ASX Small Caps Lunch Wrap: Gold and silver deliver as Star falls and stocks fail to rock

Via Getty

The sounds are not all that marvellous from inside the Australian Stock Exchange Centre at 20 Bridge Street in Sydney, on Tuesday.

Volumes are weak and the numbers discordant.

The S&P/ASX200 is lower at lunchtime, dropping 15.70 points or 0.20% to 7,848.00.

According to the ASX, over the last five days, the benchmark has gained 1.6% and is currently 0.8% off of its 52-week high.

Traders spent the morning in Sydney giving back some of the generous gains made largely from mining stocks on Monday with a little uncertainty creeping into Wall Street business overnight, after a few disappointing corporate outlooks from big US firms.

The mixed closes on Wall Street delivered mixed signals at home as American punters turned off from markets and tuned in their wireless radios for some juicy incoming Fedspeak ahead of the FOMC minutes later this week.

Overnight the Nasdaq Composite gained 0.65%, after a pre-earnings 2.5% jump from Nvidia – taking its valuation to US$2.3trn – while the S&P500 rose 0.1% and the Dow Jones fell 0.5%.

Bemused local traders haven’t enjoyed the lack of direction on Tuesday morning, always a difficulty when Technology is the best performing S&P500 sector – adding 1.33% and Financials are the worst, down 1.2%.

The dice is still rolling on Star Entertainment Group (ASX:SGR), although the stock has plummeted after Monday’s fireworks.

The smoke has cleared and the mirrors are out with headline act, the US-based Hard Rock International denying any such talks of a takeover.

This morning Star mumbled something along the lines of: yeah, okay… we seen Hard Rock’s dismissal and while we’ve had some outside interest in a buyout… we haven’t actually “engaged in substantive discussions.”

First on the chopping block this morning is the building products supplier James Hardie, where a terrific Q4 has delivered record results, but a crappy outlook, dragged into the mire by a crappy property construction market put a cauld of doom over its outlook.

The stock has plunged more than 10%.

Proving that getting out in front of bad news doesn’t always work either is the blood-sucking ASX pathology outfit, Sonic Healthcare (ASX:SHL), where the stock is looking etiolated on Tuesday before lunch – down almost 9% after lowering FY24 guidance thanks very much to inflation.

But as Stockhead’s erstwhile Robert Badman reports, silver prices just keep rising.

The second most precious metal after Motley Crue surged past US$30 per ounce last week, hitting its highest level in decades.

And hello? Spot gold touched a new record high of US$2,449.89/oz, before retreating to trade at US$2,430/oz currently.

Gold’s recent rally has been driven by a mix of factors like US rate cut expectations, China’s stimulus measures, and geopolitical tensions.

Local small caps are seeing dividends too. More of that below.

On a glummer note, at midday the price of platinum is withering, down more than 3%.

But hey, copper, silver and gold are all higher.

Lithium has now lost more than 55% over the last 12 months.

Elsewhere in local company news and as reported by this outstanding rag, Alpha HPA (ASX:A4N) has completed its (originally $120m but now $175m) equity raise to go nuts in making what’s said to be the “world’s largest single site high purity alumina products refinery”.

That’s happening out in Gladstone.

Proceeds will be used to start stage two of its $550m HPA First Project.

“This decision to proceed with the commercialisation of stage 2 of the HPA First Project and the successful project financing represents a major step-change in our business growth… establishing Australia’s first, sovereign, large scale, commercial capability to manufacture high purity aluminas and related products to support technology growth sectors driving the global energy transition,” Alpha MD Rimas Kairaitis told the ASX.

Elsewhere, Jupiter Mines (ASX:JMS) dropped 7% following reports that major shareholder AMCI Group was seeking buyers for $47.4 million worth of stock in the manganese miner.

The sectors are mixed at midday.

IT winning, Telcos losing thanks largely to Telstra (ASX:TLS), despite some quality job cutting.

Oh. And Westpac says consumer sentiment has apparently fallen to “deeply pessimistic” levels after the Federal Budget.

The Westpac Melbourne Institute Consumer Sentiment Index is now at the lowest, saddest not even slightly ironic levels of feeling since the Covid – or hey, the deeply ironic recession of the early 1990s.

That’s grunge sentiment, right there.

“Consumer sentiment remains deeply pessimistic,” says Westpac senior economist, Matthew Hassan.

NOT THE ASX

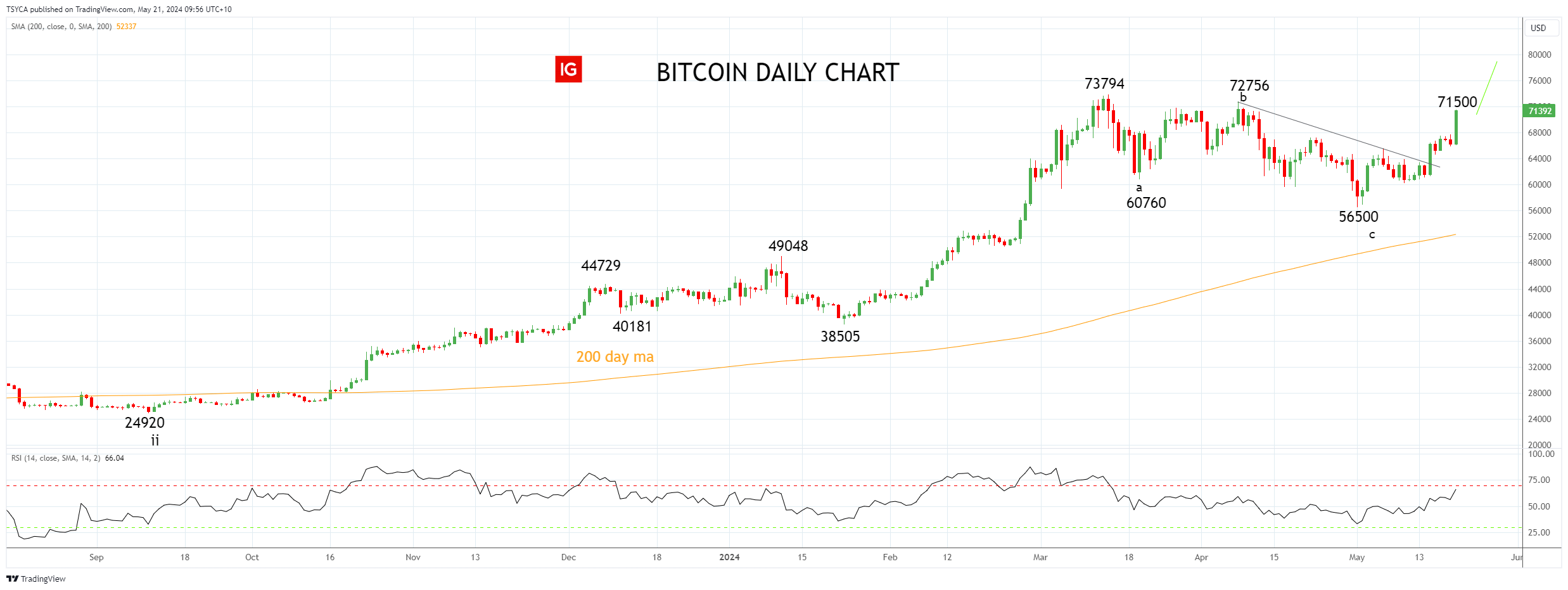

First up, Tony Sycamore from IG Markets reports that the Bitcoin, the King of Crypto, has soared 7.74% over the past 24 hours to US$71,392 and is on track for its first close above US$71,000 in six weeks.

“Our analysis over the past two months has consistently pointed to Bitcoin’s movement during April and May as a corrective pullback from the all-time March US$73,794 high within the context of a larger bull market.

“Last week’s post-CPI break above the downtrend resistance at US$63,500 was a strong indication that the correction was complete, and that the uptrend had resumed driven by improved risk seeking appetite and expectations of Fed rate cuts before year end.”

Tony continues to expect a retest and break of the March US$73,794 high before a move towards US$80k.

Here is his BTC technical analysis chart.

It will mean a lot to a few of you and something to some of you.

The rest of us will now turn to the US overnight…

Strike me down with all your hatred but the Nasdaq has closed at another record high, dragged by Nvidia shares which rallied bravely ahead of its big earnings drop midweek.

The Nasdaq set its new flag in the ground at at 16,794.87.

As mentioned, the S&P500 closed up 0.1% and the Dow lost 0.5%.

The mixed numbers follow what’s been a powerful five days for US stocks, coming off the back of a volatile but bouyant lead up – the formerly hesitant Dow Jones made it a fifth straight week of gains on Friday. The other two major indices have enjoyed a month of positive returns.

And while US investors will continue to looking for further clues about the timing of the US Fed’s interest rate cuts, the apparent about face by the greenback is a good a sign as any that inflation has topped out in the States and cuts are in the post.

The US dollar is set for its first monthly decline this year.

In company news, Palo Alto Networks fell more than 8% in after trade on Wall St, as the cybersecurity specialist offered rotten and unambitious forward guidance.

Target shares slid 2.1% after the retailer announced it would cut prices on roughly 5,000 frequently bought items to attract cost-conscious consumers.

And very big bank JPMorgan lost almost 5% after very big CEO Jamie Dimon hinted his retirement may be sooner than previously stated.

Or did the stock fall because the verbose CEO ruled out any very big stock buyback for the foreseeable future?

US FUTURES on TUESDAY

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Last % Volume Market Cap SNX Sierra Nevada Gold 0.085 107% 3,027,006 $3,119,072 GIB Gibb River Diamonds 0.043 72% 1,479,785 $5,287,736 LPD Lepidico Ltd 0.0035 40% 64,236,714 $21,472,798 CDD Cardno Limited 0.4 38% 574,378 $11,327,592 FG1 Flynn Gold 0.037 37% 32,853,995 $6,872,707 FND Findi Limited 3.82 26% 647,364 $148,355,712 G88 Golden Mile Res Ltd 0.015 25% 5,758,797 $4,934,674 CUS Copper Search 0.15 25% 80,441 $11,074,249 BMO Bastion Minerals 0.01 25% 14,897,086 $3,444,671 HIQ Hitiq Limited 0.02 25% 1,025,980 $5,629,519 RML Resolution Minerals 0.0025 25% 304,101 $3,220,044 SAN Sagalio Energy Ltd 0.005 25% 30,000 $818,641 CAG Caperangeltd 0.135 23% 11,537 $10,439,913 PNN Power Minerals Ltd 0.15 20% 960,153 $11,575,630 AAJ Aruma Resources Ltd 0.019 19% 2,546,887 $3,150,264 AVM Advance Metals Ltd 0.033 18% 158,587 $1,276,736 BNL Blue Star Helium Ltd 0.01 18% 1,827,768 $16,509,255 HAR Haranga Resources 0.11 17% 64,203 $8,415,761 88E 88 Energy Ltd 0.0035 17% 3,844,994 $86,678,016 GGE Grand Gulf Energy 0.007 17% 1,200,000 $12,571,482 NAG Nagambie Resources 0.014 17% 899,521 $9,559,628 NTM Nt Minerals Limited 0.007 17% 6,298,387 $6,104,417 SI6 SI6 Metals Limited 0.0035 17% 509,658 $7,106,578 PH2 Pure Hydrogen Corp 0.18 16% 2,058,123 $55,564,527

Gold and Silver are rocking it.

Up like a champion on Tuesday in the small cap division is Sierra Nevada Gold (ASX:SNX) which has added more than 105% at midday after declaring its intentions to follow up drill hole BHD006 which returned up to 1270g/t silver at Endowment mine, part of its Blackhawk epithermal project in Nevada, US.

SNX has previously identified a large and high-grade intermediate sulphidation epithermal Ag-Au-Pb-Zn vein system, likely related to a large porphyry system located immediately to the south.

It’s a great time to be stumbling into silver as SNX executive chairman Peter Moore well knows.

“These results which returned up to 1270g/t silver from Blackhawk are very promising, coming from a vast and extensive vein network.

“We’ve identified 22.5-line kilometres of veins at Blackhawk, but this known mineralisation has sat largely untouched since mining ceased in the area in the 1920s.

“We have two shallow oxide resources which have not been defined to a JORC-compliant level but this provides us the opportunity to deliver value from an existing project with further drilling and mineral resource definition. Our 20-hole drill program is permitted and ready to drill, providing us with the opportunity to use modern exploration techniques to potential to return further high-grade results and shape this as a company-making discovery for Sierra Nevada.”

Also loving it this morning:

Flynn Gold (ASX:FG1) has sampled up to 64g/t gold at the Link Zone prospect, part of the Golden Ridge project in Northeast Tasmania.

Bastion Minerals (ASX:BMO) says a recent mapping and sampling program uncovered “extensive new pegmatites and targets” at the Morrissey lithium project in WA.

And Everest Metals (ASX:EMC) is hitting super grade gold up to 97g/t as part of a bulk sampling campaign at the Revere project in WA.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AMS Atomos 0.027 -33% 6,467,563 $32,179,273 AVE Avecho Biotech Ltd 0.003 -25% 316,000 $12,677,188 MRD Mount Ridley Mines 0.0015 -25% 245,026 $15,569,766 TD1 Tali Digital Limited 0.0015 -25% 48,844 $6,590,311 EXL Elixinol Wellness 0.004 -20% 3,217 $6,505,370 PUR Pursuit Minerals 0.004 -20% 506,449 $14,719,857 RLG Roolife Group Ltd 0.004 -20% 6,272,530 $3,911,908 TMR Tempus Resources Ltd 0.004 -20% 61,050 $3,654,994 SS1 Sun Silver Limited 0.585 -18% 3,471,197 $49,820,485 1MC Morella Corporation 0.0025 -17% 4,566,334 $18,536,398 MEL Metgasco Ltd 0.005 -17% 309,000 $7,397,320 AN1 Anagenics Limited 0.006 -14% 1,165,000 $3,229,243 NSM Northstaw 0.03 -14% 7,917 $4,895,652 ACM Aus Critical Mineral 0.091 -13% 112,411 $3,709,256 CHW Chilwaminerals 0.48 -13% 67,329 $25,231,251 AMD Arrow Minerals 0.0035 -13% 8,268,088 $40,557,460 KPO Kalina Power Limited 0.0035 -13% 130,000 $9,945,576 MGU Magnum Mining & Exploration 0.014 -13% 490,465 $12,949,782 VML Vital Metals Limited 0.0035 -13% 2,080,253 $23,580,268 BRX Belararoxlimited 0.21 -13% 148,550 $20,455,651 VBS Vectus Biosystems 0.14 -13% 151,715 $8,513,498 AL8 Alderan Resource Ltd 0.004 -11% 3,147,948 $4,980,876 EXT Excite Technology 0.008 -11% 100,117 $13,088,176 PLC Premier1 Lithium Ltd 0.032 -11% 530,000 $6,284,667 WHK Whitehawk Limited 0.016 -11% 1,207,239 $8,324,573

ICYMI – AM EDITION

Altech Batteries (ASX: ATC) has raised $3.7mn via share purchase plan (SPP) of 57,246,037 shares at $0.065 per share and 28,622,799 free-attaching options with an exercise price of $0.08 per share.

Funds will be used to progress the company’s CERENERGY battery project as well as its Silumina Anodes pilot plant.

“With the positive definitive feasibility study and excellent economics for the 120MWh CERENERGY battery project having been recently released in March 2024, Altech is also focused on securing offtake as well as finance to commence plant construction,” ATC managing director and CEO Iggy Tan says.

Renegade Exploration (ASX:RNX) has started diamond drilling to test the large Mongoose Deeps magnetic gravity anomaly at the Cloncurry project in QLD.

The Mongoose Deeps magnetic anomaly is a highly attractive target beneath the Mongoose copper deposit, which is similar in size, shape and magnitude as the world-class Ernest Henry copper mine.

RNX says the drilling program will take six to eight weeks, with additional assaying time expected.

At Stockhead we tell it like it is. While Altech Batteries and Renegade Exploration are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.