ASX Small Caps Lunch Wrap: Aussie markets and people are depressed going into lunch on Tuesday

The thing that makes this photo truly sad is the fact that if she walked about 20m down the path, she'd be out of the rain entirely. But... no. Gotta be all dramatic for the 'grams. Pic via Getty Images.

I can tell you point blank, I’m not a regular attendee of the sonorous Westpac-Melbourne Institute Consumer Sentiment index.

I say good on ’em for doing it so often. Kudos to the idea. The more data, the better.

But you don’t have to be an economist (and I’m not) to know that anything which claims to be a reliable measure of an Australian’s sentiment is in trouble from the get go.

I mean, have you met an Australian man and/or woman?

David Beckham we are not.

The last definite emotion I felt was when Kim Hughes cried. And I certainly never told anyone.

And I still couldn’t say exactly what it was I felt either. Other than it seemed to sting.

Even with the benefit of beer and hindsight it’s safe to conclude as highly doubtful that any Australian anywhere ever knew what they were feeling at any given moment, let alone be possessed of the capacity to express it.

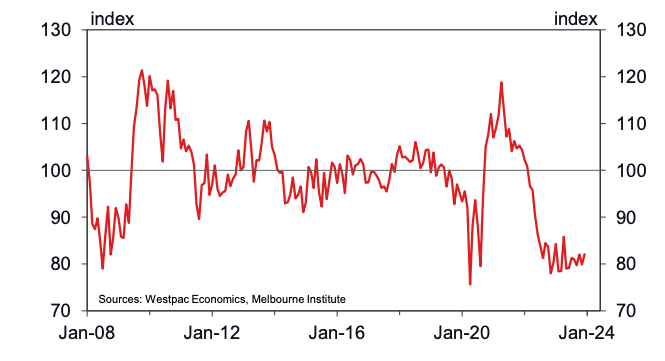

With that said, both Westpac and the Melbourne Institute have reported this morning that the co-mingled Aussie feelings of Aussie shoppers have hit ’81’ in January, down from ‘82.1’ in December. This, they continue, is a fall of 1.3%.

Such readings of sentiment have been wallowing at what are apparently “pessimistic levels” for nearly two years now.

Naturally, that’s down to the crap cost of living and the high interest rates.

How you’ve felt buying stuff over the last 15 years

We’ve been feeling various shades of pessimism since February 2022, which Westpac says is almost the longest streak of pessimism on record.

Well, almost:

“The latest January read is in the bottom 7% of all observations since the survey was first run in the mid-1970s.

More pessimistic starts to the year have only been seen during the deep recession of the early 1990s.”

And we had to have that recession, I seem to recall.

I mention all this because the Australian stock market has feelings too.

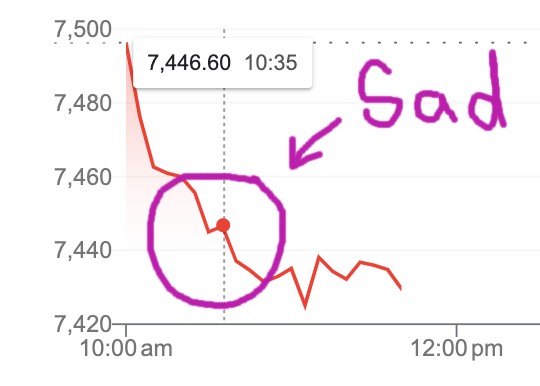

For example, this is how the ASX200 felt around the time the Consumer Sentiment data dropped:

At 12pm on Tuesday, January 16 (me lovely mum’s birthday: Happy Birthday Mum!!), the ASX200 was down by 73 points or 1.0% at 7422.

Trashy Euro leads

So, the Australian market’s opened lower on Tuesday and looked instantly forlorn without signals from a Wall Street session to lead them.

With New York off the clock for the Martin Luther Day holiday, it was left to the Europeans to offer some guidance and it came willingly enough in the shape of grim central bank prognostications, awfully weak equity markets and – get this – a calamitous -0.3% quarterly GDP read out of Germany!

The good news on that front is that everyone was totally expecting it and the former industrial powerhouse’s economy will probably (narrowly) avoid a recession.

So the market action in Sydney’s been dull, bordering on the Anthropomorphic: the ASX on Tuesday morning, I’d say, is feeling about an 81 on the pessimistic scale.

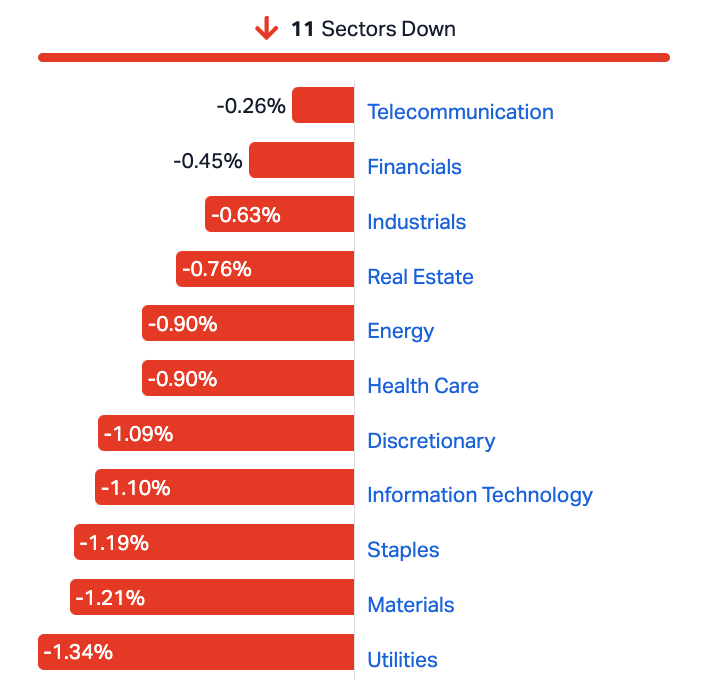

All 11 Sectors are roundly depressed.

Utilities are so hangdog, I could scream:

ASX SECTORS AT LUNCH ON TUESDAY

Trying to find something happy… ahh.

DroneShield (ASX:DRO) has turned a maiden profit.

The Aussie drone killer and defence contractor says that over the three-month period ended 31 December 2023, the company hauled in a record $48m in customer cash receipts and grants.

- That’s x5 more than the next largest quarter on record, (September 2023, at $10mn)

- There’s been record cash receipts (and grants) of $73.5m, also up x5 vs entire 2022

- Record revenues of $55.1m, up x3 vs entire 2022 with some 80% coming from repeat customers

- Pre-tax profit of $4m, DRO’s first, vs $2.9m loss before tax in 2022.

DRO just answered the age old question: War, what is it good for?

Look out, brussell sprout!

The next 48 hours are important if you’re German, or wondering what might happen if China falls over.

There’s inflation and more feelings rolling out for the rest of the day across Japan and Deutschland. While Wednesday is the biggie in China.

TUESDAY

Japan PPI (Dec)

Germany Inflation (Dec, final)

United Kingdom Labour Market Report (Dec)

Germany ZEW Economic Sentiment Index (Jan)

Canada Inflation (Dec)

WEDNESDAY

Singapore Non-oil Domestic Exports (Dec)

China GDP (Q4)

China Industrial Production (Dec)

China Retail Sales (Dec)

China Fixed Asset Investment (Dec)

China Unemployment Rate (Dec)

United Kingdom Inflation (Dec)

United States Retail Sales (Dec)

United States Industrial Production (Dec)

United States Business Inventories (Nov)

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 16 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MCT Metalicity Limited 0.003 50% 499,000 $8,970,108 MHC Manhattan Corp Ltd 0.0055 38% 104,371,003 $11,747,919 PKO Peako Limited 0.004 33% 95,000 $1,581,254 KNB Koonenberry Gold 0.07 27% 180,395 $6,586,200 BMG BMG Resources Ltd 0.016 23% 18,361,999 $8,239,363 RDS Redstone Resources 0.006 20% 105,000 $4,606,892 SI6 SI6 Metals Limited 0.006 20% 333,333 $9,969,297 TMX Terrain Minerals 0.006 20% 600,000 $6,767,139 AMX Aerometrex Limited 0.285 19% 109,234 $22,797,753 TSL Titanium Sands Ltd 0.013 18% 133,208 $21,931,032 LVH Livehire Limited 0.049 17% 115,117 $15,305,392 AHF Aust Dairy Limited 0.014 17% 57,682 $7,870,402 TX3 Trinex Minerals Ltd 0.007 17% 4,022,234 $8,922,148 TOE Toro Energy Limited 0.63 15% 2,087,015 $53,145,401 TAR Taruga Minerals 0.008 14% 799,392 $4,942,187 CHW Chilwaminerals 0.16 14% 8,200 $6,422,500 FRB Firebird Metals 0.125 14% 9,960 $15,659,754 PVW PVW Res Ltd 0.05 14% 112,952 $4,461,810 ERA Energy Resources 0.067 14% 3,886,884 $1,306,749,652 SHO Sportshero Ltd 0.017 13% 34,700 $9,267,493 FAL Falcon Metals 0.135 13% 124,818 $21,240,000 MHK Metalhawk 0.135 13% 54,696 $11,929,734 AUZ Australian Mines Ltd 0.009 13% 816,355 $7,560,394 GBZ GBM Rsources Ltd 0.009 13% 55,000 $5,851,463 NRX Noronex Limited 0.009 13% 1,272,938 $3,026,414

The morning’s good going belongs to Koonenberry Gold (ASX:KNB), which dropped an announcement this morning that final approvals have been received for the maiden drilling program at its Atlantis Au-Cu Prospect, and “as soon as weather conditions permit” they’ll get the drills spinning to conduct first pass Air Core drilling at the site.

“The Atlantis outcropping copper-gold mineralisation, copper-gold soil anomaly, geophysical targets, structural and geological setting make Atlantis a compelling target,” KNB MD Dan Power said.

“Whilst this prospect has been known about for some years, Koonenberry Gold has advanced it to drill ready status and will be the first ever exploration company to conduct drill testing.” Presumably he means at that particular site, but you get the idea.

KNB also has assay results incoming from its Bellagio project, which the company says are “anticipated soon”.

BMG Resources (ASX:BMG) has dropped a bit of a bombshell this morning, fuelling a major surge in volume and pushing its price up more than 23% with news that long-time MD Bruce McCracken has resigned from BMG and all of its subsidiaries.

With McCracken gone, non-executive director John Prineas assumes the role of non-executive chairman, while non-executive chairman Greg Hancock transfers to the role of independent non-executive director.

Prineas steps into the role with a host of other responsibilities on his plate as well – he’s currently BMG’s largest shareholder (holding 9.8%), and is also the founder and executive chairman of St George Mining (ASX:SGQ) and founder and a non-executive director of American West Metals (ASX:AW1).

As it stands with BMG, Prineas is set to assume day-to-day responsibilities for BMG matters, until a new CEO or MD is appointed to the role.

There’s a bunch of Small Caps moving around for reasons probably known only to them – that includes Firebird Metals (ASX:FRB), which is clawing back some of the ground that it lost late last week, and Fatfish Group (ASX:FFG) which is lurching around like it often does, so no huge surprise there, really.

Chilwa Minerals (ASX:CHW), PVW Resources (ASX:PVW) and Metal Hawk (ASX:MHK) are also heading north this morning, without any announcements providing information about why.

And Aerometrex (ASX:AMX) delivered a quarterly this morning, bearing upbeat news for investors – the company expects to deliver a record first half (1H) revenue outcome, driven by “strong ongoing performance of the LiDAR and MetroMap product lines”.

AMX reckons it’s likely to post a group revenue in the $11.8-$12.2 million range, which is a tidy climb from the previous years’ $10 million high water mark.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.001 -50% 2,000 $3,267,458 ME1 Melodiol Global Health 0.001 -50% 17,077,777 $9,457,648 CPO Culpeo Minerals 0.049 -37% 22,945,084 $10,474,677 PUA Peak Minerals Ltd 0.002 -33% 208,333 $3,124,130 NVQ Noviqtech Limited 0.003 -25% 10,000 $5,237,781 JGH Jade Gas Holdings 0.034 -23% 104,195 $69,380,704 PVT Pivotal Metals Ltd 0.019 -21% 70,836 $16,321,339 ATH Alterity Therap Ltd 0.004 -20% 8,215,110 $19,056,631 ESR Estrella Res Ltd 0.004 -20% 55,500 $8,796,859 HCD Hydrocarbon Dynamic 0.004 -20% 1,263,400 $3,848,330 KPO Kalina Power Limited 0.004 -20% 650,711 $11,050,640 UBN Urbanise.Com Ltd 0.3 -19% 5,374 $23,746,789 NGS NGS Ltd 0.013 -19% 914,700 $4,019,638 NKL Nickelx Ltd 0.039 -19% 660,200 $4,215,128 PNM Pacific Nickel Mines 0.054 -17% 713,194 $27,186,452 1MC Morella Corporation 0.005 -17% 257,174 $37,072,797 BPP Babylon Pump & Power 0.005 -17% 1,500,000 $14,979,884 RGL Riversgold 0.01 -17% 3,808,374 $11,611,937 FIN FIN Resources Ltd 0.016 -16% 2,920,235 $12,336,105 AJL AJ Lucas Group 0.011 -15% 82,500 $17,884,485 BXN Bioxyne Ltd 0.011 -15% 15,478 $24,721,390 NIS Nickelsearch 0.05 -15% 1,625,228 $12,599,004 HAW Hawthorn Resources 0.085 -15% 34,784 $33,501,561 AHN Athena Resources 0.003 -14% 398,373 $3,746,636 AMD Arrow Minerals 0.006 -14% 27,617,791 $24,316,356

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.