ASX Small Caps Lunch Wrap: Different US jobs data helps push ASX higher by 1.3pc

Pic via Getty Images

- US jobs data that was nicer than last week’s has helped the ASX 200 climb 1.3pc

- QBE Insurance has doubled its after-tax profit to $801 million by charging more money

- Small Caps winners include Pointerra, Triangle Energy and EVZ today

Local markets followed Wall Street higher this morning, after a different set of US jobs data was delivered overnight, which had the complete opposite effect of the US jobs data that caused such a ruckus this time last week.

The Aussie benchmark has climbed past +1.0% on the way towards lunch, InfoTech stocks are absolutely flying and the goldies are back in the good books as well.

What a difference a week makes.

TO MARKETS

Last Thursday night, some wonky US jobs data sent ripples of apprehension through US markets and set the ASX on a collision course for two days of sell-off mayhem – and there was much wailing and gnashing of teeth.

Last night, different jobs data was delivered that was not as bad as some people were expecting, and US investors – being the not-at-all fickle bunch that they are – responded by sending New York markets racing up the charts with the best one-day rally Wall Street has seen since the end of 2022.

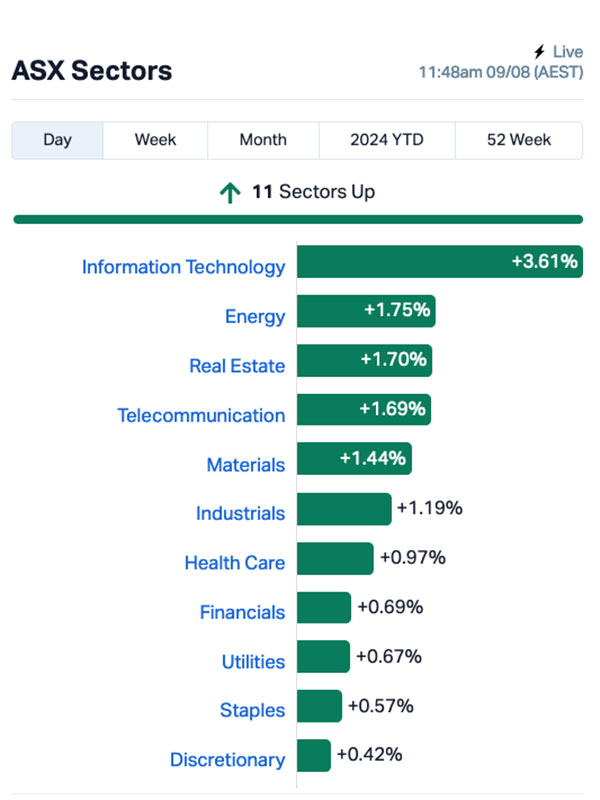

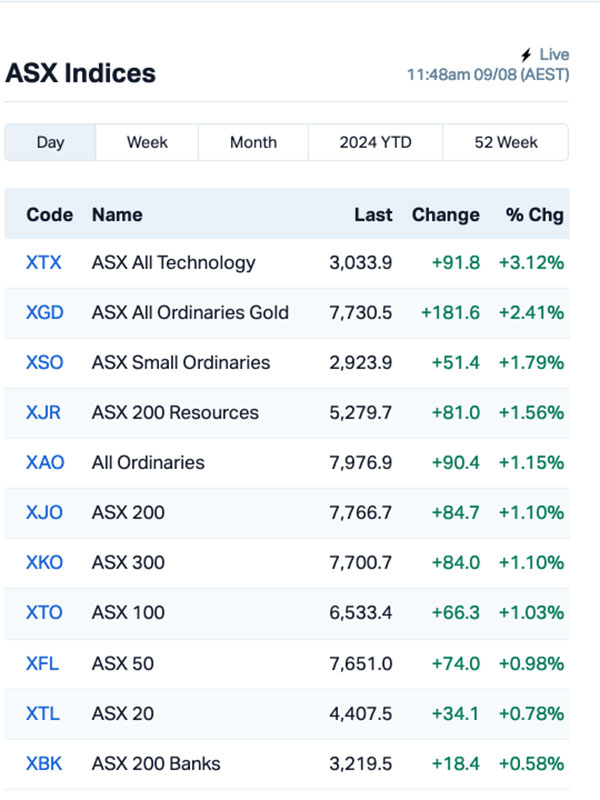

That, in turn, pumped significant amounts of buoyancy into Australian markets this morning, and by lunchtime all our sectors were performing well and looking a bit like this:

The big winner for today is, evidently, our InfoTech sector. It’s enjoying some solid lovin’ from local investors, charging past +3.6% thanks to significant gains for sector big guns such as Wisetech and Xero, which were up 2.7% and 2.6% respectively.

The sector’s overall performance is also being helped along by the ASX’s fifth-largest tech company, Life360. The roughly $4 billion market capper has jumped more than 19% this morning on news that it has grown its monthly active user total to approximately 71 million, and boosted total revenue 20% year-on-year to $84.9 million.

Also performing well this morning were the local goldies, with the XGD All Ords Gold index higher by 2.41% at lunchtime, slotting in behind tech stocks at the top of the ladder.

Two of the ASX’s larger companies have reported in today, with varying results despite both telling a similar story.

On the plus side, News Corp (ASX:NWS) – part owner of Stockhead – was up 7.7% today on news that the board is shopping its 65%-owned pay TV option Foxtel around.

News Corp says that the group’s subscriber base is now around 4.7 million, up 1.0% on pcp, bringing in revenue of US$506 million – saying the uptick was “driven by growth in Kayo and Binge subscribers, partly offset by fewer residential broadcast subscribers”.

On the flip side of that, QBE Insurance (ASX:QBE) was down 3.43% this morning, despite reporting strong profit growth for the past six months.

How strong? Very strong… QBE’s profit after income tax for the six months to June has climbed to US$802 million, more than double what it was this time a year ago.

QBE has attributed strong earnings and record growth to… let me just check my notes here… jacking up the cost to consumers.

They’ve cracked the code, people, and there’s no stopping them now. Meanwhile, people are still bewildered by the mounting cost of living crisis, and none of us can figure out exactly what’s causing it.

But, QBE is paying out a monster divvy to shareholders, declaring an interim dividend of $0.24 per share, up from $0.14 in the first half of 2023. So there’s that.

NOT THE ASX

Overnight, the S&P 500 notched its biggest one-day rally since November 2022, rising by 2.3%. The tech-heavy Nasdaq surged by 2.87%, while the blue chips Dow Jones also lifted by 1.76%.

Stocks staged a strong comeback after the latest labour market data eased worries about a significant slowdown in the world’s largest economy.

According to the Labour Department data, new claims for US unemployment benefits fell to 233,000 last week, coming in lower than anticipated and helping to quell recession concerns.

The data has also lit a rocket underneath risk appetite as well – we know this because crypto markets have gone a bit bonkers, and Bitcoin is up 7.2% over the past 24 hours, swapping hands at US$61,344 per BTC.

In US stock news, Delta Air Lines rose 6% despite anticipating a US$380 million revenue loss this quarter from last month’s CrowdStrike tech outage.

Apple rose almost 2% after revealing that it was developing a new, smaller Mac mini as part of a major refresh of its Mac lineup, featuring AI-focused chips.

Eli Lilly & Co jumped 10% as it narrows the gap with Novo Nordisk A/S in the booming obesity market by boosting its weight-loss drug supplies.

And, Under Armour was a top performer overnight, soaring 20% after reporting results that beat analysts’ forecasts and raising its guidance, reflecting improvements under returning founder Kevin Plank.

In Asian market news this morning, things are looking pretty rosy round the region, with Japan’s Nikkei up by 1.45%, the Hang Seng up by 1.47% and Shanghai markets are up by a more modest 0.30% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 09 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LPD Lepidico Ltd 0.0015 50.0 1,916,276 $8,589,125 ME1 Melodiol Glb Health 0.0015 50.0 9,225,000 $789,420 KPO Kalina Power Limited 0.004 33.3 402,886 $7,459,182 MTL Mantle Minerals Ltd 0.002 33.3 1,999,886 $9,296,169 TIG Tigers Realm Coal 0.004 33.3 500,000 $39,200,107 TMK TMK Energy Limited 0.004 33.3 105,118 $20,764,836 TYX Tyranna Res Ltd 0.004 33.3 1,778,565 $9,863,776 BM8 Battery Age Minerals 0.135 28.6 9,679 $9,767,535 OLI Oliver's Real Food 0.015 25.0 12,135 $5,288,783 TEG Triangle Energy Ltd 0.0075 25.0 26,459,223 $12,480,804 BUY Bounty Oil & Gas NL 0.005 25.0 500,000 $5,994,004 RML Resolution Minerals 0.0025 25.0 1,024,786 $3,220,044 AW1 Americanwestmetals 0.145 20.8 4,319,630 $62,121,236 IMI Infinitymining 0.012 20.0 50,000 $1,187,534 VEN Vintage Energy 0.0095 18.8 805,309 $13,356,250 360 Life360 Inc. 17.59 18.3 2,225,519 $3,307,171,317 AMS Atomos 0.047 17.5 881,975 $48,546,492 3DP Pointerra Limited 0.069 16.9 2,826,702 $47,499,531 GES Genesis Resources 0.007 16.7 215,905 $4,697,048 GTI Gratifii 0.007 16.7 13,381 $10,536,286 Code Name Price % Change Volume Market Cap LPD Lepidico Ltd 0.0015 50.0 1,916,276 $8,589,125 ME1 Melodiol Glb Health 0.0015 50.0 9,225,000 $789,420 KPO Kalina Power Limited 0.004 33.3 402,886 $7,459,182 MTL Mantle Minerals Ltd 0.002 33.3 1,999,886 $9,296,169 TIG Tigers Realm Coal 0.004 33.3 500,000 $39,200,107 TMK TMK Energy Limited 0.004 33.3 105,118 $20,764,836 TYX Tyranna Res Ltd 0.004 33.3 1,778,565 $9,863,776 BM8 Battery Age Minerals 0.135 28.6 9,679 $9,767,535 OLI Oliver's Real Food 0.015 25.0 12,135 $5,288,783 TEG Triangle Energy Ltd 0.0075 25.0 26,459,223 $12,480,804 BUY Bounty Oil & Gas NL 0.005 25.0 500,000 $5,994,004 RML Resolution Minerals 0.0025 25.0 1,024,786 $3,220,044 AW1 Americanwestmetals 0.145 20.8 4,319,630 $62,121,236 IMI Infinitymining 0.012 20.0 50,000 $1,187,534 VEN Vintage Energy 0.0095 18.8 805,309 $13,356,250 360 Life360 Inc. 17.59 18.3 2,225,519 $3,307,171,317 AMS Atomos 0.047 17.5 881,975 $48,546,492 3DP Pointerra Limited 0.069 16.9 2,826,702 $47,499,531 GES Genesis Resources 0.007 16.7 215,905 $4,697,048 GTI Gratifii 0.007 16.7 13,381 $10,536,286

Triangle Energy (ASX:TEG) was climbing on Friday, after the company released an investor presentation that outlined, among other things, the company’s progress in the Perth Basin, where a two-well farm-in is underway and proceeding nicely. The company has also revealed that the sale of Cliff Head oil field and facilities to Pilot for conversion to CCS is in its final stages, with Triangle expecting it to be finalised in October, pocketing $16 million.

Pointerra (ASX:3DP) was also gaining on Friday, after revealing that it has signed new contract awards with existing US energy utility customer Florida Power & Light. Pointerra will be paid $1.23 million to analyse lidar and imagery for FPL business cases, and expects to complete all contract deliverables during FY25.

Life360 (ASX:360) is the only other company in the Top 10 with news this morning, climbing on the back of an excellent quarterly report that says the company has achieved record results, including Monthly Active Users reaching approximately 71 million, and total revenue was up 20% year-on-year to $84.9 million.

EVZ (ASX:EVZ) was climbing early on news that it has been awarded a major contract in the mining and industrial sector through its wholly owned subsidiary, Brockman Engineering. The total value of this contract – to provide a bulk process water tanks package by Rio Tinto as part of the seawater desalination project at Parker Point, Dampier – is roughly $23 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 01 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PHX Pharmx Technologies 0.03 -33.3 6,301,556 $26,932,806 CNJ Conico Ltd 0.001 -33.3 435,000 $3,302,291 PUR Pursuit Minerals 0.002 -33.3 60,000 $10,906,200 ATV Activeportgroupltd 0.0495 -29.3 1,524,983 $22,255,907 EXL Elixinol Wellness 0.003 -25.0 77,358 $5,284,729 PRX Prodigy Gold NL 0.0015 -25.0 17,153,010 $4,235,549 ALR Altairminerals 0.004 -20.0 2,037,929 $21,482,888 EEL Enrg Elements Ltd 0.002 -20.0 1,892,761 $2,524,913 OVT Ovanti Limited 0.004 -20.0 276,570 $7,613,027 RGL Riversgold 0.004 -20.0 10,403,835 $6,637,313 RIL Redivium Limited 0.002 -20.0 40,000 $6,827,137 ROG Red Sky Energy. 0.004 -20.0 2,654,432 $27,111,136 TX3 Trinex Minerals Ltd 0.002 -20.0 20,999,999 $4,571,631 ECT Env Clean Tech Ltd. 0.0025 -16.7 27,963 $9,515,431 VML Vital Metals Limited 0.0025 -16.7 119,300 $17,685,201 NGY Nuenergy Gas Ltd 0.021 -16.0 37,313 $37,023,887 RWD Reward Minerals Ltd 0.037 -15.9 114,350 $10,025,538 ASE Astute Metals NL 0.034 -15.0 100,000 $16,961,205 GBE Globe Metals &Mining 0.034 -15.0 154,314 $27,657,820 MKL Mighty Kingdom Ltd 0.003 -14.3 6,666,667 $11,255,801

ICYMI – AM EDITION

Ain’t nothin’ to see here this morning… I suspect it’s because there might be a few post-Diggers hangovers being nursed around the place.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.