ASX Small Caps Lunch Wrap: Local markets are lower and Albo bought a beach house

The PM is now all set to kick off the new annual tradition of the Harold Holt Memorial March into the Sea. Pic: Getty Images

- ASX 200 down 0.35pc at lunchtime, for a number of reasons

- Goldies and Banks did their best early on, to no avail

- Everyone’s losing their mind because the PM bought a beach house

Local markets have dipped this morning, after Wall Street got a soggy batch of chips overnight and quite a few people lost quite a bit of money when Euro-chippy ASML and US Mega-Chips Nvidia et al hit the skids.

Early doors, it was only the Banks and the Goldies holding firm in positive territory, with the rest of the market hitting hump day harder than a high-speed cyclist into the side of a careless camel.

Best we move on before any of us give that metaphor any more thought than it deserves.

TO MARKETS

The ASX 200 dipped early this morning, opening lower – as expected – because things were a little dreary on Wall Street overnight.

Some 30 minutes into the session, the benchmark was down 0.35% and seemed pretty determined to stay there this morning, as global influences did their thing to investor sentiment.

The reasons are many and varied, but basically look like this: Brent crude fell 3.7% to $US74.62 per barrel, iron ore fell 1.6% to US$106.30 per tonne, and the price of gold was flat when the sun came up over Sydney this morning.

That made a lot of people unhappy, apparently, so words were exchanged, phone calls made and things got sold.

That included some market heavyweights, such as Pilbara Minerals (ASX:PLS), Mineral Resources (ASX:MIN) and Deep Yellow (ASX:DYL), which dropped more than 3% each in early trade.

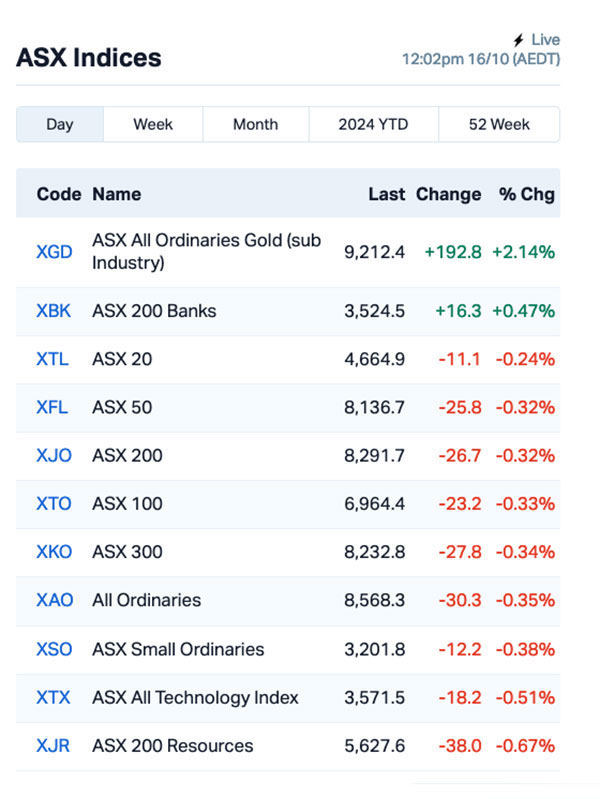

That left the market sectors looking like this at lunchtime:

A clearer indication of what the market is doing lies in the sub-indices chart:

Oddly enough, the banks are doing pretty well today, despite Westpac (ASX:WBC) rolling into the day with yet another outage this morning, marking the third day on the trot that its customers haven’t been able to experience the unbridled joys of mobile banking.

Westpac says “we’re fixing it. No, really… we’re on it” – meanwhile, their customers are most likely going without their morning caffeine hit for the third day in a row, and are now too tired and weak to complain, so… problem solved!

In broader business news, it looks like Aussie businesses are having a rough time again, with reports that businesses are battling the highest rate of late payments since COVID-19 turned the nation to mush.

According to CreditorWatch, 4.9% of payments were more than 60 days overdue in September, which is a 21.4% increase on pcp and a 7.9% rise since the start of the calendar year.

Outside of the market, everyone’s losing their minds because Albo’s bought himself a little shack by the beach on the NSW central coast – just like pretty much every single Labor MP before him, if I’m remembering my time embroiled in that side of politics correctly – which is a bit mean.

Y’all are just jelly… because that man is a saint, who has worked his fingers to the bone for every single one of the 20-something weeks of the year that he has actually had to turn up in Canberra to be an MP since he got onto the taxpayer payroll in 1996… and who are we to tell the Prime Minister of all people that he’s not allowed to buy some two-story 50-bedroom monstrosity that’ll be gone in the next round of bushfires?

I jest, of course. We all know he’s no saint.

Anyhoo… let’s look at what happened overseas before Albo realises I still live in his electorate, and pays off the council guys to tip my bins over every week.

NOT THE ASX

Overnight, Europe’s most valuable tech company, ASML, led a tech rout on Nasdaq after the company released a gloomy outlook, Eddy Sunarto reported this morning.

The Dutch chipmaker warned of a slower recovery in the semiconductor market and cut its guidance for next year. ASML’s CEO pointed to cautious customers outside of AI. Plus, ASML said it expect sales to China to drop from nearly half of its revenue to about 20% next year due to export restrictions.

Nvidia sold off by 4.7% and Arm by 7% after the report release, dragging the Nasdaq index lower by 1%. Both the S&P 500 and blue chips Dow Jones also fell by 0.75%.

“We worry that valuations are getting stretched, as stocks are near ‘priced to perfection,” said Lamar Villere, at Villere & Co.

Apple shares, however, hit a record high early on, briefly pushing its market cap to $US3.6 trillion, before retreating to a 1.1% gain.

LVMH’s sales of luxury fashion and leather goods have dropped for the first time since the pandemic, hit hard by a decline in demand from Chinese shoppers. Its shares fell by 2% in Paris.

Adidas has raised its annual profit target for the third consecutive quarter, driven by strong demand for retro sneakers like the Samba and Yeezy inventory. Shares fell by 1.2% in Frankfurt.

Pharmacy stock Walgreens Boots Alliance shares surged about 16% after the company announced its plans to close 1,200 stores over the next three years as part of a turnaround strategy.

United Airlines posted third-quarter results that exceeded expectations for both revenue and earnings. Shares rose around 1%.

Trading in Trump Media & Technology stock was briefly halted due to volatility. The stock fell 5% in late afternoon trading after surging over 13% earlier in the day. The cause of the sudden drop is unclear, but it ended the day 10% lower.

It might have had something to do with the presidential candidate abandoning any sense of rational thought or reasoning in Pennsylvania the other night, when his “town hall” meeting turned into a 40-minute interpretive dance session while he blasted an increasingly bemused audience with the top songs off his iPod.

Or it was just a Trump stock doing Trump stuff in a very Trump way… and I guess we’ll never know.

In Japan this morning, the Nikkei was down 1.81% in early trade, possibly because Starbucks Japan has released this year’s Halloween Frappucino, with marketing to suggest “it’s like drinking a magic spell”, which is 100% accurate, as long as “Diabetus Maximus” is included somewhere in your spellbook.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 16 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MKG Mako Gold 0.015 57.9 17,574,911 $9,372,881 AXP AXP Energy 0.0015 50.0 505 $5,824,681 OAR OAR Resources 0.003 50.0 817,044 $6,601,669 TD1 Tali Digital 0.0015 50.0 504,253 $3,295,156 POS Poseidon Nickel 0.0055 37.5 29,447,668 $16,815,502 MRQ MRG Metals 0.004 33.3 1,054,653 $8,134,556 RIL Redivium 0.004 33.3 47,706 $8,240,564 TX3 Trinex Minerals 0.002 33.3 150,000 $2,742,978 NYR Nyrada 0.13 31.3 4,207,111 $18,038,661 RFA Rare Foods Australia 0.017 30.8 51,441 $3,535,782 88E 88 Energy 0.0025 25.0 6,073,545 $57,867,624 GTI Gratifii 0.005 25.0 114,556 $8,596,785 T3D 333D 0.01 25.0 47,086 $955,559 ERA Energy Resources 0.011 22.2 2,343,799 $199,334,693 MEL Metgasco 0.006 20.0 3,655,833 $7,287,934 PUR Pursuit Minerals 0.003 20.0 5,634,253 $9,088,500 TMK TMK Energy 0.003 20.0 166,669 $18,979,030 SPX Spenda 0.013 18.2 9,372,902 $50,639,555 TGH Terragen 0.059 18.0 87,069 $18,454,056 MPK Many Peaks Minerals 0.245 16.7 1,447,610 $17,112,414

Mako Gold (ASX:MKG) was up quite rapidly this before lunch, on news the company has entered into a Bid Implementation Agreement with Aurum Resources (ASX:AUE), for “an agreed merger pursuant to which Aurum proposes to acquire 100% of the issued shares in Mako and 100% of two classes of unlisted options by way of an off-market takeover bid”.

The deal, as it stands, is for 1 Aurum share for every 25.1 Mako shares, representing an offer price of $0.018 per Mako share, along with 1 Aurum share for every 170 Class A Options, and 1 Aurum share for every 248 Class B Options, with the merger aimed at creating “an emerging exploration and development gold business in West Africa, with cash of over A$20 million1 to advance the flagship Napié and Boundiali Projects in northern Côte d’Ivoire”.

Meanwhile, drug discovery and development company Nyrada (ASX:NYR) was up after the company announced the successful completion of the final GLP safety study for its lead candidate NYR-BI03, a first-in-class neuroprotection treatment for stroke and traumatic brain injury. The company says this latest step has “confirmed a favourable safety profile for NYR-BI03, giving us confidence that it will transition well into human studies”.

Energy Resources of Australia (ASX:ERA) was up on news that the ASX Takeover Panel had knocked back requests from two ERA shareholders – Zentree Investments and WA stockbroker Willy Packer’s Packer and Co. – which had complained that ERA’s 19.87 for 1 renounceable entitlement offer would enable Rio Tinto (ASX:RIO), which owns 86.3% of ERA, to take its stake beyond 90% and compulsorily acquire the rest of its stock at just 0.2c a pop.

The entitlement offer has resumed, with an updated Ex-Date set for Friday, 18 October 2024 and entitlements will trade on ASX on a deferred settlement basis on this date, the Record Date set for 7:00pm (Sydney time) on Monday, 21 October 2024 and the Entitlement Offer is now scheduled to open on Wednesday, 23 October 2024, and close at 5:00pm (Sydney time) on Wednesday, 13 November 2024.

TMK Energy (ASX:TMK) was up after announcing a three day extension to the closing date of Entitlement Issue (Offer), which will now close at 5.00pm (AWST) Friday 25 October 2024 to allow additional time for shareholder participation. The company also notes that directors and management have agreed to a 50% reduction in cash fees for the next 6 months, with the company aiming to reduce costs by $250,000 through the initiative, as it moves towards a commercial outcome from its 100% owned Gurvantes XXXV Coal Seam Gas Project in the South Gobi Desert of Mongolia.

Earlier, GTI Energy (ASX:GTR) was up after releasing an investor presentation this morning, focused on its Lo Herma uranium play in Wyoming, which the company says is currently “the only “junior”in Wyoming with compliant ISR uranium resources”, with current drilling underway aimed at a providing a resource upgrade and scoping study. Currently, the company says it has an inferred resource of 7.4 Mlbs so far in Wyoming, and at an $80/lb contract price, that makes Wyoming ISR projects “very attractive”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ICU Investor Centre Ltd 0.002 -33.3 388,227 $913,534 AHN Athena Resources 0.004 -20.0 3,080 $5,352,338 AKN Auking Mining Ltd 0.004 -20.0 2,000,000 $1,762,851 OCN Oceanalithiumlimited 0.036 -18.2 285,999 $3,629,912 AD1 AD1 Holdings Limited 0.005 -16.7 1,866,632 $6,584,090 IBG Ironbark Zinc Ltd 0.0025 -16.7 1,858 $5,500,943 AL8 Alderan Resource Ltd 0.003 -14.3 54,545 $5,499,371 AUR Auris Minerals Ltd 0.006 -14.3 50,000 $3,336,382 1AE Auroraenergymetals 0.039 -13.3 246,936 $8,057,868 PHO Phosco Ltd 0.04 -13.0 121,249 $12,868,416 MOM Moab Minerals Ltd 0.0035 -12.5 327,500 $3,235,257 RGL Riversgold 0.0035 -12.5 25,340,368 $5,309,850 W2V Way2Vatltd 0.007 -12.5 2,826,872 $7,220,036 SGA Sarytogan 0.105 -12.5 380,520 $17,847,999 CYM Cyprium Metals Ltd 0.029 -12.1 1,116,455 $50,356,757 PVE Po Valley Energy Ltd 0.0405 -12.0 595,301 $53,312,235 DGR DGR Global Ltd 0.015 -11.8 951,114 $17,742,789 AX8 Accelerate Resources 0.008 -11.1 28,174 $5,595,785 CUF Cufe Ltd 0.008 -11.1 1,562,721 $12,030,074 EFE Eastern Resources 0.004 -11.1 825,725 $5,588,759

At Stockhead we tell it like it is. While GTI Energy was a Stockhead advertiser at the time of writing, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.