ASX Small Caps Lunch Wrap: Business confidence is shot, the ASX is hot

Via Getty

Local markets are up this morning, probably not because of the NAB business confidence index which has increased to -1.

Actually, that’s pretty good considering the downwardly revised -8 of the prior month.

NAB says it was the third straight month of a negative reading, but the softest drop in the sequence. Make of that what you will. I won’t be.

In the real world of local equities, where numbers = money, we are rising, ladies and gents, for a third straight session.

The S&P/ASX 200 Index was 43 points or almost 0.5% higher at lunchtime on Tuesday to around 7,520.

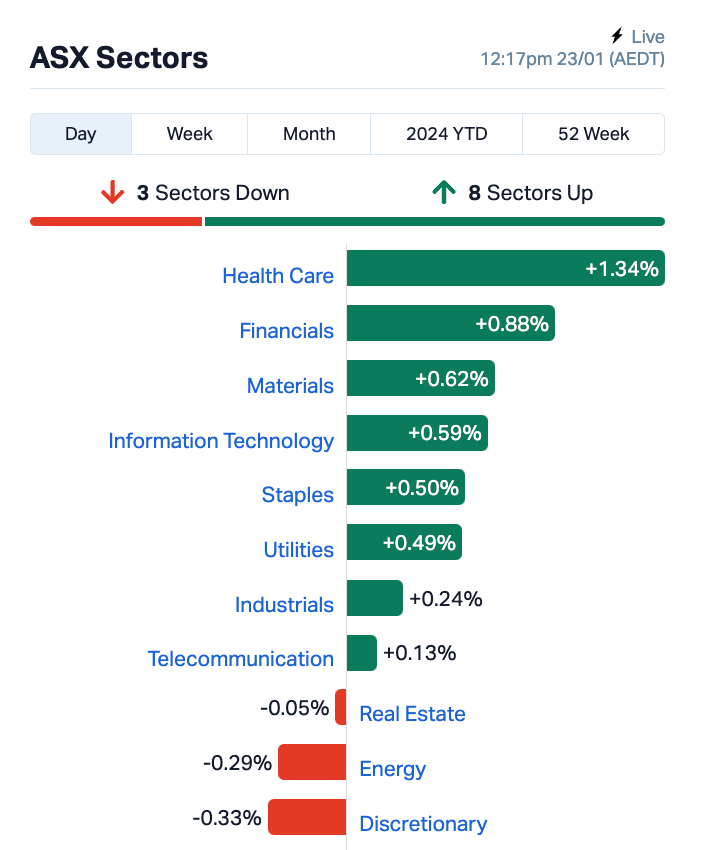

Eight out of the 11 ASX Sectors were in the green on Tuesday morning.

Consumer Discretionary stocks made strong gains on Monday and were paying for it in Sydney this morning, down alongside Energy and Real Estate.

IDP Education (ASX:IEL) has given back the full 7% it gained on Monday, while The Lottery Corporation (ASX:TLC) was also lower.

Zip Co (ASX:ZIP) was 8% lower.

The major banks were up early, leading early gains with all the Big 4 higher by about 1%.

Macquarie Group (ASX:MQG) was doing even better, up about 1.2%.

Healthcare and Materials were also nicely higher, while metals and energy stocks were mixed amid further uncertainty around commodity prices.

Local markets are tracking the action on Wall Street overnight where even the slightest of gains can nudge the Dow Jones Industrial and the S&P500 to new record highs.

NOT THE ASX

Wall Street, it turns out, has been pretending to look awkward and volatile, but is actually running a lot like a cow with horns. It’s been doing this horny cow business more or less since October in 2022 which was when US stocks recovered from the June crash.

Overnight in the US, the Dow Jones Industrial Average and S&P 500 set fresh all-time highs, with the Dow gaining 0.36% to finish above 38,000 for the first time, while the S&P added 0.22% to hit record highs.

The tech-heavy Nasdaq Composite also climbed 0.33%.

In corporate news, that great big retail name Macy’s jumped almost 4% after saying no thanks to a US$5.8 billion proposal to take the retailer private.

SolarEdge also jumped by 4% but at the cost of culling some 16% of its workforce.

US stock futures were flat on Tuesday in Sydney after Wall Street’s new record highs.

We’re also watching the exciting progress of the Nikkei 225 over in Tokyo, where the index has opened higher Tuesday as surely all of Japan and the surrounding isles are hanging on the outcome of today’s BoJ (Bank of Japan) monetary decision.

Boffins from Bank of America (BoA), Barclays and ING reckon the BOJ won’t budge on its negative interest rate policy position, with BofA and Barclays expecting changes in Japan’s monetary policy only in the April meeting.

Meanwhile the indomitable Nikkei added another 0.66% to hit a fresh 33-year peak on Monday. The Topix added 0.72% at open. The Nikkei will hit an all-time high if it breaches 38,915.871 hit on December 29, 1989.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP CBE Cobre 0.081 98% 24,038,517 $11,763,351 MSG Mcs Services Limited 0.015 50% 594,999 $1,980,997 BXN Bioxyne Ltd 0.016 33% 800,131 $22,819,745 YOJ Yojee Limited 0.004 33% 300,000 $7,636,629 TNC True North Copper 0.088 29% 3,709,872 $26,169,219 MRL Mayur Resources Ltd 0.245 23% 11,000 $67,220,239 AYT Austin Metals Ltd 0.006 20% 412,500 $6,134,373 ODY Odyssey Gold Ltd 0.027 17% 69,382 $20,674,036 AHF Aust Dairy Limited 0.014 17% 65,615 $7,756,402 CCO The Calmer Co Int 0.007 17% 1,055,054 $5,144,971 MTB Mount Burgess Mining 0.0035 17% 15,407 $3,134,440 JDO Judo Cap Holdings 1.08 16% 3,039,621 $1,037,196,279 TYX Tyranna Res Ltd 0.015 15% 1,292,617 $42,736,529 MMC Mitremining 0.23 15% 50,000 $11,337,525 EFE Eastern Resources 0.008 14% 75,000 $8,693,625 GGE Grand Gulf Energy 0.008 14% 250,008 $14,666,729 RIE Riedel Resources Ltd 0.004 14% 2,000,000 $7,783,425 TOY Toys R Us 0.008 14% 961,283 $6,877,245 RHY Rhythm Biosciences 0.12 14% 10,000 $23,219,972 SPN Sparc Tech Ltd 0.38 13% 1,275 $28,691,301 HMG Hamelingoldlimited 0.085 13% 783,613 $11,812,500 TBN Tamboran 0.17 13% 409,333 $309,043,080 DEL Delorean Corporation 0.034 13% 423,370 $6,471,627 1MC Morella Corporation 0.0045 13% 1,358,962 $24,715,198 ATH Alterity Therap Ltd 0.0045 13% 521,334 $15,245,305

Cobre (ASX:CBE) stock is now worth twice what it was yesterday, after BHP selected the digger to participate in the 2024 BHP Xplor Program, which the company says will greatly assist the advancement of exploration plans on its Kalahari Copper Belt projects in Botswana.

BHP (ASX:BHP) will supercharge Cobre with some US$500,000 in non-dilutive funding “to support and accelerate its exploration plans.”

The Xplor Program provides not only with funding, but full access to BHP’s “deep expertise and global partnerships.”

Cobre intends to use the US$500,000 to advance its exploration programs by assessing and progressing targets which have the potential to host tier-one copper-silver deposits.

Exploration will focus on the newly identified fold hinge related trap-sites where mineralisation is expected to be upgraded, offering an opportunity for larger deposit formation.

Exactly the same thing happened to Hamelin Gold (ASX:HMG).

Managing director Peter Bewick, commenting on inclusion in the 2024 Xplor Program, was more than delighted.

“We are thrilled to have been selected to participate in the 2024 BHP Xplor program,” he said. “The identification of Ni-Cu-PGE mineralised, mafic-ultramafic intrusions by the Company in mid-2023 was a first for the Tanami region.”

Bewick says the BHP helping hand will facilitate the accelerated assessment of the nickel-copper-PGE potential of the region.

“The Xplor funded program will be completed in parallel to our ongoing gold exploration in the Tanami which includes a planned RC drill program at the Sultan prospect commencing in March-April 2024. This program is following up the identification through aircore drilling of extensive bedrock gold mineralization at Sultan announced earlier in January 2024.”

True North Copper (ASX:TNC) is almost 20% higher after revealing it has signed binding offtake and toll-milling agreements with (Glencore) for its Cloncurry Copper Project up in Queensland.

Glencore is among the world’s largest natural resource companies and has signed up for 100% of the copper concentrate from TNC’s Cloncurry.

TNC will also provide toll-milling services, of up to 1 million tonnes of ore per year for the CCP’s Life of Mine (LoM).

Aside from the certainty of concentrate sales for the mine, TNC says it will be entitled to claim 20% Queensland State Royalty discount for all material processed through the Mt Isa Smelter.

True North MD Marty Costello says the agreements with an industry major such as Glencore marks a significant milestone … with CCP fully permitted and TNC on track to soon be in production for copper with CCP located in a Tier One jurisdiction.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap YPB YPB Group Ltd 0.001 -50% 4,400 $1,580,923 JAV Javelin Minerals Ltd 0.0015 -25% 454,132 $3,267,458 ME1 Melodiol Glb Health 0.0015 -25% 346,301,311 $9,833,237 MXC Mgc Pharmaceuticals 0.3 -22% 28,615 $16,882,878 PNT Panthermetalsltd 0.047 -22% 50,000 $5,101,500 MI6 Minerals260Limited 0.18 -20% 569,429 $52,650,000 CTO Citigold Corp Ltd 0.004 -20% 283,500 $15,000,000 AXN Alliance Nickel Ltd 0.033 -20% 33,937 $29,759,424 AGR Aguia Res Ltd 0.014 -18% 1,559,750 $8,593,175 ANX Anax Metals Ltd 0.019 -17% 1,940,087 $11,120,906 G50 Gold50Limited 0.1 -17% 7,000 $13,114,800 SKY SKY Metals Ltd 0.03 -17% 1,059,012 $16,610,331 IEC Intra Energy Corp 0.0025 -17% 40,000 $4,982,345 RMX Red Mount Min Ltd 0.0025 -17% 581,666 $8,020,728 PIQ Proteomics Int Lab 0.775 -15% 793,315 $111,324,596 IMI Infinitymining 0.115 -15% 92,567 $16,031,708 WA8 Warriedarresourltd 0.042 -14% 489,108 $25,010,673 BLZ Blaze Minerals Ltd 0.006 -14% 616,097 $4,399,908 LEG Legend Mining 0.012 -14% 360,000 $40,662,681 MTL Mantle Minerals Ltd 0.003 -14% 6,550,000 $21,691,060 VRC Volt Resources Ltd 0.006 -14% 1,680,658 $28,910,747 CPN Caspin Resources 0.073 -14% 144,000 $8,012,582 S3N Sensore Ltd 0.05 -14% 675,844 $2,110,808 REC Rechargemetals 0.069 -14% 498,183 $8,908,158 OZZ OZZ Resources 0.065 -13% 78,124 $6,939,759

LUNCH ORDERS

Patriot Lithium (ASX:PAT) says it’s wrapped up the acquisition of the Beyond Claims which includes the issue of 1,100,000 PAT fully paid ordinary shares.

The Beyond Claims acquired by Patriot add a further 61 exploration claims over two claim blocks from Beyond Lithium Inc, covering 1,187ha (11.87km2) of highly prospective ground which is contiguous with Patriot’s expanded Gorman project.

The company says the mining claim form key inliers in the Patriot controlled claims at Gorman, which includes a 5.2km-long, spodumene-bearing LCT pegmatite trend with confirmed high grade lithium mineralisation, and are on trend with mapped LCT pegmatite outcrops.

Some 60km NW of Frontier Lithium’s PAK Project, PAT says, is one of the largest and highest grade lithium deposits in North America and which has announced intercepts including 398m @ 1.88% Li2O.

The host geology of the newly added claims is dominated by two-mica granite known to be a key source of fertile magmas critical in the formation of Lithium-Caesium-Tantalum (LCT) pegmatites across the Archean terrain of NW Ontario.

The newly acquired mining claims include several target areas with probable LCT pegmatite outcrops recognised in orthophotos and LiDAR data as well as helicopter flyovers.

Field verification and reconnaissance of these targets is planned for this year.

At Stockhead, we tell it like it is. While Patriot Lithium is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.