ASX Small Caps Lunch Wrap: Benchmark moves to record highs as iron ore momentum builds

Pic: Getty Images

- The ASX 200 benchmark has hit record a intraday high today, 8,278.6 points at 12pm

- Iron ore prices have driven Materials stocks to very healthy gains

- Small Caps are pushing up. Read on to find out who the big winners are today

Local markets are up this morning, with the benchmark moving through a new record high as Energy and Materials stocks drove the market well into positive territory today.

A boost to iron ore prices is helping things along, while huge question marks remain around what’s likely to happen with crude oil prices as the situation in the Middle East gets murkier by the hour.

But on the plus side of the ledger, Federal Treasurer Jim Chalmers has delivered another surplus – this one even bigger than last time. It’s been a long time since a treasurer managed to deliver two on the trot.

Time to jump in and see in more detail what’s been happening.

TO MARKETS

The big news of the morning was the ASX 200 benchmark setting a record intraday high of 8271.90 points in the opening minutes of the session. It was up 0.6% within 30 minutes of the session starting, led by mining and energy gains.

By lunchtime, that new high was even higher – the benchmark continued to climb and at midday was at 8,278.6 points, 0.8% higher than open.

The gains are being led by the big iron ore-dependent miners, with Mineral Resources (ASX:MIN) and Fortescue (ASX:FMG) well out in front on +4.23% and +4.13% respectively. Other big players are getting their share of the action as well, with BHP (ASX:BHP) up 2.11% and Rio Tinto (ASX:RIO) adding 2.42%.

That’s largely off the back of fast-improving iron ore prices, which were up by 0.5% to US$103 a tonne after rising by 4% on Friday, as the stimulus packages in China started to breathe life into the property sector, before today’s session began.

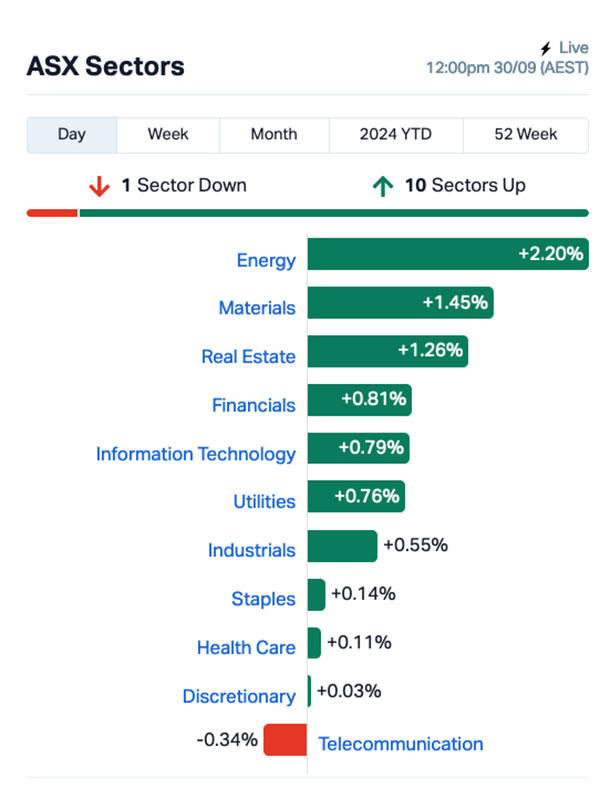

At midday, the market sectors looked like this:

Still up the top end of town, Commonwealth Bank (ASX:CBA) is leading the way for the Big Four this morning, up 1.13% with its nearest neighbour National Australia Bank (ASX:NAB) on +0.95% for the morning.

Locally, dental group Pacific Smiles (ASX:PSQ) turned down an unsolicited off-market takeover bid from Genesis Capital, with the board encouraging shareholders to ignore what it has classed as an “opportunistic” bid.

Overseas, REA Group (ASX:REA) is waiting on a response from the UK property portal Rightmove – it’s the fourth offer REA has put forward, but so far it’s seen little more than a cool acknowledgement that the offer is there.

And the big-picture economic news this morning is that Federal Treasurer Jim Chalmers has turned in his homework for the year, and delivered a budget surplus of $15.8 billion – $6.4 billion more than last time.

It’s the first time a federal government has delivered two surpluses in a row in about two decades, so Chalmers gets to take his pick from the sticker book, and is first in line for recess and lunch today.

NOT THE ASX

On Friday, the S&P 500 fell by 0.13%, the blue chips Dow Jones index rose by 0.33% – a new record, and the tech heavy Nasdaq slipped by 0.39%.

Investors were pleased with the August reading of the Personal Consumption Expenditures (PCE) index, the inflation measure favoured by the US Fed.

The PCE indicated that price pressures are continuing to cool, rising just 0.1% month over month and coming in below Wall Street’s forecasts.

“I think Fed officials are feeling pretty good about where inflation is sitting,” said PIMCO’s Tiffany Wilding.

In US stock news, Nvidia fell 2% on no specific news. The company, however, had some headwinds lately as Super Micro Computer, one of its major customers and an AI server manufacturer, found itself in a pickle following news of a DOJ investigation into possible accounting violations.

Intel fell slightly despite Financial Times reporting that the chipmaker is close to securing US$8.5 billion in funding from the CHIPS Act by the end of the year. In a separate development, Bloomberg reported that Arm Holdings has shown interest in buying out Intel’s product business.

Biotech company Cassava Sciences dropped over 10% following a settlement with the US SEC. The SEC had alleged that the company made misleading claims regarding an Alzheimer’s clinical trial, and the settlement amounts to over US$40 million.

Bristol Myers Squibb climbed 1.5% after the FDA approved its schizophrenia drug. This marks the first new treatment option for patients with the disease in 30 years.

Across Asian markets this morning, Chinese markets are red-hot this morning ahead of a week-long shutdown for national holidays.

Shanghai markets were up 3.20% at midday, while Hong Kong’s Hang Seng was up 0.42%.

Hong Kong markets will be closed tomorrow, while China’s markets will be closed every day (except on Thursday) for the rest of the week.

In Japan, however, the Nikkei has shuddered to a 4.2% drop, probably on news that budget snack staple Umaibo corn puff snacks are going to see a price rise for only the second time in the product’s 45-year history.

The price will rise to 15 Yen – roughly AUD$0.15 – per snack, which is hardly wallet-busting by any measure, but which has still sent shockwaves through the Japanese pocketmoney-conscious public.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ODE Odessa Minerals 0.004 100.0 18,846,762 $2,086,565 IBX Imagion Biosys 0.044 76.0 1,767,585 $891,164 AL8 Alderan Resources 0.0045 50.0 12,748,317 $3,818,584 CDE Codeifai 0.0015 50.0 704,554 $2,641,295 CAN Cann Group 0.087 45.0 3,066,697 $28,119,989 TFL Tasfoods 0.014 40.0 398,505 $4,370,955 ALR Altair Minerals 0.004 33.3 137,511 $12,889,733 AOK Australian Oil 0.004 33.3 303,559 $2,833,920 CTO Citigold Corp 0.004 33.3 3,588,323 $9,000,000 ENT Enterprise Metals 0.004 33.3 125,693 $3,309,952 FGH Foresta Group 0.004 33.3 22,513,380 $7,066,137 POS Poseidon Nickel 0.004 33.3 7,587,241 $12,611,626 RNE Renu Energy 0.002 33.3 960,798 $1,206,201 BUR Burley Minerals 0.069 30.2 639,979 $7,969,660 AAR Astral Resources 0.1325 26.2 6,057,299 $98,195,741 MPP Metro Perf Glass 0.05 25.0 23,387 $7,415,123 TEG Triangle Energy 0.005 25.0 2,675,100 $8,320,536 VML Vital Metals 0.0025 25.0 1,180,151 $11,790,134 RMY RMA Global 0.068 23.6 317,696 $30,686,845 KPO Kalina Power 0.016 23.1 2,238,271 $32,323,122

Odessa Minerals (ASX:ODE) was up early on Monday on news that the company has received firm commitments from professional and sophisticated investors for a Placement to raise $1,112,500 (before costs) by way of a two tranche placement. The placement will fund exploration at Odessa’s projects, including exploration and drilling of the company’s Lyndon Uranium Project.

Alderan Resources (ASX:AL8) has reported that its Stage 1 drilling program at the New Years copper prospect in the Cactus copper-gold (Cu-Au) district in Utah, USA has intersected high grade copper mineralisation, based on visual inspection and pXRF readings on the drill core. Spot pXRF readings showed grades of 45.5% copper between 14.0-14.2m downhole, with the average of three separate readings over this interval being 23.2% copper within a 30m interval from 10.8m downhole.

Citigold (ASX:CTO) was up on the heels of a quarterly report this morning, outlining how things are going at its high-grade, production-ready Charters Towers gold project. The report says that while gold is the main focus of the company’s work in the area, it is keeping a keen eye out for other critical minerals as well.

Enterprise Metals (ASX:ENT) was gaining on news that it has received the results of a recent 81 sample UltraFine orientation soil sampling program completed within the Mandilla Tenement E15/1437 in Western Australia. The results have identified a cluster of +30ppb gold results within shallow soils east of the Emu Rocks Granite, which the company says is “in the general area where the 744oz Ausrox gold nugget was purported to have been found in 2013”.

Burley Minerals (ASX:BUR) was up on news that it has been granted an exploration licence over the Cane Bore Iron Ore Project within the Hamersly Province of the Pilbara, Western Australia, less than 100km by sealed road from the export Port of Onslow. The company says it is a “major milestone for Burley as Cane Bore has the potential for significant CID-style iron resources, rivalling its neighbours in the local region”.

Triangle Energy (ASX:TEG) was up on news that its JV with Strike Energy (ASX:STX) and Echelon Resources (ASX:ECH) has received approval of the EP to drill the Becos-1 well, which is a commitment well under the EP 437 permit title. The news clears the path to drilling the Becos-1 well when a rig is available, with discussions underway with a number of possible alternatives and a decision is anticipated within the next few weeks.

RMA Global (ASX:RMY) was up on news that it has signed a strategic partnership deal with a major US brokerage Realty ONE Group, will see RMA become integrated into ROG’s technology architecture to gather agent and team reviews, and syndicate these on the Realty ONE Group website.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for September 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ADD Adavale Resources 0.002 -33.3 479,341 $3,671,296 LPD Lepidico 0.002 -33.3 774,735 $25,767,375 WEL Winchester Energy 0.001 -33.3 3,272 $2,044,528 ATH Alterity Therapeutics 0.003 -25.0 2,270,136 $21,281,344 LNU Linius Tech 0.0015 -25.0 751,284 $11,730,481 ESR Estrella Resources 0.011 -21.4 12,265,534 $25,447,873 EEL ENRG Elements 0.002 -20.0 4,213 $2,612,540 H2G Greenhy2 0.004 -20.0 3,049,318 $2,990,921 NTM NT Minerals 0.004 -20.0 219,248 $5,087,015 ERG Eneco Refresh 0.01 -16.7 38,500 $3,268,300 IPB IPB Petroleum 0.005 -16.7 65,000 $4,238,418 DGR DGR Global 0.016 -15.8 1,699,296 $19,830,176 ASQ Australian Silica 0.022 -15.4 278,025 $7,328,370 NVU Nanoveu Limited 0.018 -14.3 219,376 $10,603,376 ERL Empire Resources 0.003 -14.3 1,000,000 $5,193,696 FBM Future Battery 0.02 -13.0 1,032,399 $15,303,186 ADN Andromeda Metals 0.007 -12.5 1,644,974 $27,148,834 BNL Blue Star Helium 0.0035 -12.5 541,920 $9,724,426 CUF Cufe 0.007 -12.5 15,528,813 $10,693,399 PPY Papyrus Australia 0.007 -12.5 45,530 $3,941,541

ICYMI – AM EDITION

The company says geochemical exploration at its Rosario copper project in Chile commenced last week, where strong visuals of samples containing green malachite – a secondary copper mineral – are supporting previous exploration results.

While not a substitute for laboratory anaylsis, MD Paul Lock says it boosts the company’s confidence in the project.

“In conjunction with the first ever IP survey at Rosario, we have started a systematic geochemical survey to confirm previous exploration results and determine the potential size of Rosario,” he said.

“The presence of small scale historical mines, and the proximity of the El Salvador copper mine, provide a high level of confidence in the project.”

Work is continuing along the Rosario East and Rosario Central trends with rock chip sampling and reconnaissance geological mapping. Assays are expected by late October.

QMines has completed its strategic acquisition of 100% of the Develin Creek copper-zinc project in Queensland.

A large drilling program is now underway with outstanding initial results from the scorpion prospect including 31m at 2.35% copper, 0.37g/t gold, 20g/t silver, 2.37% zinc and 19% sulfur from 104m, and 17m at 2.88% copper, 0.61g/t gold, 21g/t silver, 2.06% zinc and 24% sulfur from 106m.

The drilling aims to convert two of five additional deposits into the Mt Chalmers mine plan.

“We are very pleased to have completed the acquisition of the strategically important and high-grade Develin Creek copper project,” executive chairman Andrew Sparke said.

“We wish to thank Zenith Minerals for their support for the transaction and welcome them as a large shareholder in our company”.

At Stockhead, we tell it like it is. While Pan Asia Metals and QMines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.