ASX Small Caps Lunch Wrap: Benchmark lower after Wall Street lets us down

Pic: Getty Images.

- ASX opens lower, tracking a small slump on Wall Street

- Hurricane Milton drove up crude prices overnight, bumping energy stocks

- Small Cap winners included Nagambie and Energy World this morning

Aussie markets opened lower this morning, tracking a lukewarm Wall Street that finished the day in the red, thanks to a rise in CPI and less-than-excellent jobs data spooked investors in New York.

Locally, energy shares are in the spotlight today thanks to a hurricane-driven spike in oil prices, but otherwise the ASX is fairly lacklustre this morning, so it’s a slow-mo Friday on the bourse.

There’s not much to talk about today, so let’s get this outta the way and go eat some food.

TO MARKETS

The ASX 200 opened slightly lower, thanks to a weak lead-in from Wall Street overnight. Energy stocks have been the main winners, with that spike driven by a storm-induced surge in crude oil prices.

Largely the fault of Hurricane Milton, which is giving Florida a very hard time at the moment, causing sales of petroleum products in the region to spike as locals attempt to flee the damaging winds.

Hurricane Milton is also disrupting production and pipeline operations around the Gulf Coast, with supply expected to be interrupted or delayed for weeks as the post-storm clean-up is expected to be a lengthy process.

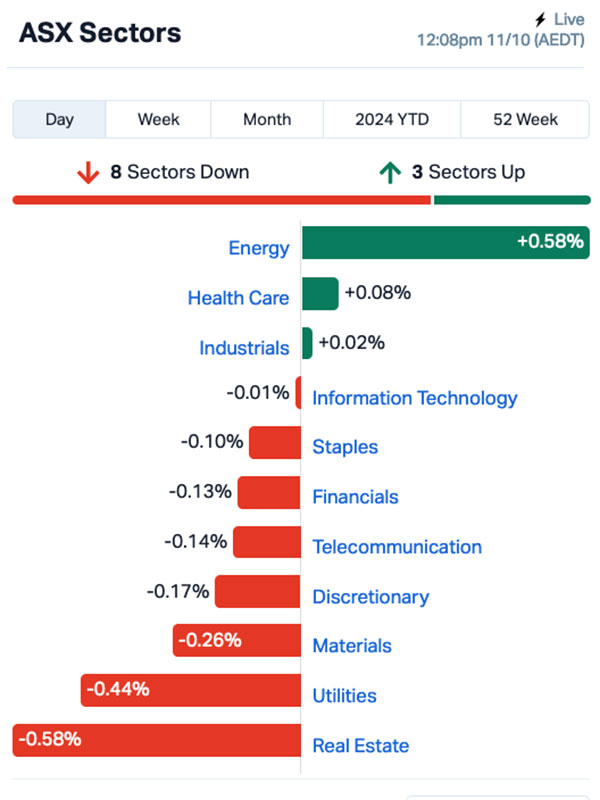

Here’s how the market sectors were looking at lunchtime.

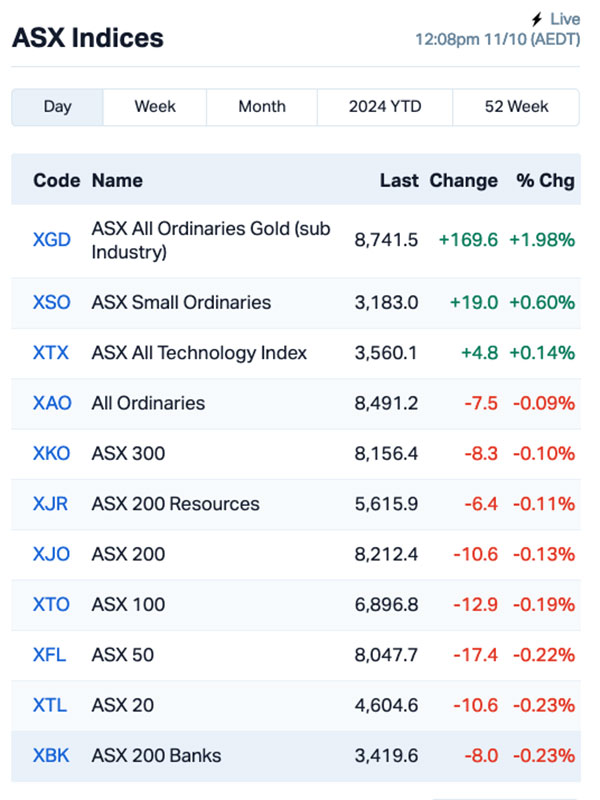

A look at the sub-indices shows the goldies outperforming the rest of the market this morning, up close to 2.0% against a pretty dour backdrop across the rest of the bourse.

Up the big end of town, there is still a lot of chatter around Rio Tinto’s (ASX:RIO) decision to buy up Arcadium Lithium (ASX:LTM) for $10 billion in cash, and the buy-out talks have helped push Arcadium shares higher by more than 100% this week.

However, Rio’s shares are down this morning as the cost of the purchase sinks in for investors, leaving the mining giant off by 0.65% at lunchtime.

And on the topic of housing affordability, Macquarie’s boffins have been crunching the numbers and revealed that a “very high” number of first homebuyers are leaning on family for funds to get into the property market, especially in New South Wales.

“Macquarie found on average borrowers received $68,000 from family members, with NSW borrowers enjoying far more familial largesse topping $94,000,” The Australian reports.

“A further 10% of borrowers also saw family members going guarantor on their home loans ‘suggesting that a very high proportion of first home borrowers relied on some assistance from their families,” the report continues.

NOT THE ASX

In the US overnight, the S&P 500 fell by 0.21%, the blue chips Dow Jones dropped by 0.14%, and the tech heavy Nasdaq slid by 0.05%.

Tesla dropped by almost 1% ahead of its much anticipated Robotaxi Event, which was due to kick off at 7:00pm California time (1:00pm AEST).

The company is set to reveal its first driverless car at the event, along with plans for a new robotaxi service that will directly compete with Alphabet’s Waymo. Elon Musk has called it the most important moment for Tesla since the launch of the Model 3 sedan in 2017.

Notably absent was any comparison to Tesla’s Cybertruck launch, which featured as many shattered windows as there have been expectations with the troubled off-roader. Maybe the worst auto product launch since ‘The Homer’.

Delta Air Lines fell 1% after projecting profits and sales that fell below Wall Street’s expectations for the last few months of the year, indicating a sluggish recovery after a tough summer travel season.

Drugmaker Eli Lilly & Co. said it was stepping up legal efforts against companies that were briefly permitted to produce and sell generic versions of its popular weight loss drugs until the US shortage ended last week.

Meanwhile, oil stocks could be in focus again today after crude prices jumped by over 3% as Hurricane Milton made landfall in Florida as a Category 3 storm.

At least 12 people have died and over 3.4 million customers left without power after the tornadoes caused widespread damage.

In Asian market news, Shanghai isn’t open yet, and Hong Kong is closed for Chung Yeung Day, while Japan’s Nikkei is up 0.3% in very early trade this morning.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap NAG Nagambie Resources 0.02 42.9 6,643,848 $11,152,899 CSS Clean Seas 0.225 40.6 186,313 $32,210,125 IR1 Iris Metals 0.25 38.9 853,422 $25,039,797 MTL Mantle Minerals Ltd 0.002 33.3 1,979,266 $9,296,169 EWC Energy World Corp 0.012 33.3 2,353,346 $27,710,291 MTM MTM Critical Metals 0.09 30.4 6,571,874 $19,396,373 88E 88 Energy 0.0025 25.0 213,473 $57,867,624 BYH Bryah Resources 0.005 25.0 29,000 $2,013,147 VML Vital Metals 0.0025 25.0 50,428 $11,790,134 1CG One Click Group 0.012 20.0 558,970 $7,747,935 AD1 AD1 Holdings 0.006 20.0 483,368 $5,486,742 FIN FIN Resources 0.006 20.0 77,339 $3,246,344 NIM Nimy Resources 0.071 18.3 313,754 $10,410,816 MM8 Medallion Metals 0.086 17.8 728,367 $29,777,368 ATH Alterity Therapeutics 0.0035 16.7 1,072,831 $15,961,008 GW1 Greenwing Resources 0.066 15.8 610,993 $13,459,134 AGH Althea Group 0.045 15.4 3,847,170 $15,807,965 BLU Blue Energy 0.008 14.3 67,060 $12,956,815 CRR Critical Resources 0.008 14.3 37,986 $13,745,785 LU7 Lithium Universe Ltd 0.016 14.3 2,080,801 $8,314,790

Nagambie Resources (ASX:NAG) was rising on news that diamond drilling of the shallow high-grade gold-antimony orebody at the 100%-owned Nagambie Mine will recommence in early November, 2024. The company has previously announced that the four shallow gold-antimony lode systems included in the maiden Resource announced earlier this year are open at depth, and along strike, within Nagambie’s freehold land and Mining Licence.

Iris Metals (ASX:IR1) rose sharply on news that the company has successfully converted its spodumene concentrate to 99.5% battery grade lithium carbonate, using ore entirely sourced from its Beecher Project in South Dakota, USA. The conversion to lithium carbonate was done in the US, using “a domestic process and IP, marking a significant new capability in America’s efforts to secure domestic supply chains of critical minerals and IRIS’ role in that,” the company says.

Energy World Corporation (ASX:EWC) was up on news that the company has entered into a share purchase agreement with PT EMP Energi Jaya – a party related to PT Energi Maju Abadi – with respect to selling EWC’s 51% participating interes t in the 2,925.2 km2 Sengkang Contract Area that EWC’s subsidiary Energy Equity Epic (Sengkang) holds, for US$35 million.

Alterity Therapeutics (ASX:ATH) was up on news that the company has announced promising new data related to ATH434 – its candidate in the fight against neurodegenerative diseases – which has been presented at the Society for Neuroscience 2024 in Chicago. The company says that the poster it presented “demonstrates that the neuroprotective and mitochondrial protectant properties of ATH434 include reducing lipid damage in two distinct and disease-relevant neuronal injury models”.

Greenwing Resources (ASX:GW1) climbed following an update on progress at its San Jorge Lithium Brine Project in Argentina, with completion of further surface exploration work providing additional confirmation of likely resource extension. The company released the maiden Mineral Resource Estimate for the project in May 2024, containing 1.07 Mt of Lithium Carbonate Equivalent (LCE), made up of 0.67Mt of Indicated Resources and 0.4Mt of Inferred Resources.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LPD Lepidico 0.002 -33.3 363,189 $25,767,375 RNE Renu Energy 0.001 -33.3 329,120 $1,267,868 NOV Novatti Group 0.043 -26.5 2,527,563 $20,811,401 BNL Blue Star Helium 0.003 -25.0 1,045,321 $9,724,426 EXL Elixinol Wellness 0.004 -20.0 845,960 $7,800,356 TMK TMK Energy 0.002 -20.0 553,056 $18,979,030 FHS Freehill Mining 0.005 -16.7 2,600,000 $18,471,167 SFG Seafarms Group 0.0025 -16.7 353,529 $14,509,798 WML Woomera Mining 0.0025 -16.7 4,000 $6,165,223 CGO CPT Global 0.071 -15.5 1,200 $3,519,379 BXN Bioxyne 0.011 -15.4 4,242,000 $26,606,390 EXT Excite Technology 0.011 -15.4 10,183,522 $19,171,318 HOR Horseshoe Metals 0.006 -14.3 250,000 $4,642,972 QXR Qx Resources 0.006 -14.3 124,884 $7,770,545 OLL Open Learning 0.013 -13.3 11,666 $6,346,031 THR Thor Energy 0.013 -13.3 1,942,074 $3,469,099 NMT Neometals 0.105 -12.5 2,543,509 $82,787,771 MGA Metalsgrove Mining 0.075 -11.8 47,000 $8,960,700 NHE Noble Helium 0.053 -11.7 1,442,059 $31,307,980 ANX Anax Metals Ltd 0.016 -11.1 8,633,202 $12,502,851

ICYMI – AM EDITION

Anax Metals (ASX:ANX) has received firm commitments from institutional, sophisticated and professional investors to raise ~$2.54m to fund exploration across its base metal projects in WA’s Pilbara region.

The funds were raised through the issue of 169.65 million shares priced at 1.5c each. It includes the issue of one free attaching option exercisable at 2.5c and expiring three years from issue for every subscribed share.

Proceeds will be used to fund soil and auger sampling, geophysics and reverse circulation drilling at the Evelyn project as well as geophysics and drilling at the Mons Cupri South prospect.

Other work includes geophysics at the Whim Creek deposit, conducting technical studies to assess the treatment of GreenTech Metals’ (ASX:GRE) base metal assets and copper content of Artemis Resources’ (ASX:ARV) Greater Carlow resource at Whim Creek, and advancing the scoping study in collaboration with Develop Global.

Sunshine Metals (ASX:SHN) has kicked off a nine hole reverse circulation drill program at the Truncheon and Highway East targets within its Ravenswood Consolidated project to test strong, coincident geochemical and geophysical anomalies.

The targets sit ~2.5km from the historical Highway-Reward copper-gold mine that produced 3.9Mt at 5.4% copper and 1.1g/t gold before closing in 2005.

Drilling over these targets, which were not assayed for gold in limited historical drilling, is expected to be completed in late October with assays due in early December.

The company also plans to start geophysical surveys at the Coronation South copper-gold target in late 2024.

At Stockhead, we tell it like it is. While Anax Metals and Sunshine Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.