ASX Small Caps and IPO Weekly Wrap: InfoTech rules and Health Care drools on the ASX this week

After swapping Mary's heart pills for LSD, Frank didn't warn her about the bats... but she'd be seeing them herself soon enough. Pic via Getty Images

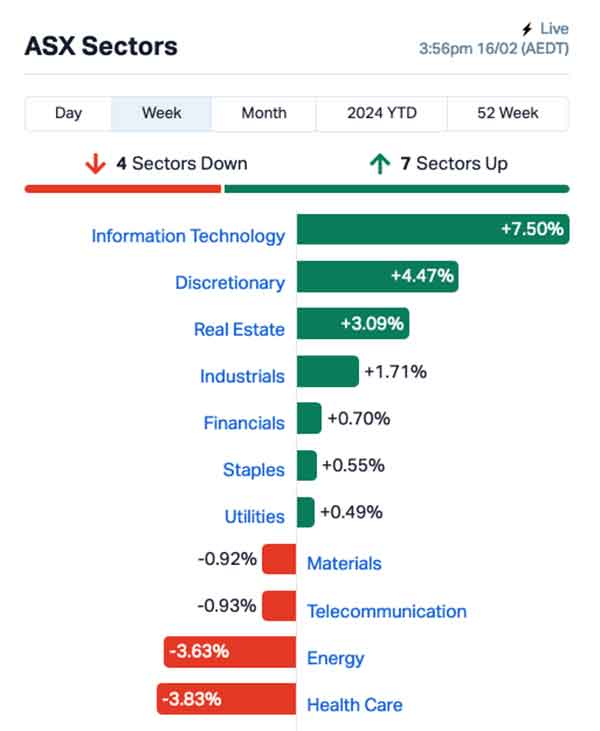

- The needle barely moved all told, ASX benchmark ends the week up 0.25pc

- InfoTech wins, Health Care loses and that’s mostly down to a couple of large caps

- Weakening US dollar at the tail end of the week helps Resources claw back losses

This week has been fairly pedestrian in many respects, but a mid-week – and unexpected – Valentine’s Day massacre put a pretty good ding in the market’s driver-side door and capped the weekly winnings at the +0.25% mark.

The skyline was dominated by a massive tech surge on Thursday, which saw the InfoTech sector bank more than 7.2% worth of gains for the week, which is kind of a big deal.

There were two clear catalysts for that rise; the first of them being an absolute banger for large cap tech mob Altium (ASX:ALU) , after the multi-billion dollar market cap “global leader in electronics design systems” revealed that a deal has been struck that would see Renesas Electronics acquire “all outstanding shares of Altium for a cash price of A$68.50 per share, representing a total equity value of approximately A$9.1 billion” – a juicy premium to the previous day’s $51.26 close for ALU.

An hour or so later, January’s unemployment figures – up slightly to 4.1% – landed, and it was like someone lit a bottle rocket deep inside the tech sector’s bum, sending it hurtling heavenward more than 100 points in the space of minutes.

The other big large cap news came from pharma giant CSL (ASX:CSL), which started the week by dropping some really bad news on the market, after its big play into the global heart attack market stumbled at the third hurdle.

The company’s Phase 3 AEGIS-II trial evaluating the efficacy and safety of heart attack drug CSL112 “did not meet its primary efficacy endpoint of MACE – major adverse cardiovascular events – reduction at 90 days”.

CSL did also point out that there were “no major safety or tolerability concerns with CSL112”, so the issue is that the drug simply doesn’t do what it was meant to do.

The market took the news hard – it’s kinda rare for such a large company to have a drug trial fall apart at this stage of proceedings – and CSL was down close to 5.0% mid morning, and continued to drag for most of the week.

Meanwhile, Materials and Energy were both at the whim of the commodities markets all week, and it wasn’t pretty for most.

Sinking prices across a wide range of key metals and industrials put a lot of downward pressure on those two sectors.

However, a late-in-the-week form slump from the US dollar helped make things more expensive, which in turn offered some level of structural support, enough to spark a bit of a rally on Friday.

It wasn’t enough to lift either of those sectors out of the red entirely, though.

But, who won the week? Let’s find out together…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.0025 | 150% | $9,878,481.43 |

| TD1 | Tali Digital Limited | 0.002 | 100% | $6,590,311.25 |

| BRX | Belararox Ltd | 0.245 | 81% | $18,445,445.20 |

| AUK | Aumake Limited | 0.005 | 67% | $9,572,034.01 |

| ENV | Enova Mining Limited | 0.03 | 67% | $17,946,021.52 |

| KPO | Kalina Power Limited | 0.005 | 67% | $8,840,512.04 |

| DUB | Dubber Corp Ltd | 0.22 | 63% | $70,426,850.94 |

| HTG | Harvest Tech Grp Ltd | 0.03 | 58% | $21,178,900.14 |

| MKG | Mako Gold | 0.022 | 57% | $14,573,006.95 |

| VMS | Venture Minerals | 0.014 | 56% | $17,680,104.28 |

| HMY | Harmoney Corp Ltd | 0.65 | 53% | $66,276,695.55 |

| GRE | Greentech Metals | 0.34 | 51% | $28,587,191.50 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | $2,753,344.67 |

| KGD | Kula Gold Limited | 0.009 | 50% | $3,808,907.29 |

| PNX | PNX Metals Limited | 0.006 | 50% | $32,283,748.31 |

| PUA | Peak Minerals Ltd | 0.003 | 50% | $3,124,129.85 |

| YRL | Yandal Resources | 0.135 | 50% | $32,861,661.84 |

| BRN | Brainchip Ltd | 0.24 | 50% | $361,162,937.00 |

| QXR | Qx Resources Limited | 0.022 | 47% | $29,972,102.06 |

| ARV | Artemis Resources | 0.019 | 46% | $27,059,138.38 |

| AXN | Alliance Nickel Ltd | 0.046 | 44% | $29,759,424.22 |

| ACS | Accent Resources NL | 0.01 | 43% | $4,731,272.83 |

| JAN | Janison Edu Group | 0.355 | 42% | $95,851,089.00 |

| OPN | Oppenneg | 0.007 | 40% | $9,033,437.08 |

| DEL | Delorean Corporation | 0.053 | 39% | $11,433,208.50 |

| IR1 | Iris Metals | 0.78 | 38% | $81,575,538.66 |

| CCZ | Castillo Copper Ltd | 0.0055 | 38% | $6,497,526.78 |

| BOC | Bougainville Copper | 0.475 | 36% | $200,531,250.00 |

| DRO | Droneshield Limited | 0.695 | 35% | $361,170,630.49 |

| RDM | Red Metal Limited | 0.175 | 35% | $53,698,200.84 |

| CL8 | Carly Holdings Ltd | 0.02 | 33% | $4,830,667.04 |

| NES | Nelson Resources | 0.004 | 33% | $2,454,377.31 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619.43 |

| SYR | Syrah Resources | 0.52 | 33% | $364,984,774.20 |

| OIL | Optiscan Imaging | 0.098 | 31% | $81,863,398.69 |

| AUN | Aurumin | 0.039 | 30% | $15,054,609.40 |

| PER | Percheron | 0.075 | 29% | $64,009,692.94 |

| NGL | Nightingale Intelligent Sytems | 0.053 | 29% | $5,479,125.13 |

| AUR | Auris Minerals Ltd | 0.009 | 29% | $4,289,633.61 |

| KAU | Kaiser Reef | 0.135 | 29% | $21,380,486.75 |

| PEC | Perpetual Res Ltd | 0.009 | 29% | $5,760,264.78 |

| CYP | Cynata Therapeutics | 0.185 | 28% | $32,333,721.48 |

| GTE | Great Western Exploration | 0.042 | 27% | $16,008,488.38 |

| HT8 | Harris Technology Gl | 0.014 | 27% | $4,187,896.73 |

| TGM | Theta Gold Mines Ltd | 0.14 | 27% | $64,750,125.26 |

| PLC | Premier1 Lithium Ltd | 0.044 | 26% | $5,881,195.76 |

| WC8 | Wildcat Resources | 0.54 | 26% | $562,043,917.81 |

| ZIP | ZIP Co Ltd.. | 0.91 | 26% | $888,558,677.31 |

| EOS | Electro Optic Sys. | 1.455 | 25% | $233,737,148.19 |

| ASV | Asset Vision Co | 0.01 | 25% | $7,258,365.65 |

The clear winner this week was American Rare Earths, which banked a highly impressive 164% increase since close of play last week, which was all the more impressive considering the headwinds that sector had been facing all week.

The weird part about it is that ARR went soaring without the benefit of actual, tangible news to hang its success on – the last thing of note that it had to say to the ASX was on 07 February, when it announced an upgrade of its mineral resource estimate at Halleck Creek which had increased to 2.34 billion tonnes at 3,166 ppm TREO.

It’s great news, obviously, but… +164% worth? Investors seemed to think so.

Venture Minerals (ASX:VMS) lobbed into second place for the week, again on slightly old news but with the benefit of a bit of the ol’ razzle dazzle at the RIU Explorers conference. ARR lifted 88% to $0.015 per share.

And it was another faintly mysterious mover in third place for the week, after InhalerX popped a +80% wheelie down the middle of main street, apparently just because it can.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TTA | TTA Holdings Ltd | 0.003 | -73% | $412,270.23 |

| EE1 | Earths Energy Ltd | 0.014 | -66% | $7,419,499.05 |

| BCT | Bluechiip Limited | 0.006 | -51% | $4,772,242.76 |

| SLB | Stelar Metals | 0.084 | -46% | $4,245,041.93 |

| T3D | 333D Limited | 0.01 | -41% | $1,313,894.29 |

| DY6 | DY6 Metals | 0.052 | -39% | $2,567,228.69 |

| MSG | Mcs Services Limited | 0.01 | -38% | $1,782,896.87 |

| WIN | Widgie Nckel | 0.0415 | -36% | $12,513,692.23 |

| M24 | Mamba Exploration | 0.034 | -36% | $8,099,620.14 |

| EPX | EP&T Global Limited | 0.02 | -36% | $9,810,101.62 |

| ARC | ARC Funds Limited | 0.125 | -34% | $5,714,506.88 |

| EMU | EMU NL | 0.001 | -33% | $2,024,771.29 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $1,633,728.79 |

| JAY | Jayride Group | 0.02 | -33% | $4,453,773.24 |

| NET | Netlinkz Limited | 0.004 | -33% | $15,513,793.42 |

| NRZ | Neurizer Ltd | 0.006 | -33% | $8,483,464.99 |

| RBR | RBR Group Ltd | 0.002 | -33% | $4,855,213.98 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208.21 |

| YPB | YPB Group Ltd | 0.002 | -33% | $1,580,922.94 |

| INV | Investsmart Group | 0.105 | -32% | $22,115,475.02 |

| PIM | Pinnacle Minerals | 0.09 | -31% | $3,812,942.87 |

| UNT | Unith Ltd | 0.014 | -30% | $13,510,712.51 |

| HXL | Hexima | 0.012 | -29% | $1,837,435.92 |

| SCN | Scorpion Minerals | 0.018 | -28% | $7,370,211.46 |

| IMR | Imricor Med Systems | 0.43 | -28% | $76,857,750.97 |

| AMT | Allegra Medical | 0.023 | -26% | $2,631,442.62 |

| MXO | Motio Ltd | 0.023 | -26% | $8,582,347.07 |

| GLN | Galan Lithium Ltd | 0.305 | -26% | $124,589,390.40 |

| RBX | Resource B | 0.056 | -25% | $4,961,069.10 |

| CNJ | Conico Ltd | 0.003 | -25% | $4,710,284.84 |

| ENT | Enterprise Metals | 0.003 | -25% | $3,207,883.73 |

| INP | Incentiapay Ltd | 0.003 | -25% | $3,731,790.05 |

| MOH | Moho Resources | 0.006 | -25% | $3,215,646.98 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $11,677,324.30 |

| MRQ | MRG Metals Limited | 0.0015 | -25% | $4,942,682.06 |

| OXT | Orexplore Technologies | 0.024 | -25% | $4,885,391.15 |

| PLN | Pioneer Lithium | 0.12 | -25% | $3,979,500.14 |

| RGS | Regeneus Ltd | 0.006 | -25% | $1,838,621.48 |

| TMK | TMK Energy Limited | 0.0045 | -25% | $30,612,896.50 |

| VAR | Variscan Mines Ltd | 0.009 | -25% | $3,411,003.31 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832.41 |

| ZMM | Zimi Ltd | 0.03 | -25% | $3,905,783.33 |

| EVS | Envirosuite Ltd | 0.064 | -25% | $78,621,707.22 |

| CBE | Cobre | 0.052 | -25% | $14,919,371.74 |

| LPM | Lithium Plus | 0.16 | -24% | $14,188,053.00 |

| REE | Rarex Limited | 0.016 | -24% | $10,934,185.17 |

| FTL | Firetail Resources | 0.045 | -24% | $7,296,372.24 |

| DTR | Dateline Resources | 0.01 | -23% | $13,295,561.64 |

| IPD | Impedimed Limited | 0.081 | -23% | $171,981,173.37 |

| MTC | Metalstech Ltd | 0.17 | -23% | $32,122,280.30 |

HOW THE WEEK SHOOK OUT

Monday 12 February, 2024

American Rare Earths (ASX:ARR) was way out in front of the game on Monday morning, despite not having any news for the ASX today – possibly on the heels of Friday’s investor presentation, and late news that chairman Ken Traub has been replaced by non-executive director Richard Hudson. Traub is set to remain on the board as a non-executive director.

But that seems kinda unlikely, given that 99.9% of the time, shuffling of the board is roundly ignored by investors, especially in the absence of any really juicy gossip – but the company did respond to a Please Explain from the ASX with a cheerful “We don’t know either” about the sudden surge in price.

Appen (ASX:APX) climbed on news that the company has finalised details of additional measures to mitigate the impact of the loss of a material customer contract.

On 22 January, Appen was dealt a major blow when Google told the company that it would no longer require its services, bringing work between the two companies to a halt on or before 19 March 2024 – a huge blow for Appen, as Google’s contract was worth $82.8 million at a gross margin of 26% in FY23.

Battery metals explorer Australian Mines (ASX:AUZ) went soaring late in the day without any news to explain why, as did RareX (ASX:REE) – but with tin and silver the only metals and/or industrials showing any signs of positive movement in commodities, it could have been something obscure getting very valuable today, or it could just have been the wind…

And Nanollose (ASX:NC6) lifted through the afternoon, on news that it has received the first purchase order for 340kg of the company’s Nullarbor-20 fibre, with the order coming from Orta Anadolu Ticaret Ve Sanayi İşletmesi, which is apparently “a leader in clothing sustainability”. (Turkish jeans are bloody comfy, though.)

Tuesday 13 February, 2024

Dateline Resources (ASX:DTR) was well out in front Tuesday morning, after the company reported hitting wide, high grade gold during drilling at its Colosseum Gold Project in San Bernardino County, California, with the highlight being 70.1m @ 6.53g/t Au in drill hole CM23-14 Inc. 25.9m @ 15.31g/t Au.

IncentiaPay (ASX:INP) was also tracking well in early trade, after the company delivered its half-yearly report after hours on Monday evening, showing that while revenue has faltered -6.41% to 8,674,712 in PCP, the company has managed to turn around Loss from ordinary activities after tax attributable to members by 80.6% to $3,236,540, compared to $16,707,381 on PCP.

And a takeover deal in the works pushed Ansarada (ASX:AND) higher, after the company entered into a Scheme Implementation Deed with Datasite, an entity owned by funds managed by CapVest, to acquire 100% of the fully diluted share capital in Ansarada at $2.50 cash per share, which implies an equity value of A$236.3 million and represents a premium of 19.0% to the last closing price of A$2.10 per share.

Hammer Metals (ASX:HMX) took off like a jackrabbit around lunchtime, rushing through +37% before going into a trading halt, ahead of announcing drilling results from one of its copper interests in the Mt Isa region of Queensland.

BrainChip Holdings (ASX:BRN) also enjoyed a sizeable jump during the day, responding to an ASX “Please Explain” with “nothing to see here”, leaving the company’s 19% leap a total mystery…

Wednesday 14 February, 2024

Blue Star Helium (ASX:BNL) got off to a good start early in the day, after the company revealed results from initial testing and evaluation at Bolling #4 SESW well, which resulted in gas to surface flow of >4% helium under vacuum with flow up to 268.4 mscf/d. The company has engineers evaluating well production potential.

Rox Resources (ASX:RXL) had good news, revealing that it has recently completed geophysical Gradient Array Induced Polarisation (GAIP) surveys at its Mt Fisher and Mt Eureka gold projects in Western Australia, identifying numerous high-priority, walk-up drill targets in the process.

The new targets add to a previous result from its 100% owned Mt Fisher project, which the company reported as 9m @ 34.34g/t Au, with work continuing on both that project and the 51% (with an avenue for earn-in up to 75%) owned Mt Eureka site.

Bastion Minerals (ASX:BMO) was also making news on Wednesday morning, announcing that 53 samples from old mine workings have confirmed that the strategic 115km2 Gyttorp land holding in Southern Sweden is highly prospective for high-grade REE, with laboratory results to 6.8% (68,078 ppm) total REE + yttrium and elevated results throughout the property.

The company says that other high-grade Total REE+Y samples that exceeded 1.0% (10,000 ppm) include: 3.09%, 2.85%, 2.46%, 2.09%, 1.52%, 1.49%, 1.45%, 1.29% and 1.1%.

Hammer Metals (ASX:HMX) announced that its JV partner, Sumitomo Metal Mining Oceania, has reached a $6 million (60% interest) earn-in milestone and has elected to continue to fund the JV, with drilling of the Shadow South IOCG target scheduled to commence in early March.

As such, Hammer has elected to dilute its position in the MIEJV in accordance with the JV agreement, noting that it can elect to contribute to the Joint Venture in the future to maintain its interest at that point in time.

Kin Mining (ASX:KIN) surged more than 19% on no news, earning itself a speeding ticket from the ASX, while Sovereign Cloud Holdings (ASX:SOV) jumped around 24% in after-lunch trade, also without much in the way of news for the market.

Thursday 15 February, 2024

James Bay Minerals (ASX:JBY) was at the top of the leader charts early on Thursday, posting a 42% gain on news that a review of aeromagnetic and spectromagnetic survey results across its flagship Joule Property, within the 100%-owned La Grande Lithium Project in the James Bay region of Quebec, Canada, has generated significant new rare earths and uranium targets.

The announcement includes this nugget of information from Joel Dube from Dynamic Discovery Geoscience, who commented: “As a comparison, Joule is only one of two projects over the entire James Bay area, including the Matoush Uranium Project area, with maximum eU values exceeding 20 ppm, while the global average is approximately 0.5 ppm. This is considering a thorough review of over 80,000 l-km of public airborne gamma-ray spectrometric data.”

James Bay executive director, Andrew Dornan, was quick to point out that the company “will remain firmly focused on LCT pegmatites with potential for world-class lithium discoveries”, but these results “cannot be ignored”.

“As we have been doing for lithium, we will continue to sample and understand all relevant minerals on our properties,” Dornan said.

Olympio Metals (ASX:OLY) surged throughout the morning despite no fresh news, as did Yojee (ASX:YOJ) – they were trading 32% and 25% higher respectively by lunchtime.

Way2VAT (ASX:W2V) was surging on news that it’s set to roll out a new product called “AI-AP Compliance”, which the company says is a world-first AI-driven automated accounts payable auditing product, which it says has been built out to tie in seamlessly with the rest of its AI-driven software suite.

Large capper Altium (ASX:ALU) was also on the winners list – it’s not often we get to see an $8 billion company this high up in the rankings – so it’s definitely worth another mention, because it’s currently trading 28% higher than it was Wednesday.

And in late mail, it seems like Bellavista Resources (ASX:BVR) lit a fire under a few folks’ backsides at the RIU Explorers conference – after posting its presentation as an ASX announcement, it barrelled through a very tidy +30% jump.

Friday 16 February, 2024

The Australian Wealth Advisors Group (ASX:WAG) made its debut this morning, and was leading the ladder through the afternoon session, up close to 50% from its $0.25 IPO price that brought in $5 million.

The company, which refers to itself as AWAG, was “founded in Melbourne in September 2021 by a group of experienced financial market professionals as a holding company”, and has a stated mission to “acquire and build upon sound, profitable and complementary Australian financial services businesses.”

Adslot (ASX:ADS) was up on news of the launch of a new wholly-owned subsidiary called Br1dge, a New York based tech company “established to capitalise on the significant opportunities emerging with the imminent deprecation of 3rd party cookies”.

Third party cookies are the privacy-invading snippets of code that websites leave on your computer so advertisers can continue beaming you ads for monster-sized sex toys long after you’re done with that part of your browsing for the evening and scuttled back to Reddit in shame.

Big tech is phasing out the use of those cookies – most browsers won’t accept them by the end of the year – but by the looks of things, Adslot (via Br1dge) has found a workaround that will keep the targeted ads rolling in, so… hooray?

Olympio Metals (ASX:OLY) saw a bit of a rush in the morning, after the company advised the market that it’s current diamond drilling programme at the Cadillac Project is “well advanced and ahead of schedule”, with 22 holes completed to date on four separate pegmatite targets.

Mighty Kingdom climbed higher after informing the market after hours on Thursday of its intention to buy back all MKL shares held by Gamestar Studios – all 59,657,143 of them – for the princely sum of $1.

IPOs that happened

The Australian Wealth Advisors Group (ASX:WAG)

Listed: February 16, 2024

IPO:$5 million at 25 cents per share

The Australian Wealth Advisors Group (ASX:AWG) (or AWAG, please… I don’t want to keep typing that mouthful out over and over again) made its market debut on Friday 16 February, breaking immediately into a gallop and climbing as high as $0.37 by mid afternoon, before coming slightly off the boil as investors took profits to spend on the weekend.

The company describes itself as having a stated mission to “acquire and build upon sound, profitable and complementary Australian financial services businesses”, and will be led by Executive Chairman Lee IaFrate, with Paul Young, Mark Stephen and Michael Fitzpatrick AO filling out the remainder of the director’s chairs.

IPOs we’re (still) waiting for…

All dates are sourced from the ASX website. They can, and frequently do, change without notice.

Metals Acquisition (ASX:MAC)

Expected listing: February 20, 2024

IPO:$6 million at 20 cents/share

MAC is focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonisation of the global economy.

The company completed its first acquisition with the purchase of the CSA copper mine in Australia from Glencore PLC in June 2023.

The CSA Mine is located in Cobar in regional NSW, and is one of Australia’s highest grade copper mines. CSA Mine produces about 40,000 tonnes of copper each year.

In addition to the current operations, MAC also holds 566 square kilometres of tenements with the potential to expand and extend CSA’s future mine life.

Metals Acquisition is primarily listed on the NYSE under the ticker MTAL, and is now seeking a secondary listing on the ASX with CDI (CHESS depository interests) securities.

Golden Globe Resources (ASX:GGR)

Expected listing: February 26, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was down to list on the local bourse in October 2023.

In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.