ASX Small Caps Lunch Wrap: ASX 200 down ahead of China data, Wisetech scandal deepens

Pic: Getty Images

- ASX 200 down 0.65pc after hitting record high yesterday

- Most sectors down, Flight Centre and Wisetech both taking hits

- Small Caps winners include some solid gains for Anteotech and InhaleRX

So, it’s a little bit grim on the bourse today.

After hitting a record high of 8384.5 points on Thursday, the benchmark had taken a 0.65 per cent step back at lunchtime, as the expectations of data out of China weighed heavily on local investors, and a number of major stocks took a bit of a beating.

As it turned out, China’s latest data only confirmed a slowdown in the Asian superpower’s economy, with reactions so far a mixed bag.

Flight Centre (ASX:FLT) in particular is having a bad day, after it foreshadowed a murky FY25 result, and an underwhelming Utilities sector isn’t helping things along either.

But WiseTech Global (ASX:WTC) is the headline grabber today, as sordid allegations against founder and CEO Richard White pile up and get played out in court filings. I’ll get to that in a minute.

There are a couple of small caps making major gains, though, so at least we’ve got that going for us.

So… it’s Friday. Let’s just grit our teeth and get through this together, so we can pretend for two days that none of this exists and come back fresh on Monday.

TO MARKETS

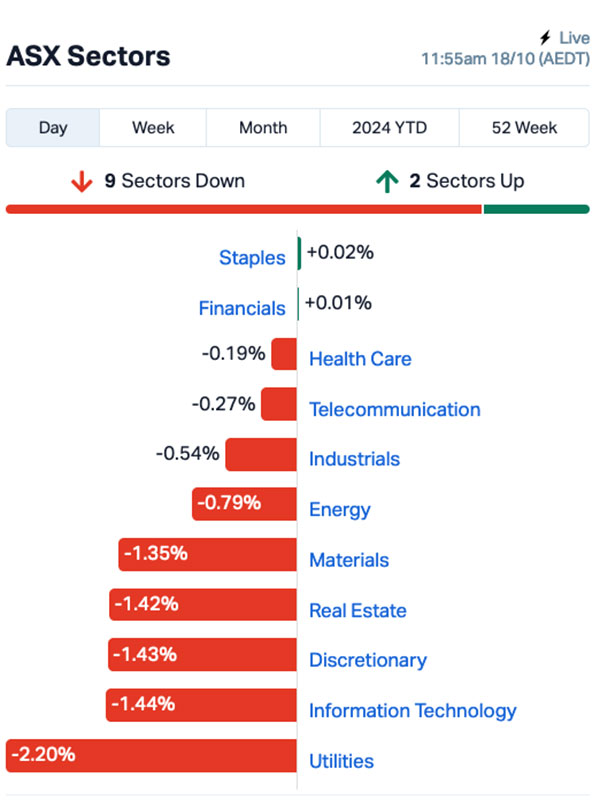

The ASX 200 benchmark is lower at lunchtime, down 0.65% with pretty much every sector either in the red, or on life support – last time I looked, Financials was a masculine insectile protuberance above break-even, and everything else was into the negatives – but Consumer Staples was heading in the right direction.

The Utilities sector has fared worst today, with a 2.35% descent into the mire, with the likes of the $9bn market cap energy infrastructure giant APA Group (ASX:APA) dropping about 6% this morning adding to the wider bourse’s woes.

Here’s how the sectors looked at lunchtime:

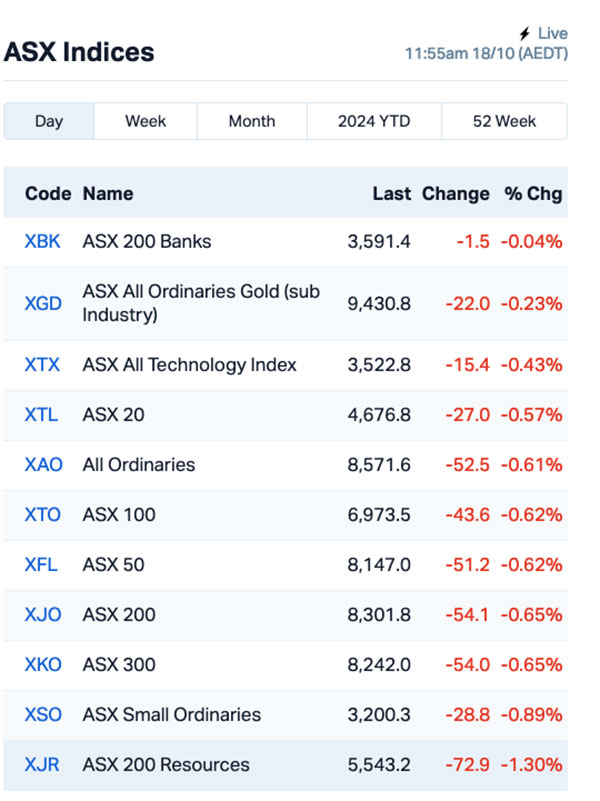

And the sub-indices aren’t very pleasant to look at either:

Up the big end of town, tech giant Wisetech is suffering badly today, as the market digests some ugly, sordid allegations being made against company founder and chief executive Richard White. It’s a tale almost as old as time itself… but in case you’ve missed the drama so far, here’s a very brief please-don’t-get-mad-and-sue-me recap.

Our friends at The Australian recently revealed that White is embroiled in bankruptcy proceedings against “former lover Linda Rogan”, a Sydney-based wellness entrepreneur who has alleged that White “offered to invest in her business, Bionik Wellness, in exchange for sex”.

Per The Australian, Ms Rogan claims the relationship soured after White’s now wife, Zena Nasser, discovered the alleged affair, and the financial side of the arrangement is now being sorted out in court, with a one-day final hearing date set for next year.

Meanwhile, current Wisetech Global chair Richard Dammery is reportedly setting up a series of crisis meetings with the company’s larger shareholders in the wake of those allegations and amid further developments being reported involving another woman who has come forward with similar (as yet untested) claims of an improper relationship.

Wisetech shares are down 3.2% today, taking the losses for the week to more than 8.5%.

And probs best we leave that one there for now.

NOT THE ASX

Overnight, things were mixed on Wall Street, with the S&P 500 inching 0.02% lower, the Nasdaq adding 0.04% and the Dow rising 0.37% to yet another record high.

However, S&P 500 futures were up 0.2% after hours, with streaming giant Netflix up 4.7% on a stronger-than-expected report after the US close.

In other US stock news, Apple fell 0.9% after hitting a record high in the previous session, while Alphabet, Meta Platforms and Microsoft all dipped between 0.2% and 1.6%.

However, chip heavyweight Nvidia bucked the megacap trend, adding 3.1% after slumping nearly 5% in the previous session.

In Asia this morning, all eyes are on China ahead of the release of crucial GDP reporting today, which is partially the reason for the slowdown on local markets this morning.

Japan’s Nikkei is up 0.24% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap ERA Energy Resources 0.006 162.3 27,793,246 $50,657,590 OVT Ovanti 0.025 78.6 128,079,473 $21,788,877 IRX InhaleRX 0.039 77.3 3,731,435 $4,250,659 DOU Douugh 0.0065 44.4 3,990,270 $4,869,310 SFG Seafarms Group 0.004 33.3 32,500 $14,509,798 LGP Little Green Pharma 0.15 30.4 1,524,063 $34,830,394 SLM Solis Minerals 0.125 28.9 635,382 $7,506,083 ADO Anteotech 0.033 26.9 36,405,962 $64,734,020 BDG Black Dragon Gold 0.019 26.7 449,414 $4,012,765 CMX ChemX Materials 0.048 26.3 60,000 $4,902,848 BMG BMG Resources 0.01 25.0 8,315,183 $5,470,377 BYH Bryah Resources 0.005 25.0 100,000 $2,013,147 INP Incentiapay 0.005 25.0 306,601 $5,060,960 MPP Metro Perf.Glass 0.062 24.0 34,630 $9,268,904 ADD Adavale Resource 0.003 20.0 333,333 $3,059,413 POS Poseidon Nick 0.006 20.0 2,835,446 $21,019,377 TAM Tanami Gold 0.043 19.4 10,263,962 $42,303,494 LPM Lithium Plus 0.17 17.2 421,507 $19,261,800 BSA BSA Limited 1.135 17.0 210,032 $71,043,964 AUZ Australian Mines 0.014 16.7 22,870,678 $16,782,145

Energy Resources of Australia (ASX:ERA) opened way higher this morning following yesterday’s resumption of the company’s Rio Tinto-led 19.87 for 1 non-underwritten pro rata renounceable entitlement offer, seeking to raise about $90 million.

InhaleRX (ASX:IRX) has entered into a significant funding agreement with Clendon Biotech Capital, securing up to $38.5 million in funding to cover all direct costs associated with the Phase 1 & 2 clinical development of the Company’s key projects, IRX-211 and IRX-616a. IRX-211 is a drug-device medication, specifically designed to target breakthrough cancer pain, while IRX-616a is an innovative drug device medication designed to offer fast and effective relief for individuals suffering from panic disorder.

AnteoTech (ASX:ADO) was up after it announced a few days ago that it had secured a deal for the first commercial order of its Ultranode product from “leading European EV manufacturer EV1”. This morning’s announcement, in response to a query from the ASX, is that EV1 is in fact the AMG arm of German automaker Mercedes Benz.

BSA rose nicely after delivering a healthy quarterly this morning, revealing that the company has continued its strong financial performance into the new financial year, delivering Q1 FY2025 revenue of $76.9 million, an improvement of 35.6% on pcp. The company also announced Q1 FY2025 EBITDA of $6.5m, and an increase of 47.7% on pcp, with an EBITDA margin of 8.4% also increasing on pcp as the Group aims for improved margins throughout FY2025.

Meanwhile, Flight Centre (ASX:FLT) was sinking badly this morning, after releasing a business update that was a little skimpy on some details, but looks like it lays out a pretty severe downturn for the business over the first 6 months of this financial year. Flight Centre said 1QFY25 was trading “marginally above” the previous corresponding period on TTV, profit margin and underlying profit, and tried to gloss things over, saying its FY25 profit was “again expected to be heavily second-half weighed.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MOV Move Logistics Group 0.2 -39.4 25,179 $42,112,626 PER Percheron 0.088 -34.8 20,235,847 $121,708,571 CDE Codeifai 0.001 -33.3 1,020,000 $3,961,942 MRQ MRG Metals 0.003 -25.0 2,500,000 $10,846,075 RML Resolution Minerals 0.0015 -25.0 163,900 $3,220,044 88E 88 Energy 0.002 -20.0 10,000,005 $72,334,530 CTO Citigold Corp 0.004 -20.0 575,816 $15,000,000 LVH Livehire 0.032 -20.0 253,396 $15,264,583 PUA Peak Minerals 0.002 -20.0 1,740 $6,242,776 FLT Flight Centre Travel 17.855 -17.4 4,351,955 $4,796,888,033 TOU Tlou Energy 0.024 -17.2 820,500 $37,658,945 EGY Energy Tech 0.03 -16.7 1,000,000 $15,714,142 ERG Eneco Refresh 0.01 -16.7 1,424 $3,268,300 GCM Green Critical Minerals 0.0025 -16.7 1,999 $4,405,628 ICR Intelicare 0.011 -15.4 2,925 $6,320,446 ID8 Identitii 0.011 -15.4 182,576 $8,457,898 SBW Shekel Brainweigh 0.05 -15.3 177,956 $13,455,613 XGL Xamble Group 0.023 -14.8 303,959 $7,996,242 PIL Peppermint Inv 0.006 -14.3 115,008 $14,849,508 RDS Redstone Resources 0.003 -14.3 620,000 $3,238,825

ICYMI – AM EDITION

Regener8 Resources (ASX:R8R) has executed a contract with Gyro Drilling for maiden drilling at its East Ponton project in WA.

The program will initially test the Hatlifter paleochannel-hosted nickel-cobalt target, where historical drilling returned a high-grade, end-of-hole intersection of 3m at 1.26% nickel and 0.6% cobalt from 57m.

Hatlifter shares many geological similarities to the Mulga Rocks project owned by Deep Yellow (ASX:DYL) and is located within the same paleochannel system.

Drilling will also test the Grasshopper rare earths and niobium carbonatite prospect where historical drilling by Anglo Gold Ashanti in 2013 highlighted numerous REE anomalies coincident with magnetic features interpreted as an intrusive complex.

R8R’s magnetic inversion modelling indicated that historical drilling did not fully intersect the magnetic features, and the prospect remains effectively untested.

At Stockhead, we tell it like it is. While Regener8 Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.