.145 | 26% | 6,151,274 | $68,547,402 |

| WC8 | Wildcat Resources | 0.3275 | 26% | 6,389,283 | $319,556,717 |

| MEL | Metgasco Ltd | 0.005 | 25% | 4,000,000 | $5,830,347 |

| CC9 | Chariot Corporation | 0.21 | 24% | 281,558 | $15,236,736 |

| MX1 | Micro-X Limited | 0.073 | 22% | 323,073 | $34,896,226 |

| CZN | Corazon Ltd | 0.006 | 20% | 852,730 | $3,339,528 |

| FTC | Fintech Chain Ltd | 0.006 | 20% | 178,651 | $3,253,848 |

| SFG | Seafarms Group Ltd | 0.003 | 20% | 170,786 | $12,091,498 |

| HVY | Heavy Minerals | 0.125 | 19% | 237,227 | $7,039,577 |

| NMR | Native Mineral Resources | 0.026 | 18% | 996,000 | $8,764,209 |

| EV1 | Evolution Energy | 0.04 | 18% | 600,678 | $12,259,283 |

| G11 | G11 Resources Ltd | 0.02 | 18% | 8,050,702 | $15,837,576 |

| BRN | Brainchip Ltd | 0.27 | 17% | 11,937,397 | $451,367,634 |

| BMO | Bastion Minerals | 0.007 | 17% | 587,346 | $3,086,205 |

| CMD | Cassius Mining Ltd | 0.007 | 17% | 1,400,000 | $3,252,027 |

| PL3 | Patagonia Lithium | 0.1 | 16% | 1,149 | $4,325,224 |

| AQC | Auspac Coal Ltd | 0.145 | 16% | 1,734,928 | $66,725,116 |

| PLL | Piedmont Lithium Inc | 0.1675 | 16% | 1,787,581 | $59,512,640 |

| DGR | DGR Global Ltd | 0.015 | 15% | 199,999 | $13,568,015 |

| AOK | Australian Oil. | 0.004 | 14% | 219,000 | $3,306,240 |

Arcadium Lithium (ASX:LTM) shares have caught a rocket on the back of confirmation by Rio Tinto (ASX:RIO) that the big gun has made an approach to acquire Arcadium – one of the few producers to have rolled out direct lithium extraction at its El Fenix site on Argentina’s Hombre Muerto Salar.

Murmurs about a potential take-over have been circling around the traps since a report in The Australian’s Dataroom column highlighted Arcadium and Albemarle as possible takeover targets for Rio, which has a number of early-stage lithium projects but is said to be keen on the takeover of a big producer now that valuations have come down from their insane 2023 highs.

Rio is testing a form of its own DLE technology at the Rincon brine project, where a US$335 million pilot project with a 3000tpa LCE capacity is set to be completed this year.

Rhythm Biosciences (ASX:RHY) , a predictive cancer diagnostics technology company, is also shooting up the bourse today, having announced it’s received the first batch of the ‘Alpha’ version of multiplex antibody detection kits developed and manufactured by the Company’s CMO, Quansys Biosciences, in the USA.

Meanwhile, Kali Metals (ASX:KM1) has expanded its JV with Chilean lithium giant SQM, adding two new tenements: DOM’s Hill and Pear Creek.

Kali is acquiring the new DOM’s Hill tenements from major shareholder Kalamazoo Resources (ASX:KZR) for a cash consideration of $100,000, while the Peak Creek tenement is being snapped up from KZR for just $20,000.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 7 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 402,467 | $1,223,243.04 |

| BCB | Bowen Coal Limited | 0.0075 | -38% | 201,261,403 | $35,165,876.44 |

| MBK | Metal Bank Ltd | 0.019 | -30% | 162,168 | $10,542,400.86 |

| ATH | Alterity Therapeutics | 0.003 | -25% | 1,897,478 | $21,281,344.47 |

| IVX | Invion Ltd | 0.003 | -25% | 1,471 | $27,066,366.68 |

| MHC | Manhattan Corp Ltd | 0.0015 | -25% | 1,200,000 | $6,185,066.68 |

| OVT | Ovanti Limited | 0.003 | -25% | 634,627 | $6,225,393.37 |

| RNE | Renu Energy Ltd | 0.0015 | -25% | 63,449 | $1,608,268.00 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 14,670,166 | $7,923,242.53 |

| VML | Vital Metals Limited | 0.002 | -20% | 559,991 | $14,737,667.38 |

| AQD | Ausquest Limited | 0.009 | -18% | 2,051,581 | $9,087,641.45 |

| WAF | West African Res Ltd | 1.375 | -17% | 12,673,128 | $1,895,033,021.72 |

| RR1 | Reach Resources Ltd | 0.012 | -17% | 3,534,710 | $12,679,254.56 |

| AL8 | Alderan Resource Ltd | 0.003 | -14% | 250,000 | $5,499,371.28 |

| MRQ | MRG Metals Limited | 0.003 | -14% | 468,714 | $9,490,315.19 |

| SRN | Surefire Rescs NL | 0.006 | -14% | 1,367,228 | $13,904,154.69 |

| TEG | Triangle Energy Ltd | 0.006 | -14% | 81,751 | $14,560,938.19 |

| CVR | Cavalier Resources | 0.13 | -13% | 7,307 | $6,507,249.90 |

| CAN | Cann Group Ltd | 0.06 | -13% | 2,316,648 | $32,337,987.33 |

| POS | Poseidon Nick Ltd | 0.0035 | -13% | 343,807 | $16,815,501.97 |

| 5EA | 5Eadvanced | 0.105 | -13% | 380,293 | $39,968,986.80 |

| IBX | Imagion Biosys Ltd | 0.035 | -13% | 149,820 | $1,425,862.04 |

| SUM | Summit Minerals | 0.21 | -13% | 1,174,747 | $20,238,717.12 |

| EMD | Emyria Limited | 0.029 | -12% | 53,573 | $13,707,850.07 |

| M24 | Mamba Exploration | 0.0115 | -12% | 200,000 | $2,445,069.59 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.