ASX Small Caps Lunch Wrap: MinRes highlights today’s bourse-based misery as most sectors wallow

"Jamón Ibérico de Bellota and Gruyère sandwiches AGAIN? I hate you, Mummy." Pic via Getty Images

- ASX dips 0.5% in morning trade after weak Wall Street lead

- MinRes’ rough lithium and iron ore results don’t help – Chris Ellison’s mob are down 9%

- Qantas profit sinks, but there are some ridiculously big gains among small caps including MC Mining and HyTerra

The ASX has dipped by 0.5% at the time of writing, opening lower this morning after a weak lead from Wall Street and a steep decline in Nvidia share price.

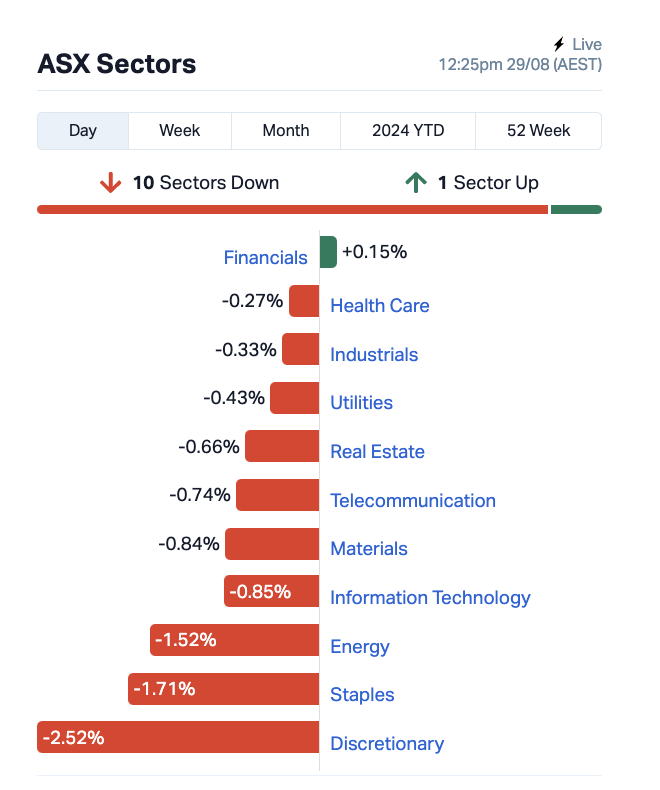

This morning, 10 of the 11 ASX sectors saw losses, led by declines in Discretionary and Staples.

Financials is the only sector to see any small hint of a gain at the moment, with the big four banks all rising and National Australia Bank (ASX:NAB) leading the way with a 0.7% uptick.

In Mining, Mineral Resources (ASX:MIN) was the biggest laggard, down 9% after a disappointing earnings report.

Despite a 10% increase in revenue to $5.278 billion for FY24, the company faced a 40% drop in underlying EBITDA and a 79% plunge in underlying net profit after tax.

Additionally, the decision to cut its dividend and ongoing issues with high production costs contributed to the market reaction.

READ MORE ON THAT HERE > ‘No one is making money in lithium’, says big dog Ellison as MinRes cuts back

Qantas (ASX:QAN) , meanwhile, dropped over 1% after reporting a 16% full year profit decline to $2.08 billion.

CEO Vanessa Hudson noted increased demand for corporate and international travel, Jetstar’s success with price-sensitive travellers, and the positive impact of new initiatives like Classic Plus and fleet upgrades.

Looking ahead, Qantas expects stable travel demand and positive revenue growth in the first half of FY25.

The ASX sectors looked like a stairway to… meh around lunch time in the eastern states today:

NOT THE ASX

The S&P 500 fell 0.6% overnight, driven down by declines in Nvidia, Apple, Microsoft, and Amazon, as 56% of the index’s stocks ended the day in the red.

Nvidia dropped 7% in after-hours trading despite reporting strong Q2 earnings with revenue of $30.4 billion and a 168% increase in net income.

The company’s Q3 revenue guidance of $32.5 billion exceeded expectations but disappointed investors, who had much loftier expectations.

READ MORE IN THIS MORNING’S MARKET HIGHLIGHTS > here.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for August 29 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MCM | Mc Mining Ltd | 0.09 | 143% | 1,560,379 | $15,318,494 |

| IVX | Invion Ltd | 0.004 | 100% | 5,000,194 | $13,275,731 |

| LSR | Lodestar Minerals | 0.002 | 100% | 37,567,373 | $2,600,780 |

| HYT | Hyterra Ltd | 0.048 | 55% | 37,644,219 | $28,869,137 |

| NXD | Nexted Group Limited | 0.18 | 50% | 848,682 | $26,582,013 |

| ECG | Ecargo Hldg | 0.004 | 33% | 1,201,930 | $1,845,750 |

| EXL | Elixinol Wellness | 0.004 | 33% | 2,500,043 | $3,963,547 |

| FGH | Foresta Group | 0.004 | 33% | 522,293 | $7,066,137 |

| MCT | Metalicity Limited | 0.002 | 33% | 400,000 | $7,044,099 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 1,818,624 | $4,951,252 |

| UCM | Uscom Limited | 0.016 | 33% | 60,000 | $2,992,134 |

| ASQ | Australian Silica | 0.03 | 30% | 253,315 | $6,482,789 |

| MWY | Midway Ltd | 0.825 | 25% | 90,598 | $57,641,907 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 200,000 | $5,296,765 |

| HLX | Helix Resources | 0.005 | 25% | 100,000 | $13,056,775 |

| AIM | Ai-Media Technologie | 0.55 | 21% | 3,261,596 | $95,010,391 |

| SNS | Sensen Networks Ltd | 0.042 | 20% | 40,000 | $27,226,806 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 283,333 | $10,692,115 |

| ROG | Red Sky Energy. | 0.006 | 20% | 25,763,075 | $27,111,136 |

| SLZ | Sultan Resources Ltd | 0.006 | 20% | 150,000 | $987,932 |

| LGM | Legacy Minerals | 0.25 | 19% | 208,320 | $22,145,549 |

| FRM | Farm Pride Foods | 0.13 | 18% | 2,003 | $18,085,373 |

| PVT | Pivotal Metals Ltd | 0.013 | 18% | 25,180 | $7,745,301 |

| ECS | ECS Botanics Holding | 0.02 | 18% | 7,746,176 | $21,905,343 |

| RKT | Rocketdna Ltd. | 0.01 | 18% | 9,177,487 | $5,576,976 |

HyTerra Limited (ASX:HYT) surged after announcing a $21.9m investment from Andrew Forrest’s $60 billion resources giant Fortescue (ASX:FMG), which will take a near 40% stake in the hydrogen and helium explorer.

The deal will, for starters, treble the scale of a drilling campaign at its Nemaha project in Kansas from two to six wells.

South African coal stock MC Mining (ASX:MCM) surged over 100% after exiting a trading halt and now over 150% after securing a US$90m deal for Chinese coal miner Kinetic Development Group Limited to take a 51% via a two tranche subscription agreement which will back the development of its Makhado steelmaking coal project.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for August 29 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 17,866 | $9,515,431 |

| SIS | Simble Solutions | 0.003 | -25% | 4,943,759 | $3,013,803 |

| SMM | Somerset Minerals | 0.003 | -25% | 45,000 | $4,123,995 |

| PRS | Prospech Limited | 0.025 | -24% | 118,111 | $9,986,716 |

| EEL | Enrg Elements Ltd | 0.002 | -20% | 9,729 | $2,612,540 |

| LPD | Lepidico Ltd | 0.002 | -20% | 844,333 | $21,472,812 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 8,424,764 | $5,294,436 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 99,500 | $4,026,248 |

| PUR | Pursuit Minerals | 0.0025 | -17% | 6,510,000 | $10,906,200 |

| S2R | S2 Resources | 0.105 | -16% | 49,961 | $56,607,249 |

| SWP | Swoop Holdings Ltd | 0.21 | -16% | 107,479 | $52,052,234 |

| CTT | Cettire | 1.12 | -16% | 7,026,223 | $507,046,833 |

| ICR | Intelicare Holdings | 0.017 | -15% | 205,475 | $5,819,993 |

| PR1 | Pureresourceslimited | 0.085 | -15% | 114,504 | $4,250,751 |

| HMG | Hamelingoldlimited | 0.076 | -15% | 199,956 | $14,017,500 |

| NIS | Nickelsearch | 0.018 | -14% | 1,753,200 | $4,484,391 |

| GCM | Green Critical Min | 0.003 | -14% | 3,013,085 | $5,139,899 |

| ILT | Iltani Resources Lim | 0.22 | -14% | 1,085,441 | $8,672,679 |

| SPA | Spacetalk Ltd | 0.032 | -14% | 1,016,672 | $17,559,935 |

| PFE | Panteraminerals | 0.026 | -13% | 148,181 | $11,370,801 |

| M3M | M3Mininglimited | 0.033 | -13% | 285,668 | $3,184,604 |

| NKL | Nickelxltd | 0.02 | -13% | 250,000 | $2,352,186 |

| SLX | Silex Systems | 3.91 | -13% | 785,939 | $1,061,202,244 |

| ATH | Alterity Therap Ltd | 0.0035 | -13% | 3,903,200 | $21,281,344 |

| AUK | Aumake Limited | 0.007 | -13% | 2,342,857 | $15,425,928 |

ICYMI – AM EDITION

Airtasker (ASX:ART) has capped off FY2024 with positive free cash flow of $1.2m, up 115.4% on the previous corresponding period despite challenging macroeconomic conditions.

Its marketplaces revenue has increased by 9.8% to $38.1m while its UK operations reported a 76.3% increase in Q4 FY2024 revenues.

The company has $17.8m in cash and term deposits.

iCandy Interactive (ASX:ICI) has advised that Cheng Fei Wong and Ka King Foong, the respective chief executive officer and chief operating officer of its subsidiary Lemon Sky Animation have decided to retire.

Both Wong and Foong decided to retire after 16 years of working on the business, which was acquired by ICI in January 2022, slightly ahead of the expiry of the management agreement.

ICI has appointed executive director Kin Wai Lau to oversee the leadership transition – involving existing key studio executives and talents – over the coming months.

Meteoric Resources (ASX:MEI) has raised $420,046 from its share purchase plan and will place $3m of the shortfall at the same price of 11c per share to sophisticated investors.

This adds to the $27.5m that the company had raised in July through an institutional placement to high-quality domestic and international institutional investors, as well as existing shareholders.

Proceeds will be used to accelerate development of Caldeira, one of the world’s best rare earths discoveries.

This includes completing the pre-feasibility study, commissioning of a demonstration plant, progressing key licences and approvals, as well as ongoing exploration and drilling activities.

At Stockhead, we tell it like it is. While Airtasker, HyTerra, iCandy Interactive and Meteoric Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.