ASX Small Caps Lunch Wrap: How horribly dirty has North Korea been fighting this week?

After decades of development, top scientists have perfected the ultimate Borth Korean weapon, dubbed The Mighty Floating Poo. Pic via Getty Images.

Local markets have completed a worrisome trifecta this morning, losing ground for the third session in a row after a woeful effort on Wall Street overnight set the stage for more losses.

That arrived like an unwanted knock on the door this morning, alongside a sentiment hangover from yesterday’s not-great CPI data that has some analysts sounding the alarm bells about the possibility of a rate hike by the RBA.

I’ll get into more detail on that shortly, but first there’s been a development on the Korean peninsula, where relations between South Korea and its unpredictable namesake to the north have once again boiled over.

It’s not uncommon for slight provocations – both real and imagined – to set Kim Jung Un off, and it normally results in either a barrage of bellicose bloviating, or a desultory “launch” of a Super-Deadly™ North Korean rocket into the sea.

It’s also not uncommon for South Korean activists to use prevailing wind conditions to drop leaflets across the border into North Korea, in an attempt to tell citizens there that they’re living in a horrifying dystopian dictatorship, and that there’s a more ‘normal’ existence waiting for them across the border.

It’s a very basic, cost-effective way of getting the message across the border, but a batch that went out earlier this week has been met with an equally low-tech, but vastly more unpleasant response.

South Korean citizens have been reporting packages of excrement falling from the sky, courtesy of North Korean forces attaching said packets of poo to helium balloons and releasing them to waft across the border to wreak foul, smelly havoc.

“The Joint Chiefs of Staff of the [South Korean] puppet army said that [North Korea] is scattering a large number of balloons over [South Korea] from last night,” North Korean leader Kim Jong Un’s sister, Kim Yo Jong, told state-run news agency KCNA.

“It urged [North Korea] to stop such an act at once, claiming that it is a clear violation of international law, an act of seriously threatening the security of [South Korean] people and an unethical and lowbrow act.”

How she managed to keep a straight face while saying it is anyone’s guess, because it’s one of the most bizarrely amusing acts of international sabre-rattling you’re ever likely to see. It’s not often international diplomacy descends into an actual, literal shitfight… but, here we are.

And speaking of wads of dung hurtling from the sky, it’s time we took a look at how the ASX was doing this morning.

Spoiler alert: you might want to bring an umbrella.

TO MARKETS

The ASX 200 benchmark has delivered a sorry old hat-trick on Thursday morning, as markets opened lower for the third day on the trot amidst poor showings in New York, and some Chicken Little-level doomsayers getting everyone worked up about a possible rate hike on the horizon.

It’s the latter part of that mood-setting that’s a worrying issue – as you no doubt heard yesterday, the ABS dropped some fresh CPI data that basically said “whatever the RBA’s been doing to fix inflation hasn’t worked”, because it’s still creeping higher than expected, or desired.

That’s left a sour taste in the mouths of many investors, and the market’s in the doldrums this morning as a result.

Elsewhere in the headlines, it seems that BHP (ASX:BHP) has finally understood that “no means no”, and formally walked away from its bid to consume Anglo American, after three fairly determined efforts were brushed off by the target company.

“While we believed that our proposal for Anglo American was a compelling opportunity to effectively grow the pie of value for both sets of shareholders, we were unable to reach agreement with Anglo American on our specific views in respect of South African regulatory risk and cost and, despite seeking to engage constructively and numerous requests, we were not able to access from Anglo American key information required to formulate measures to address the excess risk they perceive,” said BHP boss Mike Henry, all in one breath apparently.

“We remain of the view that our proposal was the most effective structure to deliver value for Anglo American shareholders, and we are confident that, working together with Anglo American, we could have obtained all required regulatory approvals, including in South Africa,” Henry continued.

That’s a lot of woulda-coulda-shoulda from BHP, and it is very much the end of the road for the bid for at least six months, as stipulated under UK laws governing takeovers and other forms of harassment.

But while there’s sad news for BHP, there’s some good news for Aussie beefers, after Agriculture Minister Murray Watt confirmed that a Chinese ban on Australian beef imports has, as of last night, been lifted.

Senator Watt told ABC news that the ban on five major beef exporters in NSW and Queensland had been put in place by China during the vicious trade spat that upset the apple cart in 2020, locking out close to $1 billion in beef exports every year.

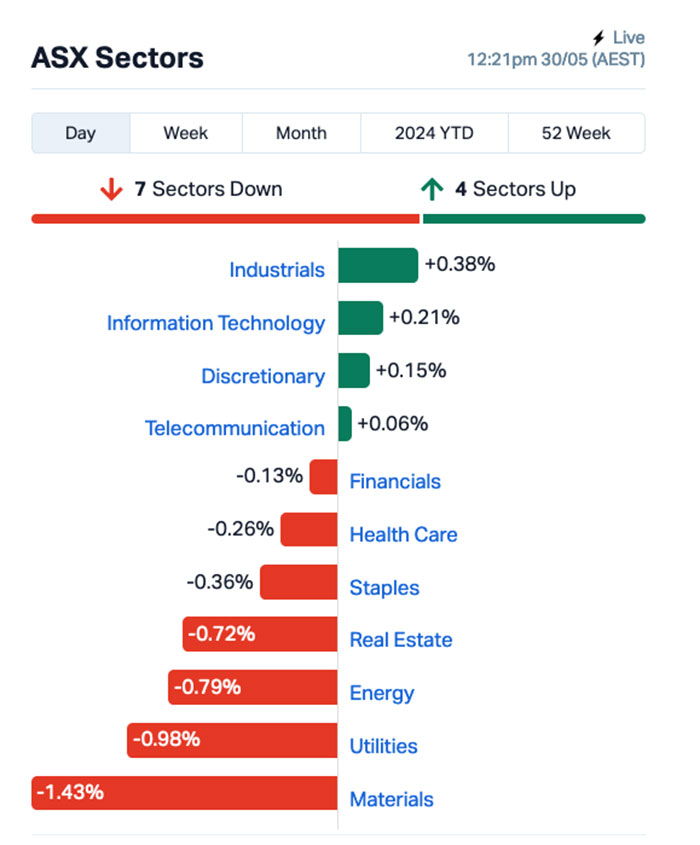

A look at how the markets were behaving this morning reveals that fortunes among the sectors are broadly mixed, with Materials bearing the brunt of the sell-off, while Industrials took centre stage for a rare moment at the top of the pile.

A more granular look at the ASX indices shows that tech stocks are well out in front, thanks to a solid rally through the morning session that has taken the slice of the market that requires batteries nicely into greener pastures.

NOT THE ASX

As I mentioned earlier, things didn’t go so good in New York overnight, with Wall St seemingly spooked by the goings on with our local CPI data yesterday, ahead of US officials releasing their own inflation data later this week.

That, alongside concerns about a rise in US bond yields after a poor Treasury auction, let the air out of the NYSE’s tyres, and the the S&P 500 fell by -0.74%, the blue chips Dow Jones index was down -1.06%, and the tech-heavy Nasdaq retreated by -0.58%.

In US stock news, Salesforce dropped by -16% in after-hours trading as the company’s revenue forecast for the current quarter fell short of Wall Street’s estimates.

Nvidia closed higher for the fourth day in a row – up +0.8% – and has jumped more than 20% in the past few days on the back of its blowout earnings.

Netflix was up by almost +1% after bullish calls from several Wall Street analysts who expressed strong confidence in the streaming giant’s future growth. Morgan Stanley, for instance, believes the stock could rise by 30% from its current price.

And ConocoPhillips is set to purchase Marathon Oil, an independent oil and gas company, in a US$22.5 billion all-stock deal, marking another step in the ongoing consolidation of the US energy industry.

In Asian markets this morning, it’s a similar story to yesterday – both the Nikkei and Hang Seng are tracking Wall Street lower, losing -1.71% and -0.28% respectively, while Shanhai markets are proving to be remarkably resilient and resistant to external influences, rising +0.20% in early trade.

Meanwhile, markets in Poland, Brazil, Malaysia and Croatia are all closed for holidays today, while South Korea’s Kospi index is down -0.88%, with trading there subdued while officials pause to clean Kim Jong Un’s airborne turds off the windows.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 30 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap NVU Nanoveu Limited 0.036 64% 47,192,996 $9,805,303 FTC Fintech Chain Ltd 0.015 50% 23,732 $6,507,696 88E 88 Energy Ltd 0.003 50% 15,999,754 $57,785,344 MRQ MRG Metals Limited 0.0015 50% 61,335 $2,525,119 HCT Holista CollTech Ltd 0.007 40% 80,000 $1,394,000 OAU Ora Gold Limited 0.0055 38% 87,992,464 $23,224,004 FAL Falcon Metals 0.27 29% 1,315,112 $37,170,000 MHI Merchant House 0.045 29% 141,333 $3,299,327 AHK Ark Mines Limited 0.17 26% 55,291 $7,485,266 NRZ Neurizer Ltd 0.0025 25% 484,464 $3,804,861 MGA Metals Grove Mining 0.054 23% 210,000 $3,956,062 MDX Mindax Limited 0.041 21% 1,137,795 $69,658,649 EQS Equity Story Group 0.03 20% 446,447 $2,724,837 TSL Titanium Sands Ltd 0.006 20% 1,899,990 $11,058,736 LRD Lord Resources 0.065 18% 68,877 $2,961,729 XPN Xpon Technologies 0.013 18% 180,815 $3,766,856 MMI Metro Mining Ltd 0.049 17% 34,175,447 $244,345,851 WEC White Energy Company 0.042 17% 1,219 $4,076,472 AVE Avecho Biotech Ltd 0.0035 17% 101,647 $9,507,891 MCL Mighty Craft Ltd 0.007 17% 68,542 $2,213,456 ACW Actinogen Medical 0.029 16% 1,172,293 $63,173,032 AMD Arrow Minerals 0.004 14% 2,570,309 $35,487,778 EPM Eclipse Metals 0.008 14% 483,381 $15,755,989 DXB Dimerix Ltd 0.455 14% 7,423,797 $219,869,853 FDR Finder 0.068 13% 103,786 $9,450,000

Leading the way on Thursday morning was films and coating company Nanoveu (ASX:NVU), climbing on news that the company has signed a binding deal giving Rahum Nanotech exclusive distribution rights in South Korea for the EyeFly3D product, which “allows users to experience 3D without the need for glasses on everyday handheld devices”.

NVU says Rahum must receive orders of ~$30 million by the end of 2026 to maintain exclusivity.

Big news for Ora Gold this morning, after the explorer revealed that it is set to team up with miner Westgold (ASX:WGX) to bring OAU’s high grade 240,000oz Crown Prince deposit into production, with WGX signing on to snap up $6 million worth of shares in the junior for a cornerstone stake of around 15%.

And rounding out Thursday morning’s best Small Caps with news was Merchant House (ASX:MHI), after the company announced that it’s set to sell off its 33% shareholding in Tianjin Tianxing Kesheng Leather Products Company to Tianjin Wuxi International Trading Company, for the equivalent of a cool $8.3 million Aussie dollars.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 30 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SNX Sierra Nevada Gold 0.075 -38% 185,931 $9,128,991 APC Aust Potash Ltd 0.001 -33% 150,000 $6,030,284 ME1 Melodiol Global Health 0.002 -33% 824,586 $2,469,412 BFC Beston Global Ltd 0.003 -25% 3,340,386 $7,988,188 LPD Lepidico Ltd 0.003 -25% 3,620,017 $34,356,478 PPY Papyrus Australia 0.012 -25% 426,666 $7,883,081 SI6 SI6 Metals Limited 0.003 -25% 5,963,673 $9,475,438 EXT Excite Technology 0.007 -22% 6,972,063 $13,088,176 EEL Enrg Elements Ltd 0.004 -20% 200,000 $5,049,825 EXL Elixinol Wellness 0.004 -20% 23,771 $6,505,370 MOM Moab Minerals Ltd 0.004 -20% 200,553 $3,559,815 VRC Volt Resources Ltd 0.004 -20% 442,500 $20,793,391 TSI Top Shelf 0.0975 -19% 362,718 $25,041,103 5EA 5Eadvanced 0.215 -17% 444,284 $86,727,118 BCT Bluechiip Limited 0.005 -17% 25,052 $6,604,601 ZMM Zimi Ltd 0.018 -14% 320,000 $2,590,309 AAU Antilles Gold Ltd 0.006 -14% 2,539,983 $6,975,745 LMG Latrobe Magnesium 0.048 -14% 4,644,731 $108,430,973 NAE New Age Exploration 0.003 -14% 120,386 $6,278,646 RKT Rocketdna Ltd. 0.006 -14% 50,000 $4,592,804 CNB Carnaby Resource Ltd 0.65 -14% 1,245,082 $129,812,621 ECT Env Clean Tech Ltd. 0.0035 -13% 30,566 $12,687,242 HLX Helix Resources 0.0035 -13% 878,097 $13,056,775 PAB Patrys Limited 0.007 -13% 108,334 $16,459,579 SPX Spenda Limited 0.007 -13% 1,364,873 $34,595,662

ICYMI – AM EDITION

Copper Search (ASX:CUS) has raised $2m through a private placement of shares priced at 10c each to sophisticated, professional and institutional investors.

Proceeds from the placement will be used to fund drilling at its Peake project in South Australia, which starts next week, along with assessing the gold prospectivity of the Mt Denison claim.

The six week diamond drill program will test the Paradise Dam and Douglas Creek prospects for large-scale copper deposits.

Prospect Resources (ASX:PSC) has finalised the second part of its acquisition of a 85% interest in its highly prospective Mumbezhi copper project within the world-class Zambian Copper Belt.

The company will now transfer US$5.35m and issue about 7 million PSC shares to the vendor Global Development Cooperation Consulting Zambia.

It is currently well advanced in the evaluation of the Orpheus drilling data from the 2021 drill programs and integrated geological datasets on Mumbezhi. Results from this will provide guidance for its planned activities during H2 2024 with initial drilling and metallurgical test work expected to start during Q3 2024.

Riversgold (ASX:RGL) has identified several channel iron deposits at its Wodgina East project in WA’s Pilbara project following completion of the Phase 1 reconnaissance exploration program of geological mapping and rock chip sampling.

Historical rock chip sampling from Mesa 2 returned eight samples returned iron grades of between 51.94% and 56.67%.

The company plans to carry out infill and extensional sampling along with metallurgical bulk sampling to determine its beneficiation potential.

At Stockhead, we tell it like it is. While Copper Search, Prospect Resources and Riversgold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.