ASX Small Caps Lunch Wrap: ASX up modestly today as Chalmers beats the RBA drum

Pic via Getty Images.

- Local markets have opened slightly higher following rally on Wall Street

- Big banks lead the way, while Industrials struggle for traction

- Treasurer Jim Chalmers is on the warpath over proposed RBA restructure

Local markets have climbed slightly higher this morning, getting a boost from a rally on Wall Street that saw indices there put on about 1.0% overnight.

There’s not a whole lot of action happening today – some facts and figures of interest to investors, but nothing earth shattering so far this morning.

What is interesting, though, is a deepening political stoush around federal government plans for the future of the RBA, which I’ll dig into shortly.

But first, let’s take a look and see how things are progressing by the numbers today.

TO MARKETS

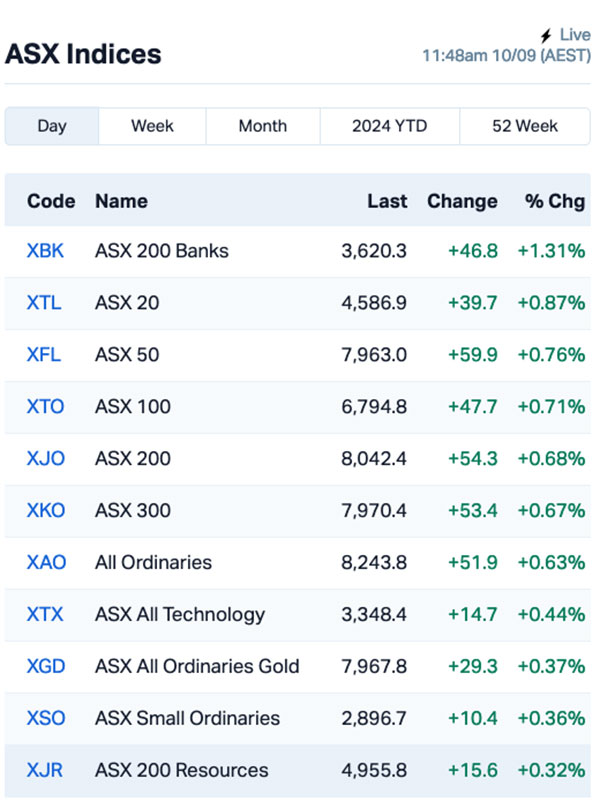

The ASX 200 benchmark has gained a little over the course of the morning, following Wall Street’s lead from a moderate session overnight.

The benchmark rose quickly at open to be up 57 points – or about 0.7% – which was slightly below where the ASX Futures index was pointing before markets opened this morning.

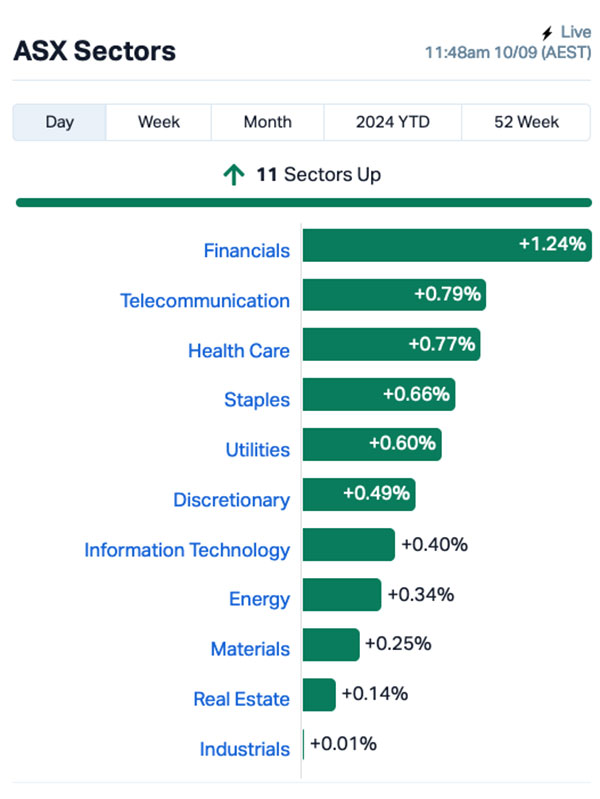

The stand-out leader for the morning was the Financials sector, with the big banks providing a solid foundation for the rest of the market, which had every sector in positive territory to varying degrees.

Westpac had the best of the morning among Big Four, putting on 1.6% while the Commonwealth Bank (ASX:CBA) added 1.3% and is (I’ve just noticed) currently almost precisely twice as huge as its nearest stablemate National Australia Bank (ASX:NAB), with a market cap closing in on a quarter of a trillion dollars.

The Industrials sector was struggling to make any headway, though, barely hanging on at +0.01% just before lunch, with sector heavyweight Brambles (ASX:BXB) down nearly 1.0%, and fleet manager SG Fleet (ASX:SGF) showing an 8.6% dip after going ex-div this morning.

A look at the ASX sub indices paints a similar picture – it’s the big guys making the gains today, with the broader indices in descending order of value, while the goldies and tech stocks scrabble for traction with more modest gains.

Data-wise, there’s not a whole lot happening around the place today, but the ABS has published its latest stab at telling the nation what our housing situation looks like in terms of total dollar value… and it’s a lot.

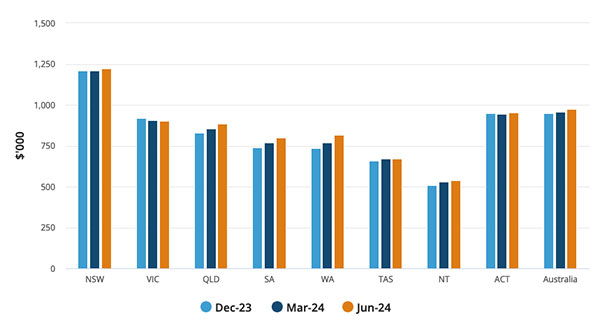

The total value of housing in Australia has risen $225.9 billion in the June quarter, with the addition of 52,900 new homes to the pile.

The average price for a home in Australia is now resting at $973,300 this quarter – up $15,600 from the previous quarter, and providing very little in the way of comfort for anyone who’s not already trudging on the mortgage treadmill, around ever owning a home.

Here’s an at-a-glance for a state-by-state breakdown of how things have changed over the previous couple of quarters.

From the department of “We Already Figured This Out, Thanks” came fresh consumer confidence data, showing that we – as consumers – are not even remotely confident about spending our pocket money at the moment.

According to the ABS – whose job it is to count receipts and tally things up in super-complicated spreadsheets, consumer confidence fell -0.8 points last week to 82.3, while the four-week moving average fell -0.4 to 82.8 points.

There was the usual preamble from the boffins who put the report together, and the standout line from that is pretty jarring.

“The Stage 3 tax cuts and cost-of-living relief do not appear to be progressively boosting households’ confidence,” the report says, confirming that The Great Australian Belt-Tightening is far from over.

Which leads nicely into the only other thing that caught my eye this morning, which was what looks suspiciously like the opening salvo of a war between the Albanese government and the opposition over changes to the structure of the Reserve Bank of Australia.

Federal Treasurer Jim “Supernintendo” Chalmers has opened up about a possible walking back from commitments to RBA reform by his coalition counterpart, Angus Taylor.

Chalmers has been pretty vocal about his desire to restructure the way the RBA operates, splitting the board into two bodies – a “Governance Board” in charge of the bank’s overarching policy moves, and a “Monetary Policy Board” responsible for setting interest rates.

From Chalmers’ comments this morning, it sounds like there’s already been some back-channel wheeling and dealing on the issue with Taylor, who seemed receptive.

But it looks like the bilateral approach has been scuppered by Opposition Leader Peter Dutton, after Taylor went public last night with concerns that Labor is seeking to stack the new board, should it be implemented.

Taylor said the coalition would not be “complicit in Labor’s ‘sack and stack’ strategy” – which prompted Chalmers this morning to claim that Taylor has been “rolled” by his boss in the party room.

“Unfortunately we have been held hostage by his inability to convince his leader,” Chalmers said. “I dealt with him in good faith for the best part of a couple of years. I did genuinely put a premium on bipartisanship, but there’s only so much that you can do.”

And thus begins yet another round of Federal blame-shifting for the ponderous lack of action from both sides of the cost of living debacle we find ourselves in.

It’s been nearly 30 years since I was fired walked away from my job in politics, and it’s wearying to see that absolutely nothing seems to have changed.

NOT THE ASX

Overnight, US stocks also rebounded strongly as investors jumped back in after Friday’s big sell-off.

By the close of play in New York, the S&P 500 was up by 1.16%, the blue chips Dow Jones rose by 1.2%, and the tech-heavy Nasdaq lifted by 1.16%.

Also overnight, the gold price rose by 0.6% to US$2,502 an ounce and oil prices jumped by 1%, with Brent crude now trading at US$71.60 a barrel.

Eddy Sunarto reported this morning that in the US, all eyes are now on Wednesday’s (US time) August CPI report, which is the last big piece of the puzzle before the Fed decides on rates on September 18.

Economists are predicting a 2.6% year-over-year reading, which is a drop from the 2.9% recorded in July.

At the recent Jackson Hole meeting, Fed Chairman Powell hinted at a rate cut in September, and last week’s mixed job numbers pretty much locked in that cut. The only question now is how hard the Fed’s going to swing the axe.

In US stock news, Apple has just launched its iPhone 16 at its product event in Cupertino, California and now I want one. Ugh.

The company also rolled out updates to the whole Apple Watch range and added new hearing protection features to the AirPods Pro 2. Shares didn’t move much on the news.

PayPal has teamed up with Shopify, striking a deal to handle some of Shopify’s debit and credit card transactions.

NYSE-listed discount retailer Big Lots Inc. has gone for bankruptcy protection and is set to sell off its assets and business in a court-managed process.

Discount stores like Big Lots, Dollar Tree and Dollar General have been struggling with their shares plunging 20-30% over the past week or so.

Once the go-to for bargain hunters, they’re now losing traction to the bigger players as Walmart and Target slash their prices.

Across Asia this morning, markets are mixed. Japan’s Nikkei is up a relatively modest 0.14%, but the Hang Seng is down 0.1% and Shanghai markets are off by 0.24% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AAJ Aruma Resources 0.031 93.8 56,471,437 $3,552,931 IEC Intra Energy Corp 0.0015 50.0 853,272 $1,690,782 AOK Australian Oil 0.004 33.3 12,382,672 $2,833,920 FGH Foresta Group 0.004 33.3 1,262,354 $7,066,137 AGD Austral Gold 0.02 33.3 101,553 $9,184,670 AMM Armada Metals 0.012 33.3 100,555 $1,872,000 EOF Ecofibre 0.033 32.0 200,000 $9,471,848 DGR DGR Global 0.014 27.3 2,191,191 $11,480,628 AVE Avecho Biotech 0.0025 25.0 500,000 $6,338,594 CRB Carbine Resources 0.005 25.0 3,381,277 $2,206,951 JAV Javelin Minerals 0.0025 25.0 350,000 $8,553,692 LML Lincoln Minerals 0.005 25.0 383,763 $8,225,038 PNT Panther Metals 0.02 25.0 37,500 $1,394,659 CXL Calix 1.12 24.4 1,912,316 $163,445,630 LNR Lanthanein 0.003 20.0 214,500 $6,109,090 A8G Australasian Metals 0.125 19.0 545 $5,472,652 HXG Hexagon Energy 0.025 19.0 1,131,302 $10,771,234 NHE Noble Helium 0.065 18.2 2,129,112 $26,110,162 ENV Enova Mining 0.013 18.2 6,409,894 $10,834,223 CMD Cassius Mining 0.007 16.7 204,000 $3,252,027

Aruma Resources (ASX:AAJ) was soaring on Tuesday morning, after announcing that an initial surface sampling program at its Fiery Creek Copper Project in the Mt Isa copper belt, Queensland has returned multiple very high-grade copper assay results. The results, covering over 600m of strike include; 11.83% Cu, 11.53% Cu, 9.95% Cu and 9.53% Cu.

Intra Energy Corporation (ASX:IEC) has released an update to its announcement of results from a 1,960-metre reconnaissance drilling program which identified a large-scale lithium-caesium-tantalum system and a large-scale gold system at the Maggie Hays Hill project, in the Lake Johnston Greenstone Belt, Western Australia. The numbers are the same as previously reported on September 04, 2024 – the update includes drill hole details and sectional views as required by the JORC code.

Austral Gold (ASX:AGD) was rising after being reinstated to the ASX, after it was suspended for not filing its FY24 financial reports on time.

Noble Helium (ASX:NHE) was rising on news that new NHE data available for NSAI evaluation indicates better reservoir properties, higher helium concentrations and more or larger prospective structures than previously at the Western Margin of the North Rukwa basin. The company says the total Western Margin P50 Helium Prospective Resource has increased by 66%, and the Lake Beds P50 Helium Prospective Resource has increased by 31%, while the deeper Karoo P50 Helium Prospective Resource jumped 500% after mapping with the 2023 seismic.

Audeara (ASX:AUA) was climbing earlier on news that it has signed a binding Letter of Intent with prominent, Hong Kong based technology services provider Eastern Asia Technology, to deliver Audeara’s healthy hearing technology into the Chinese medical device market. Eastech has “a strong presence in China and a proven track record of successfully delivering advanced technology products and solutions, ensuring high standards of quality and customer satisfaction.” the company says.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 10 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap IVX Invion 0.002 -33.3 18,415 $19,999,775 NSX NSX 0.011 -26.7 290,800 $6,866,715 LPD Lepidico 0.0015 -25.0 692,435 $17,178,250 MRQ MRG Metals 0.003 -25.0 1,259,958 $10,846,075 WEL Winchester Energy 0.0015 -25.0 625,000 $2,726,038 MTC Metalstech 0.2 -23.1 496,199 $51,183,180 PVT Pivotal Metals 0.01 -23.1 700,000 $9,153,538 BCB Bowen Coal 0.007 -22.2 46,083,045 $25,642,612 MGL Magontec 0.2 -20.0 1,351 $19,910,942 ADD Adavale Resources 0.002 -20.0 76,105 $3,059,413 SFG Seafarms Group 0.002 -20.0 3,205 $12,091,498 SVM Sovereign Metals 0.54 -18.2 3,182,188 $394,384,979 AZI Altamin 0.029 -17.1 7,875 $15,359,716 LEX Lefroy Exploration 0.07 -16.7 176,602 $16,838,512 ECT Env Clean Tech 0.0025 -16.7 26,338 $9,515,431 PRM Prominence Energy 0.005 -16.7 177,714 $1,868,258 PUR Pursuit Minerals 0.0025 -16.7 1,536,089 $10,906,200 APL Associate Global 0.14 -15.2 7,833 $9,321,250 WIN WIN Metals 0.028 -15.2 388,661 $10,888,007 GTR GTI Energy 0.003 -14.3 1,000,246 $8,924,815

ICYMI – AM EDITION

Miramar Resources (ASX:M2R) has provided an update on its quest for nickel, copper, cobalt and PGEs in Western Australia’s Capricorn Orogen.

The company has completed a maiden reverse circulation drilling campaign at the Bangemall project, testing geological and geophysical targets at Mount Vernon and Trouble Bore.

While the company did concede difficulty drilling through Trouble Bore’s alluvial cover, it did successfully test seven targets at Mount Vernon with selected samples already submitted for analysis.

The initial drilling was co-funded by the WA Government’s Exploration Incentive Scheme and was the first of its class to target Norilsk-style Ni-Cu-Co-PGE mineralisation in the region. Miramar will review other options for testing Trouble Bore – including the possibility of implementing diamond drilling.

Argentine explorer Pursuit Minerals (ASX:PUR) has appointed Stephen Layton as non-executive director – effectively immediately.

Layton holds more than 35 years’ experience in equity capital markets in both the United Kingdom and Australia, including years on the trading floor of the London Stock Exchange from 1980 to 1986. After stepping foot in Australia in the late 1980s, Layton worked with a number of stockbroking and corporate advisory firms, specialising in capital raisings and the facilitation of ASX listings.

Layton also currently works as a non-executive director for Mithril Resources (ASX:MTH) and EQ Resources (ASX:EQR) .

At Stockhead, we tell it like it is. While Miramar Resources and Pursuit Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.