ASX Small Caps Lunch Wrap: ASX climbing Monday, because America’s data is better than ours

America. Land of the Free, Home of the Grossly Irresponsible. Pic via Getty Images.

- Aussie benchmark up after Wall Street lead

- Gold for Jess Fox, gold for Aussie miners early

- Tech takes over in ASX 200, while copper, uranium samplers gain among small caps

Local markets are enjoying a reasonably buoyant Monday morning, taking advantage of a strong lead-in from Wall Street’s Friday session, where US investors got some decent economic news, and re-ignited their passion for riskier stocks.

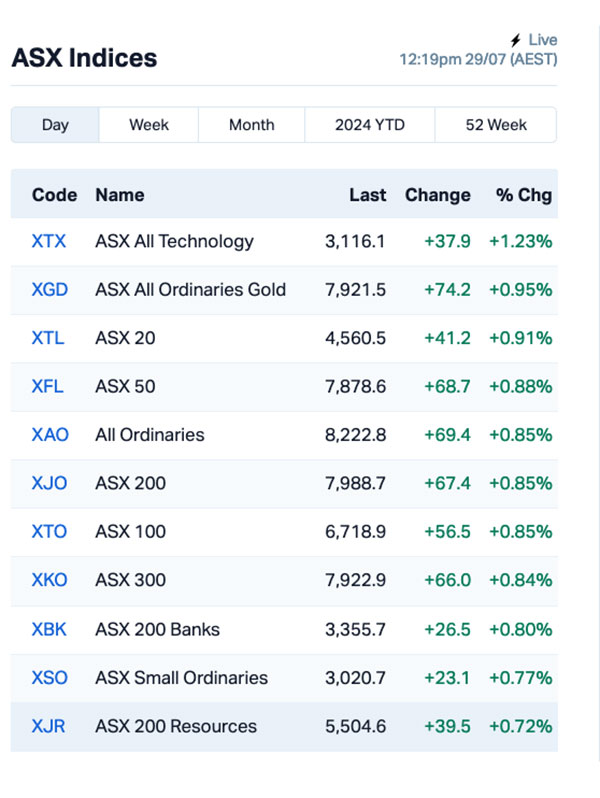

The Aussie benchmark opened with a 66 point jump out of the gate, and it’s been hovering around +0.8 to +0.9% for most of the morning. Taking Jess Fox’s gold medal-winning lead in the Olympics kayak overnight in Paris, goldies were leading the charge, up by as much as 2.1%, before falling around 11:00am to leave local Tech stocks in the driver’s seat.

There’s a bit happening around the place, so let’s dive right in.

TO MARKETS

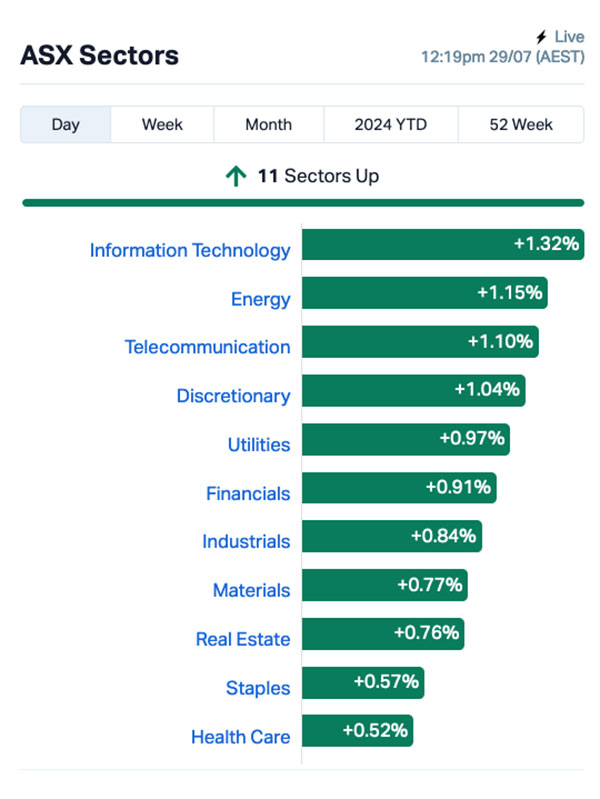

It’s a rare Monday morning that we get to see every sector deep in the green, but local investors are making the most of some positive talk in the US about a September rate cut – which I’ll get to shortly.

Every local market sector is chugging along nicely, though, which is what matters right now. Earlier in the day, it was the Aussie InfoTech sector well out in front, with Energy and Materials coming up nicely behind it.

However, closer to lunch, tech stocks have come off the boil a little, and goldies have come off the boil by quite a bit, dragging Materials lower and leaving Energy shares to carry the torch on the way into lunch.

Over on the ASX indices side of the page, the morning’s early leaders are still making the best headway – the goldies and Tech stocks were basically neck and neck just before midday, following a rapid slide for gold stocks around 11:00am which coincided with a sharp dip in spot gold prices, so that’s probably that.

An update to that – in the 20 minutes since midday, the goldies retreated even further.

It’s worth noting that as of shortly after midday, the only let-down in the Big Guns ASX 20 was ANZ Bank (ASX:ANZ), which had dipped into negative territory by just a smidge before lunch.

The rest of the heavyweights were still making headway, with REA Group (ASX:REA) and CSL (ASX:CSL) both breaking +3% before lunch.

In market-adjacent news, it’s shaping up to be a busy week for data enthusiasts, with a slew of spreadsheets due to be released both locally and overseas, with the potential to shift sentiment quite a bit.

In Australia, we’ve got some very important numbers on the way, including Big Wednesday, when we can expect June quarter CPI data, alongside June retail trade figures and private sector credit data as well.

Thursday, we’ll see June Trade balance and July house price data, and Friday we’ll have June home lending figures and the June quarter Producer Price Index numbers as well.

Of all that, it’s Wednesday’s CPI data that is most likely to be the most market sensitive, given the direct relationship between that and interest rate sentiment for the RBA board, which is set to meet again in a couple of weeks.

The forecasts are a bit all over the shop, but the general consensus is that it’s going to come in pretty hot, with anything above a 1% jump for the June quarter pretty much the tipping point for the RBA board to yank the rate hike lever again to try to bring it under control.

It’s not great news for local investors, and while we’re not alone in staring down a rate hike, we’re certainly lagging behind on getting inflation under control compared to a few examples from overseas.

Which seems like as good a time as any to segue neatly into…

NOT THE ASX

… what’s happening internationally, where the headline news from the US is that investors are really getting behind the idea of a rate cut as early as September.

The Fed’s preferred gauge of US inflation, the core personal consumption expenditures (PCE) price index, increased in June albeit at a modest pace, while consumer spending stayed strong. However, consumer sentiment fell in July to its lowest point in eight months.

All of that has US investors positively salivating at the prospect of rate cuts by the US Fed, with September firming strongly as the month that investors reckon J-Pow and his cronies will do the deed.

The Fed is due to meet later this week (Wednesday night/Thursday morning, our time) and while the odds are vanishingly small that there’s going to be a cut this early, whatever the Fed says once the meeting is over is going to feed speculation either way.

The US isn’t the only major economy with goings-on from its central bank this week.

Japan’s central bank is meeting on Wednesday, and Britain’s chief money hoarders are meeting on Thursday – it is widely expected that things there are going to remain as-is, so once again investors are going to be looking deep into the sideline chatter that emerges for any indication of what the current thinking from both of those is likely to be.

To more immediate matters, and US investors gave local markets a strong platform to build on, with a strong session on Wall Street that suggested risk appetite is alive and growing in New York.

Friday’s session saw S&P 500 finish the day 1.11% higher, the blue chips Dow Jones index rose by 1.64%, while the tech heavy Nasdaq was up by 1.03%.

Apple and Microsoft are among the ‘Magnificent Seven’ group of stocks scheduled to report earnings this week.

In other stocks, Dexcom Inc was the worst large cap stock, plunging by over 40%, after the maker of devices for blood sugar monitoring for diabetics unexpectedly slashed its 2024 sales forecast, surprising analysts.

And almost a week after a major IT outage that disrupted computer systems globally, cybersecurity firm CrowdStrike’s CEO George Kurtz announced that more than 97% of Windows sensors are now back up and running. Crowdstrike’s stock price has been down 15% since the outage began a week ago.

In Asian markets this morning, things are mostly good – the Nikkei’s up 1.83%, the Hang Seng is up 1.1%, but Shanghai’s doing its own thing again, down 0.07%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 29 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AIV Activex Limited 0.008 60.0 160,000 $1,077,513 GTR Gti Energy Ltd 0.004 33.3 833,441 $7,649,841 PLG Pearlgullironlimited 0.018 28.6 60,000 $2,863,585 ACP Audalia Res Ltd 0.019 26.7 47,619 $10,382,043 AHN Athena Resources 0.005 25.0 3,392,400 $4,281,870 CAV Carnavale Resources 0.005 25.0 200,000 $13,694,207 NAE New Age Exploration 0.005 25.0 400,000 $7,175,596 NAG Nagambie Resources 0.01 25.0 2,087,118 $6,373,085 TAL Talius Group Limited 0.01 25.0 5,080,000 $20,595,492 TFL Tasfoods Ltd 0.02 25.0 435,406 $6,993,528 BEL Bentley Capital Ltd 0.017 21.4 328,002 $1,065,791 OAU Ora Gold Limited 0.006 20.0 84,628 $35,705,798 AAJ Aruma Resources Ltd 0.013 18.2 5,569,933 $2,165,807 NGSDA NGS Ltd 0.026 18.2 38,257 $897,998 B4P Beforepay Group 0.665 17.7 53,830 $26,659,060 T92 Terrauraniumlimited 0.11 17.0 2,825,071 $5,650,789 OSL Oncosil Medical 0.0105 16.7 11,807,795 $30,584,786 PUA Peak Minerals Ltd 0.0035 16.7 3,000,001 $3,592,130 NUC Nuchev Limited 0.18 16.1 98,222 $22,682,592 CTQ Careteq Limited 0.015 15.4 211,542 $3,082,543

Aruma Resources (ASX:AAJ) was rising quickly Monday morning on news of surface rock chip samples that have led to high-grade copper assay results from the Fiery Creek Copper Project in the Mt Isa copper belt, in northern Queensland.

Terra Uranium (ASX:T92) has received assay results from sampling during the recent field visit to the Amer Lake project, with samples up to 7,950 ppm uranium (0.94% U3O8). The company has also revealed that assessment reporting is now complete and submitted to the Nunavut Mining Recorder for processing which is anticipated to extend the mineral claims expiry by at least 5 – 7 years.

ActivEX (ASX:AIV) was up thanks to a positive quarterly report, with headway made at both its Gilberton Gold Project in North Queensland, and the Aramac REE Project in Central Queensland. The company also outlined plans for further exploration work in the near term.

Beforepay Group (ASX:B4P) was also climbing after a happy quaterly on Monday morning, with the company revealing it has achieved a net profit before tax of $1.4m and an EBITDA of $2.7m. This is the company’s fourth consecutive quarterly un-audited net profit.

New Age Exploration (ASX:NAE) is up on news it has commenced drilling in the next step of its six-month exploration program at the Wagyu Gold Project in the Pilbara, WA, following the successful completion of a cultural heritage survey. The drill program will test high priority targets, including a “Hemi-Style” intrusive gold target.

Nagambie Resources (ASX:NAG) was moving quickly on Monday after alerting the market to the fact that the market prices of antimony (Sb) and gold (Au) have currently increased 110% and 24% respectively above the conservative forecasts considered at the time its maiden JORC Resource was announced, which claimed 415,000 tonnes averaging 3.6g/t Au plus 4.3% Sb for in-ground metal content of 47,800oz gold and 17,800t antimony.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 29 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap RMX Red Mount Min Ltd 0.001 -50.0 196,000 $6,847,155 VPR Voltgroupltd 0.001 -50.0 750,000 $21,432,416 APC Aust Potash Ltd 0.001 -33.3 18,000 $6,030,284 RIL Redivium Limited 0.002 -33.3 92,304 $8,192,564 DNA Donaco International 0.029 -25.6 2,450,482 $48,180,186 HCD Hydrocarbon Dynamic 0.003 -25.0 45,334 $3,234,329 TMK TMK Energy Limited 0.003 -25.0 7,000,000 $27,686,448 RCR Rincon 0.077 -23.0 14,093,650 $29,127,568 LPD Lepidico Ltd 0.002 -20.0 170,000 $21,472,812 NRZ Neurizer Ltd 0.004 -20.0 9,621,525 $9,512,153 SGC Sacgasco Ltd 0.004 -20.0 93,750 $4,483,201 TAS Tasman Resources Ltd 0.004 -20.0 26,500 $3,563,346 ASO Aston Minerals Ltd 0.009 -18.2 1,403,020 $14,245,707 HE8 Helios Energy Ltd 0.018 -18.2 11,722,660 $57,289,088 ECS ECS Botanics Holding 0.015 -16.7 7,124,877 $23,193,892 ESR Estrella Res Ltd 0.005 -16.7 1,279,458 $10,556,231 SIT Site Group Int Ltd 0.0025 -16.7 1,666,666 $7,807,471 FRB Firebird Metals 0.096 -16.5 122,000 $16,371,561 PXX Polarx Limited 0.011 -15.4 1,250,455 $26,656,272 AAU Antilles Gold Ltd 0.003 -14.3 1,072,255 $5,114,997

ICYMI – AM EDITION

QMines (ASX:QML) has submitted the mining lease application for its Mount Chalmers copper-gold project in Queensland, which has been allocated the Mining Lease number ML 100403.

The submission was made after the state provided feedback on the application and was satisfied that the formal Mining Lease application could be made.

QML’s recent pre-feasibility study for the project, which has a measured, indicated and inferred resource of 15.1Mt grading 1.3% copper equivalent for 195,800t contained copper equivalent, has demonstrated a long life, low cost and high margin mining operation.

At Stockhead, we tell it like it is. While QMines is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.