ASX Small Caps Lunch Wrap: Are bulletproof aliens really stealing Peruvian gold this week?

Pic via Getty Images.

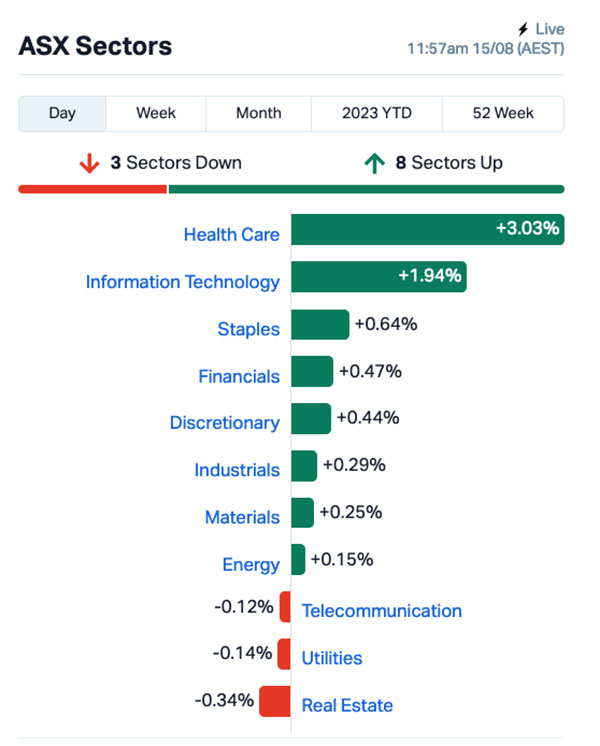

Local markets are up 0.63% at lunchtime today, as the ASX recovers from a two-session losing streak to be back in the good books once more.

Health Care is surging well ahead of the broader market, most of which is down to CSL (ASX:CSL) cranking out a 4.1% surge – an enormous chunk of value for the $132 billion market cap biotech giant.

Plus there’s fresh data from Canberra and China to digest – but before I get too deeply into all that, I’d like to whisk you all away to Peru, where residents of the remote Peruvian village of Loreto belonging to the Ikitu tribe have been complaining over the past week or so about being attacked by giant, face-eating aliens.

Village leader Jairo Reátegui Dávila described the aliens to local media, including claims that the ETs – which the villagers are calling “Los Pelacaras” (The Face Peelers) – are 7 feet tall, and have sent at least one teenage girl to hospital.

“Their shoes are round-shaped, which they use to float… Their heads are long, they wear a mask and their eyes are yellowish,” Dávila said, accurately describing several current NBA stars.

“I shot one of them twice and he wasn’t injured, he rose and disappeared,” he added, widening the pool of suspects to include at least 25 current NFL players as well.

This is, clearly, a source of some distress for the villagers, who took a short break from soiling themselves to appeal to the Peruvian government for assistance in dealing with the nuisance of being constantly hassled by aggressive intergalactic sport freaks.

And so in rolled the investigators, who had a poke around, and after a few days came up with their own explanation, which – if I’m being honest – is even more bizarre than the frightened locals claims of bulletproof flesh devouring aliens.

“Illegal gold-mining crime syndicates,” are apparently behind it all. Specifically, Peruvian officials suggest, South American drug cartels like Brazil’s ‘O Primeiro Comando da Capital,’ and Colombia’s ‘Clan del Golfo’.

The same cartels that have been forced from their hyper-profitable cocaine operations by haphazard law enforcement operations, assistance interference by US covert ops and other cartels, so they’re opting for poaching local gold reserves to raise money to keep the lights on.

The basic gist of it is this: the whole area around the village of Loreto is littered with gold, much of it in very hard-to-reach places that makes exploring very difficult.

As the terrain’s too tough to walk into, and impossible to land helicopters on, the cartels have reportedly been buying up jetpacks (no, really…) and strapping hapless gold explorers into them to go looking for the precious metal in the wild, mountainous jungles.

When the locals started getting a bit nosy, the ‘campaign of alien terror’ began, sometime around 11 July this year, which saw cartel members dressing up in menacing attire, donning their jetpacks and doing their best to frighten the villagers away.

Bear in mind that’s still just a theory – which means Peru is left with no choice but to call in a crack squad of international busybodies to unmask the villains, who – as this recently declassified footage from previous missions demonstrates – are the very best in the business.

TO MARKETS

Local markets have rallied this morning, shaking off the sour sentiment of the past couple of sessions and pushing the ASX 200 benchmark back onto the right side of 7,300 points this morning, up 0.42% in early trade.

Health Care and InfoTech are doing the bulk of the heavy lifting this morning, while of the sectors that aren’t faring too well, Real Estate is taking the worst of it today, down 0.34% this morning.

In the expensive seats this morning, Life360 (ASX:360) has gone soaring 12.9% after delivering a stunning quarterly results announcement, featuring such gems as a total Q2 revenue of $70.8 million (+45% YoY), with core Life360 Subscription revenue of $47.6 million, up 57% YoY.

And people said there’s no money in spying on your family…

Meanwhile GUD Holdings (ASX:GUD) – they sell pool pumps and spa stuff – has spiked 11.4% this morning after it revealed that underlying EBITA increased 27.0% to $191.1m, “driven by organic growth of 6.5% and full year contributions from [recent] acquisitions APG and Vision X”.

Wages data hit the airwaves at 11.30 this morning, showing that annual wage growth fell from 3.7% in the March quarter to 3.6% in the June quarter, with the quarterly rate of growth stable at 0.8% – a sign that the results of the RBA’s rate hike spree might have started to kick in. Finally.

And at the top end of town, National Australia Bank (ASX:NAB) has followed CBA (ASX:CBA) into an on-market buy-back, announcing it’s putting $1.5 billion on the table “to progress managing its Common Equity Tier 1 (CET1) towards its target range of 11%-11.5%”.

The precise timing and actual number of shares purchased under the buy-back will depend on market conditions, the prevailing share price and other considerations, NAB says.

NOT THE ASX

A surge from the big names in US tech has helped Wall Street into a favourable position overnight, which saw the broad S&P 500 index up +0.58%, and the recently-underwhelming Nasdaq jump by by 1.05%.

Nvidia surged by 7% – its biggest single day rise since May 25 (aka The Day Nvidia Went Ballistic), PayPal rose almost 3% after announcing that Intuit executive Alex Chriss will be its next CEO, and other mega tech stocks like Meta and Microsoft also lifted around 1%.

Tesla shares fell -1.2% after the EV maker once again cut its prices in China, whipping up more concerns over its margins.

Earlybird Eddy reported this morning that Warren Buffett’s Berkshire Hathaway announced it has cut its position in Activision Blizzard, and put new bets on the US housing market with fresh stakes in D.R. Horton, NVR Inc, and Lennar Corp, according to the latest filing.

The big news out of the mega-investor playground, though, is the revelation that Michael Burry – the guy made famous by The Big Short – has apparently sunk some 93% of his entire portfolio into a move to short the entire market.

BREAKING :

Michael Burry just shorted the market with $1.6B

Bought $890M of $SPY Puts

Bought $740M of $QQQ PutsThis now makes up 93% of his entire portfolio

Look out below. pic.twitter.com/jiOEYxpVra

— Michael Burry Stock Tracker ♟ (@burrytracker) August 14, 2023

There’s already a movie in the works – Ron Howard is attached to direct the three-hour-long cinematic experience that will mostly just be footage of the director’s weird looking brother playing the lead role of “All of Wall Street” verbally abusing a bull and a bear, to see which one attacks him first.

In Japan, the Nikkei is up 0.87% as the nation recovers from the brain-melting spectacle of a drone show put on to help celebrate the Pokemon World Championships in Yokohama over the weekend.

If you’re a fan of bright colours, muffled outdoor techno beats and Japanese people making some extremely Japanese “ooooh” and “aaaaah” noises, then have I got a treat for you.

In China, things are looking grim. Beijing released July data that broadly missed expectations, but did include a magic act in the middle of it, with a trick called The Amazing Disappearing Youth Unemployment Statistics.

The unemployment rate for 16-24 year olds in June hit a knee-trembling 21.3% in June – but this time around, it’s been ‘mysteriously’ omitted from the report.

That means either someone’s made a mistake and will be spending the next 20 years compiling spreadsheets in Mongolia, or the data is much, much worse than Beijing’s prepared to put its logo on.

Shanghai markets are flat on the news, while in Hong Kong, the Hang Seng is down 0.98%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 15 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.0015 50% 1,024 $15,642,574 1MC Morella Corporation 0.009 29% 30,680,746 $42,690,063 GTG Genetic Technologies 0.0025 25% 66,214 $23,083,316 LSA Lachlan Star Ltd 0.01 25% 1,118,597 $10,552,102 LKE Lake Resources 0.26 24% 51,030,131 $298,713,388 AJQDA Armour Energy Ltd 0.135 23% 5,500 $10,826,953 INP Incentiapay Ltd 0.006 20% 1 $6,325,318 WML Woomera Mining Ltd 0.013 18% 4,150,075 $10,518,140 DLI Delta Lithium 0.875 17% 6,782,969 $391,931,016 HPC The Hydration 0.042 17% 502,814 $6,490,021 ATH Alterity Therapy Ltd 0.007 17% 500,030 $14,639,386 LGM Legacy Minerals 0.15 15% 4,324 $6,997,571 ADC ACDC Metals Ltd 0.083 15% 811,530 $3,365,820 AVE Avecho Biotech Ltd 0.008 14% 400,000 $15,135,146 BUY Bounty Oil & Gas NL 0.008 14% 3,182,202 $9,593,507 RLC Reedy Lagoon Corp. 0.008 14% 423,214 $3,967,037 360 Life360 Inc. 9.1 13% 1,971,828 $1,607,964,374 VHM VHM Limited 0.59 13% 73,554 $79,666,935 AJX Alexium Int Group 0.017 13% 30,873 $9,770,846 REZ Resource & Energy Group 0.017 13% 55,001 $7,497,087 UVA Uvre Ltd 0.135 13% 616,929 $3,923,787 VSR Voltaic Strategic 0.045 13% 5,279,680 $18,052,009 CCO The Calmer Co International 0.0045 13% 16,741 $3,268,477 RIM Rimfire Pacific 0.009 13% 4,885,462 $16,841,958 RNE Renu Energy Ltd 0.038 12% 3,646 $14,977,072

Top of the Small Caps Pops this morning is Lake Resources (ASX:LKE), up 22.6% after the company revealed “successful testing that has proved the concept of extraction and injection to support the production of high purity battery grade lithium carbonate at the Kachi lithium brine project in Catamarca Province, Argentina”.

“The tests represent a significant milestone for the Project, as they provide important data and higher confidence for our modelling, which is essential for the completion of our DFS for Phase 1,” Lake CEO David Dickson said, adding: “The results are indicative of high-yield, production-scale, extraction wells in the core resource area.”

Next best is Delta Lithium (ASX:DLI), jumping 16% this morning in a healthy bounce back from the drubbing it took a week ago – a gut punch that’s been attributed to the hugely funny but somewhat lackadaisical presentation by executive chairman David Flanagan at Diggers and Dealers last week.

In case you’d forgotten, it looked like this:

And in third place, it’s ACDC Metals (ASX:ADC), up 15.3% on news that the company has hit high-grade total heavy minerals intervals across 78 drill holes at its Watchem project in Victoria’s Murray Basin.

The best of the intervals include 45m @ 2.01% THM from 0m, including 4.5m @ 4.69% from 13.5m in hole 23WAC046, and 42m@ 1.77% THM from 4.5m including 3m @ 4.2% from 39m in hole 23WAC017.

ACDC says it’s also acquired additional land holding along trend from the Watchem project, and that assays are imminent from the company’s 66 holes at Goschen Central and 43 from Douglas projects as well.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap APC Aust Potash Ltd 0.005 -33% 2,090,000 $7,790,092.94 KEY KEY Petroleum 0.001 -33% 4,000 $2,951,892.19 MAY Melbana Energy Ltd 0.074 -30% 74,626,137 $353,871,430.92 MCT Metalicity Limited 0.0015 -25% 1,687,385 $7,472,171.61 BMG BMG Resources Ltd 0.009 -18% 191,452 $6,971,768.78 RNX Renegade Exploration 0.009 -18% 1,577,445 $10,484,361.58 MRQ Mrg Metals Limited 0.0025 -17% 17,000,000 $6,557,755.88 TTT Titomic Limited 0.021 -16% 2,635,732 $21,638,214.33 NRX Noronex Limited 0.017 -15% 1,654,269 $7,041,021.76 EXL Elixinol Wellness 0.012 -14% 165,063 $6,397,879.15 DCL Domacom Limited 0.025 -14% 50,000 $12,629,551.42 AD1 AD1 Holdings Limited 0.007 -13% 1,196,577 $6,580,551.47 CHK Cohiba Min Ltd 0.0035 -13% 10,000 $8,852,976.74 MTB Mount Burgess Mining 0.0035 -13% 12,607,112 $4,062,587.15 TAS Tasman Resources Ltd 0.007 -13% 10,000 $5,701,354.30 ARN Aldoro Resources 0.15 -12% 336,305 $22,886,036.31 DNA Donaco International 0.04 -11% 73,000 $55,592,522.19 VBS Vectus Biosystems 0.4 -11% 10,000 $23,935,283.55 BXN Bioxyne Ltd 0.016 -11% 100,000 $34,229,617.16 SP8 Streamplay Studio 0.008 -11% 200,000 $10,243,113.92 LIT Lithium Australia 0.041 -11% 9,998,782 $56,174,816.91 ATX Amplia Therapeutics 0.083 -11% 40,682 $18,042,537.91 DAL Dalaroometalsltd 0.051 -11% 59,288 $2,956,875.00 HIQ Hitiq Limited 0.026 -10% 878 $7,736,599.38 NOX Noxopharm Limited 0.035 -10% 42,300 $11,397,280.05

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.