ASX Small Caps and IPO Weekly Wrap: ASX falls 1.1% for the week, an ass-kicking we probably didn’t deserve

This visual pun is proudly brought to you by the Australian Dad Joke Association. Pic via Getty Images.

Unless your entire portfolio is “diversified” over Utilities and Consumer Staples, then it’s probably safe to say that you’ve just had a pretty bad week.

Broadly speaking, I reckon the best analogy for the week is that it’s like watching a Tarantino film… say, for example, Once Upon a Time in Hollywood – that bloated, self-indulgent miasma of a film, which served only to give the director a chance to add several hours of footage of the soles of Margot Robbie’s street-dirty feet into his long-rumoured spank bank.

The first act of the film was a fairly pedestrian expositional affair, but about halfway through it was nothing but foot porn and fist fights, with the final act a horrible bloodbath that managed to make us even more nauseous than before.

When the dust finally settled and the corpses tallied up, the ASX 200 benchmark was more than 1.0% lower, which (as I’m sure you already know), is widely considered to be a sub-optimal performance.

There are so many reasons why things went south this week, it’s hard to even know where to begin – but if you’re short on time right now and need to sound smart at the pub tonight, just say “We’re headed for a global recession… I give it 2 months, maybe 3” and get yourself a cold pint.

If pushed for more detail, “inflation has pushed interest rates super-high in the UK… worst for decades, like at least 30 years. Same kinda deal in the US, too – they’ll have two more rate hikes before Christmas”.

Between that, and the old “oil prices are tumbling while gas prices skyrocket”, it’ll probably be enough to stop any further questions.

You’re welcome.

TO MARKETS

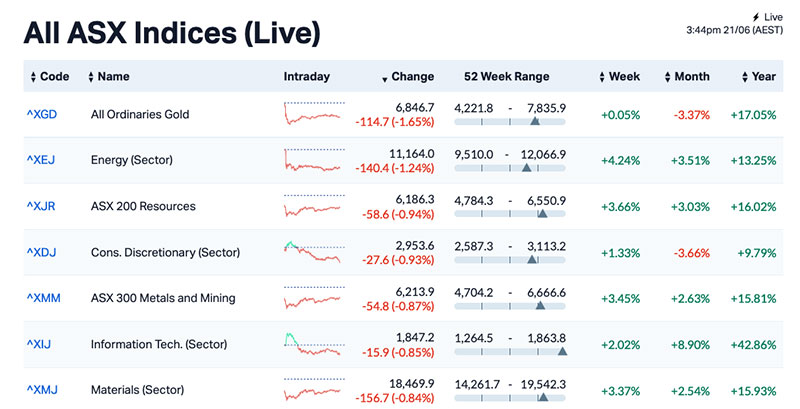

In more specific terms, two market sectors that really did well were the aforementioned Utilities and Staples.

Utilities added about 2.5% for the week, with large supplier AGL Energy (ASX:AGL) happily price-gouging its way to a 13.6% gain, after the failure of the federal government’s price-capping strategy became even more glaringly apparent.

Households are facing energy bill rises in the coming months that are astronomically huge, since the market took one look at the $12 a gigajoule price cap on wholesale gas prices and promptly decided it looks a lot more like a floor than a ceiling, because of course they did.

Im not angry, just disappointed. But also really angry.

By Tuesday, wholesale gas prices had climbed 17% in just a week, dooming us normal folks to a shivery winter where the only source of warmth would be our houses burning down.

On the Consumer side, the market movers have all banked solid weeks, with Woolworths (ASX:WOW) adding 3.5% and Coles Group (ASX:COL) climbing 2.5% because people gotta eat… and Endeavour Group (ASX:EDV) 6.23% climb (thanks to Dan Murphy’s, BWS et al) indicating that we’re all in desperate need of a drink to take our minds of how poorly things are going.

But other than those two, the sectors are grim.

InfoTech wore the worst of it, down 3.0% and shadowing broad tech sell-offs in the US which were hardly surprising, considering how hard – and unsustainably – they’ve been surging in recent times.

The Materials sector also took a beating, down 2.7% this week because it’s conveniently located right next to the “In case of emergency, break glass to sell all your mining shares” sign in the break room.

Even the goldies weren’t immune, despite normally being a pretty safe bet when the macro news from overseas starts pointing to the toilet with a weary look in its eyes.

The XGD All Ords Gold index fell 1.9% this week, after being among the most reliable market leaders for weeks.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week 19 – 23 June, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| RGI | Roto-Gro Intl Ltd | 0.22 | 1900% | $4,333,920 |

| TNC | True North Copper | 0.2475 | 367% | $63,661,155 |

| RDN | Raiden Resources Ltd | 0.007 | 75% | $12,331,614 |

| GRE | Greentechmetals | 0.56 | 70% | $22,840,725 |

| XAM | Xanadu Mines Ltd | 0.1 | 67% | $155,593,298 |

| KNM | Kneomedia Limited | 0.005 | 67% | $7,523,927 |

| ERD | Eroad Limited | 1.135 | 62% | $127,598,565 |

| MRZ | Mont Royal Resources | 0.14 | 59% | $8,217,920 |

| CMD | Cassius Mining Ltd | 0.033 | 57% | $12,914,933 |

| KGL | KGL Resources Ltd | 0.155 | 57% | $85,093,779 |

| KNI | Kunikolimited | 0.45 | 53% | $19,314,681 |

| AYM | Australia United Min | 0.003 | 50% | $5,527,732 |

| KEY | KEY Petroleum | 0.0015 | 50% | $2,951,892 |

| WEL | Winchester Energy | 0.003 | 50% | $3,061,266 |

| MI6 | Minerals260Limited | 0.685 | 49% | $135,720,000 |

| AHI | Advanced Health | 0.22 | 42% | $54,300,992 |

| JNO | Juno | 0.095 | 42% | $12,209,220 |

| ADY | Admiralty Resources. | 0.007 | 40% | $10,428,633 |

| AUG | Augustus Minerals | 0.3 | 40% | $21,364,300 |

| BLZ | Blaze Minerals Ltd | 0.0265 | 39% | $11,437,706 |

| DCL | Domacom Limited | 0.039 | 39% | $16,549,067 |

| SCN | Scorpion Minerals | 0.096 | 37% | $32,842,088 |

| DUB | Dubber Corp Ltd | 0.185 | 37% | $60,361,816 |

| FZR | Fitzroy River Corp | 0.185 | 37% | $19,971,536 |

| AW1 | Americanwestmetals | 0.12 | 36% | $31,939,394 |

| EMC | Everest Metals Corp | 0.15 | 36% | $18,120,635 |

| FNX | Finexia Financialgrp | 0.3 | 36% | $14,389,673 |

| NGX | Ngxlimited | 0.27 | 35% | $23,559,078 |

| CTT | Cettire | 2.55 | 34% | $914,971,728 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $8,737,021 |

| CCO | The Calmer Co Int | 0.004 | 33% | $1,334,333 |

| CTN | Catalina Resources | 0.004 | 33% | $4,953,948 |

| EPM | Eclipse Metals | 0.016 | 33% | $30,420,897 |

| MCT | Metalicity Limited | 0.002 | 33% | $7,472,172 |

| REC | Rechargemetals | 0.35 | 32% | $31,282,350 |

| WEC | White Energy Company | 0.12 | 30% | $5,348,315 |

| LRS | Latin Resources Ltd | 0.26 | 30% | $612,197,180 |

| PSC | Prospect Res Ltd | 0.13 | 30% | $62,405,027 |

| AFW | Applyflow Limited | 0.013 | 30% | $1,922,448 |

| AZS | Azure Minerals | 1.335 | 30% | $519,013,976 |

| AUE | Aurumresources | 0.155 | 29% | $3,875,000 |

| IND | Industrialminerals | 0.725 | 28% | $20,895,000 |

| AQC | Auspaccoal Ltd | 0.14 | 27% | $50,360,088 |

| SLS | Solsticeminerals | 0.165 | 27% | $14,541,587 |

| MM1 | Midasmineralsltd | 0.31 | 27% | $21,374,824 |

| MMC | Mitremining | 0.34 | 26% | $12,426,408 |

| GRX | Greenx Metals Ltd | 1.13 | 26% | $273,027,928 |

| CGO | CPT Global Limited | 0.295 | 26% | $11,102,802 |

| LVH | Livehire Limited | 0.069 | 25% | $22,479,663 |

| AHC | Austco Healthcare | 0.175 | 25% | $52,342,230 |

There are some oddities in the charts this week, most notably True North Copper (ASX:TNC) which posted what looks like a 367% gain, but it’s not quite what it looked like on the data charts.

True North Copper was the subject of a reverse takeover by Duke Exploration that started late last year, and the whole thing has taken quite a while to get resolved.

As Stockhead’s very own Josh Chiat explains it, a reverse takeover is “kind of like the alien spawn growing inside of Sigourney Weaver, which then bursts out and becomes a (more friendly) xenomorph.”

That xenomorph has emerged from the chest of the ASX today, with the whole rebranded thing assuming the value of both DEX and TNC, which was well above TNC’s price when the reverse takeover began, and so that’s why it looks like such a huge gain.

Greentech Metals (ASX:GRE), which did super-well last week has managed to creep under the radar and into top spot for the week, up 70% for the week and so close to +300% for the month that I doubt anyone would fight you if you started to say that it was.

Xanadu Mining (ASX:XAM) finished the week 67% higher, takeover target Eroad (ASX:ERD) closed 62% higher and Mont Royal Resources (ASX:MRZ) added 59% – all stirling efforts considering what an abomination the week turned out to be.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week 19 – 23 June, 2023:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -50% | $1,721,315 |

| INP | Incentiapay Ltd | 0.008 | -43% | $11,385,573 |

| MBX | Myfoodieboxlimited | 0.006 | -40% | $185,640 |

| FAU | First Au Ltd | 0.0025 | -38% | $4,355,980 |

| SRJ | SRJ Technologies | 0.082 | -37% | $8,741,232 |

| LKE | Lake Resources | 0.305 | -34% | $433,845,636 |

| CAV | Carnavale Resources | 0.002 | -33% | $5,467,103 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| TMX | Terrain Minerals | 0.006 | -33% | $6,499,196 |

| LRL | Labyrinth Resources | 0.0095 | -32% | $8,635,386 |

| IGN | Ignite Ltd | 0.05 | -32% | $4,837,437 |

| MRL | Mayur Resources Ltd | 0.125 | -31% | $42,097,626 |

| OPN | Oppenneg | 0.011 | -30% | $3,637,950 |

| DGL | DGL Group Limited | 0.675 | -30% | $195,164,175 |

| C29 | C29Metalslimited | 0.095 | -30% | $3,929,856 |

| SFM | Santa Fe Minerals | 0.043 | -30% | $3,131,208 |

| EGY | Energy Tech Ltd | 0.032 | -29% | $10,805,115 |

| TIG | Tigers Realm Coal | 0.005 | -29% | $65,333,512 |

| WFL | Wellfully Limited | 0.005 | -29% | $2,464,721 |

| PKD | Parkd Ltd | 0.023 | -28% | $2,341,822 |

| AN1 | Anagenics Limited | 0.013 | -28% | $5,484,299 |

| ECG | Ecargo Hldg | 0.013 | -28% | $7,998,250 |

| AT1 | Atomo Diagnostics | 0.021 | -28% | $11,988,711 |

| ELE | Elmore Ltd | 0.008 | -27% | $11,195,071 |

| ENV | Enova Mining Limited | 0.008 | -27% | $3,127,435 |

| ILA | Island Pharma | 0.095 | -27% | $7,720,504 |

| M4M | Macro Metals Limited | 0.003 | -25% | $7,948,311 |

| MTB | Mount Burgess Mining | 0.0015 | -25% | $1,324,757 |

| PIL | Peppermint Inv Ltd | 0.006 | -25% | $14,264,998 |

| TYM | Tymlez Group | 0.003 | -25% | $3,276,586 |

| VPR | Volt Power Group | 0.0015 | -25% | $16,074,312 |

| HTG | Harvest Tech Grp Ltd | 0.034 | -24% | $23,377,318 |

| CDR | Codrus Minerals Ltd | 0.087 | -24% | $3,557,840 |

| MNS | Magnis Energy Tech | 0.1325 | -24% | $156,146,408 |

| ABE | Ausbondexchange | 0.15 | -24% | $5,812,965 |

| UNT | Unith Ltd | 0.026 | -24% | $24,943,467 |

| MDX | Mindax Limited | 0.06 | -23% | $122,733,527 |

| RXH | Rewardle Holding Ltd | 0.02 | -23% | $11,052,751 |

| MQR | Marquee Resource Ltd | 0.047 | -23% | $14,397,130 |

| RLF | Rlfagtechltd | 0.135 | -23% | $11,814,818 |

| BYH | Bryah Resources Ltd | 0.014 | -22% | $4,782,742 |

| GLL | Galilee Energy Ltd | 0.098 | -22% | $38,931,812 |

| ARN | Aldoro Resources | 0.11 | -21% | $14,786,612 |

| CI1 | Credit Intelligence | 0.11 | -21% | $9,184,908 |

| JAL | Jameson Resources | 0.055 | -21% | $21,533,111 |

| NNG | Nexion Group | 0.011 | -21% | $2,284,618 |

| PVW | PVW Res Ltd | 0.055 | -21% | $5,415,498 |

| TOY | Toys R Us | 0.011 | -21% | $9,493,953 |

| TRU | Truscreen | 0.023 | -21% | $9,582,766 |

| ELT | Elementos Limited | 0.135 | -21% | $26,289,911 |

HOW THE WEEK PLAYED OUT

Monday 19 June, 2023 – ASX 200 up 0.5%

A positive start to the week, for sure, thanks to strong performances in the Health Care sector pushed it to a much-needed 1.83% gain, after the -6.1% shocker it had the week before.

Gold 50 (ASX:G50) won the day with a 36% gain news that the company has intersected high-grade gold-silver mineralisation within several broad mineralised zones at its Golconda project in Arizona.

The intersects include 35m at 5.2g/t gold and 5.9g/t silver from 176.8m including 9m at 19.5g/t gold and 17.8g/t silver, and 11m at 1.2g/t gold, 399g/t silver, 0.31% copper and 0.55% zinc from 61.0m and immediately below historic underground workings.

Bastion Minerals (ASX:BMO) locked in second on the ladder, up 31% after it reported staking a strategic 115km2 REE exploration tenure near Gyttorp in South Sweden., and Mont Royal Resources (ASX:MRZ) packed on a very tidy 31%.

Tuesday 20 June, 2023 – ASX 200 up 0.5%

Tuesday rolled round and it was Energy’s time to shine, stacking on 1.94% thanks to market movers like Woodside (ASX:WDS) adding 2.4%, Santos (ASX:STO) climbing 2.25% and the little guys got into the action as well, including White Energy’s (ASX:WEC) 20% gain.

But the rumblings on Tuesday set the tone for the rest of the week. China’s rumoured stimulus package was shaping up to be tiny compared to what many analysts expected, and a raft of inflationary data was due from the UK which was rumoured to be on the terrible side of bad.

Plus, Jerome Powell was gearing up to tell Congress some sour news as well, which is never a good idea.

Locally, the RBA’s call for 0.9% more Australians to join the dole queue for some reason failed to resonate with the public, as the argument for a large chunk of the population to lose their job so that the interest they’d be left to pay on the mortgages they then couldn’t pay might be lower was judged to be just as ludicrous as it sounds.

Brightstar Resources (ASX:BTR) emerged as the Small Caps winner for the day, up 30% after announcing that its journey to becoming the nation’s newest gold producer is one large step closer to completion.

BTR said that mining personnel and equipment supplied by its partner BML Ventures will be mobilising in late July to its Menzies project in WA, marking the kick-off of production with an expected 30,000t of ore at a head grade of more than 6 grams per tonne (g/t) gold from within the Selkirk open pit mine in August.

Xanadu Mining (ASX:XAM) continued its mysterious climb, up another 27.8% in spite of a Please Explain from the ASX and Olympio Metals (ASX:OLY) added 27.3% for the day and earned itself a speeding ticket all of its own for its efforts.

Wednesday 21 June, 2023 – ASX 200 down 0.6%

And here’s where the rot set in, with a sad performance by the market that left the benchmark 0.6% lower, after pretty much everything even tangentially related to mining was thrown to the wolves by investors.

The fact that it kicked off the morning after Federal Resources Minister dropped her long-awaited Critical Minerals Strategy 2023–2030 roadmap, might be a coincidence, but probably (definitely) is not.

The Hon Madeleine West and the team in her Resource portfolio’s office put out the outlook and strategy document that was big on PR buzzwords and promises, and disappointingly light in the other parts that it seems investors were looking for, to back up their trust in the country’s place in a decarbonised, zero-emissions, battery-powered future.

Any suggestion the minister might be slightly out of her depth are entirely your own opinions, and definitely weren’t suggested by me.

By the end of the day the rout was all but complete, with six of the seven worst performers all mining related.

But Consumer Staples did “okay”, adding 0.78% led by Bubs Australia’s (ASX:BUB) 27.5% jump, after the recently-revamped board revealing the company’s banked its first $1 million month on Amazon, and its Direct-to-Consumer (DTC) business is growing nicely, with YTD Net Revenue of $1.8 million.

The Small Caps headline was the market’s Welcome Back party for Iris Metals (ASX:IR1), which had been MIA from the ASX since December, but emerged from the murk and relisted on Wednesday.

After falling foul of a few bits of Chapters 1 and 2 of the ASX Listing Rules, and as part of its re-compliance requirements, the company says it has successfully completed the $15 million cap raise required to get back in the good books and start being traded again.

Investors were well on board with Iris returning to the fold, pushing it 45% higher by lunchtime, which has settled back to a +33.6% gain for the day.

Imagion Biosystems Limited (ASX:IBX), with brand new CEO Isaac Bright at the helm, and an announcement that the company’s MagSense HER2 imaging agent Phase 1 study (IBI10103) has achieved its enrolment target, and is set to get rolling, added 25%.

And American West Metals (ASX:AW1), put on 29.12%, riding high on last week’s news that a high-resolution ground gravity survey at the company’s Storm prospect has identified significant new anomalies that support the potential for a large-scale sediment-hosted copper system.

Thursday 22 June, 2023 – ASX 200 down 1.63%

Yeah. Total shocker yesterday, with the board a sea of red and providing a proper boot to the nards market-wide.

InfoTech led the race to the basement, banking a horrible 3.94% loss after a number of their US compatriots took a hammering on Wall Street overnight, thanks to yet another round of inflationary pressure-driven rate-hike heebie-jeebies rattled things in New York.

The US wasn’t alone with its woes – in the UK, inflation data there came back a lot more shop-soiled than economists were hoping, and Asian markets continued to try to make sense of why China had been sounding all bullish on a rate cut-driven stimmy pack, only to barely move the needle at all.

Research by property marketplace Domain suggested that anyone not already established on the property markets in the nation’s capital cities might want to practice some deep-breathing exercises, or invest in a 44-gallon drum of lube.

Domain reckons prices are going to skyrocket – in Sydney’s case, by between 6% and 9% – next year, which is set to push prices well beyond reach of pretty much everyone. Yes, even you.

In Small Caps, it was fleet and safety management company Eroad (ASX:ERD) Eroad (ASX:ERD) up top on +61.7% (down from +69.5 at lunch), on news that it’s received an unsolicited, non-binding indicative proposal from Brillian APAC Pty Ltd, part of the Volaris Group.

The Volaris Group is an operating group of Toronto Stock Exchange-listed Constellation Software Inc (TSX:CSU).

The proposal on the table is for 100% of ERD at $1.30 per share, well above its $0.70 open for the day – and at present, a day later, it’s seemingly stuck around the $1.13 mark.

Estrella Resources (ASX:ESR) hit a 57.1% home run on news that the company has signed an agreement with Canadian-based geophysical firm Expert Geophysics to commence a world-first helicopter-borne electromagnetic survey (TargetEM) at the company’s Carr Boyd nickel-copper-PGE project, and Errawarra Resources (ASX:ERW) gained 37.9% on no news, after apparently restarting its recent climb that has seen it gain 150% for the month, despite a hiccup that knocked some of the gloss off over the previous couple of days.

Friday 23 June, 2023 – ASX 200 down 1.5%

And that brings us to today, which has also been a bit shit, with the benchmark down around 1.5% with about 30 minutes left to run on the session.

Today, it was Energy’s turn to eat itself, falling 4.4% and taking the rest of the market with it on a death spiral to the depths of the deep red sea after a number of our biggest players in the sector were heavily sold off throughout the morning.

Woodside (ASX:WDS) fell 5.2%, Santos (ASX:STO) fell 4.6%, New Hope (ASX:NHC) is down 3.8%… and yeah, you get the picture.

It’s most likely got something to do with crude prices freefalling again overnight, leaving Brent crude down 3.9%.

Adding to the market-wide woes, Real Estate (-2.6%) and the bloated fat cats in Financials (-1.8%) certainly didn’t help the cause – and neither did Materials, Industrials and InfoTech, which all fell more than 1.0% today too.

Biotech Invex Therapeutics (ASX:IXC) topped the day, up 48% on news that the European Medicines Agency (EMA) has granted the company’s Exenatide orphan drug designation (ODD) in the treatment of moderate to severe Traumatic Brain Injury (TBI).

It’s the second ODD for Exenatide in Europe, with IXC receiving an ODD for Idiopathic Intracranial Hypertension (IIH) in 2017, alongside an ODD from the US Food and Drug Administration (FDA), also for IIH.

Tempest Minerals (ASX:TEM) is up another 46%, continuing its run on yesterday’s announcement that they’re going to fly a helicopter over the company’s 100% owned Yalgoo tenements, which is about as positive as news needed to be to give investors something happy to aim at for the day.

And Delta Lithium (ASX:DLI), put on 26% for the day after hitting intercepts of 33m @ 1.9% Li2O from 218m, and 19m @ 1.6% Li2O from 190m, while drilling at its 505km2 Yinnetharra lithium project in the Gascoyne region of WA.

IPO listings this week

There aren’t any leaping out of the data this afternoon for me to see, but we’re due to have one next week (allegedly), which I am thoroughly looking forward to telling you all about, when (and if) it goes ahead.

But for now, that’s it from me for the week. Enjoy your weekend.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.