ASX Small Caps and IPO Weekly Wrap: ASX 200 oozes to a fraught +0.75pc weekly ‘win’

Well... it's kind of a victory, but was the prize really worth it? Pic via Getty Images.

- Solid early losses this week lead to a very pedestrian finish.

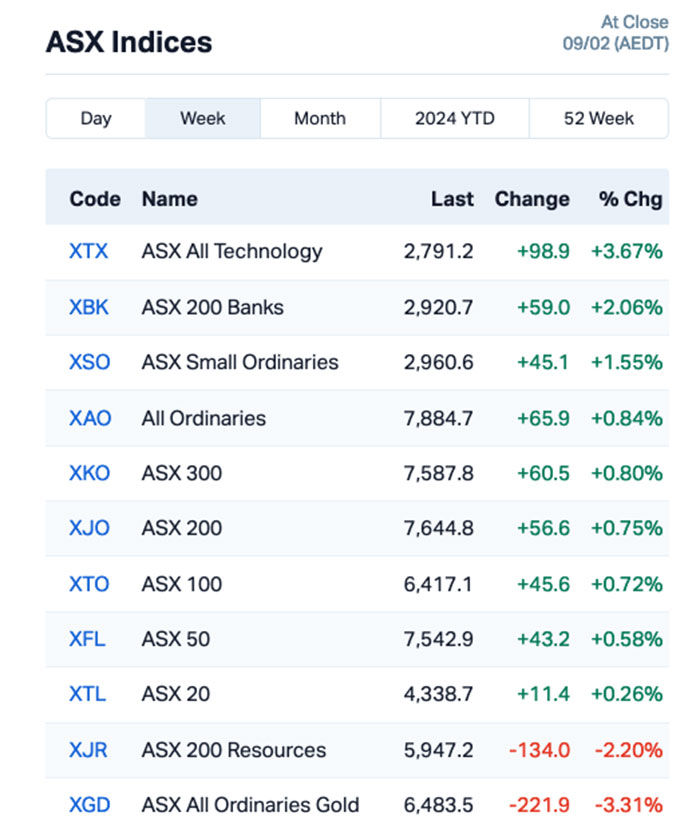

- ASX 200 benchmark wraps the week +0.75pc better off.

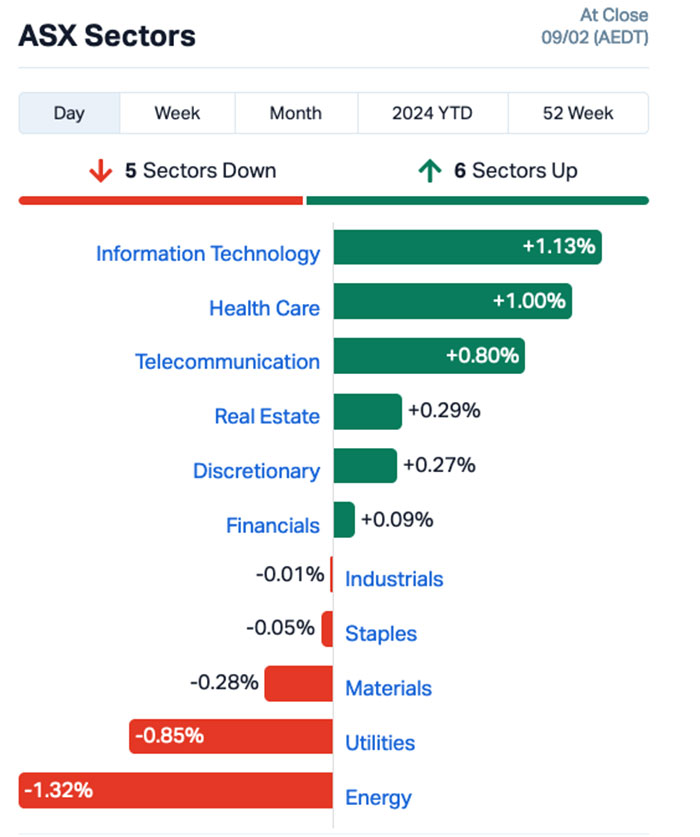

- Volatile Tech sector ranks best, with last week’s leader Real Estate close behind.

This week got off to a pretty poor start, with two days of broad sell-offs that rattled investors for a wide variety of reasons – but principal among them were external factors that are consistent drivers of sentiment, whether we like it or not.

The first and most visible was US reactions to words from the top at the US Federal Reserve, where a shambling pension-ready Jerome Powell did what he does best, spooking the market about interest rates, causing US investors to sell and making the cows give sour milk.

It’s an odd scenario whenever Powell speaks – nothing he said at the top of the week was in any way surprising, we all knew what he was likely to be talking about, and his explanation as to why the US Fed isn’t contemplating making any near-future rate cuts is crystal clear and entirely within the realms of Good Policy.

But… there’s the fact that a large percentage of the time that the market tanks when he’s been at the microphone suggests that it might be him, personally, that’s getting on US investor’s collective goats.

The second tranche of international interference came via Xi Jinping taking China on his own version of a Long March, as the economy in China continues to crater and commodities markets take an inescapable beating.

Metals in particular have been in the firing line – and while gold has managed to remain relatively stable throughout the week, clinging desperately onto a better-than US$2,000 per ounce value, other metal markets are falling in a heap.

Copper, for example, is off by about 3.0% this week. Iron ore is down below $130/t after shedding more than 4.0% this week. Palladium is off 5.7%, Lead is off 4.74%, Zinc is off 6.0%… the list continues.

There was a ray of hope from lithium this week – it’s priced up by about 2.1% this week, but it’s still down 78.5% over the past 12 months, so any single digit gains are a drop in the bucket for any lithium-heavy investors.

The big mover, again, has been uranium, which has been surging ever since Borat’s buddies at Kompromat or whatever the big uranium miner there is called revealed that things aren’t going so well for them any more.

That was a shot in the arm for local uranium diggers – but even they had the wind knocked out of their very non-renewable sails at the tail end of the week, when uranium giant Comeco stepped up to the microphone and told the world that it has more than enough capacity – and all the financial incentive – to step up and produce enough yellowcake for everybody who wants some.

It was the ever-mercurial InfoTech sector that took line honours this week, but not before taking investors on a five-day rollercoaster ride of economic emotions, through the simple expedience of being so volatile, it’s a damned miracle the whole place wasn’t reduced to matchsticks by the blast.

Tucked in close behind was Real Estate, which threw another 3.9% gain on top of last week’s 6.0% rocket ride.

But the tail of the tape tells the story of rotten commodities and slowing demand for raw materials in China – the Energy sector ended the week on the bottom rung, more than 2.0% off its game.

The beleaguered Materials sector was, likewise, in the murk and well below breakeven as well.

At a more granular level, it was the bankers and small caps that out-performed everything other than InfoTech, with those two ‘official’ indices banking +2.0% and +1.5% rises respectively.

But, who won the week? Let’s find out together…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.0025 | 150% | $9,878,481.43 |

| TD1 | Tali Digital Limited | 0.002 | 100% | $6,590,311.25 |

| BRX | Belararox Ltd | 0.245 | 81% | $18,445,445.20 |

| AUK | Aumake Limited | 0.005 | 67% | $9,572,034.01 |

| ENV | Enova Mining Limited | 0.03 | 67% | $17,946,021.52 |

| KPO | Kalina Power Limited | 0.005 | 67% | $8,840,512.04 |

| DUB | Dubber Corp Ltd | 0.22 | 63% | $70,426,850.94 |

| HTG | Harvest Tech Grp Ltd | 0.03 | 58% | $21,178,900.14 |

| MKG | Mako Gold | 0.022 | 57% | $14,573,006.95 |

| VMS | Venture Minerals | 0.014 | 56% | $17,680,104.28 |

| HMY | Harmoney Corp Ltd | 0.65 | 53% | $66,276,695.55 |

| GRE | Greentech Metals | 0.34 | 51% | $28,587,191.50 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | $2,753,344.67 |

| KGD | Kula Gold Limited | 0.009 | 50% | $3,808,907.29 |

| PNX | PNX Metals Limited | 0.006 | 50% | $32,283,748.31 |

| PUA | Peak Minerals Ltd | 0.003 | 50% | $3,124,129.85 |

| YRL | Yandal Resources | 0.135 | 50% | $32,861,661.84 |

| BRN | Brainchip Ltd | 0.24 | 50% | $361,162,937.00 |

| QXR | Qx Resources Limited | 0.022 | 47% | $29,972,102.06 |

| ARV | Artemis Resources | 0.019 | 46% | $27,059,138.38 |

| AXN | Alliance Nickel Ltd | 0.046 | 44% | $29,759,424.22 |

| ACS | Accent Resources NL | 0.01 | 43% | $4,731,272.83 |

| JAN | Janison Edu Group | 0.355 | 42% | $95,851,089.00 |

| OPN | Oppenneg | 0.007 | 40% | $9,033,437.08 |

| DEL | Delorean Corporation | 0.053 | 39% | $11,433,208.50 |

| IR1 | Iris Metals | 0.78 | 38% | $81,575,538.66 |

| CCZ | Castillo Copper Ltd | 0.0055 | 38% | $6,497,526.78 |

| BOC | Bougainville Copper | 0.475 | 36% | $200,531,250.00 |

| DRO | Droneshield Limited | 0.695 | 35% | $361,170,630.49 |

| RDM | Red Metal Limited | 0.175 | 35% | $53,698,200.84 |

| CL8 | Carly Holdings Ltd | 0.02 | 33% | $4,830,667.04 |

| NES | Nelson Resources | 0.004 | 33% | $2,454,377.31 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619.43 |

| SYR | Syrah Resources | 0.52 | 33% | $364,984,774.20 |

| OIL | Optiscan Imaging | 0.098 | 31% | $81,863,398.69 |

| AUN | Aurumin | 0.039 | 30% | $15,054,609.40 |

| PER | Percheron | 0.075 | 29% | $64,009,692.94 |

| NGL | Nightingale Intelligent Sytems | 0.053 | 29% | $5,479,125.13 |

| AUR | Auris Minerals Ltd | 0.009 | 29% | $4,289,633.61 |

| KAU | Kaiser Reef | 0.135 | 29% | $21,380,486.75 |

| PEC | Perpetual Res Ltd | 0.009 | 29% | $5,760,264.78 |

| CYP | Cynata Therapeutics | 0.185 | 28% | $32,333,721.48 |

| GTE | Great Western Exploration | 0.042 | 27% | $16,008,488.38 |

| HT8 | Harris Technology Gl | 0.014 | 27% | $4,187,896.73 |

| TGM | Theta Gold Mines Ltd | 0.14 | 27% | $64,750,125.26 |

| PLC | Premier1 Lithium Ltd | 0.044 | 26% | $5,881,195.76 |

| WC8 | Wildcat Resources | 0.54 | 26% | $562,043,917.81 |

| ZIP | ZIP Co Ltd.. | 0.91 | 26% | $888,558,677.31 |

| EOS | Electro Optic Sys. | 1.455 | 25% | $233,737,148.19 |

| ASV | Asset Vision Co | 0.01 | 25% | $7,258,365.65 |

Tech minnows Linius Technologies (ASX:LNU) and TALi Digital (ASX:TD1) didn’t exactly feature in a lot of the headlines this week, but the pair of them have dominated the small caps winners table for the week.

Linius announced on Monday that it had received firm commitments from professional and sophisticated investors to raise $565,000, including $50,000 from Directors and/or nominees, before costs – and since then, has piled on a 150% gain for the week.

As for Tali Digital, the news appears to be something of a blow to the ego for David Williams, after the company added 100% to its market cap when the only news to the ASX was that Williams was stepping down from the board, effective at the end of this month.

There was a big move by Belararox (ASX:BRX) this week, after assay results revealed anomalous lithium up to 300 ppm (646 ppm Li2O) from the company’s 100% owned Bullabulling Lithium and Gold project located west of Coolgardie in Western Australia.

Belarox is showing a gain of around 81% from the past five sessions – including a short loss taken today that saw the company dipping by 5.7% late on Friday afternoon.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| TTA | TTA Holdings Ltd | 0.003 | -73% | $412,270.23 |

| EE1 | Earths Energy Ltd | 0.014 | -66% | $7,419,499.05 |

| BCT | Bluechiip Limited | 0.006 | -51% | $4,772,242.76 |

| SLB | Stelar Metals | 0.084 | -46% | $4,245,041.93 |

| T3D | 333D Limited | 0.01 | -41% | $1,313,894.29 |

| DY6 | DY6 Metals | 0.052 | -39% | $2,567,228.69 |

| MSG | Mcs Services Limited | 0.01 | -38% | $1,782,896.87 |

| WIN | Widgie Nckel | 0.0415 | -36% | $12,513,692.23 |

| M24 | Mamba Exploration | 0.034 | -36% | $8,099,620.14 |

| EPX | EP&T Global Limited | 0.02 | -36% | $9,810,101.62 |

| ARC | ARC Funds Limited | 0.125 | -34% | $5,714,506.88 |

| EMU | EMU NL | 0.001 | -33% | $2,024,771.29 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $1,633,728.79 |

| JAY | Jayride Group | 0.02 | -33% | $4,453,773.24 |

| NET | Netlinkz Limited | 0.004 | -33% | $15,513,793.42 |

| NRZ | Neurizer Ltd | 0.006 | -33% | $8,483,464.99 |

| RBR | RBR Group Ltd | 0.002 | -33% | $4,855,213.98 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208.21 |

| YPB | YPB Group Ltd | 0.002 | -33% | $1,580,922.94 |

| INV | Investsmart Group | 0.105 | -32% | $22,115,475.02 |

| PIM | Pinnacle Minerals | 0.09 | -31% | $3,812,942.87 |

| UNT | Unith Ltd | 0.014 | -30% | $13,510,712.51 |

| HXL | Hexima | 0.012 | -29% | $1,837,435.92 |

| SCN | Scorpion Minerals | 0.018 | -28% | $7,370,211.46 |

| IMR | Imricor Med Systems | 0.43 | -28% | $76,857,750.97 |

| AMT | Allegra Medical | 0.023 | -26% | $2,631,442.62 |

| MXO | Motio Ltd | 0.023 | -26% | $8,582,347.07 |

| GLN | Galan Lithium Ltd | 0.305 | -26% | $124,589,390.40 |

| RBX | Resource B | 0.056 | -25% | $4,961,069.10 |

| CNJ | Conico Ltd | 0.003 | -25% | $4,710,284.84 |

| ENT | Enterprise Metals | 0.003 | -25% | $3,207,883.73 |

| INP | Incentiapay Ltd | 0.003 | -25% | $3,731,790.05 |

| MOH | Moho Resources | 0.006 | -25% | $3,215,646.98 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $11,677,324.30 |

| MRQ | MRG Metals Limited | 0.0015 | -25% | $4,942,682.06 |

| OXT | Orexplore Technologies | 0.024 | -25% | $4,885,391.15 |

| PLN | Pioneer Lithium | 0.12 | -25% | $3,979,500.14 |

| RGS | Regeneus Ltd | 0.006 | -25% | $1,838,621.48 |

| TMK | TMK Energy Limited | 0.0045 | -25% | $30,612,896.50 |

| VAR | Variscan Mines Ltd | 0.009 | -25% | $3,411,003.31 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832.41 |

| ZMM | Zimi Ltd | 0.03 | -25% | $3,905,783.33 |

| EVS | Envirosuite Ltd | 0.064 | -25% | $78,621,707.22 |

| CBE | Cobre | 0.052 | -25% | $14,919,371.74 |

| LPM | Lithium Plus | 0.16 | -24% | $14,188,053.00 |

| REE | Rarex Limited | 0.016 | -24% | $10,934,185.17 |

| FTL | Firetail Resources | 0.045 | -24% | $7,296,372.24 |

| DTR | Dateline Resources | 0.01 | -23% | $13,295,561.64 |

| IPD | Impedimed Limited | 0.081 | -23% | $171,981,173.37 |

| MTC | Metalstech Ltd | 0.17 | -23% | $32,122,280.30 |

HOW THE WEEK SHOOK OUT

Monday 05 February, 2024

The party was most definitely on at Bioxyne (ASX:BXN), after news that the company’s wholly-owned subsidiary Breathe Life Sciences has been awarded a Good Manufacturing Practice (GMP) licence to manufacture medical cannabis. And psilocybin. And MDMA.

That’s huge news for Bioxyne, as the licence also allows Breathe Life Sciences to produce “final dose form capsules for supply to authorised prescribers and clinical trials”.

Battery anode business Ecograf (ASX:EGR) surged 36%, despite not having anything of interest to tell the market – and I’m not entirely sure why. I’ll try and find out, but don’t hold your breath waiting for an answer just yet.

And a couple of the smaller goldies, namely Belararox and Great Western Exploration, saw significant post-lunch surges despite a lack of fresh announcements as well.

Red Metal continued its recent success, moving 21.5% higher on last week’s news of outstanding leach results received from initial metallurgical testing at the company’s new Sybella discovery.

Last week’s high-flyer Mako Gold (ASX:MKG) was at it again, rising another 16.6% after delivering a presentation to the 121/Mining Indaba Conference in Cape Town, South Africa.

The prezzo didn’t contain any salient information that the market didn’t already know about, by the looks of things – but it does tie up all of Mako’s recent great news in a pretty format, so there’s that.

Tuesday 06 February, 2024

Janison Education Group (ASX:JAN) was topping the winners list on Tuesday morning, posting a 43% gain on news that the company has inked a deal with the New South Wales Department of Education to deliver the state’s selective education placement tests as computer-based tests via Janison’s digital assessment platform.

The deal, which also includes Cambridge University Press & Assessment, is reportedly worth up to $45 million over the initial five-year term – provided all stages are approved – with an option for the department to extend for a further five-year term.

Mako Gold’s (ASX:MKG) position as market darling looks set to continue again today, with the company landing another 25% jump this morning on the back of a string of happy announcements that kicked off at the end of January with the company’s quarterly.

Since then, Mako has revealed positive rock chip sampling results that suggest a “very high grade” find at Tchaga North, on the company’s 90% owned flagship Napié Project in Côte d’Ivoire.

Since 30 January, Mako has improved from a close of $0.011 to be at $0.032 per share at lunchtime today, and up 220% for the year so far.

And another junior goldie, Koonenberry Gold (ASX:KNB), was up 23% Tuesday morning, improving on the previous session’s gains when it announced that Phase 2 drilling at the company’s Bellagio prospect has defined widespread gold mineralisation >1g/t Au over >125m area, with the target remaining open down dip and plunge.

The afternoon session saw a couple of small goldies meandering around on no news, including BMG Resources (ASX:BMG) and Australasian Metals (ASX:A8G).

Wednesday 07 February, 2024

Sunshine Metals (ASX:SHN) was out in front on Wednesday morning, popping a 40% spike on news that there’s been a significant upgrade to the company’s Liontown resource (not to be confused with Liontown Resources (ASX:LTR), which is a whole different company).

Sunshine’s Liontown resource (again, not the company) has increased 21% to 2.94mt @ 10.6% ZnEq, which includes a 116% increase in Indicated Resources to 1.85mt @ 10.9% ZnEq, now 63% of the total resource.

For what it’s worth, Liontown Resources (the company, not the resource) is also moving sharply – up nearly 10% last time I checked, without any announcement… so I am growing concerned that there might be investors throwing money at the wrong thing in their rush to get behind Sunshine’s fabulous news.

Direct-to-consumer unsecured personal loan specialists Harmoney Corp (ASX:HMY) posted a solid gain for the morning as well, up 28.6% despite not having much to say to the market for about a week.

Yowie Group (ASX:YOW) is up again as well, after the apparently-stalled takeover bid by Keybridge Capital (ASX:KBC) was thrown a lifeline by regulators late on Tuesday.

“Keybridge has sought, and received, consent from the Australian Securities and Investments Commission (ASIC) … to enable unaccepted offers under its takeover bid for Yowie,” according to an announcement that arrived after hours on Tuesday.

There was, apparently, a SNAFU at Keybridge during the Christmas break, and I suspect someone forgot to put something in the mail – meaning Keybridge “did not dispatch the Bidder’s Statement within the 28-day time period prescribed by item 6 of subsection 633(1)”.

But, ASIC has seen fit to allow things to continue like nothing happened, and Keybridge is set to deliver a new bidder’s statement shortly as the takeover bidding continues.

Harris Technology (ASX:HT8) moved quickly in the afternoon, rising 38.5% to take the company’s gains to 50% for the week, and more than 68% for the month, after the company announced Q2 FY24 Sales of $4.9 million that led to positive operating cash flow of $235,000 for the quarter, which was reported to the market in late January.

NickelX (ASX:NKL) was likewise moving apparently on old news, up 28% after the company kicked off an RC program over at its Dalwallinu project in WA’s West Yilgarn a few days ago, testing for nickel, copper and PGE some 208km northeast of Perth.

Thursday 08 February, 2024

Alliance Nickel (ASX:AXN) led the charge, on news that it’s signed a non-binding term sheet with Samsung – yes, that Samsung – for the future offtake of battery grade nickel and cobalt sulphate products from the NiWest Nickel-Cobalt Project in Western Australia.

Sarytogan Graphite (ASX:SGA) made headway after announcing that the first batch of coincell batteries has been produced using the company’s Uncoated Spherical Purified Graphite, which the company says have been outperforming many synthetic graphite anodes that are currently used in electric vehicles.

Aldoro Resources (ASX:ARN) rose more than 34% before lunch, after telling the market it had traced intermittent intrusive dyke bearing pyrochlore (a niobium containing mineral) over 200m and at widths of up to 1m, out along the southwest margin of the Kameelburg carbonatite.

Junior goldie Kula Gold (ASX:KGD) climbed on news that it had pinned down two new gold prospects at the Marvel Loch project near Southern Cross, one of WA’s better gold fields – namely, the new Stingray gold and lithium prospect and the Boomerang gold prospect, the latter identified in drilling for kaolin three years ago in a hit of 1m at 2.6g/t from 54m.

Lanthanein Resources (ASX:LNR) moved higher early after saying that an extensive soil sampling programme across its entire 77km2 granted tenement on the Forrestania Greenstone Belt has kicked off, directly adjacent to Covalent Lithium’s (SQM & Wesfarmers) Earl Grey Mine, 189Mt @1.53% Li2O.

And Chimeric Therapeutics (ASX:CHM) made early progress after it announced that the first patient in the ADVENT-AML Phase 1B clinical trial in Acute Myeloid Leukemia (AML) has received treatment with CHM 0201 in combination with Azacitidine and Venetoclax.

There was a sudden middle-of-the-day burst of interest in Cynata Therapeutics (ASX:CYP), despite no announcements on the list, nor any headline news.

QX Resources (ASX:QXR) enjoyed a sizeable jump mid-day as well, after it reported that a second diamond hole has intersected multiple brine reservoirs at its 102km2 Liberty project. The results revealed that a single 443.5m drilling in the hole intersected five brine aquifers at 90m, 130m, 210m, 245m and 295m that have widths varying from just a few metres to 10m.

Friday 09 February, 2024

Top of the Pops among the small caps on Friday was Venture Minerals (ASX:VMS), up 63% before lunch on news that the company has delivered a record drill hit at its large-scale, clay hosted Jupiter Rare Earths prospect in the Mid-West region of Western Australia, with the intercept measuring in at 48m @ 3,025ppm TREO, alongside assays up to 10,266ppm and 20,538ppm TREO from nearby holes.

Aussie tech minnow AVA Risk Group (ASX:AVA) was also rising nicely on news that it has inked a Telstra Supply Agreement with Telstra Group (of course… duh) that will see the telco putting the company’s risk assessment tech to use.

The deal follows 10 months of collaboration through product trials with Telstra and its customers, including monitoring the urban fibre network in metropolitan Melbourne and the subsea fibre cables in the Port of Darwin.

However, there seems to be some kind of problem with the announcement. AVA was evidently pinged by the ASX over the initial announcement, and trading was paused at 10.45am.

The company issued another announcement with more details at 2:54pm, and was immediately suspended again, “pending the release of a satisfactory response to an ASX Query Letter regarding the announcements it has made today.”

BPH Global (ASX:BP8) got in on the Chinese New Year festivities, up 33% ahead of what is likely to be a productive period for the company.

BPH Global’s wholly-owned subsidiary Foshan Gedishi Biotechnology recently signed a major supply deal with Chinese tobacco company China Tobacco, to supply birds’ nests for distribution and consumption throughout Guangzhou City and the surrounding Province of Guangdong.

Novonix (ASX:NVX) gained weight in the morning on news that it has signed a binding off-take agreement for high-performance synthetic graphite anode material to be supplied to Panasonic Energy’s North American operations from Novonix’s Riverside facility in Chattanooga, Tennessee.

Theta Gold Mines (ASX:TGM) went screaming for the stratosphere in the middle of the day, and was almost as quickly put into a trading halt before the bell rang, after moving rapidly to +52% on no news – no doubt there will be something on the lists on Monday.

BMG Resources (ASX:BMG) enjoyed a late surge on Friday on the previous day’s news that it had signed a binding option agreement pursuant to which it has the right to acquire a 90% interest in three exploration licences (one granted and two in application) in the West Arunta region of Western Australia, with plans to name the bundle the Dragon Niobium-REE Project.

IPOs we’re (still) waiting for…

All dates are sourced from the ASX website. They can, and frequently do, change without notice.

Metals Acquisition (ASX:MAC)

Expected listing: February 20, 2024

IPO:$6 million at 20 cents/share

MAC is focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonisation of the global economy.

The company completed its first acquisition with the purchase of the CSA copper mine in Australia from Glencore PLC in June 2023.

The CSA Mine is located in Cobar in regional NSW, and is one of Australia’s highest grade copper mines. CSA Mine produces about 40,000 tonnes of copper each year.

In addition to the current operations, MAC also holds 566 square kilometres of tenements with the potential to expand and extend CSA’s future mine life.

Metals Acquisition is primarily listed on the NYSE under the ticker MTAL, and is now seeking a secondary listing on the ASX with CDI (CHESS depository interests) securities.

Golden Globe Resources (ASX:GGR)

Expected listing: February 26, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was down to list on the local bourse in October 2023.

In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.