ASX Small Caps Lunch Wrap: Market opens slightly higher with plenty of wounds to lick

Pic via Getty Images

Local markets are up slightly this morning, following a mediocre session on Wall Street and yesterday’s blood-letting on the ASX.

Early in the session, the benchmark ASX 200 made it all the way to 0.5%, but – much like a Cybertruck in a headwind – it’s pretty much running on memory on the way into lunch, with apparently not much left in the battery.

US investors were depressed about weak job data, local investors are feeling a little gun-shy and we’re left to try to figure out which way the chips are going to fall today.

But that’s okay – new research from the Grattan Institute has shown that Aussies are the best in the world when it comes to gambling our money away, so let’s roll up our sleeves and get going.

TO MARKETS

I think it’s important that we acknowledge that yesterday was not a good day.

Things were said, often in the heat of the moment, and while we all know that it’s impossible to unsay the unkindnesses, the true measure of a person is in their ability to learn, to forgive, and to move forward in the face of adversity.

So… let’s all shake hands, agree to work together, and move on to today’s results… which are not even remotely spectacular, but they’re better than things were on Wednesday.

The ASX opened slightly higher on Thursday morning, peaking early around +0.5%, with big gains coming out of the Information Technology and Real Estate sectors.

Those gains were pared by continued heavy bleeding among Energy stocks, which – as we approach lunchtime – really look like they could use a friend right now.

That sector is off by an alarming 3.5% today, with industry giant Woodside (ASX:WDS) showing a 6.7% fall after going ex-div this morning, lining shareholder pockets to the tune of $1.01 per share.

That’s despite Woodside getting crunched over the past few months, down more than 19% so far for 2024, and off by close to 35% over the past 12 months, with tumbling crude prices adding to the misery.

WTI crude is currently below US$70 a barrel, and Brent Crude has edged back over US$73 a barrel this morning – but they’re down 8.3% and 7.3% respectively over the past week.

The closely watched Singapore iron ore futures is also a bit of a tale of woe this morning, as demand from China softens like a dropped ice cream and prices continue to fall.

Iron ore was down another 1.4% overnight, getting perilously close to US$90/tonne.

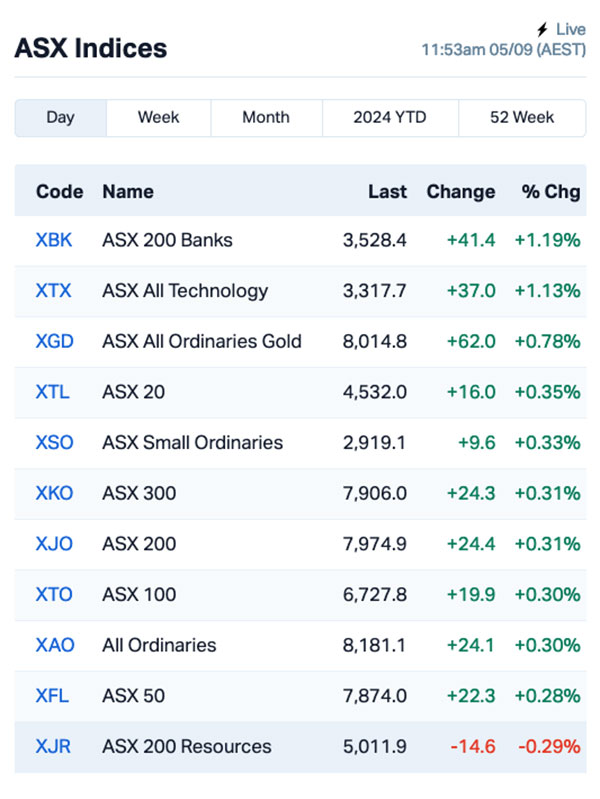

Here’s how the sectors looked at lunchtime:

But there are some bright spots on the ASX, as the indies charts reveal that the banks and tech stocks are kicking a few goals today.

The banks are doing well because they’re chock full of money, and everyone loves money, so that’s a no-brainer.

Tech stocks are lifting this morning, with data centre company NextDC (ASX:NXT) surging massively after un-listed competitor AirTrunk’s CEO Robin Khuda became Australia’s newest billionaire through the sale of his company to US investment monolith Blackstone for a toe-curling $23 billion.

Not bad for a CEO that was searching down the back of the couch for spare change eight years ago.

NOT THE ASX

The headline news from overseas this morning comes from Scandi automaker Volvo, which has confirmed what a lot of us have been predicting for the past few months, walking back its commitment to go full-EV by 2030.

Volvo abandoning that lofty goal is yet another kidney punch to the burgeoning battery metals industry in Australia, coming on the heels of ever-tightening protectionist tariffs on Chinese EVs around the world.

Volvo has moved the goalposts so that it’s now aiming at a minimum 90% of its vehicles rolling out of the factory as either full EV, or plug-in hybrid with a growing number of Volvo cars featuring a suspiciously oily-sounding “mild hybrid” nametag.

Mild hybrids are vehicles that rely mostly on conventional combustion engines, with only a minor portion of drive supplied by EV motors that are supplementary at best – along the lines of modern F1 cars, for want of a better example.

To overseas markets, and the US is still reeling from the Great Nvidia Wipeout, after what is arguably the single biggest one-day value shedding in history.

The chipmaker took a 9.5% nosedive on Tuesday, worth around US$267 billion – and you could hear the screaming from here. Overnight, it fell another 1.7% and there was much wailing and gnashing of teeth.

By close of play in New York last night, the S&P 500 was down 0.16%, the blue chips Dow Jones was up by 0.09%, and the tech-heavy Nasdaq slipped by 0.3%.

Treasury yields tumbled (bond prices soared), as another jobs data, the JOLTS, came in below expectations and hit its lowest point since 2021.

This led traders to start betting that the Fed might lower rates sooner, with the yield on the US two-year note now dropping below the 10-year note.

The 10-year Treasury and 2-year Treasury are now at their least inverted levels in more than two years, Eddy Sunarto noted this morning.

In other US stock news, Dollar Tree took a big hit, dropping 22.2% — the biggest fall among S&P 500 stocks — after slashing its full-year earnings forecast.

Verizon‘s got its eye on buying up rival Frontier Communications, with talks well advanced, according to someone in the know. Verizon’s share price was down 3%.

And, the Nordstrom family is eyeing a move to make its namesake department store chain private in a US$3.8 billion deal. Nordstrom’s shares were flat.

In Asian markets this morning, things are best described as “subdued” after yesterday’s mayhem.

Japan’s Nikkei is off by 0.62%, while the Hang Seng and Shanghai markets are flatter than a long-forgotten football, -0.2% and +0.2% respectively.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 05 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap EME Energy Metals Ltd 0.115 64.3 3,915,476 $14,677,832 LPD Lepidico Ltd 0.0015 50.0 7,519,955 $8,589,125 CRB Carbine Resources 0.004 33.3 20,913 $1,655,213 EDE Eden Inv Ltd 0.002 33.3 500,373 $6,162,314 SMM Somerset Minerals 0.004 33.3 250,075 $3,092,996 AIV Activex Limited 0.009 28.6 310,000 $1,508,518 ECT Env Clean Tech Ltd. 0.0025 25.0 217,116 $6,343,621 EMD Emyria Limited 0.045 25.0 463,425 $14,723,618 FGH Foresta Group 0.005 25.0 100,000 $9,421,516 IVX Invion Ltd 0.0025 25.0 231,500 $13,275,731 TSL Titanium Sands Ltd 0.005 25.0 134,481 $8,846,989 TYX Tyranna Res Ltd 0.005 25.0 200,000 $13,151,701 VRC Volt Resources Ltd 0.005 25.0 2,513,110 $16,634,713 NOU Noumi Limited 0.145 20.8 150,447 $33,253,118 H2G Greenhy2 Limited 0.006 20.0 1,000,226 $2,990,921 LRL Labyrinth Resources 0.02 17.6 4,810,782 $22,497,410 NRZ Neurizer Ltd 0.0035 16.7 32,260 $6,543,358 SRN Surefire Rescs NL 0.007 16.7 4,659,758 $11,917,847 TAT Tartana Minerals Ltd 0.029 16.0 71,595 $4,566,147 M2R Miramar 0.015 15.4 6,964,179 $5,132,134

As is often the case after a blood-letting, most of the market movers this morning have been moving without any news to hang their travels on, so the pickin’s are a little slim today.

Surefire Resources (ASX:SRN) was up on Thursday morning on news that a detailed soil sampling programme has turned up highly anomalous copper and zinc assays, with values up to 1000ppm Nickel, 310ppm Copper; 100ppm Zinc, 100ppm Cobalt and 452ppm Sulphur at the company’s Yidby gold project in the mid-west of Western Australia.

Earlier, Matsa Resources (ASX:MAT) was up slightly this morning on news that it has executed an extension to the Confidentiality Agreement it had previously executed on 31 July 2023 with AngloGold Ashanti Australia, granting it a 45-day extension as talks continue about the future of of the Lake Carey gold project.

Nova Minerals (ASX:NVA) was up on news that the company has sent off two bulk samples for testing for antimony content. Nova has sent 2,500kg from its Stibium prospect and another 500kg from its Styx prospect off to the lab, along with other samples sent to ALS Laboratories, with results expected in the coming weeks.

On the downside, Falcon Metals (ASX:FAL) has seen a setback to the expected date of re-commencing drilling to test the extent of the high-grade Farrelly Mineral Sands Deposit, initially targeted for Q4 2024. Landowners at the site have reportedly decided not to allow access to the site, and Falcon says negotiations are continuing with the hope of finding a resolution soon.

And big gun Coronado Global Resources (ASX:CRN) has blamed the weather for a revised guidance issued this morning, in which the company has said that Saleable Production will decrease from 16.4 – 17.2MMt to 15.4 – 16.0MMt, while the Average Mining Cost per Tonne Sold will increase from $95 – $99 to $105 – $110.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 05 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BNL Blue Star Helium 0.004 -33.3 7,922,217 $11,669,312 BP8 BPH Global 0.002 -33.3 400 $1,189,924 GCM Green Critical Minerals 0.002 -33.3 4,850,000 $4,405,628 FAL Falcon Metals 0.215 -28.3 1,467,482 $53,100,000 LSR Lodestar Minerals 0.0015 -25.0 6,404,316 $5,301,560 MTL Mantle Minerals 0.0015 -25.0 2,022,225 $12,394,892 WBE Whitebark Energy 0.007 -22.2 960 $2,271,001 LML Lincoln Minerals 0.004 -20.0 87,500 $10,281,298 EMS Eastern Metals 0.026 -18.8 840,565 $3,637,640 SPQ Superior Resources 0.009 -18.2 1,277,158 $22,013,425 TSI Top Shelf 0.049 -16.9 228,893 $19,181,334 FTC Fintech Chain 0.005 -16.7 47,636 $3,904,618 HOR Horseshoe Metals 0.005 -16.7 1,680,000 $3,979,690 PUR Pursuit Minerals 0.0025 -16.7 750,000 $10,906,200 ROG Red Sky Energy 0.005 -16.7 15,889,954 $32,533,363 TX3 Trinex Minerals 0.0025 -16.7 300,000 $5,485,957 8VI 8Vi Holdings 0.057 -16.2 2 $2,849,977 CRN Coronado Global 0.925 -15.5 8,474,450 $1,835,716,834 HMD Heramed 0.022 -15.4 65,000 $16,464,495 GAP Gale Pacific 0.115 -14.8 99,634 $38,341,977

ICYMI – AM EDITION

Blue Star Helium (ASX:BNL) has received firm commitments to raise $3m via an institutional investment of 750m new ordinary shares to institutional and sophisticated investors at an issue price of 0.4c.

Funds raised from the placement will allow BNL to progress helium development and exploration evaluation activities across its Las Animas acreage in Colorado, including the Galactica/Pegasus and Serenity projects.

“We are very pleased to have received such encouraging support from existing shareholders and look forward to an exciting quarter of activity across multiple projects culminating in production early in H1 2025,” BNL managing director and CEO Trent Spry said.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.