ASX Small Caps Lunch Wrap: ASX pushes higher after Russian uranium slowdown and US tech rally

Pic via Getty Images

Local markets have opened higher, following a boost for tech stocks on Wall Street overnight and a jump among local techies and uranium stocks this morning.

Elsewhere, there are some major deals being worked out in the world of business, Nine boss Mike Sneesby has pulled the pin on his time with the company, some big names on the bourse are trading ex-div and – as I’m writing this – every market sector is on positive ground.

I am nursing the mother of all headaches today, so this – I hope – will be mercifully brief, so that I can retreat back into the darkness of my bed and pretend that the rest of today isn’t actually a thing. (Take two tablets and if pain persists, call your doctor in the morning – Ed.)

TO MARKETS

The ASX 200 benchmark has been working its way towards a 0.75% gain at lunchtime, after local tech stocks and some of the bigger names in the uranium sphere made solid headway since the bell rang this morning.

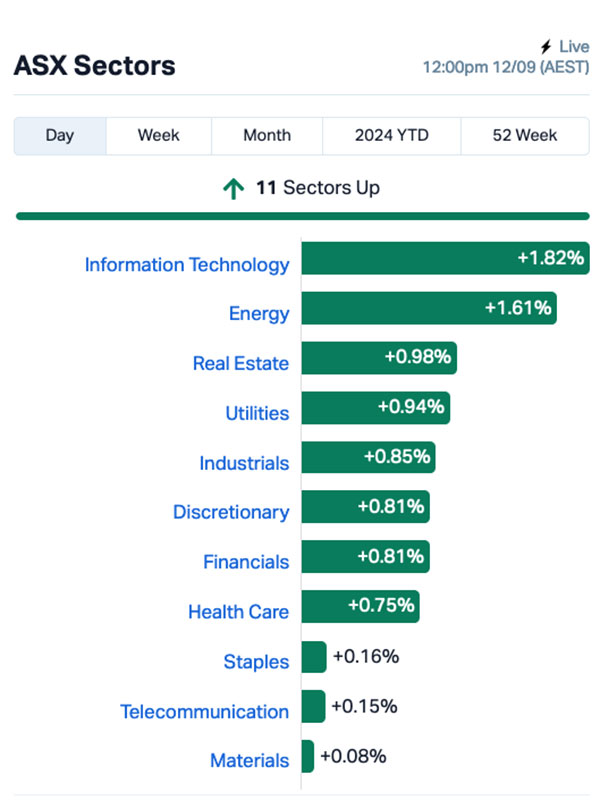

Here’s a quick glance at the market sectors:

Infotech is out in front of the rest of the market this morning, taking its lead from a rally among tech stocks on Wall Street overnight, with the sector getting a boost from it’s bigger names.

That includes WiseTech Global (ASX:WTC) , up more than 3.0% today to take its gains since the start of calendar 2024 to nearly +75.0%, as it’s trading beyond $130 per share, a decent climb from its recent low point of $85 in early August.

Nuix (ASX:NXL) is also on the move, with the company still moving positively – up 7.6% this morning – since it confirmed its numbers for FY24, when it saw a 20.9% YoY increase in revenue.

The Energy sector also saw a boost among uranium miners this morning, with Paladin Energy (ASX:PDN) up 9.99%, Boss Energy (ASX:BOE) up more than 10% and Deep Yellow (ASX:DYL) on +9.9% for the morning as well.

The rise among the yellowcakers comes after Russian President Vladimir Putin suggested that Moscow should consider limiting exports of uranium, titanium and nickel, as the country’s “four-week conflict” with Ukraine enters its 931st day.

The Materials sector was struggling, though, partially held back by a couple of the big guns doing ex-div this morning, including BHP (ASX:BHP) which is showing a 1.6% dip as a result.

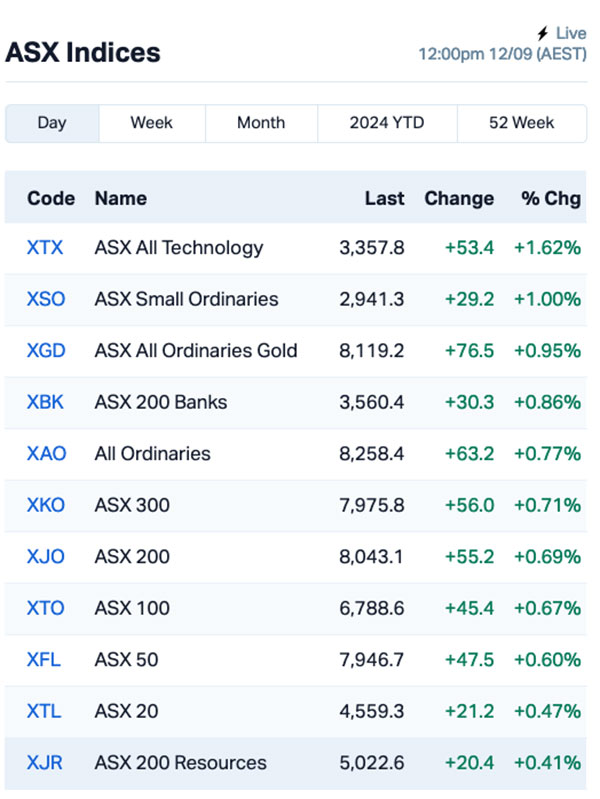

Here are the ASX indices:

Nothing out of the ordinary there today – other than everything in positive territory, which makes a nice change for the week.

In other news today, former RBA chief Bernie “The Sandman” Fraser has weighed into the discourse surrounding the Reserve Bank, agreeing with federal treasurer Jim Chalmers that the board’s interest rate calls are “smashing the economy”.

However, Fraser is at odds with Chalmers over plans to split the RBA into two governing bodies – one to look after monetary policy, and a separate board convened solely to figure out what to do about interest rates.

Fraser told the ABC that the move “will lead to a ‘preoccupation with inflation’ to an exclusion of other things it must take into account as part of its charter”, as if every single Australian with half a brain and a bank account isn’t already preoccupied with what’s happening in the rates department.

“Talking tough on inflation and threatening to keep interest rates high, and even put them up higher, will overall do nothing at all to wind in inflation, Fraser said.

“What it will do, though, is worsen the problem for those people who are already suffering, and those that would be further caught up in any worsening of the likely slowing down in the economy and in unemployment and so on.

“So I think it’s time for the bank to take regard to all its objectives that are specified in its charter, and get on its bike and start winding interest rates down to avoid these threatening problems on recession and unemployment, and greater vulnerability for the poorest sectors of our community.”

And a major story developing overseas is the possible sale of 7-Eleven – as in, all of them, everywhere – after Canadian company convenience store giant, Couche-Tard (It’s French for Convenience Store Customer) indicated that it’s keen to take over 7-Eleven and become the world’s largest convenience store network.

It’s hard to tell what stage negotiations are at, though, as Couche-Tard representatives have allegedly (ie, not at all, because I am making this bit up) turned up for meetings, only to find locked doors with hand-written “Back in 5 Minutes” signs taped on them for hours at a time.

The real story is that Couche-Tard has reportedly lobbed a US$38 billion bid on the table, and 7-Eleven’s Japanese owners reckon that’s nowhere near enough to pay for the 80,000-or-so outlets the company currently has across 20 countries.

Which seems as good a segue as anything to move onto what’s been happening on overseas markets.

NOT THE ASX

Overnight, fresh data in the US revealed that consumer prices climbed just 2.5% from last August, down from 2.9% in July, while core prices ticked up slightly to 3.2%.

Wall Street surged on the CPI reading – the S&P 500 gained 1%, the Dow Jones rose by 0.3% and the tech heavy Nasdaq lifted by over 2%.

While this gives the Federal Reserve room to cut interest rates when it convenes on September 17, a more modest 25 basis-point cut is now expected instead of a bigger 50-basis point cut, Eddy Sunarto reported this morning.

“The data reinforced bets that the Federal Reserve might lower interest rates by 25 basis points, with the market currently pricing in an 85% probability,” said Erik Boekel at DHF Capital.

In US stock news, market darling Nvidia popped by over 8% after CEO Jensen Huang revealed the company was struggling to keep up with soaring demand.

Pfizer fell 0.3% despite being upgraded to a Buy rating by Zacks, reflecting its improved earnings estimates.

Meme stock Gamestop plunged 12% after reporting that its revenue fell by nearly a third to $798.3 million in the last quarter.

Albemarle‘s shares soared 13% after reports that Chinese EV battery maker CATL may have suspended two lepidolite mines, potentially cutting China’s lithium carbonate production by 8%. This sparked a buying frenzy in lithium stocks, including those on the ASX yesterday.

And following a less-than-stellar performance in the presidential debate yesterday, Trump Media & Technology Group shares plummeted 10.5%, taking its loss to 57.33% over the past 6 months.

In Asian market news, things are looking up around the region today, with Japan’s Nikkei surging 2.84%, while the Hang Seng and Shanghai markets added a more modest 0.19% and 0.05% respectively.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 12 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LNU Linius Tech 0.002 100.0 417,810 $5,546,741 BP8 BPH Global 0.003 50.0 166,666 $793,283 SFG Seafarms Group 0.003 50.0 529,739 $9,673,198 TON Triton Minerals 0.011 37.5 2,705,781 $12,547,110 SNS Sensen Networks 0.046 35.3 698,205 $26,448,897 ALR Altair Minerals 0.004 33.3 250,000 $12,889,733 GTR GTI Energy 0.004 33.3 2,422,429 $7,649,841 TG6 TG Metals 0.16 33.3 148,855 $8,532,905 LKY Locksley Resources 0.031 29.2 41,214,225 $3,520,000 M2R Miramar 0.009 28.6 6,922,616 $2,763,457 BCB Bowen Coal 0.0115 27.8 15,550,895 $25,642,612 BYH Bryah Resources 0.005 25.0 216,085 $2,013,147 NAE New Age Exploration 0.005 25.0 912,955 $7,175,596 TAS Tasman Resources 0.005 25.0 213,356 $3,220,998 TSL Titanium Sands 0.005 25.0 109,600 $8,846,989 GBE Globe Metals Mining 0.046 21.1 131,529 $26,274,929 ADD Adavale Resource 0.003 20.0 303,334 $3,059,413 ICG Inca Minerals 0.006 20.0 500,000 $4,052,682 LNR Lanthanein 0.003 20.0 10,324,075 $6,109,090 AL3 Aml3D 0.155 19.2 6,249,955 $49,282,874

SenSen Tech (ASX:SNS) was winning on Thursday, on news that the company has secured a tender to provide mobile and fixed camera technology in The City of Calgary, Canada. The deal will see Sensen provide mobile and fixed lane enforcement systems with a first-year value of $1.9 million, with the entire contract worth a reported $4.6 million over five years, with two additional two-year extension options for a total potential length of nine years.

GTI Energy (ASX:GTR) was up on news that it has completed 66 of the proposed 76 drill hole exploration program at its Lo Herma ISR uranium project, located in Wyoming’s prolific Powder River Basin which the company says “confirms that uranium mineralisation continues north from the current mineral resource area with strong mineralised intercepts over good thicknesses encountered stretching at least 2km north along projected trends”.

Locksley Resources (ASX:LKY) has reported results of a holistic review of antimony potential outside of the known high-grade REE mineralisation within the Mojave Project, California which the company says has uncovered six rock chip samples grading >0.5% Sb, including two samples grading 11.2% Sb and 8.3% Sb.

AML3D (ASX:AL3) reports the signing of a new Manufacturing License Agreement, which allows the company to work with key suppliers and internal teams within the US Navy submarine industrial base through the exchange of technical assistance and data, facilitating an expansion of AML3D’s activities to support the US Navy.

Earlier, Belararox (ASX:BRX) was rising on news that the company has bought the rights to 4,286km2 of prospective tenure across 14 prospecting licenses on Botswana’s highly prospective Kalahari Copper Belt, through the acquisition of 100% of KCB Resources, including its subsidiaries Blackrock Resources and NI MG Northern Nickel.

The acquisition secures BRX a second significant copper-prospective project in a highly prospective and mining-friendly jurisdiction, close to Sandfire Resources’ (ASX:SFR) Motheo Copper Mine, MMG Limited’s Khoemacau Mine and Cobre’s (ASX:CBE) flagship Ngami Copper project.

Great Western Exploration (ASX:GTE) was moving well after announcing that it has identified a “large, robust and coherent niobium lag soil anomaly”, which it has named the Sumo Niobium Target, 70km south-east of Sandfire Resources’ DeGrussa Copper-Gold Project and within Great Western’s 100% owned Yerrida North Project.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 12 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VPR Volt Group 0.001 -50.0 700,000 $21,432,416 88E 88 Energy 0.0015 -25.0 10,304,821 $57,867,624 IBG Ironbark Zinc 0.003 -25.0 2,545,105 $7,334,591 SI6 SI6 Metals 0.0015 -25.0 236,343 $4,737,719 EDU EDU Holdings 0.07 -22.2 104,550 $14,869,300 ADG Adelong Gold 0.004 -20.0 11,112 $5,589,945 BNL Blue Star Helium 0.004 -20.0 950,000 $9,724,426 EVR EV Resources 0.004 -20.0 2,554,393 $6,981,357 WML Woomera Mining 0.002 -20.0 35 $3,795,347 KLI Killi Resources 0.13 -18.8 3,825,266 $22,435,799 CC9 Chariot Corporation 0.11 -18.5 42,716 $12,099,761 CTN Catalina Resources 0.0025 -16.7 257,513 $3,715,461 GEN Genmin 0.06 -15.5 593,643 $48,722,763 ACM Aus Critical Mineral 0.074 -14.9 315,778 $3,073,384 BLZ Blaze Minerals 0.003 -14.3 28,571 $2,199,954 EPM Eclipse Metals 0.006 -14.3 4,000,000 $15,755,989 MGU Magnum Mining 0.012 -14.3 2,925,367 $11,331,060 TMK TMK Energy 0.003 -14.3 105,293 $24,225,642 ST1 Spirit Technology 0.052 -13.3 8,327 $96,671,423 AER Aeeris 0.06 -13.0 173,963 $5,037,956 Code Company Price % Volume Market Cap VPR Volt Group 0.001 -50.0 700,000 $21,432,416 88E 88 Energy 0.0015 -25.0 10,304,821 $57,867,624 IBG Ironbark Zinc 0.003 -25.0 2,545,105 $7,334,591 SI6 SI6 Metals 0.0015 -25.0 236,343 $4,737,719 EDU EDU Holdings 0.07 -22.2 104,550 $14,869,300 ADG Adelong Gold 0.004 -20.0 11,112 $5,589,945 BNL Blue Star Helium 0.004 -20.0 950,000 $9,724,426 EVR EV Resources 0.004 -20.0 2,554,393 $6,981,357 WML Woomera Mining 0.002 -20.0 35 $3,795,347 KLI Killi Resources 0.13 -18.8 3,825,266 $22,435,799 CC9 Chariot Corporation 0.11 -18.5 42,716 $12,099,761 CTN Catalina Resources 0.0025 -16.7 257,513 $3,715,461 GEN Genmin 0.06 -15.5 593,643 $48,722,763 ACM Aus Critical Mineral 0.074 -14.9 315,778 $3,073,384 BLZ Blaze Minerals 0.003 -14.3 28,571 $2,199,954 EPM Eclipse Metals 0.006 -14.3 4,000,000 $15,755,989 MGU Magnum Mining 0.012 -14.3 2,925,367 $11,331,060 TMK TMK Energy 0.003 -14.3 105,293 $24,225,642 ST1 Spirit Technology 0.052 -13.3 8,327 $96,671,423 AER Aeeris 0.06 -13.0 173,963 $5,037,956 Code Company Price % Volume Market Cap VPR Volt Group 0.001 -50.0 700,000 $21,432,416 88E 88 Energy 0.0015 -25.0 10,304,821 $57,867,624 IBG Ironbark Zinc 0.003 -25.0 2,545,105 $7,334,591 SI6 SI6 Metals 0.0015 -25.0 236,343 $4,737,719 EDU EDU Holdings 0.07 -22.2 104,550 $14,869,300 ADG Adelong Gold 0.004 -20.0 11,112 $5,589,945 BNL Blue Star Helium 0.004 -20.0 950,000 $9,724,426 EVR EV Resources 0.004 -20.0 2,554,393 $6,981,357 WML Woomera Mining 0.002 -20.0 35 $3,795,347 KLI Killi Resources 0.13 -18.8 3,825,266 $22,435,799 CC9 Chariot Corporation 0.11 -18.5 42,716 $12,099,761 CTN Catalina Resources 0.0025 -16.7 257,513 $3,715,461 GEN Genmin 0.06 -15.5 593,643 $48,722,763 ACM Aus Critical Mineral 0.074 -14.9 315,778 $3,073,384 BLZ Blaze Minerals 0.003 -14.3 28,571 $2,199,954 EPM Eclipse Metals 0.006 -14.3 4,000,000 $15,755,989 MGU Magnum Mining 0.012 -14.3 2,925,367 $11,331,060 TMK TMK Energy 0.003 -14.3 105,293 $24,225,642 ST1 Spirit Technology 0.052 -13.3 8,327 $96,671,423 AER Aeeris 0.06 -13.0 173,963 $5,037,956

ICYMI – AM EDITION

Killi Resources (ASX:KLI) has started maiden drilling at the Kaa gold-copper prospect within its Mt Rawdon West project in Queensland to test a large chargeable anomaly that was identified from an induced polarisation survey below the historical Wonbah copper mine.

While laboratory analysis is essential to determining what is present at the prospect, visual observations of the diamond drilling core has granted “confidence” in the targets.

The company has also started an IP survey at Baloo, which is adjacent to Kaa, to cover the 2.5km by 1.8km gold-copper-molybdenum anomaly in a bid to define drill targets.

At Stockhead, we tell it like it is. While Killi Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.