ASX Small Caps Lunch Wrap: All sectors rally as US votes trickle in; Auking wins Saudi gold mining bid

Auking Mining wins gold mining licence in Saudi. Picture via Getty Images

- ASX rises this morning as tech stocks rally

- Nvidia overtakes Apple as world’s largest company

- Auking Mining wins gold mining licence in Saudi

The ASX kicked off Wednesday with a bang, up by 0.82% and mirroring a strong rally from Wall Street where tech heavyweights rallied.

The tech-heavy Nasdaq surged 1.43% overnight, with Nvidia leading the charge after a 3% jump that pushed the stock past Apple to become the world’s largest company.

Meanwhile, as polls close across seven key battleground states this morning, the first results in the US election are beginning to come in.

Georgia, North Carolina, Pennsylvania, Michigan, Wisconsin, Arizona, and Nevada are all set to report their results in the coming hours.

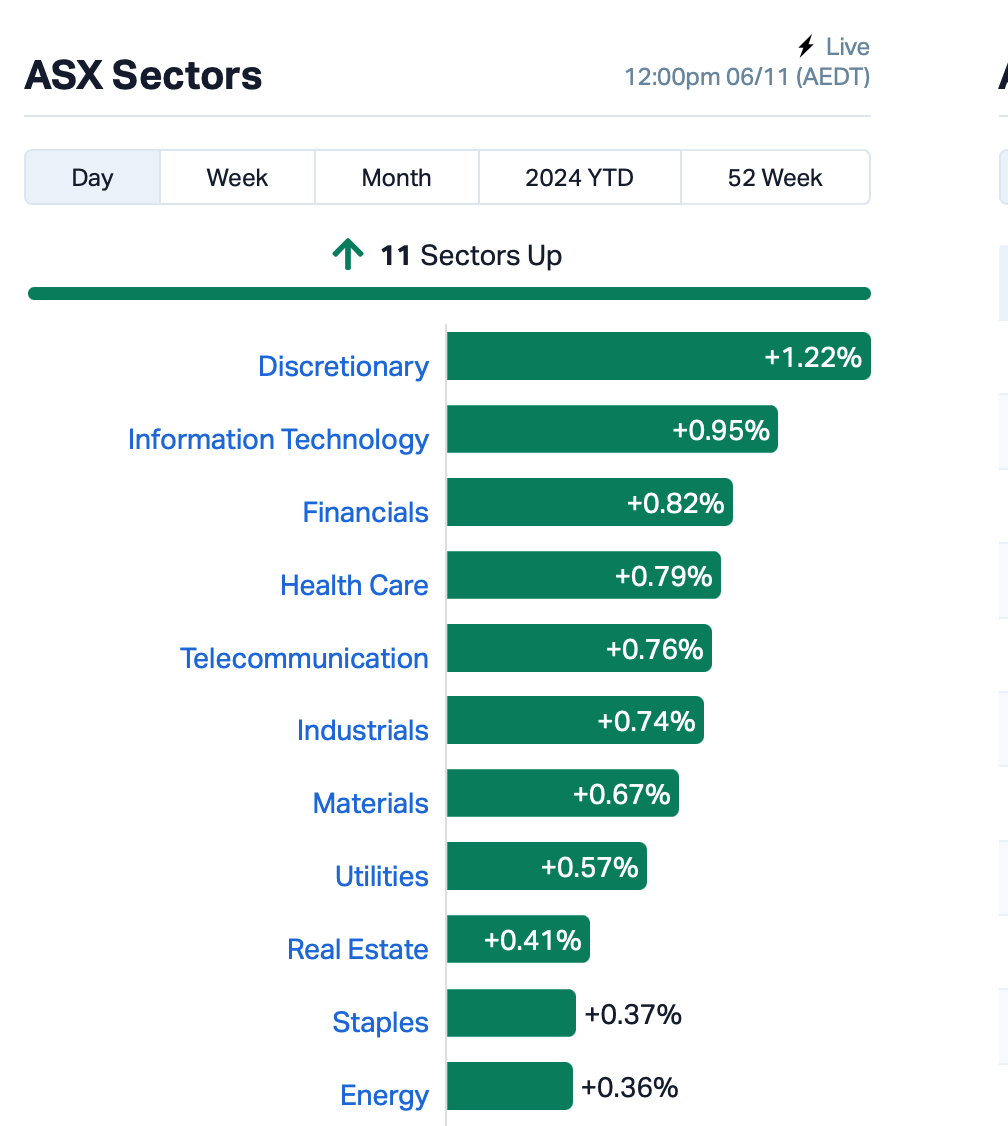

On the ASX, all 11 sectors looked nice and green at midday.

Miners were driven higher by a 2% spike in iron ore prices, which were bolstered by expectations that Beijing will announce new stimulus measures to support the Chinese economy.

In the Discretionary sector, JB HiFi (ASX:JBH) led with a 2.5% on no specific news. Tech stock BrainChip Holdings (ASX:BRN) also rose by 9% on no news.

Real estate play Goodman Group (ASX:GMG) rose by 0.5% after predicting a 9% growth in operating earnings per share for FY25, and confirmed a 30¢ full-year distribution.

Westpac (ASX:WBC) rose 1% despite announcing the resignation of two directors from its ranks after just one term.

Meanwhile, Domino’s Pizza, Fortescue, and IGO are all hosting their annual general meetings today.

NOT THE ASX

Overnight, Nvidia surpassed Apple to become the world’s largest company, with a market cap of US$3.45 trillion, driven by the surge in artificial intelligence demand.

Nvidia’s stock rose 3%, marking a dramatic 850% increase since the end of 2022.

US Treasury bonds swung violently as voting in the presidential election started, with bond yields fluctuating.

Across Asia today, most major stock markets climbed as early results trickle in from a tight presidential race.

Equities rose in Japan and Australia, while US futures edged higher, with Donald Trump and Kamala Harris neck-and-neck in the polls.

Bitcoin surged late this morning above US$70,000, but traders will need to be prepared for potentially a lot of volatility in the coming hours.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AKN Auking Mining Ltd 0.005 67% 5,546,249 $1,174,051 AVE Avecho Biotech Ltd 0.003 50% 179,075 $6,338,594 SI6 SI6 Metals Limited 0.002 50% 128,700 $2,767,292 WEL Winchester Energy 0.003 50% 600,000 $2,726,038 GTI Gratifii 0.004 33% 250,000 $12,008,879 RML Resolution Minerals 0.002 33% 50,000 $2,415,033 CDX Cardiex Limited 0.125 30% 422,980 $28,240,759 RMX Red Mount Min Ltd 0.013 30% 5,317,610 $3,873,578 LRD Lordresourceslimited 0.038 23% 2,645,655 $2,269,188 WEC White Energy Company 0.060 20% 8,908 $9,949,214 PUR Pursuit Minerals 0.003 20% 60,000 $9,088,500 PV1 Provaris Energy Ltd 0.025 19% 373,500 $13,298,989 EVG Evion Group NL 0.034 17% 540,256 $10,061,932 AUK Aumake Limited 0.007 17% 845,441 $16,279,446 BP8 Bph Global Ltd 0.004 17% 125,000 $1,189,924 RGL Riversgold 0.004 17% 500,533 $4,882,388 BNZ Benzmining 0.300 15% 1,011,866 $27,787,351 BMG BMG Resources Ltd 0.015 15% 10,879,131 $8,889,363 CXU Cauldron Energy Ltd 0.015 15% 3,453,470 $18,987,788 ENV Enova Mining Limited 0.008 14% 2,853,758 $6,894,505 SHO Sportshero Ltd 0.016 14% 48,000 $9,349,660 TAL Talius Group Limited 0.008 14% 3,572,266 $18,021,055 NOX Noxopharm Limited 0.120 14% 30,168 $30,684,985

Auking Mining (ASX:AKN), in partnership with local Saudi company Barg Alsaman Mining Company (BSMC), has won the bid for the Shaib Marqan gold exploration licence in Saudi Arabia.

The project is located in a promising gold-mineralised area within the Arabian-Nubian Shield, close to established gold deposits like the Al Amar mine, which produced nearly 30,000oz of gold in 2022.

The area is under-explored, with at least 22 ancient workings and gold-rich quartz veins averaging 5.8g/t, reaching up to 40g/t in some samples. The company will now work with the Saudi Ministry and BSMC to finalise the exploration licence in the coming weeks.

Si6 Metals (ASX:SI6) said it will begin a drill program in November 2024 at the Fred’s Well prospect, located within its Monument Gold Project in Western Australia’s Laverton Gold District.

The program will include 1,700 metres of drilling with 25 aircore and 2 reverse circulation holes, targeting an area along a 30km structural trend with promising gold mineralisation.

Fred’s Well is close to Monument’s 154,000oz gold resource, with previous drilling intercepts showing significant gold, including 24m at 3.24g/t Au. The drilling will aim to expand the resource by testing the depth and strike of known mineralised areas, potentially upgrading the project’s resource calculation.

Red Mountain Mining (ASX:RMX) has received promising gold results from 91 rock chip samples collected from its Flicka Lake prospect in Ontario, Canada.

The best results came from the Flicka Zone, with Vein #2 returning values of 24.2g/t Au and 19.4g/t Au, and Vein #3 showing a peak of 9.35g/t Au.

These results confirm high-grade gold mineralisation at Flicka Lake, similar to historical data, and highlight the potential for strike extension of the mineralisation along the shear. Additional soil assay results are expected by the end of November.

Lord Resources (ASX:LRD) has secured an earn-in agreement to acquire up to 80% of the Ilgarari Copper Project in Western Australia, which hosts high-grade copper mineralisation over a 4 km strike.

Historic drilling has returned impressive results, such as 17m at 1.27% Cu and 3m at 3.26% Cu, with mineralisation continuing into fresh sulphide ore at depth.

The project is located near Newman, and further exploration will focus on extending known mineralisation and identifying the source, with additional tenement applications submitted to cover regional structures. CEO Andrew Taylor highlighted the acquisition as a low-cost entry into a highly prospective copper project.

Evion Group’s (ASX:EVG) joint venture (JV) near Pune, India, has completed production testing and secured its first sales contract for expandable graphite, with 386 tonnes to be sold to European buyers for over A$2 million at prices above US$3,000 per tonne.

The JV expects to produce around 400 tonnes over the next 10 weeks, with further sales contracts likely to follow, as global demand for expandable graphite grows, especially in industries like electric vehicles, energy storage and aerospace.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap FCG Freedomcaregrouphold 0.077 -41% 443,154 $3,104,908 AMD Arrow Minerals 0.002 -25% 7,190,910 $26,447,256 GMN Gold Mountain Ltd 0.002 -25% 82,777 $7,814,946 ADD Adavale Resource Ltd 0.002 -20% 92,592 $3,059,413 MRQ Mrg Metals Limited 0.004 -20% 2,912,161 $13,632,593 RIL Redivium Limited 0.004 -20% 468,700 $13,734,274 PPY Papyrus Australia 0.013 -19% 709,448 $7,883,081 JBY James Bay Minerals 0.465 -18% 561,470 $18,895,013 CUL Cullen Resources 0.005 -17% 152,977 $4,160,411 GES Genesis Resources 0.005 -17% 50,000 $4,697,048 M2R Miramar 0.005 -17% 1,815,333 $2,380,940 ILT Iltani Resources Lim 0.190 -16% 312,843 $9,902,364 LML Lincoln Minerals 0.006 -14% 50,000 $14,393,817 MOH Moho Resources 0.006 -14% 65,999 $3,774,247 S66 Star Combo 0.130 -13% 144,451 $20,262,447 BSX Blackstone Ltd 0.029 -13% 422,017 $17,625,079 AAU Antilles Gold Ltd 0.004 -13% 1,128,542 $7,422,971 AQX Alice Queen Ltd 0.007 -13% 10,000 $9,175,121 HHR Hartshead Resources 0.007 -13% 4,880,808 $22,469,457 STM Sunstone Metals Ltd 0.007 -13% 2,986,763 $41,191,229 USL Unico Silver Limited 0.273 -12% 1,678,200 $109,464,231 AGC AGC Ltd 0.225 -12% 457,264 $65,432,292 AQD Ausquest Limited 0.008 -11% 169,000 $7,435,343 GTR Gti Energy Ltd 0.004 -11% 1,086,333 $13,322,023 SRK Strike Resources 0.032 -11% 8,846 $10,215,000

IN CASE YOU MISSED IT

Argent Minerals (ASX:ARD) has completed 50 reverse circulation drill holes totalling 2943m across its wholly owned Kempfield polymetallic gold-silver-lead-zinc project in New South Wales.

These holes targeted a 200m by 40m mineralised zone, which was delineated during the July-August 2024 fieldwork program, that extends the Kempfield NW zone to over 2km by and average width of 100m.

A further 12 holes totalling 1300m will be drilled to test the mineralised silver-base-metal lithology extension proximal to the Lode 300 Mineralised Zone that was discovered by the August 2024 rock chip reconnaissance program.

D3 Energy (ASX:D3E) has completed production testing at RBD01 – a repurposed gold exploration hole, which flowed gas at an average rate of 93,000 standard cubic feet per day during a 15-day period.

Importantly, world-class concentrations of 6.2% helium were measured after 12 days of sustained production, the highest recorded to date across its wells.

Managing director David Casey said it was pleasing to flow and measure gas from a legacy gold exploration hole drilled in 1982 and that the sustained gas rate was encouraging given the lack of any decline and potential downhole obstructions identified in RBD01.

RBD01 has been shut-in to allow reservoir pressures to build and the company will now move to test the recently drilled RBD12 well.

Shares of D3E have also started trading on the OTCQB Venture Market in the US under the symbol DNRGF, providing the company with access to a broader network of US-based investors, enhancing market visibility and increasing liquidity for shareholders.

Dimerix (ASX:DXB) is hosting a webinar dedicated to reviewing key initial findings from Project PARASOL, a collaborative international initiative for clinical endpoints in focal segmental glomerulosclerosis (FSGS).

Project PARASOL is focused on defining quantitative relationships between short-term changes in key biomarkers – proteinuria and glomerular filtration rate (GFR) – and long-term outcomes in FSGS. It seeks to establish alternative proteinuria-based endpoints to support both accelerated and traditional approval pathways for FSGS treatments.

Regener8 Resources (ASX:R8R) has wrapped up maiden drilling testing the Hatlifter nickel-cobalt and Grasshopper rare earths-niobium targets at its East Ponton project in WA. Samples from the drilling have been sent to ALS for assay.

“Regener8 has safely completed the maiden drilling program at East Ponton. We are proud of the team overcoming challenging subsurface drilling conditions and look forward to receiving assay results in the coming months,” managing director Stephen Foley said.

At Stockhead, we tell it like it is. While Argent Minerals, D3 Energy, Dimerix and Regener8 Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.