ASX Small Caps Lunch Wrap: ASX dips despite Resources surge, as US/China slowdowns weigh

Pic via Getty Images.

Local markets opened flat this morning, dipping slightly before lunch.

This came after a solid surge among gold and resources stocks was more than offset by a plunge in tech stocks, alongside a fall for Energy and Financials that mirrored what happened on Wall Street overnight.

In the US, as I’m writing this, there’s an incredible piece of political theatre underway, with the Presidential Debate in full swing, and that’s been taking up a fair bit of brainspace today. Also, my playlist has put me in a really sour mood.

I blame Radiohead… you should listen to this, so you can blame them, too.

And with that ringing in your ears, there’s stuff happening on the market today that is definitely important, so let’s get into that and leave the inconsolable shower-sobbing for someone else to worry about.

TO MARKETS

Today has been all about Resources so far on the ASX, and that’s left the Materials sector well out in front of the rest of the market doing a lot of heavy lifting off the back of a couple of pretty major stories.

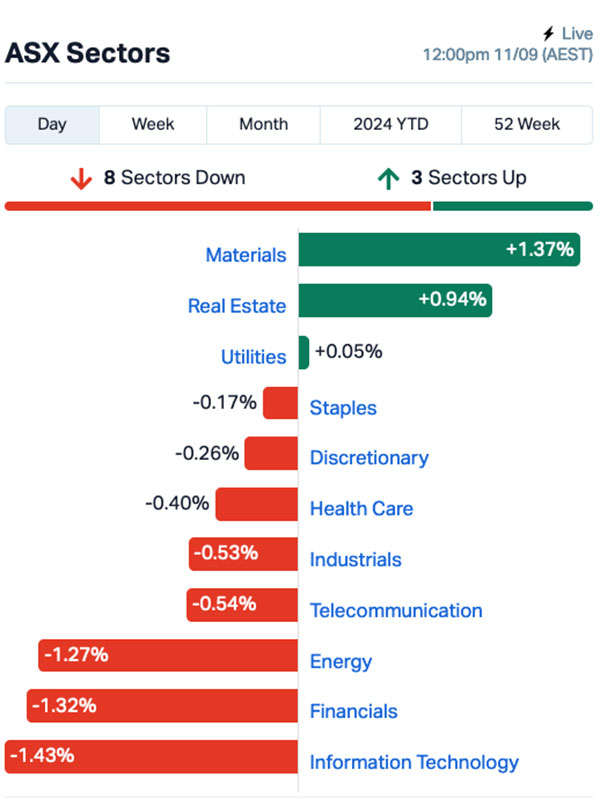

Here’s a quick glance at the sector charts to paint the picture of how everything’s tracking.

Yesterday’s winners in the Financials sector have given back a chunk of their gains, weighing heavily on the market this morning alongside the Energy sector which is – again – in trouble.

And that trouble is getting deep for Energy shares. Over the past week, Energy has fallen 10.5%, and is currently down more than 21% since the start of calendar 2024.

The finger of blame for that rests largely on the global oil market, with Brent Crude falling below US$70 per barrel overnight, after OPEC moved to slash its oil demand forecast for 2024 and 2025, sparking worries about an oversupply of thick, oily goodness.

On top of that, oil prices were already under pressure thanks to the looming spectre of a global economic slowdown that continues to hover over the market.

The US is grappling with the prospect of a Federal Reserve that might have made the mother of all missteps while dealing with inflation over the past 12 months, with an interest rate cut coming in the next two weeks – the last detail needed for the US to learn what the back end of the Fed’s FAFO equation is going to look like.

Plus – and this almost goes without saying – China’s glacial economy is still teetering on the verge of becoming the economic equivalent of the head of Walt Disney… cryogenically frozen, with a note on it saying “wake me up when things are better”.

By comparison, InfoTech has risen more than 39% in the same long-term period, but even that sector is struggling this morning, down more than 1.3% before lunch.

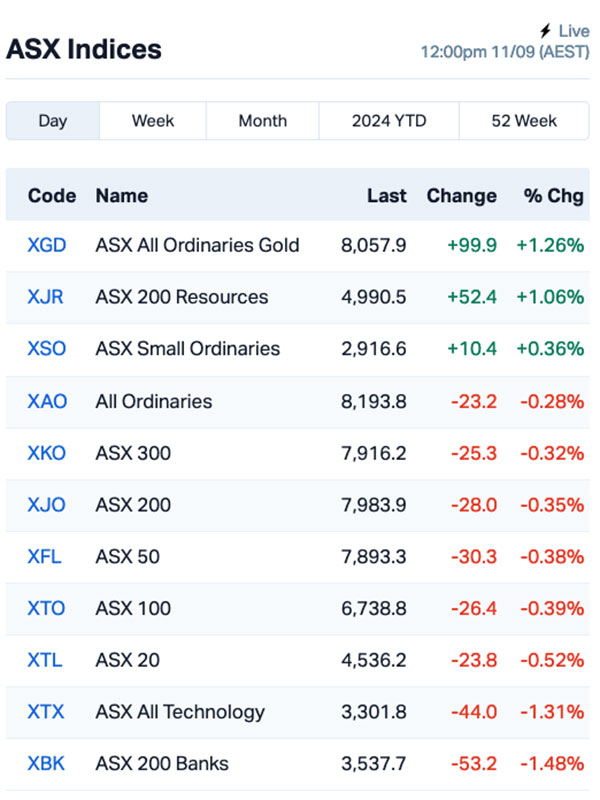

The big gainers today are in Resources, and more specifically gold – with Materials showing a 1.37% rise at lunch time and the goldies topping the ASX indices chart.

A big chunk of that has come from Big Gun Mineral Resources (ASX:MIN), which was up as much as 18.5% this morning after it announced yesterday evening that the Foreign Investment Review Board had approved the sale of a 49% interest in the Onslow Iron haul road to investment funds managed by Morgan Stanley Infrastructure Partners (MSIP) for total expected proceeds of $1.3 billion.

This morning’s spike for MinRes is undeniably huge – but it’s worth looking at in context of the company’s broader performance in recent times.

Even with today’s huge jump, it’s down 31.3% over the past month, and more than 49% since the start of the year.

Yes, a $1.3 billion cash injection into a $7 billion market cap miner is a welcome – and not insignificant – event, but whether that’s enough to stem the obvious bleeding seems a little unlikely.

MinRes, along with other lithium miners on the bourse, has also been boosted by news floating out of China that electric vehicle battery maker CATL has closed two lepidolite mines, including the enormous Jianxiawo mine, thanks to the ongoing lithium price downturn.

CATL’s cash cost level to produce from Jianxiawo has been above the spot price since July of this year, according to a UBS note.

“After making a loss for two months in the lithium business and continuous downside risk on the lithium price, we finally see normal supply response from (the) marginal-cost producer,” UBS said.

Meanwhile, Reserve Bank assistant governor Sarah Hunter has been speaking at the Barrenjoey Economic Forum in Sydney outlining the RBA’s case that employment levels in Australia are – as far as the RBA is concerned – still too high.

“Our current assessment is that the labour market is operating above full employment but has moved towards better balance since late 2022,” Hunter said.

“We expect the demand for labour to grow at a slower pace relative to the supply of labour in the coming quarters, gradually bringing the labour market into better balance. Our view is that some of this slowing in labour demand is likely to occur via a decline in average hours.

“We also expect employment to continue to increase, but at a slower pace than population growth.

“In this view of the outlook, measures of underutilisation – including the unemployment rate – are expected to continue rising gradually from here, before stabilising as the pace of growth in GDP picks up to be broadly consistent with the economy’s underlying trend pace of growth.”

NOT THE ASX

The Big Show in the US, literally as I’m writing this, is the Presidential debate – which, for some unfathomable reason – I am listening to on the TV, being streamed into my home via Disney+ … the streaming service I normally only use to watch my grown-up cartoons of an evening, because I am a responsible, fully functional adult man who makes excellent life choices.

The US is 56 days out from deciding which of two evils to go with as the nominal figurehead of the nation, and who it picks to be wearing the Captain’s hat when the ship goes down is still a tight race.

Thankfully, US media outlet CNBC was first with the Big Scoop once the debate was finished…

Tay-Tay’s mobilisation of her army of preteen voters aside, that debate was weighing pretty heavily on US markets overnight, and by the end of the session on Wall Street, the S&P 500 rose by 0.45%, the blue chips Dow Jones fell by 0.23%, while the tech heavy Nasdaq lifted by 0.84%.

I’m going to lean pretty heavily on Eddy Sunarto’s wrap from this morning, as I have been seriously distracted watching the presidential debate – the spectacle of watching a lawyer argue with an orange beachball was just too tempting to ignore.

So, Eddy reports that in the US overnight, JPMorgan Chase dropped sharply by 5%, marking its biggest decline in over four years and dragging down other US bank stocks.

The slide followed JP President Daniel Pinto’s remarks that analysts were too optimistic about the bank’s expenses and net interest income outlook for the coming year.

But there was some good news for the banking sector. The Biden administration has suggested a reduced 9% increase in capital requirements for major US banks, down from the original 19% proposed by the Fed and other regulators.

Mega-techy Apple got some bad news, though – it’s been handed a tax bill that would bring most company’s to their knees, after Ireland sent Tim Cook a postcard that says “You owe us $14 billion. lol.”

Apple has been hit with the tax bill by Europe’s top court, ending an eight-year legal battle over its Irish tax deals.

This all goes back to 2016 when the European Commission told Ireland to collect up to 13 billion euros (US$14.4 billion) from Apple, claiming the tech giant received illegal tax perks over 20 years

In other US stock news, Oracle jumped over 11% after the company posted earnings that exceeded expectations, driven by strong demand for its cloud services.

This was further boosted by Oracle’s announcement of a new partnership with Amazon’s AWS, which should ramp up its growing database business.

Taiwan Semiconductor (TSMC) shares on the NYSE fell by up to 3% despite providing strong figures for August. Revenue was up 33% last month, which is a good sign for the recovery in the smartphone market and the demand for Nvidia’s AI chips.

In Asian markets this morning, the mood is sour today. Japan’s Nikkei is off by 0.80%, the Hang Seng is down 1.11% and Shanghai markets have fallen 0.70% in morning trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for September 11 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap PTR Petratherm 0.039 95.0 7,588,058 $4,526,397 MAY Melbana Energy 0.03 57.9 48,946,991 $64,033,878 CXU Cauldron Energy 0.019 46.2 8,319,864 $15,944,898 BCB Bowen Coal 0.01 42.9 36,699,458 $19,944,254 GCM Green Critical Min 0.0025 25.0 4,696,975 $2,937,085 SKN Skin Elements 0.005 25.0 87,271 $2,357,944 VFX Visionflex Group 0.005 25.0 1,747,200 $11,671,298 VML Vital Metals 0.0025 25.0 52,729 $11,790,134 GLA Gladiator Resources 0.016 23.1 399,446 $9,857,859 WC8 Wildcat Resources 0.225 21.6 4,224,161 $223,214,395 XRG xReality Group 0.045 21.6 29,600,616 $20,826,380 FNR Far Northern 0.15 20.0 7,000 $4,533,228 STM Sunstone Metals 0.006 20.0 477,281 $19,259,518 MIN Mineral Resources. 36.02 18.9 2,797,512 $5,952,548,515 LTR Liontown Resources 0.7125 16.8 19,685,906 $1,479,252,977 DAL Dalaroo Metals 0.028 16.7 646,177 $5,961,000 DOU Douugh 0.0035 16.7 66,392 $3,246,207 IXR Ionic Rare Earths 0.007 16.7 1,544,857 $29,218,576 TMK TMK Energy 0.0035 16.7 180,000 $20,764,836 LRS Latin Resources 0.185 15.6 36,762,440 $447,907,114

Petratherm (ASX:PTR) was climbing quickly on Wednesday morning on news that mapping, surface sampling, and re-assaying of historic drilling has discovered high-grade titanium rich heavy mineral sands (HMS) over several kilometres at the Muckanippie Project, southwest of Coober Pedy in South Australia.

Melbana Energy (ASX:MAY) says that initial development of Unit 1B from the Alameda-2 well has been formally approved and is on track for Q1 2025. The company reported that it has received construction approval for the next Unit 1B well pad, and there are additional pads progressing through the permitting process.

Cauldron Energy (ASX:CXU) jumped on news that each of the first four holes drilled at the company’s Manyingee South uranium target have intersected mineralisation, “defining a thick, high-grade mineralisation along a continuous 1.5km strike length, open in all directions”.

Visionflex Group (ASX:VFX) climbed following a market update on three recent developments, including an agreement with Royal Flying Doctor Service (RFDS) Victoria to provide a virtual health solution and a trial agreement with Kha Loc Medical, a leading medical equipment distributor in Vietnam, with the first shipment already dispatched.

XReality Group (ASX:XRG) – formerly Indoor Skydive Australia – was up on news that the company has signed a US$5.6 million deal with the US Department of Defense to deliver a new immersive training capability and includes supplying Operator XR system licenses along with R&D services.

Up the top end of town, Mineral Resources (ASX:MIN) announced after hours yesterday that it has received unconditional approval from the the Foreign Investment Review Board for the sale of a 49% interest in the Onslow Iron haul road (Haul Road) to investment funds managed by Morgan Stanley Infrastructure Partners (MSIP) for total expected proceeds of $1,300 million.

Earlier, Invion (ASX:IVX) reported this morning that the company has been granted Human Research Ethics Committee (HREC) approval for its open label Phase I/II trial on patients with non-melanoma skin cancers (NMSC) using topical INV043. The company has secured all the necessary regulatory approvals for patient screening, treatment and follow-up, which are expected to commence from next month.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GCR Golden Cross 0.002 -33.3 2,016 $3,291,768 IEC Intra Energy 0.001 -33.3 49,000 $2,536,172 VPR Volt Group 0.001 -33.3 992,525 $16,074,312 AUR Auris Minerals 0.005 -28.6 103,000 $3,336,382 AKN Auking Mining 0.006 -25.0 3,793,786 $2,549,496 AOK Australian Oil 0.003 -25.0 4,984,877 $3,778,561 CR9 Corella Resources 0.006 -25.0 101,500 $3,720,739 NGS NGS 0.025 -24.2 18,999 $3,670,683 SHO Sportshero 0.007 -22.2 1,403,334 $5,560,496 NXD NextEd Group 0.12 -20.0 112,225 $33,227,516 ADG Adelong Gold 0.004 -20.0 4,200,784 $5,589,945 AVE Avecho Biotech 0.002 -20.0 5,000 $7,923,243 BNL Blue Star Helium 0.004 -20.0 1,454,256 $9,724,426 BYH Bryah Resources 0.004 -20.0 30,000 $2,516,434 ECT Env Clean Tech 0.002 -20.0 37,000 $7,929,526 EMP Emperor Energy 0.008 -20.0 311,759 $3,897,148 LML Lincoln Minerals 0.004 -20.0 88,750 $10,281,298 PIQ Proteomics Int Lab 0.71 -18.4 1,345,625 $113,972,365 CC9 Chariot Corporation 0.115 -17.9 132,400 $12,547,900 NIS Nickelsearch 0.015 -16.7 150,000 $4,512,837

ICYMI – AM EDITION

Peel Mining (ASX:PEX) has reported the highest-grade intercepts to date from RC drilling at its Wagga Tank copper-gold project in NSW, including 6m at 20.14% lead, 16.23% zinc, 0.33% copper, 194g/t silver and 0.45g/t gold from 164m.

Notably, the new mineralisation is outside of Wagga Tank’s existing mineral resource, technical director Rob Tyson said.

“Recent drilling at Wagga Tank aimed at testing for potential shallow supergene/oxide mineralisation has returned some promising early results, including a substantial high-grade sulphide intercept outside of the existing resource,” he said.

“Within this interval was a 6m zone of very high-grade mineralisation which ranks amongst the highest grades recorded at Wagga Tank. Importantly, this new mineralisation is open along strike to the north with minimal historic drill testing, pointing to an extensional opportunity.

“This area is supported by existing geophysical data which highlights continuity of IP chargeability anomalism. We look forward to receipt of the remaining assays.”

At Stockhead, we tell it like it is. While Peel Mining is a Stockhead advertiser, they did not sponsor this article. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.