ASX Small Caps Lunch Wrap: ASX on track to end the week with an upswing

Raoul knew it would be dangerous, but launching himself off the mountain was cheaper than getting an Uber home. Pic via Getty Images.

- ASX 200 up 0.84% at lunch

- Resources big boys lead the gains

- Butchers super fund wants to own … a drilling company?

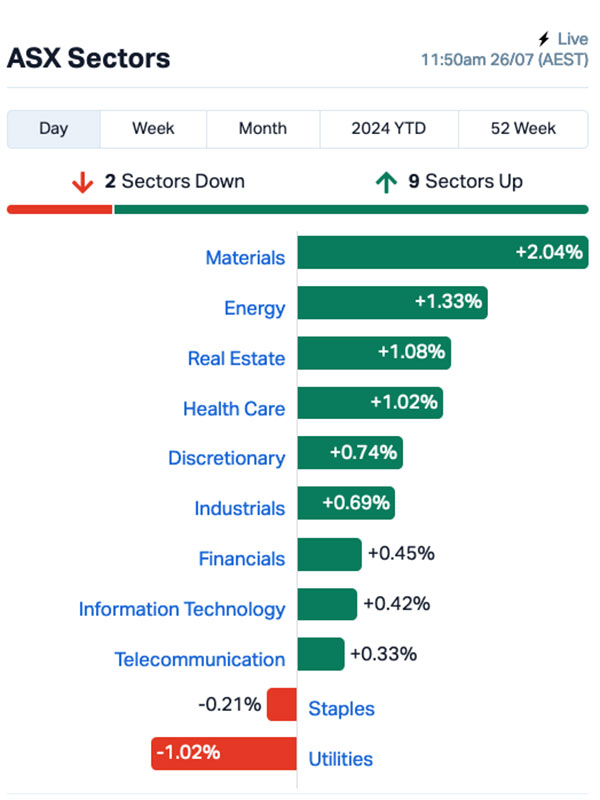

Friday morning has been pretty good for local investors. The ASX 200 is up 0.84%, I think it might actually be sunny outside and things are looking pretty happy, provided your portfolio isn’t “mostly Utilities” – in which case, you’re probs not having an excellent day.

Local markets rebounded from yesterday’s sell-off thanks, in part, to a reshuffle on Wall Street overnight that delivered a mixed bag of results – but a very modest rise by the Dow was enough to get Aussie investors up off the couch this morning, and heading off looking for value.

And there was value to be found – even if it was based on “rock chip samples”, which (and we’ve told you all this before) is not a scientifically fool-proof basis to wager your hard-earned on.

As a quick reminder, in case you’d forgotten, it involves people picking up rocks that look likely to bolster their belief that they’ve picked the right spot to go prospecting, and sending them off to have their suspicions confirmed.

And while it can sometimes be an indication of what lies beneath the ground, it also can be a little… misleading.

I’m not suggesting that anyone’s been telling fibs or anything crazy like that, it’s just that assessing an area by using rock chips can be like picking up a dog turd in the park, having it tested in a lab to confirm that it’s dog poo. You wouldn’t then declare that the entire park is undeniably 60% dog poo, with some grass on top.

Though you may, if you were heavily invested in the dog poo thematic, choose to believe it. (Ed’s Note: This metaphor may not be 100% complete, but we’ll allow it.)

I’m ranting, and it’s not quite like that, but we see it so often that it’s becoming a bit exasperating. No doubt rock chips can tell part of the story of a patch of ground in the middle of nowhere – but it’s not enough of a narrative that it warrants buying the movie rights.

And now that’s off my chest, here’s what’s happened today on the ASX.

TO MARKETS

The ASX 200 benchmark was moving in a positive manner Friday morning, following a not-even-remotely earth shattering session on Wall Street overnight.

The mixed results there, however, were enough to remind ASX investors that today might not be the day for panic selling, and hopefully avoid another rout like the one we saw yesterday.

The resources surge this morning can be attributed to the Big Guys behaving better than they have over the past few days, with BHP (ASX:BHP) , Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) up 2.4%, 1.8% and 2.9% respectively.

Likewise, the big guns of Energy were performing better on Friday morning as well, but among them there have been a handful of horror weeks.

Before the market opened this morning, I was looking back over the week and seeing what the landscape looked like in Energy, because it’s on track to be the worst performing sector this week by a significant margin.

That’s because of companies like Woodside (ASX:WDS), which was up 0.69% at lunchtime today – but is currently showing a sphincter-puckering 8.5% loss for the past week. Similarly, Whitehaven Coal (ASX:WHC) is up 1.5% today, but will be showing a more than 6% loss for the week.

Paladin Energy (ASX:PDN) is even worse – up 1.3% this morning, but down a shocking 11%-plus for the week.

It’s all very complicated but the broad stroke reasons are thus: The Aussie dollar is sinking, our biggest trading partner (China) has got some serious economic woes at the moment and its appetite for the stuff we dig out of the ground has plunged.

That’s basically it.

China’s got more than just an oozingly sluggish construction slump happening, it’s also dealing with the second coming of a deadly typhoon called Gaemi which has sunk a couple of ships overnight.

One of them was an oil tanker, and there’s a 1.4 million litre industrial fuel slick being blown at a fairly crisp rate towards the Philippines as you read this.

The upshot is the iron ore that China couldn’t get enough of previously is off – the iron ore contract on the Singapore Exchange fell below $100 (briefly), and that’s never good news for Resources.

Similarly, a number of key commodities that we rely on for export dollars are tumbling in price as well. Copper is down 4.3% for the week. Silver’s down 6.3%. Gold is retreating from recent record highs, down 3.2% this week.

But today, things are looking brighter, and the ASX sectors look like this at lunchtime.

Using a different yardstick, the XJR ASX 200 Resources index is topping the leaderboard on +1.98%, but – rather tellingly – the normally perma-buoyant goldies are playing tail-end Charlie today, languishing at the bottom of the ladder, down 1.91%.

With just the afternoon portion of proceedings to go until the end of the trading week, it’s safe to say that – barring an absolute miracle – the benchmark is going to be showing a loss for the week by the time the bell rings at 4:00pm.

There’s a non-zero chance that every sector’s going to be in the red for the week, and it’s almost guaranteed that the ASX indices are all going to be glowing malevolently like the Devil’s scary red eyes when the bell goes today.

NOT THE ASX

Overnight, Wall Street rallied weirdly, and ended the session all mixed up.

The Nasdaq continued its descent after a 3% crash on Wednesday, down by a further 0.93% The S&P 500 finished the day 0.51% lower, while the blue chips Dow Jones index rose by 0.2%

The Great US Rotation continued, as investors moved away from the big ticket items to focus more on the little guys, which has had US tech stocks in the headlights like startled deer all week.

Those big stocks that have been busting out record-setting gains in recent times are undergoing what looks a lot like a correction – which a few analysts have been a bit Chicken Little about over the past week or so.

In US stock news, Meta Platforms fell 1.7% as it faces its first fine from the European Union for allegedly misusing its market power by linking Facebook Marketplace to its social network.

American Airlines rose by over 4% lowered its earnings forecast due to past errors that the airline says will continue to impact its revenue and profits throughout the rest of 2024.

Harley-Davidson surged by 7.5% after reporting higher-than-expected revenue for Q2, thanks to increased shipments and stronger sales of its more expensive motorcycles in North America.

The company also announced a US$1 billion plan to buy back its own shares – and, having ridden a few Harleys over the years, I reckon they should probably spend a bit on quality control before splashing out a billion on a buyback.

Lululemon plunged over 9% after analysts expressed new concerns about the company’s ability to meet its guidance, citing ongoing problems with its products and a slowdown in demand for activewear that could stretch the company a little too thin for comfort in the coming months.

The US economy got a bit of a boost, courtesy of some stronger than expected GDP figures arrived in the post, showing that the US economy grew pretty bloody quickly in the last quarter, with the GDP increasing by 2.8% from April to June, beating economists’ forecasts and improving significantly from the 1.4% growth in Q1.

In Asian market news this morning, things are mixed – Japan’s Nikkei is up 0.57%, Hong Kong’s doing okay with a 0.79% rise, but Shanghai markets are losing ground, down 0.14%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 26 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MCT Metalicity Limited 0.003 50.0 1,328,350 $8,971,705 AGY Argosy Minerals Ltd 0.049 44.1 43,322,207 $49,501,312 E79 E79Goldmineslimited 0.047 38.2 46,581,548 $3,473,530 NAE New Age Exploration 0.004 33.3 5,576,436 $5,381,697 IKE Ikegps Group Ltd 0.67 28.8 77,562 $83,396,374 JAY Jayride Group 0.009 28.6 303,654 $1,654,164 VKA Viking Mines Ltd 0.009 28.6 37,050 $7,176,809 DAF Discovery Alaska Ltd 0.014 27.3 81,258 $2,576,582 KNO Knosys Limited 0.048 26.3 3,122,320 $8,213,271 EFE Eastern Resources 0.005 25.0 100,000 $4,967,786 EMT Emetals Limited 0.005 25.0 4,667,693 $3,400,000 RIL Redivium Limited 0.0025 25.0 250,000 $5,461,710 SHO Sportshero Ltd 0.005 25.0 104,404 $2,471,331 IND Industrialminerals 0.22 22.2 68,636 $12,376,800 DDB Dynamic Group 0.285 21.3 1,429,294 $32,674,376 NC6 Nanollose Limited 0.023 21.1 24,398 $3,268,121 ASQ Australian Silica 0.029 20.8 34,020 $6,764,649 CYM Cyprium Metals Ltd 0.0435 20.8 9,006,922 $54,934,644 DBO Diabloresources 0.018 20.0 833,184 $1,546,071 CDR Codrus Minerals Ltd 0.03 20.0 258,242 $4,134,688

E79 Gold Mines’ (ASX:E79) initial reconnaissance sampling program at Mountain Home has returned some promising rock chip assays, with the company announcing it’s found samples clocking in at 28.9% Cu, 0.16 g/t Au, and 0.11% Cu, 11.75 g/t Au.

Argosy Minerals (ASX:AGY) was up Friday morning on the back of a positive quarterly report, with the company’s flagship Rincon lithium project getting EIA regulatory approval for development of a 10,000tpa LCE production operation expansion, and the company’s finances in good order as well.

Eastern Resources (ASX:EFE) was up on news that it has retained Nagom, an experienced lithium consultancy in Perth, to handle a fresh round of metallurgical testwork on samples taken from its Lepidolite Hill project, which has already returned some positive samples earlier in the year, including 13m at 1.47% Li2O from 19m.

And eMetals (ASX:EMT) has jumped Friday morning on news that it has inked a deal to buy 80% of the ordinary shares in Sifang, which is the 100% legal and beneficial owner of the Mubende Gold Project and four exploration license applications located in central Uganda.

NZ-based ikeGPS (ASX:IKE) climbed higher on Friday, after revealing that it has signed a contract for significant product expansion with a longstanding partner in the United States, which the company says should result in revenue of $19 million over the next 36 months.

Industrial Minerals (ASX:IND) was up on news that is has received results from High Purity Quartz Processing Testwork1 completed by North Carolina State University’s Mineral Research Laboratory, where a maiden sample from the Mukinbudin Project achieved >99.991% SiO2 from a simple processing flow sheet, which is a Good Thing.

And for today’s episode of “I think I need to re-read this, to make sure I’ve got the story right”, Dynamic Drill & Blast (ASX:DDB) has revealed that it has received notice of an on-market takeover offer from Australian Meat Industry Superannuation, with the latter offering $0.28 per share for the percentage of the company that it doesn’t already own.

Yeah, I don’t get it, either… but it’s a real thing that is happening.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 26 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NGSDA NGS Ltd 0.02 -33.3 7 $1,224,542 88E 88 Energy Ltd 0.002 -33.3 5,587,619 $86,678,016 GTR Gti Energy Ltd 0.003 -25.0 6,206,250 $10,199,788 JAV Javelin Minerals Ltd 0.0015 -25.0 759,502 $8,553,692 PUA Peak Minerals Ltd 0.003 -25.0 1,744,740 $4,789,506 BGL Bellevue Gold Ltd 1.4325 -21.7 51,925,799 $2,154,535,587 BLZ Blaze Minerals Ltd 0.004 -20.0 851,420 $3,142,791 CAV Carnavale Resources 0.004 -20.0 3,936,776 $17,117,759 ICG Inca Minerals Ltd 0.004 -20.0 6,909,633 $4,052,682 OVT Ovanti Limited 0.004 -20.0 5,982,962 $6,200,527 RCL Readcloud 0.081 -17.3 441,683 $14,328,041 AMX Aerometrex Limited 0.36 -17.2 176,190 $41,320,928 HIQ Hitiq Limited 0.015 -16.7 265,515 $6,333,209 BXN Bioxyne Ltd 0.005 -16.7 7,183,666 $12,279,872 MXO Motio Ltd 0.02 -16.7 1,333,921 $6,436,760 PRX Prodigy Gold NL 0.0025 -16.7 506,666 $6,353,323 TYX Tyranna Res Ltd 0.005 -16.7 1,132,500 $19,727,552 C7A Clara Resources 0.011 -15.4 10,000 $2,601,807 PSL Paterson Resources 0.018 -14.3 88,450 $9,576,795 AAU Antilles Gold Ltd 0.003 -14.3 5,483,724 $5,114,997

ICYMI – AM EDITION

You haven’t missed much, but check today’s Closing Bell to see if there’s something that might’ve slipped beneath your radar.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.