ASX Small Caps Lunch Wrap: ASX claws back early losses after sluggish start

I think we can all agree that Neville's Tinder profile is just awful. Pic: Getty Images

- After an early morning dip, the benchmark made it back to +0.13pc by lunch

- Wisetech has continued to bum everyone out, down 23pc for the month

- Small Cap winners include Auking, Bowen Coal and Adelong

Local markets opened lower this morning, after Wall Street lost a bit of its lustre amid a brief but savage sell-down overnight.

The ASX 200 benchmark dropped 0.35% in the opening minutes of the session, and as we head towards lunch, it’s staged a bit of a recovery to be closer to -0.15% and trending slightly higher still.

The headlines today are all a little dull. There’s a senate inquiry into home ownership underway at the moment, but I can tell you from personal experience that senate inquiries into pretty much anything are tedious, pointless busywork for just about everyone involved.

So I reckon we just let them all talk it out, wait a while for nothing to come of it, and in the meantime you and I can focus on what the market’s been doing today.

TO MARKETS

The ASX 200 has lost ground this morning, after it saw what Wall Street got up to last night and foolishly decided to join in.

Peer pressure can be brutal, so make sure you hug your shares and tell them you love them.

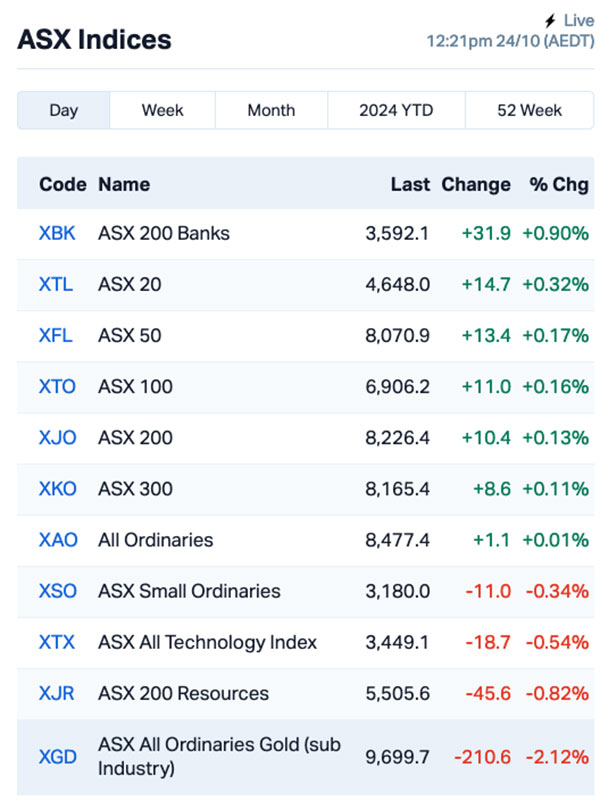

The benchmark has recovered somewhat from its early 0.35% spill today, and heading into lunch, the ASX 200 is back in happier territory above break-even, 0.13% up last time I looked.

The big miners are under pressure today, after iron ore futures slipped almost 2% to $US98.80 a tonne overnight.

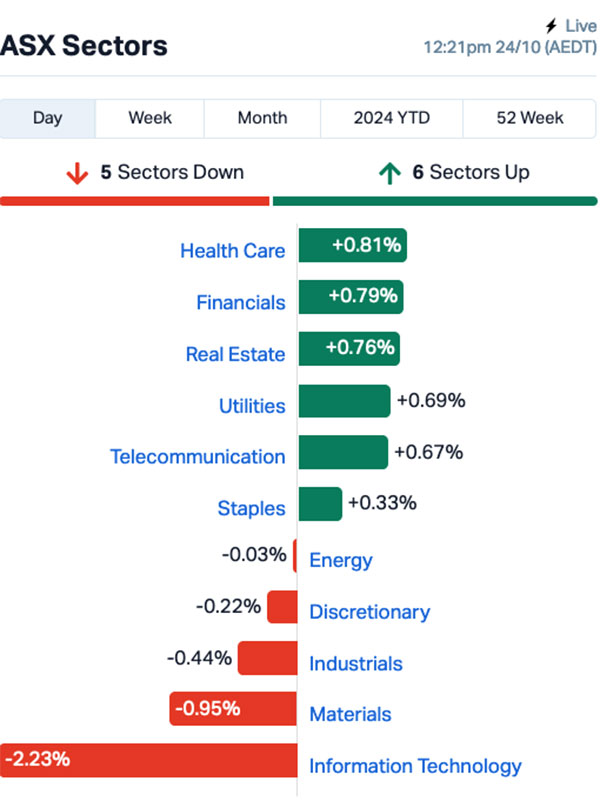

Meanwhile, it’s a now-familiar-looking chart situation for the market sectors.

Real Estate is doing well, Materials isn’t and WiseTech Global (ASX:WTC) is leading yet another InfoTech sell-off, because investors are starting to call for Richard White’s head on a pike, after his private life exploded onto the front page of every newspaper in the country.

Wisetech is another 3.6% down at the time of writing, leaving it lower by 23% for the month – and as much as it pains me to give this ridiculously tawdry story more oxygen, the shareholders are starting to get pretty crabby about it.

Rachel Waterhouse from the Australian Shareholders Association appeared on the ABC last night, to tell Kirsten Aiken that “shareholders have expressed concern about succession planning for the company”, given that tech companies tend to have “a lot of reliance in a founder-led organisation on the CEO”.

White hasn’t mentioned anything about leaving the company, while company chair Richard Dammery is still in talks with the large investors in the company – but the clock is ticking, and Wisetech’s undoubtedly pretty spicy AGM is scheduled for less than a month from now, on November 22.

For the sake of being thorough, here’s the sub-indices at lunch time.

Beyond the markets today, and the most interesting thing I’ve spotted was the unveiling of a massive sculpture outside the National Gallery in Canberra.

Per Julian Tompkin and Tim Douglas (hi Tim!) at The Australian – who I assume were in town for something other than a sculpture junket – the piece by artist Lindy Lee’ is called Ouroboros.

It’s a four-metre immersive artwork made primarily of recycled reflective metal and was commissioned by NGA director Nick Mitzivech to celebrate the gallery’s 40th anniversary in 2022.

According to the report, the mirrored stainless steel of the work is perforated with 46,000 holes, creating – *ahem* – “a cosmos of dappled light in which visitors can immerse themselves”.

The whole thing is meant to represent “eternity”, which is roughly how long it’s going to take the National Gallery’s glacial stream of pensioners and school group entry fees to pay off the $14 million price tag.

The Australian’s art critic Christopher Allen has described the cost of the sculpture as “an absurd price for a work of debatable value by an artist of modest standing”.

Looks pretty, but.

NOT THE ASX

Overnight, the tech-heavy Nasdaq led US stocks lower after plunging by 1.6%. The S&P 500 was also down by 0.6%, and the blue chips-focused Dow Jones fell by 0.96%.

The headlines from the US include a couple of saucy stories – starting with a 5% slump for fast food giant McDonald’s, after its venerable Quarter Pounder burgers killed one person and sent another 49 to hospital, thanks to an E. coli outbreak.

No, it wasn’t because Donald Trump didn’t wash his hands. That’s a silly joke, and you should all be ashamed for thinking of it.

Elsewhere, fashion label Abercrombie & Fitch also took a major hit overnight, after it emerged that the company’s former head Michael Jeffries and his partner Matthew Smith have been arrested and charged with running an international sex trafficking ring.

In other US stock news, things looked better after the bell as Tesla posted adjusted earnings of 72 cents per share for the quarter, beating analysts’ predictions.

Tesla’s Q3 net income rose 17.3% year-over-year to US$2.17 billion, driven by a 6.4% increase in vehicle sales despite price cuts and low-interest financing. While revenue fell short of analyst expectations at US$25.18 billion, the company said it expects slight growth in vehicle deliveries for the full year as it prepares to launch new, more affordable models next year.

Tesla’s shares jumped by 8% post-market.

IBM fell 2.75% after reporting disappointing revenue for Q3, affected by a slowdown in consulting demand.

T-Mobile US, however, jumped 3% after exceeding analysts’ expectations with more new mobile phone and broadband subscribers.

Hilton Hotels fell 2% after cutting its profit outlook on slowdown in travel demand.

Coca-Cola slipped 2% as investors questioned how much longer the company can increase prices without losing customer demand for its beverages.

The best gainer overnight was Nasdaq-listed, US$17m-capped, Mobile-Health Network, which rose 70% after reporting a 77% increase in revenue for fiscal 2024, driven by a significant rise in telemedicine sales. The company is a telehealth provider in the Asia-Pacific region.

Meanwhile, US Treasuries continued their slide (bond yields higher) for a third day as investors adjusted their expectations for interest rate cuts from the Fed Reserve.

The US 10-year yield has now hit its highest level since July at 4.24%, with speculation that a potential Trump victory could further fuel inflation.

In Asian market news, Japan’s Nikkei was up early today, climbing 0.37% in early trade, while Hong Kong and Shanghai markets were lower.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ASQ Australian Silica 0.051 54.5 1,141,881 $9,301,392 CRB Carbine Resources 0.004 33.3 252,857 $1,655,213 BCB Bowen Coal 0.009 28.6 17,096,657 $20,513,428 88E 88 Energy Ltd 0.0025 25.0 209,794 $57,867,624 AKN Auking Mining 0.005 25.0 347,781 $1,468,258 ADG Adelong Gold 0.0055 22.2 8,736,131 $5,030,950 CVR Cavalier Resources 0.14 21.7 37,500 $6,214,121 DGR DGR Global 0.012 20.0 1,064,085 $10,436,960 PRX Prodigy Gold 0.003 20.0 1,033,208 $5,831,140 CND Condor Energy 0.034 17.2 2,031,854 $17,003,677 BTE Botala Energy 0.07 16.7 270,191 $11,962,176 BNL Blue Star Helium 0.0035 16.7 27,499 $7,293,320 HTA Hutchison 0.028 16.7 30,200 $325,740,206 M24 Mamba Exploration 0.014 16.7 60,000 $2,256,987 ODE Odessa Minerals 0.007 16.7 1,752,561 $7,609,695 DEL Delorean Corporation 0.145 16.0 1,292,232 $27,534,769 SUH Southern Hem Min 0.037 15.6 437,560 $23,559,681 GDA Good Drinks Aus 0.335 15.5 95,214 $38,318,187 HTG Harvest Tech 0.015 15.4 189,986 $10,617,654 JNO Juno 0.03 15.4 32,000 $4,730,577

Bowen Coking Coal (ASX:BCB) released its quarterly this morning, announcing that “robust mining performance” has delivered 769Kt ROM for the quarter, while the company has managed a mining cost reduction of 7% to $53/ROMt including boxcut costs and 52% lower than this time last year. That has led to 444Kt of saleable coal produced with sales of 415Kt recorded in the quarter, at an average coal price of A$216/t, down slightly on pcp.

Auking Mining (ASX:AKN) was rising today on news that the company has completed the purchase of the Grand Codroy uranium exploration project in Newfoundland,Canada. The project features uranium mineralisation within extensive, organic-rich siliciclastic rocks is similar to sandstone-hosted uranium districts in the western United States, and exploration work has returned high-grade historical rock samples including Sample 153: >20,000ppm (2%) Cu and 435ppm U, and Sample 3522: >20,000ppm (2%) Cu and 400ppm U.

Adelong Gold (ASX:ADG) was up on news that it has entered a binding farm-in agreement with Great Divide Mining (ASX:GDM) for a staged acquisition of up to 51% interest in the Adelong Gold Project. Under the agreement, GDM is set to invest $300,000 for an initial 15% stake in Challenger Gold Mines (following successful due diligence), and will earn a further 36% interest upon achieving first gold production from the refurbished Adelong Gold Plant within 12 months, bringing their total interest to 51%.

Earlier, Chimeric Therapeutics (ASX:CHM) was up on news that the company’s Phase 1B ADVENT-AML clinical trial has completed enrolment of relapsed or refractory Acute Myeloid Leukaemia subjects in the dose-finding portion of the clinical trial. The trial is an investigator-initiated study currently open to enrolment at The University of Texas MD Anderson Cancer Center under Principal Investigator Abhishek Maiti MD, Assistant Professor in the Department of Leukaemia.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ICU Investor Centre 0.003 -40.0 2,807,636 $1,522,557 TEM Tempest Minerals 0.005 -37.5 9,308,991 $5,018,158 M4M Macro Metals 0.01 -33.3 26,880,568 $54,346,604 RLC Reedy Lagoon Corp 0.002 -33.3 136,500 $1,858,622 CDD Cardno 0.165 -31.3 367,660 $9,374,559 RML Resolution Minerals 0.0015 -25.0 385,556 $3,220,044 G88 Golden Mile 0.012 -20.0 1,499,309 $6,168,343 PSL Paterson Resources 0.012 -20.0 531,064 $6,840,568 AVE Avecho Biotech 0.002 -20.0 6,354,662 $7,923,243 RIL Redivium 0.004 -20.0 667,645 $13,734,274 WSR Westar Resources 0.008 -20.0 21,298,889 $3,987,248 MOV Move Logistics Group 0.17 -19.0 10,059 $26,798,944 TZN Terramin Australia 0.082 -18.0 495,864 $211,656,272 FHS Freehill Mining 0.005 -16.7 303,601 $18,471,167 GTI Gratifii 0.005 -16.7 156,000 $12,895,177 LOT Lotus Resources 0.265 -15.9 19,734,157 $577,573,751 PNT Panther Metals 0.034 -15.0 3,032,950 $9,413,946 SBW Shekel Brainweigh 0.041 -14.6 142,517 $10,946,939 CTN Catalina Resources 0.003 -14.3 1,000,000 $4,334,704 ILA Island Pharma 0.12 -14.3 256,162 $21,783,636

ICYMI – AM EDITION

Pursuit Minerals (ASX:PUR) has announced that it has entered into commitment letters, to secure $1 million in immediate funding through the issue of Loan Notes which will automatically convert into shares and options, subject to shareholder approval to be sought at the Company’s annual general meeting on November 28 2024.

Proceeds will be principally used to fund the ongoing works at the Rio Grande Sur Project, with a particular focus on progressing towards first production of lithium carbonate from its 250tpa plant in Salta, as well as “feasibility studies for the larger commercial operation and assessment of complementary acquisitions opportunities in the critical metals’ asset classes of lithium and copper”, the company says.

At Stockhead we tell it like it is. While Pursuit Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.