ASX Small Caps Lunch Wrap: Has anyone else noticed something’s up with the water this week?

News

News

Local markets have been flat this morning, because it’s Thursday and there’s not very much happening, aside from a couple of Small Caps making decent enough gains, and the ASX getting ready to see if it can handle Mexican food for lunch, after Guzman y Gomez (ASX:GYG) made its market debut at 12:00pm.

I’ll get into the details of all that shortly, but first, there seems to be something happening to people’s water this week, after a couple of news stories caught my eye, concerning that wonderful, refreshing stuff that plays a vital role in everyone’s lives.

The first, and perhaps most baffling of the stories, was the apparent launch of a new disposable water brand in the United States, during a conservative “People’s Convention” gabfest put on by Talking Points USA.

For background, Talking Points USA describes itself as “a non-profit organisation whose mission is to identify, educate, train, and organise students to promote freedom”.

It’s founder, a guy called Charlie Kirk, cuts a super-earnest figure at the helm of the organisation – but, credit where credit is due, because he has most definitely figured out reliable way of turning a profit by being the most anti-woke kid on the block.

Case in point is the apparent launch of Freedom2o bottle water at Charlie’s latest TPUSA convention, which is so wild that you need to see it for yourself.

Here’s current right wing media darling Alex Clark, putting the “shrill” in “shill” `while spruiking some obviously rigorously scientifically tested claims about what it means to drink this super-charged anti-woke beverage.

finally, water that isn’t WOKE!!! pic.twitter.com/Ss3KLnpLLG

— jordan (@JordanUhl) June 15, 2024

I got chills watching that… as Alex says, “Freedom2o isn’t just about what’s inside the bottle. It’s about the message it sends with every sip” – which is “I paid $2.60 for a $0.48 bottle of water, to own The Libs”.

But while that might be yet another politically motivated side-hustle from that sector of US politics, the really baffling water story is happening closer to home, after the ABC shone a light on a multi-level marketing scheme that is apparently ravaging rural communities.

The story, which is worth a read if you’re into that kind of cautionary tale, revolves around a scheme to flog Kangen alkaline water ionizer and filtration machines, distributed by a 50-year-old Japanese direct-sales company called Enagic – and it’s marketing message is almost as baffling as the TPUSA crowd.

“Our passion is to transform the tap water in your home into pure healthy electrolyzed-reduced and hydrogen-rich drinking water,” Enagic says on its website.

I’m not sure how much hydrogen they’re aiming for, but if the water they’re drinking isn’t already about 66% hydrogen, I fear that it might not be water they’re drinking…

Aussie markets were looking a little flat this morning, after the benchmark wandered marginally south of profitability like an escapee from an old folks’ home, meandering around in search of a long-dead relative and maybe even a cup of tea if he’s lucky.

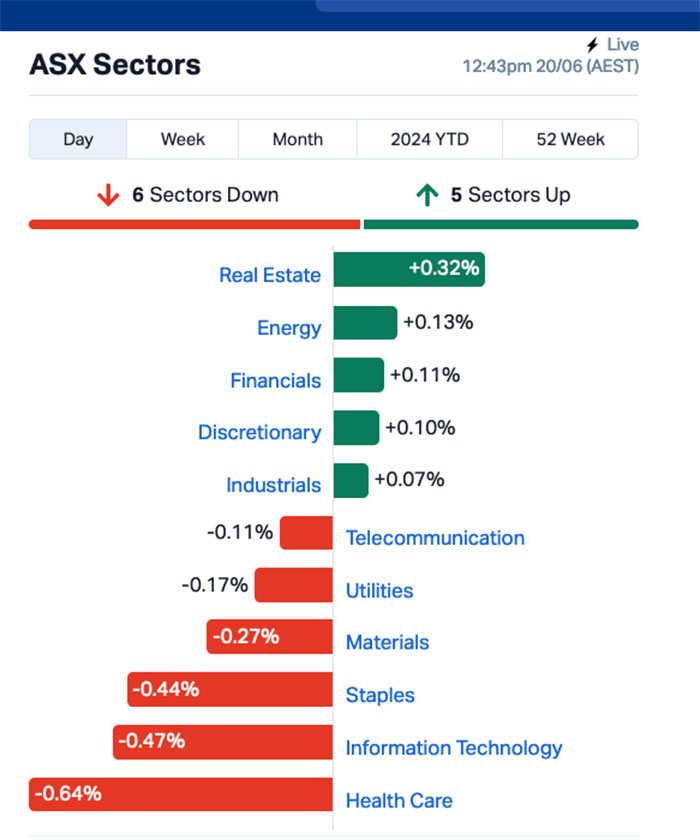

It’s all a bit of a nothingburger across the board today – Real Estate was the best performing sector, but it’s really nothing to write home about.

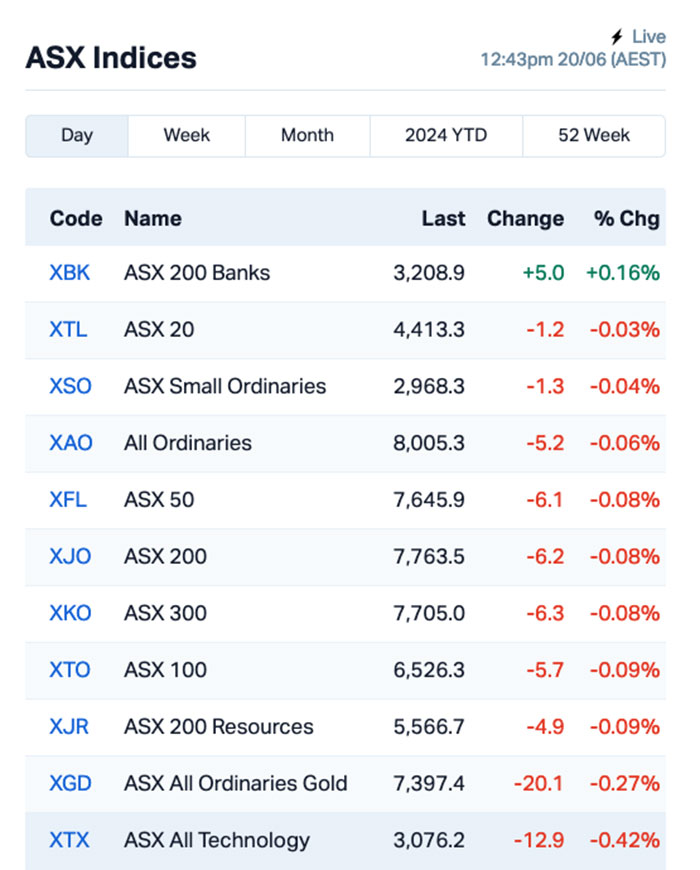

A more granular look at the market shows that the XTX ASX All Tech Index has taken a medium-pace bullet to the box, alongside the XGD All Ords Gold Index, which has suffered a similar fate.

I think I’ve got some footage here somewhere to illustrate how their morning has gone…

Really makes the eyes water, that does. Word on the street was that Livingstone was preparing to retire from cricket to take up the simple life of a farmer… so at least he got a couple of achers there as a start.

Anyway… the ASX indices looked like this by lunchtime:

The banner headline news out of the ASX today was the much-vaunted launch of Mexican Food brokers Guzman y Gomez (ASX:GYG), which made its debut at 12:00pm today off the back of what looked (if I’m being honest) like an outrageously oversized IPO that saw it valued at more than $2.2 billion.

There was plenty of conjecture, and a groaningly massive number of Mexican food puns all throughout the Aussie market news reports, so there were a lot of eyes on the market newbie to see which way it was going to go.

It’s good news for GYG, though – an hour on the bourse, and the company’s smashed through the $3 billion market cap milestone, rising to a nice, round $30 per share ceiling where it looks like it’s found solid market support.

But… the real test of Mexican food is, as everyone knows, the next-day aftermath – and so we wait with some trepidation to see whether the company is able to sustain the hype, or if investors are in for a ring-stinging round of severe intestinal distress.

Wall Street was closed last night for Juneteenth celebrations, so instead of blaming our friends in New York for this morning’s lukewarm effort on the ASX, we’re turning to Europe to figure out why our local investors are in a sour and spiteful mood this morning.

Earlybird Eddy reported this morning that stock markets overnight in Europe were generally lower, as traders looked for new catalysts to sustain the recent tech-driven rally.

They are always in the last place you look.

The benchmark European Stoxx 600 index slipped -0.2% following two consecutive days of gains. The French CAC40 also fell by -0.77%, while the UK’s FTSE 100 closed +0.17% higher.

Investors kept an eye on developments in France after the European Union criticised it for not adhering to the bloc’s deficit and debt rules. The French 10-year bond yields jumped by 4 basis points.

In Japan, the Nikkei was down -0.78%, as authorities there issue a seriously very scary warning of a growing outbreak of deadly flesh-eating bacteria.

I’m not kidding… the number of cases of streptococcal toxic shock syndrome being reported has gone through the roof – in 2023, there were 943 cases, and there have been more than 1,000 cases already in 2024.

It’s caused by the same bacteria that brings on the dreaded “strep throat”, but if the bacteria gets into the person’s deep tissues or bloodstream at the same time they started bingeing every episode of Breaking Bad from the pilot episode, they’d be dead before the episode where Walter White celebrates his 51st birthday and probably murders a bunch of people.

Meanwhile, in Hong Kong the Hang Seng is flattish on +0.07%, and Shanghai’s markets are the inverse of that, down -0.07%.

Here are the best performing ASX small cap stocks for 20 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap TM1 Terra Metals Limited 0.054 74% 16,479,700 $9,169,140 AYM Australia United Min 0.003 50% 283,333 $3,685,155 GCM Green Critical Min 0.006 50% 6,737,385 $4,546,340 RIL Redivium Limited 0.003 50% 5,000,000 $5,461,710 YPB YPB Group Ltd 0.003 50% 1,039,999 $1,615,923 AHF Aust Dairy Limited 0.025 39% 3,061,291 $11,634,602 GYG Guzman Y Gomez Ltd 30 36% 1,615,928 $2,229,764,108 CBL Control Bionics 0.058 35% 12,759,709 $8,569,331 ZGL Zicom Group Limited 0.077 31% 83,481 $12,659,040 ARN Aldoro Resources 0.085 29% 713,931 $8,885,167 CLZ Classic Min Ltd 0.0025 25% 3,089,760 $978,326 LPD Lepidico Ltd 0.0025 25% 5,421,807 $17,178,239 RLG Roolife Group Ltd 0.005 25% 5,562 $3,129,527 SIH Sihayo Gold Limited 0.0025 25% 913,000 $24,408,512 TAS Tasman Resources Ltd 0.005 25% 61,000 $2,850,677 BTR Brightstar Resources 0.018 20% 41,940,850 $68,549,770 KOR Korab Resources 0.006 20% 1,205,420 $1,835,250 TSL Titanium Sands Ltd 0.006 20% 210,122 $11,058,736 HMD Heramed Limited 0.027 17% 383,527 $9,044,746 BTH Bigtincan Hldgs Ltd 0.115 17% 1,863,753 $70,226,587 PFE Panteraminerals 0.035 17% 119,970 $8,044,997 BFC Beston Global Ltd 0.0035 17% 2,988,587 $5,991,141 RLC Reedy Lagoon Corp. 0.0035 17% 225,000 $1,858,622 TMK TMK Energy Limited 0.0035 17% 345,000 $20,734,836 TMX Terrain Minerals 0.0035 17% 500,000 $4,295,012

Thursday morning’s winner was Terra Metals (ASX:TM1), rising quickly on news that early-stage drilling has confirmed discovery of multiple copper platinum group element (PGE) reefs from surface, only 15km down the road from BHP’s (ASX:BHP) $1.7 billion Nebo-Babel mine development.

Control Bionics (ASX:CBL) was also moving quickly on Thursday morning, after revealeding that its autonomous wheelchair module, DROVE, has been officially included as a Class 1 Medical Device in the Australian Register of Therapeutic Goods, which means CBL can now commence commercial sales of the DROVE module in Australia.

And Aldoro Resources (ASX:ARN) was the next best performer with news on Thursday, climbing nicely after announcing that the company has picked up some crackerjack rock chip samples at its Kameelburg carbonatite project, with notable assays from among 74 samples including up to 10.38% Nb2O5 and 9.89% TREO.

Here are the most-worst performing ASX small cap stocks for 20 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LSR Lodestar Minerals 0.001 -33% 10,000 $3,035,096 RNE Renu Energy Ltd 0.004 -33% 1,168,375 $4,356,804 REY REY Resources Ltd 0.051 -27% 62,453 $14,818,128 EXL Elixinol Wellness 0.003 -25% 285,554 $5,284,729 OAR OAR Resources Ltd 0.0015 -25% 255,005 $6,444,200 WEL Winchester Energy 0.003 -25% 650,000 $4,081,688 ME1 Melodiol Glb Health 0.0135 -21% 7,535,404 $2,407,674 LRL Labyrinth Resources 0.004 -20% 1,807,976 $5,937,719 MOM Moab Minerals Ltd 0.004 -20% 2,552,215 $3,559,815 PRX Prodigy Gold NL 0.002 -20% 111,004 $5,294,436 SGC Sacgasco Ltd 0.004 -20% 3,961,186 $3,898,435 1MC Morella Corporation 0.0025 -17% 1,872,389 $18,536,398 88E 88 Energy Ltd 0.0025 -17% 4,750,569 $86,678,016 FCT Firstwave Cloud Tech 0.01 -17% 9,964,311 $20,520,232 ION Iondrive Limited 0.01 -17% 667 $7,258,279 VRC Volt Resources Ltd 0.005 -17% 603,820 $24,952,069 MBH Maggie Beer Holdings 0.058 -16% 250,264 $24,318,354 LPM Lithium Plus 0.215 -16% 232,777 $33,746,700 PVT Pivotal Metals Ltd 0.017 -15% 218,000 $14,082,366 RC1 Redcastle Resources 0.018 -14% 1,115,000 $6,893,967 CYP Cynata Therapeutics 0.24 -14% 353,165 $50,296,900 LML Lincoln Minerals 0.006 -14% 99,988 $14,393,317 LNR Lanthanein Resources 0.003 -14% 313,728 $8,552,726 SPX Spenda Limited 0.006 -14% 836,000 $30,271,205 WML Woomera Mining Ltd 0.003 -14% 75,000 $4,263,486

Renascor Resources (ASX:RNU) has appointed Kathryn Presser to strengthen its board as a non-executive director.

Presser has extensive executive management and directorship experience, including substantial roles in the resource, energy, finance and banking industries.

This includes a stint as chief financial officer and company secretary at Beach Energy (ASX:BPT) and as a current director of the Australian Energy Market Operator.

Future operations at Sovereign Metals (ASX:SVM) Kasiya rutile-graphite project in Malawi will benefit from the government starting the upgrade of the 399km Nkaya- Mchinji section of railway.

This railway section runs across the company’s project from Mchinji at the Malawi-Zambia border to Nkaya Junction where it connects to the Nacala Logistics Corridor, providing an export route through the deepwater port of Nacala.

The upgrade will improve both efficiency and capacity of the railway by increasing the maximum axle load from 15t to 18t.

Sun Silver (ASX:SS1) is starting a planned geophysical gravity survey at its Maverick Springs silver-gold project in Nevada.

The survey will further define geological structures within the current resource area and along extensional targets.

It will capture ~546 stations within a dense 100m by 100m grid to inform targeting for the upcoming inaugural drill campaign.

Toubani Resources (ASX:TRE) resource definition drilling at the advanced 2.4Moz Kobada project has hit more near-surface gold, which will feed into a planned updated resource estimate.

At Stockhead, we tell it like it is. While Renascor Resources, Sovereign Metals, Sun Silver and Toubani Resources are Stockhead advertisers, they did not sponsor this article.