ASX Small Caps Lunch Wrap: Local markets sink at lunch while we’re drowning in lithium at Lake Johnston

Via Getty

Local markets are back in Struggletown on Friday, but it isn’t all doom and gloom – following the excellent drill results from TG Metals (ASX:TG6), and subsequent share price rise, there’s now suddenly quite a bit of interest in companies with tenements in that Lake Johnston region in WA.

Off the back of the TG6 success we’ve now seen Flynn Gold (ASX:FG1), which has neighbouring land to TG6, jump as much as 69% yesterday, nice, and this morning Rubix Resources (ASX:RB6) has been up as much as 58% after it also announced developments in Lake Johnston.

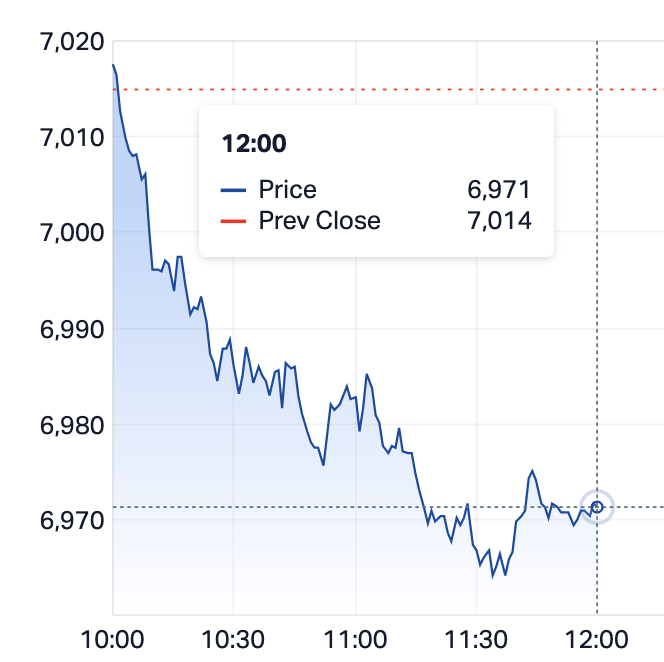

At 12pm the benchmark ASX 200 (XJO) index was down 43 points or -0.62% to 6,971.

The ASX200 finished 19 points (+0.28%) higher yesterday at 7015. It’s a shame to be back in the more mentally challenging under 7,000 points range again.

Still, it’s been a good run. Overnight Wall Street snapped the winning ways of November thus far as once again US yields came surging back into play after an unloved and poorly attented 30-year bond auction.

More troublesome – US Fed Chair J. Powell said the Fed won’t hesitate to tighten the money taps further if needed.

Powell noted that the FOMC are not confident that policy rates are high enough to achieve the 2% target and that the FOMC won’t hesitate to tighten more if appropriate.

There was quite a lot inappropriate about J Powell last night, if you stay to the end:

JUST IN: FED Chair Jerome Powell says “just close the f*cking door” after climate protestors interrupt his speech. pic.twitter.com/feDlOteRaz

— Watcher.Guru (@WatcherGuru) November 9, 2023

Oil prices rose from 3‑month lows, with Brent near $US80bbl.

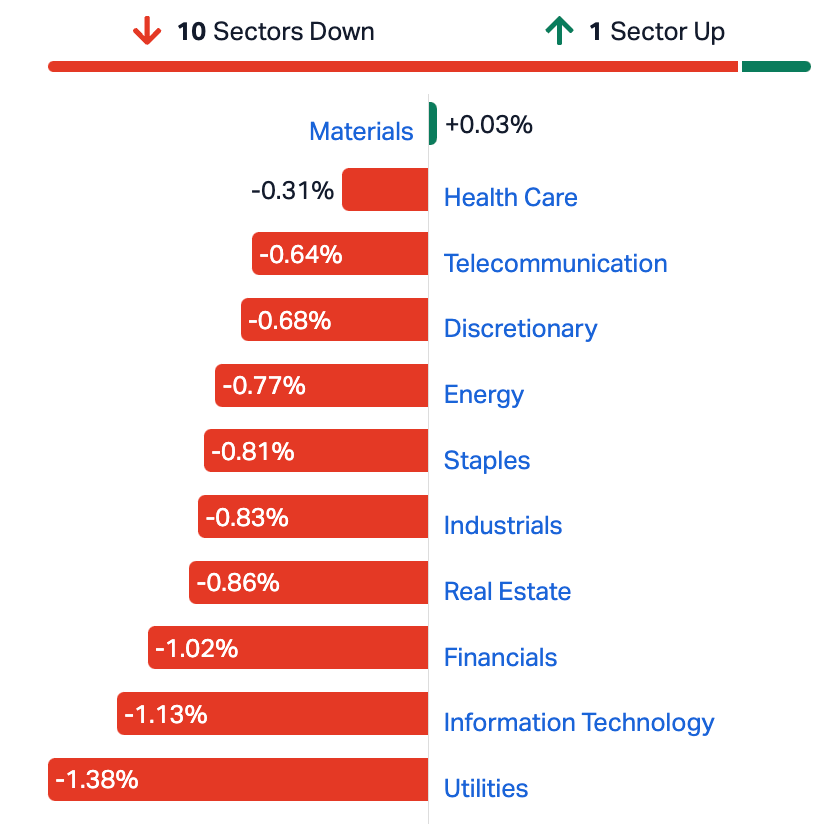

ASX SECTORS ON FRIDAY

Today is a little payback, as all 11 sectors on the Australian equities exchange head to the deep red of disappointment.

Remarkably, Healthcare stocks continue to prove attractive after a long year of neglect and while still in the red, are far from being sold off.

Utilities, Tech stocks and the Financial Sector have been out front of this morning’s selling.

An apologetic performance from National Australia Bank (ASX:NAB) after Thursday’s decent result was hamstrung by an indecent proposal from the CEO who suggested NAB’s 8.8% surge in FY23 profit would be as good as it gets for a bit.

Westpac (ASX:WBC), Commonwealth Bank (ASX:CBA) and Australia and New Zealand Banking Group (ASX:ANZ) are all about -1% lower at lunch.

Other big-end-of-towners to make a Friday feel like a Monday – Origin Energy (ASX:ORG) (-1.9%), Woodside Energy Group (ASX:WDS) (-1%) and Pilbara Minerals (ASX:PLS) (-2.7%). The benchmark index is on track to end the week flat.

Better signs for index heavyweight CSL, which gained 1.18% yesterday to $252.30, 10% above its $228.65 low last week. Xero saw its share price plunge 12.42% to $100.47 following a softer-than-expected 1H trading update.

Finally, inflation in China is looking a lot more like deflation in China.

IG Markets analyst Tony Sycamore says the softer Chinese activity data and inflation “raise the odds of additional government stimulus measures.”

Fortescue Metals Group (ASX:FMG), Rio Tinto (ASX:RIO) gained and BHP (ASX:BHP) are all higher.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap RB6 Rubix Resources 0.185 54% 5,294,690 $6,546,000 VPR Volt Power Group 0.0015 50% 70,954 $10,716,208 TG1 Techgen Metals Ltd 0.039 44% 404,169 $2,083,544 14D 1414 Degrees Limited 0.034 36% 161,707 $5,954,213 ENT Enterprise Metals 0.004 33% 129,250 $2,398,413 BLU Blue Energy Limited 0.026 30% 4,421,284 $37,019,472 AZL Arizona Lithium Ltd 0.035 25% 57,143,976 $92,926,009 MSI Multistack International 0.005 25% 66 $545,216 AYA Artrya 0.235 24% 1,914 $11,977,319 WEC White Energy Company 0.08 23% 119,173 $4,446,402 NRX Noronex Limited 0.011 22% 516,566 $3,404,716 VMS Venture Minerals 0.011 22% 1,461,330 $17,550,117 PNR Pantoro Limited 0.0475 22% 15,365,747 $202,957,190 VMM Viridis Mining 1.6 21% 276,340 $54,846,878 CBH Coolabah Metals 0.063 21% 50,761 $3,005,600 BTR Brightstar Resources 0.012 20% 11,108,970 $19,158,334 GMN Gold Mountain Ltd 0.006 20% 3,572,155 $11,345,393 H2G Greenhy2 Limited 0.012 20% 8,000 $4,187,558 RML Resolution Minerals 0.006 20% 800,000 $6,286,459 SIX Sprintex Ltd 0.012 20% 4,527,403 $3,413,565 BYH Bryah Resources Ltd 0.019 19% 7,905,250 $5,737,685 ARV Artemis Resources 0.034 17% 5,960,197 $45,745,133 AVH Avita Medical 3.71 17% 463,827 $190,770,601 AYT Austin Metals Ltd 0.007 17% 668,923 $6,095,248

This morning at its AGM, 1414 Degrees (ASX:14D) held an investor presso and the executive chairman’s combative address appears to have struck a chord. The stock is killing it and – every now and again – ASX shareholders deserve a big dog to rally round, like this one:

…We are aware that our Company, like many in the industrial technology space, is not achieving market recognition for its potential value.

To mitigate this, we are introducing the Company to international investor markets, and at the same time increasing exposure to potential European and North American industrial users to increase brand awareness with the aim of increasing our potential for partnerships, customers and strategic investors.

There is, of course, a more immediate source of revenue from our Aurora Energy Precinct, near Port Augusta in South Australia.

After several years of delays, we are confident of securing access to the high voltage transmission line and are now assessing infrastructure and operating partners for the large battery proposed for the site. Our intent at this time is for 1414 Degrees to retain an interest in the project and its cash flow while reducing our contribution to capital costs via strategic deals.

In summary, your Company is in a strong position to provide value for shareholders as a result of our activities during FY23. Your board maintains a tight focus on results and governance for the benefit of all shareholders. Our supportive partnerships with the Australian Government, Woodside Energy, Refratechnik Steel, Vast Solar and Adelaide University provide a very strong foundation for the future.

Meanwhile, as my fantastic colleague Nadine McGrath pointed out – it’s all about Lake Johnston lithium out in the Goldfields Esperance region of WA with several companies up on news about projects in the area.

Way out ahead at lunchtime is Rubix Resources (ASX:RB6), which says a cultural heritage survey will start on November 30 at its Lake Johnston lithium project in WA with a program of works for its maiden drilling program approved.

Also up and away is Bryah Resources (ASX:BYH) which says it’s fast-tracking its lithium exploration at Lake Johnston with CEO Ashley Jones saying TG Metals’ (ASX:TG6) recent success has put a strong emphasis again on the area.

“We have already shown that we have LCT type pegmatites on Bryah’s tenements with 403ppm Li2O at the Roundbottom Prospect. So we know the potential,” he said.

Next up is TechGen Metals (ASX:TG1) which dropped an update on its projects including stage three drilling approved for its John Bull Gold Project and pegmatite mapping to kick off at Ida Valley with historic data identifying lithium and caesiumin soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault.

Charger Metals (ASX:CHR) reports assay results from soil sampling completed earlier this year have identified several new lithium targets at the Mt Gordon tenement of its Lake Johnston lithium project.

And Avita Medical (ASX:AVH) has announced its third quarter financial results with 51% commercial revenue growth on pcp to $13.5 million and gross margin of 84.5% for the quarter.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 10 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MNS Magnis Energy Tech 0.045 -44% 26,152,775 $97,159,350 BP8 Bph Global Ltd 0.001 -33% 227,470 $2,423,345 AMD Arrow Minerals 0.0015 -25% 1,085,676 $6,047,530 DTC Damstra Holdings 0.185 -21% 2,773,420 $60,602,292 PLN Pioneer Lithium 0.25 -21% 106,185 $8,953,875 NNG Nexion Group 0.012 -20% 1,250,000 $3,034,618 CNJ Conico Ltd 0.004 -20% 204,758 $7,850,475 IEC Intra Energy Corp 0.004 -20% 1,632,866 $8,303,908 KZA Kazia Therapeutics 0.07 -20% 716,197 $20,562,396 DUN Dundas Minerals 0.057 -19% 498,148 $3,547,500 TTI Traffic Technologies 0.009 -18% 226,714 $8,334,372 MKL Mighty Kingdom Ltd 0.015 -17% 6,765 $7,566,653 LYK Lykos Metals 0.05 -15% 46,734 $3,681,600 NXS Next Science Limited 0.29 -15% 251,988 $99,176,335 IBG Ironbark Zinc Ltd 0.006 -14% 250,000 $10,267,490 SGC Sacgasco Ltd 0.006 -14% 90,000 $5,415,079 XAM Xanadu Mines Ltd 0.066 -13% 3,428,766 $124,474,639 VSR Voltaic Strategic 0.02 -13% 8,866,823 $11,111,389 OSX Osteopore Limited 0.043 -12% 18,000 $7,591,013 CAE Cannindah Resources 0.088 -12% 29,241 $57,807,995 FG1 Flynn Gold 0.086 -11% 974,579 $13,229,111 OPN Open Negotiation 0.008 -11% 6,800 $10,050,117 YAR Yari Minerals Ltd 0.016 -11% 456,727 $8,682,441

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.