ASX Small Caps Lunch Wrap: Benchmark looks bewildered after Nvidia riches; Local boy does good

Via Getty

Local markets are happy for US chip maker Nvidia, but not elated.

And neither should they be.

At lunchtime the ASX200 (XJO) index was slightly lower – down 0.13% just after midday – in the wake of some rather volatile morning trade as local investors struggled to know what to make of Nvidia’s record earnings haul, reported after the close in New York overnight.

The fact is there’s not a lot in common with what’s happening in US mega tech and the resources heavy ASX200.

Overnight, the Nasdaq Composite slid for a third session in a row, but my word, did Nvidia achieve record-breaking revenue growth of 265% or am I still having acid flashbacks from ’92.

NVDA beat all Wall Street’s expectations for both earnings and sales in its latest quarterly earnings report.

US markets ended mixed last night, but the focus was what might happen after hours when Nvidia spilled the beans in this season’s most anticipated earnings report. Which we’ll get into in a second…

But first…

A really terrific, slightly humorous, largely wonderful human interest story… Now, I haven’t written anything even remotely humanist lately (nor anything interesting about a human, so bear with me).

Because – as Phil Collins once said in his hit single Against All Odds, from the film Against All Odds, Stockhead’s own grumpy satirist with a heart of gold Gregor The Relentless Stronach has, this very morning – against all odds – made it past the half century.

Usually a moment like that, you’d check in with the birthday boy or at least send a courtesy note to make sure it’s all good before hitting publish.

Not me. And not this time. I say: forget you ASX Listing Rule 17.1.

This fabulous milestone is something I can’t allow Gregor’s deep misgivings about being inserted into the story stop me from inserting him directly into the story. Nor can I slow down a moment to consider the etiquette and/or safety issues around divulging to the internet and wider public my colleagues’ personal details.

Gregor’s unlikely achievement of this beautiful number has put all of us here at Stockhead into a screaming trading halt and we reckon the ASX would appreciate being made fully aware of it.

The various obstacles to such a cracking milestone could only possibly be achieved and even bettered by Gregor’s extraordinary courage and the daily heroics the man himself puts in just to be here. He’s a warrior. A rock. A man of endless, generous good humour.

Smart as a whip and kind as a turtle. The perfect wingman. And we salute you. Wherever you are.

And please come back so I can get on with me own work.

TO MARKETS

Rightio. Across this vast unknowable Australian financial landscape, yesterday, the benchmark ended 0.66% lower at 7,608.36.

Soaking up a fair few column inches in the AM on Thursday is Rio Tinto which announced a 12% fall in underlying net profit following the NYSE market close, citing weaker commodity prices and rising costs.

Iron ore, which is Rio Tinto’s bread and butter, saw revenue decline due to lower prices, despite a 3% production increase.

Our Eddy Sunarto says, Rio expects costs to remain steadier in 2024, reflecting the mining giant’s renewed focus on operational efficiency.

“Copper saw similar trends, with lower prices offset by production growth.”

Despite the headwinds, Rio Tinto rewarded shareholders with a generous final dividend of USD$2.58 per share, representing a year-on-year increase.

Meanwhile, CSR is up about 5% and apparently fielding offers. This one’s from French industrial giant Saint-Gobain which lobbed a $4.3bn bid for the diversified Aussie business. Saint-Gobain has reportedly secured due diligence from the CSR board with its $9 per share offer.

The blue chip flavour of earnings this week continue to drop on Thursday – we’ve got a variety of players including APA Group, Fortescue and Qantas.

And The Reject Shop (ASX:TRS) .

Unfortunately that last one’s already missing about 18% of what it started out with at 10am in Sydney after the retailer’s interim numbers all fell below analyst expectations.

Times must certainly be tough out there in $1 shop land – and hopefully the RBA is paying close attention to this one, because TRS offered the usual platitudes about the tougher trading environment amid higher rates and rising living costs, but also tried to pin some of the hit onto the “significant” leap in shoplifting. The RBA needs a retail theft indicator, for sure.

TRS says revenue rose 4% to $458.3m in the first half and its net profit fell 11 per cent to $14.5m.

The company also disappointed with a interim dividend of 10c per share.

One Aussie dollar this morning was buying 65.49 US cents.

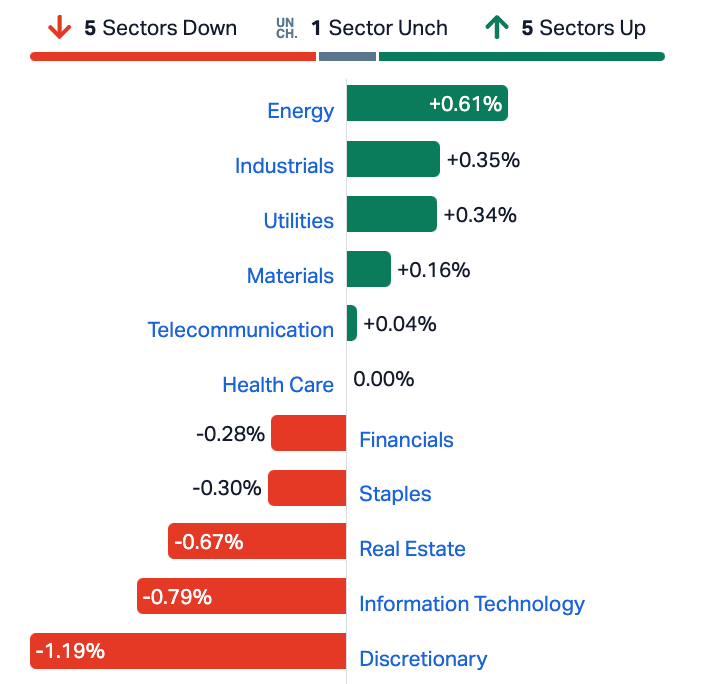

ASX Sectors at Lunch

Local stocks going ex-div on Thursday

Australian United Investment Company (ASX:AUI) is paying 17 cents fully franked.

Bendigo and Adelaide Bank (ASX:BEN) is paying 30 cents fully franked.

Deterra Royalties (ASX:DRR) is paying 14.89 cents fully franked.

JB HiFi (ASX:JBH) is paying 158 cents fully franked.

Microequities Asset Management (ASX:MAM) is paying 1.8 cents fully franked.

Virgin Money UK (ASX:VUK) is paying 3.8153 cents unfranked.

Whitehaven Coal (ASX:WHC) is paying 7 cents fully franked.

NOT THE ASX

In the US overnight, both the Dow Jones Industrial Average and the S&P500 added 0.13%. The tech-heavy Nasdaq fell 0.33%.

All US sectors closed higher overnight except for Tech. Energy was the best performer.

First things first.

Nvidia achieved record-breaking revenue growth of 265%.

Even Wall Street’s inflated expectations for both earnings and sales weren’t in the ballpark for the AI chip maker’s latest gargantuan earnings report.

NVDA puts the $$ surge down to the company’s current domination of the supply of high-performance graphics processors for servers playing with large AI (artificial intelligence) models.

The fact is the entire technology industry is gangbusters for anything which can generate AI fun.

Nvidia – by the numbers:

EPS of US$5.16 vs $4.64 expected.

Revenue of US$22.1bn vs $20.55bn expected.

Nvidia’s share price initially fell some 3.2% when the report dropped but quickly rebounded as the scale sank in and was up trading 6.5% higher at circa US$717.

CEO Jensen Huang got analysts excited when he noted that “…accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.”

Elsewhere in US corporate news, Palo Alto Networks shed more than 29% after the cybersecurity company cut its FY revenue guidance and SolarEdge Tech crashed 13% also on weaker guidance.

The Fed Minutes released overnight coincide with last week’s hotter-than-expected economic data and indicate a central bank in no rush to cut interest rates.

Fed officials are waiting for “greater confidence” that inflation is slowing down.

“Most participants noted the risks of moving too quickly to ease the stance of policy, and emphasised the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 per cent,” the minutes stated.

Ongoing tensions in the Middle East are the backdrop for oil prices rises overnight following the flood of Fedspeak highlighting rates will stay put, with West Texas Intermediate settling at $77.91 a barrel and Brent futures at $83.03 a barrel.

Gold lost 0.25%. Copper added 0.45%. Oil gained 1.3%.

European markets closed mixed. London’s FTSE fell 0.73 per cent, Frankfurt added 0.29 per cent, and Paris gained 0.22 per cent.

Across Asian markets on Wednesday, Tokyo’s Nikkei fell 0.25%. Hong Kong’s Hang Seng gained 1.6% and China’s Shanghai Composite added 1%, both higher on positive stimulus signals.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 22 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap IEC Intra Energy Corp 0.003 50% 4,877,937 3,381,563 KNM Kneomedia Limited 0.003 50% 40,000 3,066,543 MSI Multistack International 0.007 40% 90,000 681,520 TRI Trivarx Ltd 0.03 36% 3,133,757 7,442,131 EE1 Earths Energy Ltd 0.019 27% 6,000,070 7,949,463 ADG Adelong Gold Limited 0.005 25% 1,796,302 2,798,623 CCO The Calmer Co Int 0.005 25% 18,541 4,302,342 PUR Pursuit Minerals 0.005 25% 100,000 11,775,886 RMX Red Mount Min Ltd 0.0025 25% 3,962,000 5,347,152 W2V Way2Vatltd 0.036 24% 45,231,264 18,896,645 RKT Rocketdna Ltd 0.011 22% 24,219,144 5,905,034 88E 88 Energy Ltd 0.006 20% 85,919,300 123,627,103 PAA PharmAust Limited 0.28 17% 1,818,346 92,756,771 LIO Lion Energy Limited 0.02 18% 73,393 7,428,622 BFC Beston Global Ltd 0.007 17% 767,150 11,982,281 VRC Volt Resources Ltd 0.007 17% 10,615,755 24,780,640 RNT Rent.Com.Au Limited 0.037 16% 2,278,167 20,148,786 AM7 Arcadia Minerals 0.067 16% 9,999 6,324,906 EGR Ecograf Limited 0.15 15% 812,229 59,024,136 LBT LBT Innovations 0.015 15% 3,794,369 16,390,609 UNI Universal Store 4.7 15% 420,476 313,020,905 GGE Grand Gulf Energy 0.008 14% 747,625 14,666,729 GTI Gratifii 0.008 14% 50,000 9,584,559 SRZ Stellar Resources 0.008 14% 1,616,421 8,043,185

The local medtech LBT Innovations (ASX:LBT) “a leader in medical technology automation using artificial intelligence” is now also a leader in kicking some Thursday morning butt on the ASX.

The microbiology lab services and tech provider says it’s just delivered its homemade environmental monitoring tech ( an APAS Independence instrument with APAS PharmaQC software) to a Thermo Fisher facility.

It’s the maiden recognised sale of the technology, according to CEO & managing director Brent Barnes, who says the delivery is six months ahead of schedule and LBT is primed to cash in on “the positive market interest” from pharmaceutical customers following initial market development activities completed 2H23.

Barnes says LBT has now established a “pipeline of potential early adopters” who’ve shown interest in the LBT tech which aims “to provide efficiencies and improve traceability within environmental monitoring workflows.”

The stock has jumped circa 50%.

Meanwhile, it’s been a great week for Way2VAT (ASX:W2V), stretching its on-again-off again run into a near clean sweep. The stock lurched for a third consecutive day to be up over 50% on Tuesday before lunch while today the stock has added a further 25%.

The riches began pouring in after last Friday’s launch of a new AI-driven automatic auditing system.

Other early movers with news out include 88 Energy (ASX:88E) which says its 20% working interest has been successfully transferred to the company as part of stage one of a three-stage farm-in deal for its Namibian petroleum exploration licence.*

As well as Insignia Financial (ASX:IFL) which dropped a 1H statutory (NPAT) loss of $49.9mn, which IFL says is down to strategic initiatives and remediation costs. But shareholders who came for the earnings, stayed for the upgraded outlook.

The wealth manager says in its ASX announcement that FY24 group net revenue margin is expected to be between 45.5-46 bps (previously 44.8-45.8 bps) while EBITA margin has increased as well, while in-year transformation costs and benefits remain on track.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 22 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SYA Sayona Mining Ltd 0.048 -25% 1,184,397,104 $658,770,944.90 E33 East 33 Limited. 0.018 -22% 184,839 $12,353,040.08 NES Nelson Resources 0.004 -20% 1,000,000 $3,067,971.64 SIT Site Group Int Ltd 0.002 -20% 186,525 $6,506,225.54 TMR Tempus Resources Ltd 0.004 -20% 50,250 $3,654,993.74 FGH Foresta Group 0.01 -17% 1,456,180 $26,938,648.63 PNX PNX Metals Limited 0.005 -17% 419,709 $32,283,748.31 RNE Renu Energy Ltd 0.01 -17% 283,088 $8,099,608.02 MAF MA Financial Group 4.69 -17% 1,264,435 $1,002,224,777.82 TML Timah Resources Ltd 0.042 -16% 2,917 $4,437,988.05 MTC Metalstech Ltd 0.165 -15% 595,196 $36,846,145.05 TRS The Reject Shop 4.61 -14% 50,232 $206,489,333.46 1MC Morella Corporation 0.003 -14% 15,695 $21,625,797.99 AVE Avecho Biotech Ltd 0.003 -14% 162,645 $11,092,539.55 MIO Macarthur Minerals 0.12 -14% 18,712 $23,275,488.32 JBY James Bay Minerals 0.16 -14% 5,000 $6,002,325.00 HTA Hutchison 0.026 -13% 100,000 $407,175,257.31 ARC ARC Funds Limited 0.1 -13% 21,972 $3,458,780.48 EPM Eclipse Metals 0.007 -13% 500,000 $16,600,433.90 VN8 Vonex Limited. 0.014 -13% 1,752,777 $5,789,257.92 TAH TABCORP Holdings Ltd 0.635 -12% 16,285,067 $1,654,747,967.03 XST Xstate Resources 0.022 -12% 9 $8,037,978.75 CR1 Constellation Res 0.082 -12% 3,000 $4,641,204.62 CUV Clinuvel Pharmaceuticals 14.435 -11% 268,307 $816,573,228.30 NUH Nuheara Limited 0.078 -11% 221,670 $20,748,266.62

ICYMI – AM Edition

Miramar Resources (ASX:M2R) been super busy digging about in its massive 100%-owned Bangemall Project in the prospective Gascoyne region of WA.

M2R says geophysical contractors completed a reconnaissance moving loop electromagnetic (MLEM) survey over the 3km historic late-time SkyTEM anomaly at the recently granted Trouble Bore Target.

“The SkyTEM anomaly occurs at the intersection of a dolerite sill and a potential N-S trending feeder dyke both of which are mostly buried beneath later sediments,” the company said this morning.

Evidence of the dolerite sill is seen in outcrop along strike in either direction.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.