ASX Small Caps Lunch Wrap: Brace yourselves… the ASX is taking a caning

Pic via Getty Images

Local markets are copping it on all sides this morning, with the benchmark down 2.0% and the market sectors a sea of angry red, after a confluence of events that have combined to drive a ton of value off the books today.

And, right on cue, Australia’s GDP figures for the June quarter dropped this morning, and they are… not great.

There’s no time for much preamble today – so let’s dive straight in.

Deep breath, everybody.

TO MARKETS

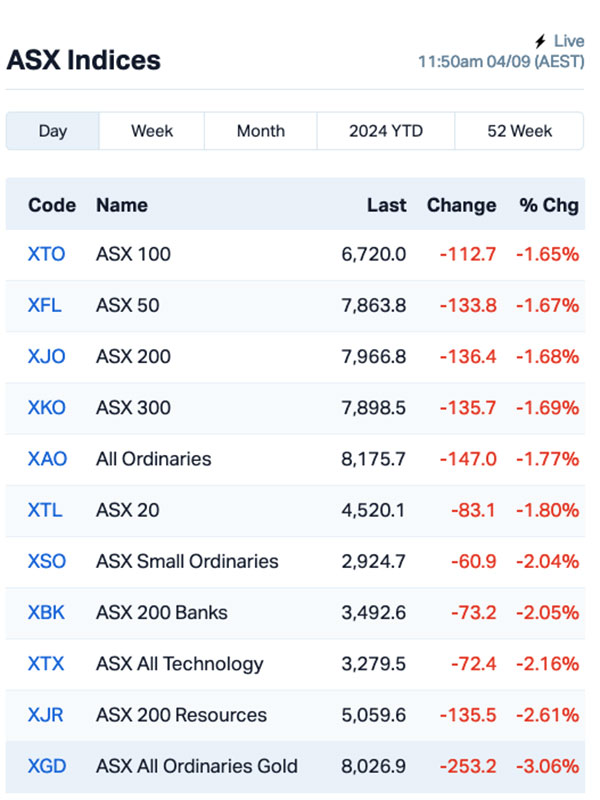

The ASX is down around 2.0% as we head towards lunch, after a slew of key commodities hit the skids overnight, Wall Street hit the panic button and Chinese economic data did little to change anyone’s mind about how dire things are getting over there.

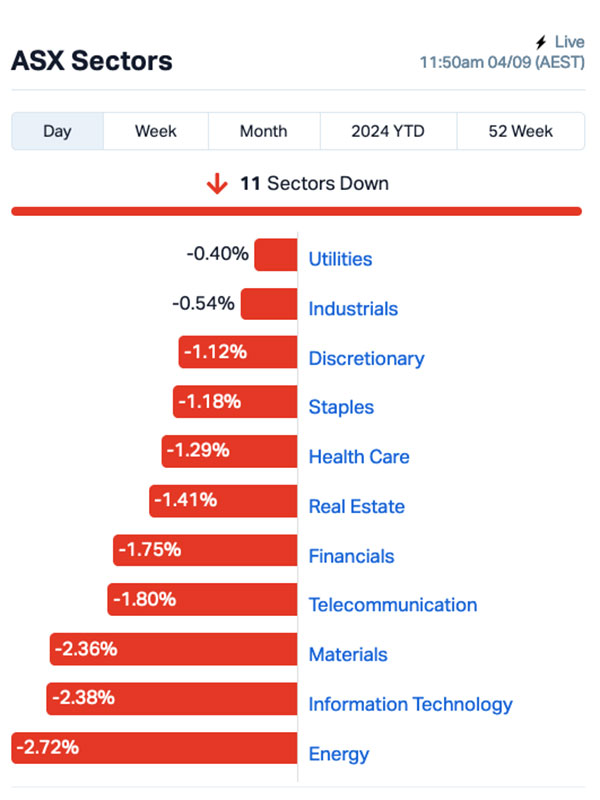

Resources are taking the worst of the beating, with Energy stocks off by around 3.0%, and Materials not far behind on -2.5% a half hour out from midday, as commodities sank sharply overnight.

Around 1.30am, when I shocked myself awake by remembering that I’d forgotten to file Rise and Shine for this morning, a number of crucial commodities were in freefall.

For starters, Singapore Iron Ore futures were way down a few hours ago, off by 3.47% at US$93.45 per tonne, which is never a good sign for local markets, given how economically dependent we are on that commodity’s performance.

Nickel and copper were both off by 1.7%, and crude prices were declining very rapidly – Brent fell below US$75 a barrel (-4.5%) and WTI flirted with US$70 a barrel (-4.7%).

Around midday today, oil is still sinking – Brent down to $73.34 and WTI to $69.89, its lowest level this year.

On top of that, Australia’s June quarter GDP figures were unveiled to much fanfare this morning, and I think it’s safe to say that it’s a dud.

Australia’s economic activity expanded a paltry 0.2% over the June quarter, which – excluding the pandemic – are the worst we’ve seen since the nation struggled to recover from Paul “The Treasurer We Didn’t Want to Have” Keating’s recession he reckoned we had to have in the early ’90s.

That totals for the 2023-2024 year at just 1.5% – and federal Treasurer Jim “Supernintendo” Chalmers has not been backward about appointing blame for such an appalling result, foreshadowing earlier this week that the RBA’s run of 13 rate hikes has been “smashing the economy”.

The end result of that – and some other stuff I’ll touch on shortly – is a sector chart that looks redder than the rear end of an amorous baboon.

The ASX indices chart isn’t much better – but it’s worth noting that the goldies are copping a pounding along with the rest of the Resources sector, despite gold bucking all of the trends and holding safe haven value above US$2,500 per ounce this morning.

Up the big end of town, the losses have been steep. Fortescue (ASX:FMG) is down 8.14%, Deep Yellow (ASX:DYL) has fallen 6.3% and gold giant De Grey Mining (ASX:DEG) has dropped just over 7.0%.

Retailer Cettire (ASX:CTT) is bleeding heavily, down 9.2%, Woodside’s (ASX:WDS) down 2.4% and Santos (ASX:STO) has dropped 2.8% – and that’s around the time I stopped doom-scrolling through the losses.

There were some winners, though. I’ll talk about them in a moment – but first, it’s time to look overseas and see if things are any better over there.

NOT THE ASX

Ah… no. Things are not better in overseas markets this morning.

Overnight, Wall Street plummeted, as the S&P 500 lost 2.12%, the blue chips Dow Jones was down by 1.51%, and the tech-heavy Nasdaq got pummelled by 3.26%.

The reason for that was US investors clocking manufacturing data that indicates a worrying slowdown in America, and similar numbers coming out of manufacturing powerhouse China.

Earlybird Eddy Sunarto reported this morning that one of the biggest losers on Wall Street overnight was, Wall Street darling Nvidia, which wiped out around US$280 billion of its US$3 trillion market cap as traders believe the stock is overcooked and that its valuation is out of whack.

There have been warnings that AI isn’t delivering on its big promises yet, making it hard to justify those sky-high valuations, Eddy says.

Nvidia also got hammered after the US Justice Department slapped the company with a subpoena, digging into whether Nvidia broke antitrust laws. It’s a big step up in the probe into the top player in AI chips.

Some experts are advising investors to sell Nvidia at the current level, Eddy reports.

“If you own lots of Nvidia stock, I will say the same thing that I said to Tesla shareholders back in early 2021 – just take the money,” said Nick Maggiulli at Ritholtz Wealth Management.

“You’ve won the game. You’ve hit a lotto that you are unlikely to hit again.”

Alphabet, Microsoft, and Apple also dropped by around 2-4% as the selloff hit the top tech giants trying to revolutionise the economy with AI.

Boeing took a 7% dive after Wells Fargo dropped its rating to a sell, saying it can’t see any good news ahead for the stock.

United States Steel Corp tumbled by 6% after Vice President Kamala Harris and President Joe Biden both said the company should stay American-owned. This news is the latest setback for the proposed sale to Japan’s Nippon Steel.

In Asian markets this morning – and I’m almost too afraid to look – things aren’t excellent.

Japan’s Nikkei is off by 3.6% and still falling, with 210 of the 225 stocks that make up that index in the red.

It’s a similar story in Hong Kong, where the Hang Seng is down 1.9%, with 76 of the 81 stocks on that index losing value.

In Shanghai, the market’s down a very sedate 0.5% – either because it’s being weirdly bulletproof again, or because investors there aren’t at all shocked by the nation’s manufacturing data, and the trajectory the Chinese economy is clearly on.

I think we need some good news… let’s see what I can find.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 04 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CYQ Cycliq Group Ltd 0.004 33.3 130,000 $1,336,550 EMS Eastern Metals 0.027 28.6 981,416 $2,387,201 88E 88 Energy Ltd 0.0025 25.0 35,386,981 $57,867,624 IBG Ironbark Zinc Ltd 0.0025 25.0 44,716 $3,667,296 WML Woomera Mining Ltd 0.0025 25.0 615,110 $3,036,278 AUG Augustus Minerals 0.061 24.5 24,742,700 $5,350,380 AZI Altamin Limited 0.035 20.7 23,639 $12,726,622 ASO Aston Minerals Ltd 0.012 20.0 1,011,913 $12,950,643 FHS Freehill Mining Ltd. 0.006 20.0 20,000 $15,392,639 SFG Seafarms Group Ltd 0.003 20.0 306,853 $12,091,498 LIT Lithium Australia 0.023 15.0 9,045,405 $24,806,833 PR1 Pureresourceslimited 0.093 14.8 20,863 $3,556,948 1AI Algorae Pharma 0.008 14.3 4,285 $11,811,763 MRQ Mrg Metals Limited 0.004 14.3 11,200 $9,490,315 LSA Lachlan Star Ltd 0.12 14.3 218,439 $21,795,185 ALM Alma Metals Ltd 0.009 12.5 694,211 $11,593,650 HLX Helix Resources 0.0045 12.5 4,000,000 $13,056,775 SHE Stonehorse Energy Lt 0.009 12.5 33,333 $5,475,481 TEG Triangle Energy Ltd 0.0045 12.5 8,146,074 $8,320,536 VEN Vintage Energy 0.009 12.5 239,692 $13,356,250

Augustus Minerals (ASX:AUG) was rising nicely on Wednesday morning, on news that the company has found a 1km-long stretch of mineralised zone associated with quartz veining, malachite (secondary copper carbonate mineral) and iron oxide after weathered sulphide minerals, 3.7km from its existing Claudius (6.6% Cu, 86ppm Ag) discovery at the Ti Tree project. Rock chip analysis from the new site has returned copper grades up to 3.1% and silver grade up to 11g/t, with the new find now bearing the name Nero.

Lithium Australia (ASX:LIT) was up on news that it has signed a new exclusive agreement with Chinese EV maker BYD Auto to provide battery recycling services for all New Energy vehicles end-of life batteries in Australia. The exclusive agreement has an initial term of three years, and the company expects to significantly increase large-format lithium-ion battery collection volumes, given the scale of BYD Auto as it expands into the Australian market.

Lachlan Star (ASX:LSA) was on the move in the latter part of the morning session, after it published its presentation for the Resources Rising Stars Gold Coast Investor Conference, which kicked off yesterday in Queensland. Lachlan CEO Andrew Tyrrell talked up the company’s Basin Creek Prospect, a near-surface high-grade copper drill target on the Gilmore Suture Zone, which has historical drilling results that include 21.3m at 4.51% Cu, incl. 9.2m at 1.23% Cu and 4.6m at 18.54% Cu.

Earlier, Marquee Resources (ASX:MQR) was up on news that a site in Italy it has options to acquire – the high-grade Sa Pedra Bianca Gold and Silver Project located in northern Sardinia, Italy – has returned antimony grades of up to 6.5% Sb from historical channel sampling and exploratory drilling. Work is being undertaken by an Italian private company recently incorporated to conduct the business activities associated with the project, with Marquee expecting to begin its own exploration in 3-6 months.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 04 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EDE Eden Inv Ltd 0.0015 -25.0 10,000 $8,216,419 IEC Intra Energy Corp 0.0015 -25.0 13,001,000 $3,381,563 SMM Somerset Minerals 0.003 -25.0 300,000 $4,123,995 TMK TMK Energy Limited 0.003 -25.0 10,000,430 $27,686,448 IMI Infinitymining 0.014 -22.2 511,163 $2,137,561 CC9 Chariot Corporation 0.105 -22.2 104,165 $12,099,761 CZN Corazon Ltd 0.004 -20.0 628 $3,339,528 FGH Foresta Group 0.004 -20.0 7,791,451 $11,776,895 GCM Green Critical Min 0.002 -20.0 250,000 $3,671,357 RFT Rectifier Technolog 0.008 -20.0 416,990 $13,819,839 RML Resolution Minerals 0.002 -20.0 12,485,707 $4,025,055 NXS Next Science Limited 0.2 -16.7 48,533 $70,118,456 ROG Red Sky Energy. 0.005 -16.7 758,888 $32,533,363 T3D 333D Limited 0.005 -16.7 201,500 $716,670 VR1 Vection Technologies 0.01 -16.7 10,737,067 $13,519,068 XPN Xpon Technologies 0.01 -16.7 397,416 $4,349,298 BDG Black Dragon Gold 0.016 -15.8 19,123 $5,082,836 GBE Globe Metals &Mining 0.035 -14.6 21,274 $28,349,265 EPM Eclipse Metals 0.006 -14.3 1,432,445 $15,755,989 ERA Energy Resources 0.006 -14.3 866,422 $155,038,094

ICYMI – AM EDITION

Green Technology Metals (ASX:GT1) has received the first tranche – $3.875m – of the $8m strategic investment from South Korean electric vehicle battery metals producer EcoPro.

This investment was made 12.5c – a 40% premium to the 90-day volume weighted average price of the company’s shares or 95% to the last traded price at that time.

It supports the company’s strategy to become Ontario’s first 12.5c – a 40% premium to the 90-day volume weighted average price of the company’s shares or 95% to the last traded price.

Tranche 2 of the investment will be completed once shareholder approval is received at the general meeting on September 28, 2024.

At Stockhead, we tell it like it is. While Green Technology Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.