ASX Small Caps Lunch Wrap: ASX 200 gives back early gains as Origin drags Utilities down

I had no idea what picture to put in here today, so here's a creepy marmoset to disturb your lunch. You're welcome. Pic via Getty Images

Local markets had a decent start to the day, but by lunchtime the friendship between investors and the benchmark appeared to have soured, leaving the ASX 200 up just 0.2% and Origin Energy in a tragic spiral.

This morning also saw July unemployment figures land, and they’re slightly worse than expected – what had looked like it could have been a promising day is turning into a bit of a brawl.

Let’s jump in.

TO MARKETS

The ASX didn’t exactly leap out of bed this morning, but there was some satisfying news from the US overnight that put a bit of pep in investors’ step when the bell rang at 10:00am.

The eagerly awaited US CPI data for July landed, and it wasn’t too shabby – a 0.2% increase for the month that all but locked in some rate relief from the US Fed in the coming months.

It was enough to give local investors a glimmer of hope and the benchmark reached a respectable +0.6% mid morning, however the arrival of slightly worse than expected unemployment figures looks to have thrown a wet blanket over the market this morning.

That’s definitely not being helped by an aggressive sell-off for Utilities giant Origin Energy (ASX:ORG), which was down around 10% by lunchtime after the company delivered its earnings report.

On the surface, it should have been excellent news for Origin; its full-year profit for FY24 was $1.39 billion, an increase of 32% from $1.05 billion a year ago – and that was enough to warrant a hefty final dividend of $0.275 per share, fully franked, up from $0.20 per share last year.

However, Origin has flagged that profits are almost definitely going to decline over the next 12 months, due to tariff changes to reflect lower retail margins and wholesale prices, and that seems to have spooked the horses somewhat.

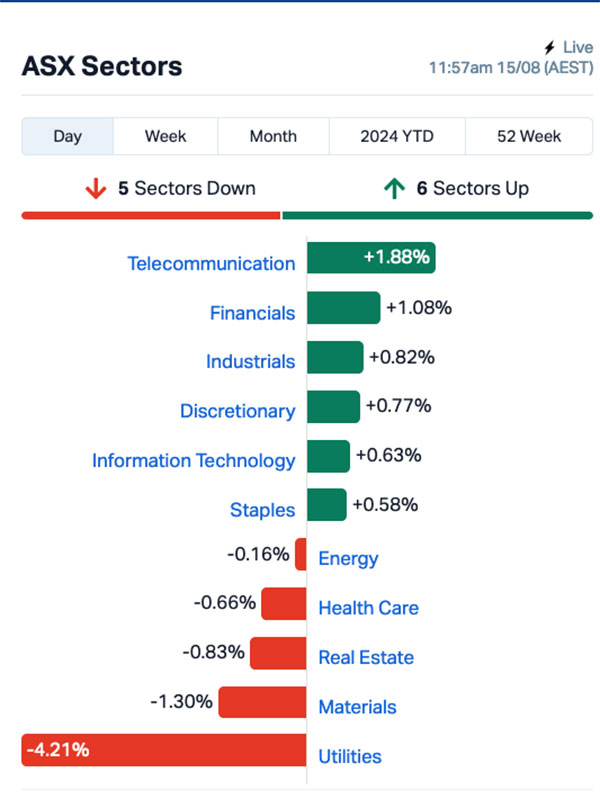

Origin’s 10% plunge shook the Utilities sector hard, leaving it languishing at the bottom of an otherwise pretty ordinary pile for the day.

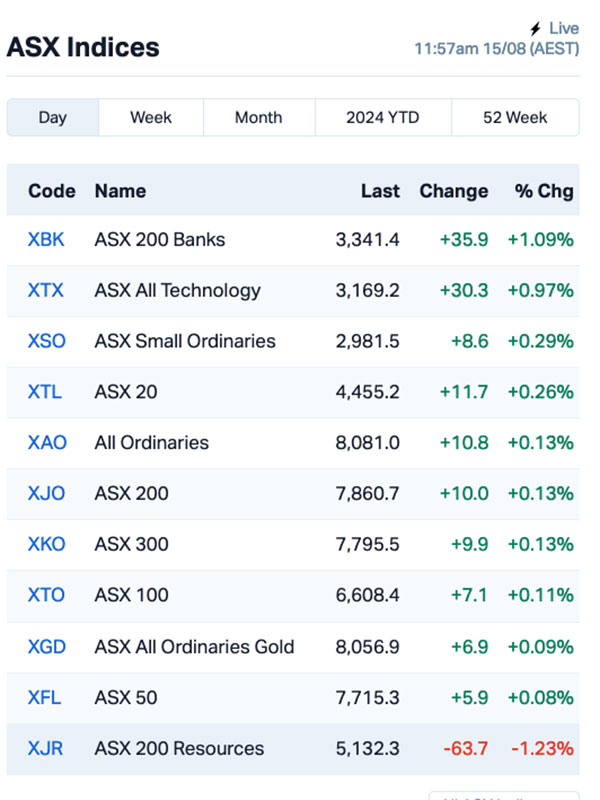

A look at the ASX indices has the banks, techies and small caps making the most of the day’s remaining positive vibes – but the benchmark is much lower as the lunch bell chimes.

Also losing ground today was health megastock Cochlear (ASX:COH), which has been beaten to the tune of -8.3% at lunchtime, after its announced statutory net profit of $357 million was deemed “not good enough” by investors, who are apparently annoyed that it has come in well below the expected $392 million.

The other hand on the brake lever today has been news that the Aussie unemployment rate has climbed to 4.2%, further evidence that the entire economy is grinding slowly to a standstill.

Despite data from the Australian Bureau of Statistics showing more than 60,000 jobs were created in July – the majority of those being full-time gigs – the number of unemployed people grew by 24,000.

The policy wonks had expected unemployment to land at 4.1% – and while it’s not a vast difference, it’s enough to give local investors pause about the health of the economy as a whole.

For what it’s worth, the RBA is factoring in its own projections that unemployment will hit 4.3% by the end of the year, in line with its plan to rein in inflation before dangling the rate cut carrot in front of us again early in the new year.

All that aside, it’s not just doom and gloom on the market today – especially for anyone holding Latin Resources (ASX:LRS) shares this morning, after news broke that mining giant Pilbara Minerals (ASX:PLS) is all set to snap up the entirety of LRS’s shares to get its hands on Latin’s Salinas lithium project in Brazil.

Pilbara’s offer is a juicy one – 0.07 new Pilbara shares for every LRS share is on the table, with that offer working out to be a 57% premium on Latin’s 10-day VWAP, pricing it at $0.20 per share and giving the whole deal a hefty half-billion-and-change price tag.

No surprises around the outcome of the news – Latin was up 50% to $0.18, where it’s likely to stay as Pilbara’s price has come down to meet it, falling 5.26% to $2.70 a pop.

NOT THE ASX

Overnight, the S&P 500 continued to rise for a fifth consecutive day, marking its longest winning streak in over a month as it rose by a further 0.38%. The blue chips Dow Jones lifted by 0.61%, while the tech heavy Nasdaq closed flat.

That’s despite the welcome – but entirely expected – news that the inflation rate in the US dropped to 2.9% in July, all but closing the padlock on a rate cut by the US Fed, possibly as early as mid-September.

The US market remains divided on just how radical J-Pow and his cronies are likely to get when they meet in a few weeks, with 36% of the market apparently betting on a hardcore 50 basis point cut, to assert dominance and show interest rates who’s really the boss.

Nearly everyone else is expecting a 0.25% cut, which would be more in line with Powell’s form when it comes to moving the needle in the States.

To US stock news, and Alphabet dropped 2.35% after Bloomberg reported that the US Justice Department is contemplating breaking up the company. This follows a court ruling that found Google holds a monopoly in the online search market.

Apple Inc was flat despite saying that it was pursuing new revenue streams by developing an expensive tabletop home device that features an iPad-like screen and a robotic arm.

Victoria’s Secret surged up by 16% after the company announced Hillary Super, the CEO of Rihanna’s Savage X Fenty brand, as its new CEO.

In the biggest deal ever in the packaged food sector, Mars announced that it will acquire Kellanova, the company behind Pringles, for nearly US$36 billion.

Mars, which owns brands such as Skittles, M&Ms, and Twix, will offer US$83.50 per share for Kellanova, which is more than 30% higher than the share price earlier this month when Reuters first revealed the potential deal.

Around Asian markets, the mood is upbeat this morning, with the Nikkei up 0.9%, the Hang Seng up by 0.47% and Shanghai markets up 1.11% in early trade.

Elsewhere, there’s a laundry list of markets that are closed for Assumption Day holidays, which I think is what happens when rumours start to swirl about a potential day off, and everyone assumes it’s a holiday and stays home.

I’m probably wrong about that, though.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 15 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap KPO Kalina Power Limited 0.006 50.0 9,362,077 $9,945,576 RIL Redivium Limited 0.003 50.0 666,666 $5,461,710 LRS Latin Resources Ltd 0.1775 47.9 61,501,203 $335,930,336 L1M Lightning Minerals 0.075 41.5 639,378 $4,859,535 ARV Artemis Resources 0.014 40.0 21,182,119 $19,168,824 NME Nex Metals Explorat 0.035 34.6 789,794 $7,079,227 VRC Volt Resources Ltd 0.004 33.3 3,324,663 $12,476,034 ODY Odyssey Gold Ltd 0.018 28.6 3,250,516 $12,584,196 EVR Ev Resources Ltd 0.005 25.0 1,000,000 $5,585,086 MMM Marley Spoon Se 0.02 25.0 196,214 $1,883,590 ODE Odessa Minerals Ltd 0.0025 25.0 508,255 $2,086,565 TTI Traffic Technologies 0.005 25.0 2,684,469 $3,891,541 LSA Lachlan Star Ltd 0.085 21.4 1,261,931 $14,530,124 NVO Novo Resources Corp 0.115 21.1 135,643 $8,498,530 WIN WIN Metals 0.023 21.1 18,961 $6,268,853 AOA Ausmon Resorces 0.003 20.0 224,998 $2,647,498 BP8 Bph Global Ltd 0.003 20.0 500,000 $991,604 EWC Energy World Corpor. 0.012 20.0 3,563,656 $30,789,212 GGE Grand Gulf Energy 0.006 20.0 4,010,728 $10,476,235 PEC Perpetual Res Ltd 0.012 20.0 5,478,306 $6,400,304

Artemis Resources (ASX:ARV) was up at lunchtime on news that high grade gold has been reported in veins at Titan prospect with abundant visible gold at surface, with the prospect tracked over 700m and remaining open. Early rock chip assays have come in strong, with three samples providing results that exceeded the testing equipment’s 10,000g/t upper limit. The company says that gold that it has already picked up at the site has been smelted into a 10.4oz bar, and that the site is just 2km from its existing Carlow project which boasts an MRE of 374,000oz Au.

Nex Metals Exploration (ASX:NME) was continuing on from its decent day yesterday, when it announced that drilling has re-commenced at its highly prospective Yundamindra Gold Project. Nex followed that up with news today that a new chief executive has been appointed, with Maki Petkovski taking the helm as of 15 August, 2024.

As already mentioned, Latin Resources (ASX:LRS) was soaring Thursday morning on news that the company and its giant Salinas lithium project in Brazil is set to be acquired by mining giant Pilbara Minerals (ASX:PLS) , in a deal worth around $580 million. Pilbara is offering the equivalent of ~$0.20 a share, to be delivered as 0.07 PLS shares, a premium of 57% on the LRS 10-day VWAP.

Emerging lithium-ion battery recycler Redivium (ASX:RIL) has been boosted by news that the company has started trading on the Frankfurt stock exchange, with the dual-listing undertaken to support the company’s strategy to broaden its investor base outside Australia.

Volt Resources (ASX:VRC) was up on news that it’s planning a $500,000 capital raise via Convertible Note to professional and sophisticated investors, after the company’s successful push to reduce cash burn from $9,528,000 during FY23 to $4,610,000 in FY24.

Lachlan Star (ASX:LSA) was making gains on news of a wide disseminated copper sulphide system discovery at the Basin Creek Prospect, part of the Junee project in NSW, following comprehensive relogging of half-a-century-old diamond drill core. The company says it has uncovered historical high-grade intercepts including 21.3m @ 4.51% copper from 41.1m, and 3.1m @ 5.50% copper from 59.4m.

Kalina Power (ASX:KPO) was up early on news of the execution of important tolling MOUs with natural gas producers for its project development portfolio of Alberta based power plants incorporating CO2 capture and sequestration. The volumes set out under the MOUs represents 40,000 GJ per day and is sufficient to supply the requirements of KDP’s first ~170 MW project of ~ 36,300 GJs per day.

Litchfield Minerals (ASX:LMS) gained on Thursday morning on news that drilling at the Silver King project area in West Arunta has intersected massive base metal sulphides, with intercepts of 17m @ 2.47% Pb, 1.06% Zn, 15.7 g/t Ag from 49m, including 3m @ 11.84% Pb, 5.62% Zn, 0.1% Cu, 57.1 g/t Ag from 51m among the highlights.

And Perpetual Resources (ASX:PEC) was on the winner’s list on news that initial drill results from its Raptor project confirm that exceptionally high TREO grades persist at depth, with “a significant weighting towards the higher-value Neodymium-Praseodymium (Nd+Pr) rare earth oxides”. Standout intercepts include 12m @ 4,601ppm TREO (23% Nd+Pr), and 7m @ 4,240ppm TREO (23% Nd+Pr) – both from surface.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap RGT Argent Biopharma Ltd 0.17 -40.4 268,878 $13,795,597 8VI 8Vi Holdings Limited 0.091 -30.0 11,207 $5,448,485 ILT Iltani Resources Lim 0.13 -27.8 352,377 $6,121,891 EMN Euromanganese 0.032 -27.3 761,625 $9,590,875 FGH Foresta Group 0.006 -25.0 9,784,853 $18,843,032 CR9 Corellares 0.005 -23.1 4,922,905 $3,023,101 NVQ Noviqtech Limited 0.022 -21.4 400,400 $4,236,637 CTO Citigold Corp Ltd 0.004 -20.0 5,192,261 $15,000,000 BCB Bowen Coal Limited 0.015 -16.7 16,653,100 $51,285,224 ROG Red Sky Energy. 0.005 -16.7 2,165,000 $32,533,363 WEL Winchester Energy 0.0025 -16.7 108,695 $4,089,057 EQR Eq Resources Limited 0.032 -15.8 1,027,294 $83,319,261 GRL Godolphin Resources 0.011 -15.4 278,272 $2,780,586 LNR Lanthanein Resources 0.003 -14.3 10,876,414 $8,552,726 PAB Patrys Limited 0.006 -14.3 475,000 $14,402,131 AQC Auspaccoal Ltd 0.135 -12.9 1,453,680 $82,739,143 AAU Antilles Gold Ltd 0.0035 -12.5 111,215 $5,845,711 IXR Ionic Rare Earths 0.007 -12.5 1,980,163 $38,958,101 NRZ Neurizer Ltd 0.0035 -12.5 1,225,000 $8,682,436 AAP Australian Agri Ltd 0.035 -12.5 4,687 $14,744,148

ICYMI – AM EDITION

D3 Energy (ASX:D3E) has started production testing at its RBD10 well in South Africa’s Free State using its fit for purpose and accurate metering equipment that was used successful at the RBD03 hole.

RBD03 testing had achieved average gas flow rates of 147,000 standard cubic feet per day (Mscf/d), almost double the previously recorded flow rates, while confirming world-class helium composition of 5.1%.

The company is hopeful that the new metering equipment will deliver a corresponding increase in gas flow rates at RBD10, which had flowed at an initial rate of 126Mscf/d over 36 hours in May.

At Stockhead, we tell it like it is. While D3 Energy is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.