ASX Small Caps and IPO Weekly Wrap: A great week for tech, but a duster for everyone else

Barney didn't care if it took him all week - he was determined to find the $2 he dropped when arriving at the beach in the morning. Pic via Getty Images.

It’s during weeks like this that I’m glad that I’ve left the Glory Days of Print Journalism behind – or, at the very least, that I’m not required to micro-manage the design of a magazine or newspaper for the presses.

That’s because red ink ain’t cheap – and trying to paint a visual picture of the market since Monday would likely have gone a long way toward bankrupting The Vatican and putting Pope Francis out to find out what “humility” and “simple living” really look like.

Any way you slice it, unless your entire portfolio is condensed into a handful of tech stocks, or a very slim picking of deftly chosen uranium pickers, then you’re likely to be down for the week – in some areas, by quite a margin.

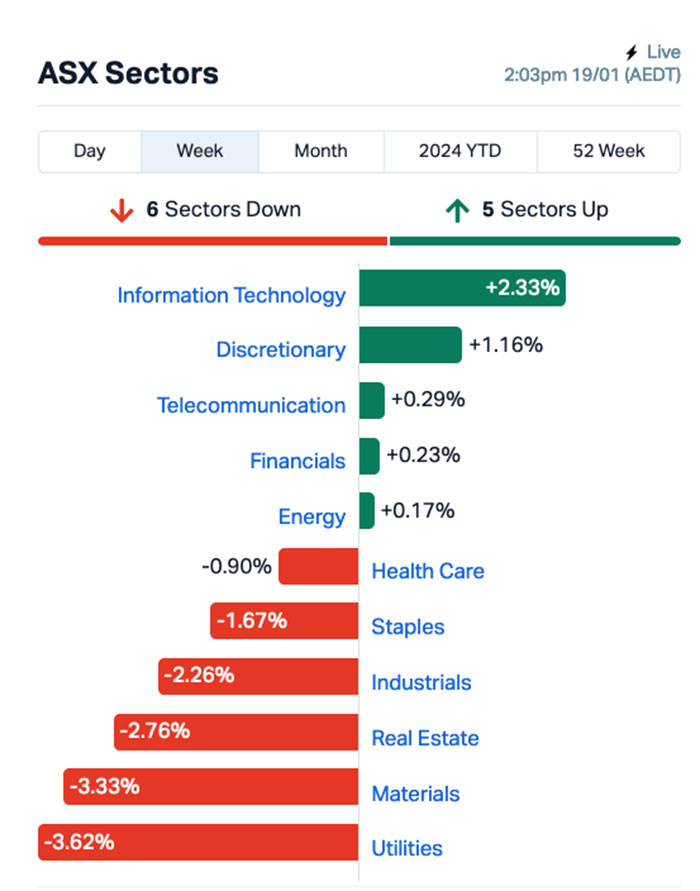

This is what the sectors looked like by the time things wrapped up on Friday.

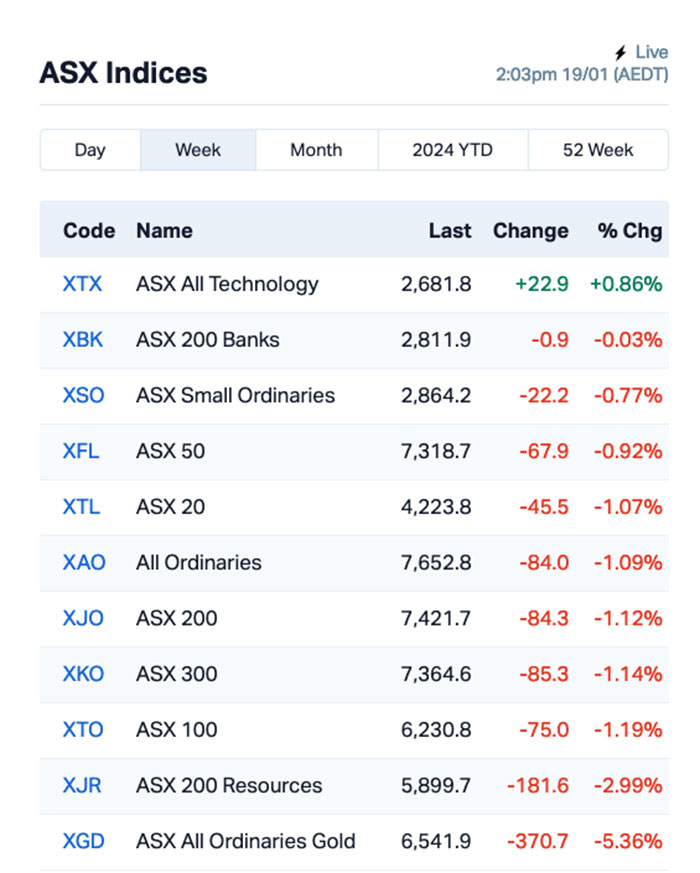

At a more granular level, the winner across the market this week was – again – the techies, after the XTX All Tech index managed a remarkably sink-proof +0.8-ish percent rise against the outgoing tide.

Take special note of where the market’s beloved goldies went this week – the XGD All Ords Gold Index tried for a big golden egg, but has clearly just shat the nest instead, blurting out a -5.4% shart that surprised everyone with its intensity.

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| KNB | Koonenberry Gold | 0.08 | 86% | $9,579,927.04 |

| WCN | White Cliff Minerals | 0.018 | 80% | $20,429,749.49 |

| EEL | Enrg Elements Ltd | 0.012 | 71% | $12,119,580.35 |

| KOB | Koba Resources | 0.115 | 64% | $10,541,666.70 |

| CLE | Cyclone Metals | 0.0015 | 50% | $10,471,171.57 |

| EME | Energy Metals Ltd | 0.195 | 50% | $33,549,329.92 |

| KEY | KEY Petroleum | 0.0015 | 50% | $3,394,392.19 |

| PXX | Polarx Limited | 0.012 | 50% | $14,756,550.98 |

| BSN | Basin Energy | 0.19 | 46% | $12,456,000.80 |

| SHG | Singular Health | 0.07 | 46% | $9,750,408.29 |

| TML | Timah Resources Ltd | 0.036 | 38% | $3,195,351.40 |

| XPN | Xpon Technologies | 0.026 | 37% | $7,893,812.39 |

| BMG | BMG Resources Ltd | 0.015 | 36% | $11,408,348.92 |

| IOD | Iodm Limited | 0.275 | 34% | $158,117,346.22 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | $1,430,066.63 |

| GTR | Gti Energy Ltd | 0.012 | 33% | $24,599,365.09 |

| PNX | PNX Metals Limited | 0.004 | 33% | $21,522,498.88 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | $24,408,512.36 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619.43 |

| UVA | Uvre Lmited | 0.16 | 33% | $5,295,716.32 |

| CXU | Cauldron Energy Ltd | 0.045 | 32% | $49,844,919.12 |

| TZL | TZ Limited | 0.033 | 32% | $8,473,017.76 |

| GUE | Global Uranium | 0.17 | 31% | $33,953,435.52 |

| ARE | Argonaut Resources | 0.13 | 30% | $23,729,426.88 |

| EML | EML Payments Ltd | 1.01 | 29% | $341,176,643.08 |

| MHC | Manhattan Corp Ltd | 0.0045 | 29% | $11,747,919.10 |

| RNX | Renegade Exploration | 0.009 | 29% | $9,015,514.02 |

| T92 | Terra Uranium | 0.18 | 29% | $10,258,159.68 |

| ART | Airtasker Limited | 0.295 | 28% | $133,303,397.88 |

| FFG | Fatfish Group | 0.046 | 28% | $65,341,265.29 |

| BIO | Biome Australia Ltd | 0.3 | 28% | $61,475,837.63 |

| RIL | Redivium Limited | 0.007 | 27% | $19,115,983.66 |

| BGE | Bridge SaaS | 0.08 | 27% | $8,357,793.92 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | $6,325,575.46 |

| DVL | Dorsavi Ltd | 0.015 | 25% | $8,949,924.27 |

| INP | Incentiapay Ltd | 0.005 | 25% | $6,388,573.13 |

| FLC | Fluence Corporation | 0.15 | 25% | $166,808,630.98 |

| HAR | Haranga Resources | 0.255 | 24% | $20,055,777.75 |

| AGN | Argenica | 0.625 | 24% | $60,482,001.42 |

| NFL | Norfolk Metals | 0.235 | 24% | $7,594,874.14 |

| AKM | Aspire Mining Ltd | 0.185 | 23% | $104,065,581.93 |

| OJC | The Original Juice | 0.185 | 23% | $54,807,629.73 |

| THR | Thor Energy PLC | 0.038 | 23% | $7,255,416.79 |

| PEN | Peninsula Energy Ltd | 0.1175 | 22% | $240,896,500.88 |

| IPB | IPB Petroleum Ltd | 0.011 | 22% | $4,520,979.59 |

| MMA | Maronan Metals | 0.2625 | 22% | $19,501,809.86 |

| PAA | PharmAust Limited | 0.145 | 21% | $53,895,183.58 |

| TSI | Top Shelf | 0.265 | 20% | $51,868,965.25 |

| WA8 | Warriedar Resources | 0.059 | 20% | $30,114,892.51 |

| SPN | Sparc Tech Ltd | 0.385 | 20% | $35,542,954.71 |

Koonenberry Gold took line honours for the week, banging out an 86% gain, made all the more impressive considering its entire segment, on carefully weight average numbers and a lot of complex mathematics, was utter gobshite.

The goldies, if you missed the memo, shanked a 5.6% loss for the week as a whole. Brutal.

White Cliff Minerals took the silver medal for the week, up 80% on news that it popped down to the shops for milk, bread and a pack of smokes – and came back with The Radium Point uranium licences, fresh from the Northwest Territories in Canada.

The pick-up for White Cliff covers an area in excess of 3,300km2 and includes significant historical mining operations, such as the Eldorado, Echo Bay, Contact Lake mines.

And the bronze gong this week went to Enrg Elements, but the reason why remains a mystery.

The company copped a Please Explain from the ASX on 12 January, offered little in the way of appreciable detail in its response – but that did not deter a very determined portion of local investors, who piled in to the tune of a 71% rocket ride.

If someone feels like they have a workable explanation for it, email me – go to the top of the page, click on my name, that’ll take you to my author bio and you’ll find an email addy for me there.

Because – and I’m just being honest here – I’m about 20 minutes away from closing the door on this week at work, and I am running critically low on several important things: Sleep, curiosity and the ability to think in blocks of cogency that last longer than … and it’s gone.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| WML | Woomera Mining Ltd | 0.009 | -64% | $10,963,250.98 |

| CPO | Culpeo Minerals | 0.046 | -53% | $6,445,954.90 |

| BP8 | BPH Global Ltd | 0.001 | -50% | $1,835,563.11 |

| NRZ | Neurizer Ltd | 0.007 | -50% | $9,645,619.96 |

| APM | APM Human Services | 0.76 | -43% | $719,987,827.61 |

| MTM | MTM Critical Metals | 0.07 | -39% | $7,258,907.28 |

| AN1 | Anagenics Limited | 0.012 | -37% | $4,545,334.32 |

| YRL | Yandal Resources | 0.099 | -36% | $25,819,877.16 |

| 8IH | 8I Holdings Ltd | 0.011 | -35% | $4,288,271.88 |

| IBX | Imagion Biosys Ltd | 0.205 | -35% | $7,508,706.73 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | $1,633,728.79 |

| APS | Allup Silica Ltd | 0.035 | -31% | $1,654,515.34 |

| KZR | Kalamazoo Resources | 0.093 | -31% | $17,301,782.40 |

| IND | Industrial Minerals | 0.455 | -31% | $29,223,000.00 |

| SLB | Stelar Metals | 0.18 | -31% | $9,433,426.50 |

| LM8 | Lunnon Metals | 0.39 | -30% | $93,368,970.20 |

| GL1 | Globallith | 0.5575 | -30% | $148,351,220.43 |

| NTM | NT Minerals Limited | 0.007 | -30% | $6,019,320.41 |

| ERG | Eneco Refresh Ltd | 0.012 | -29% | $3,268,300.16 |

| NMT | Neometals Ltd | 0.16 | -29% | $102,743,902.14 |

| ICR | Intelicare Holdings | 0.015 | -29% | $3,757,191.97 |

| SLM | Solis Minerals | 0.115 | -28% | $9,016,081.19 |

| MHK | Metalhawk. | 0.083 | -28% | $9,742,615.71 |

| BUY | Bounty Oil & Gas NL | 0.008 | -27% | $11,988,007.86 |

| TAR | Taruga Minerals | 0.008 | -27% | $5,648,214.28 |

| NIS | Nickel Search | 0.046 | -27% | $10,036,495.06 |

| T3D | 333D Limited | 0.019 | -27% | $2,508,343.64 |

| ICL | Iceni Gold | 0.048 | -26% | $12,462,214.29 |

| CAZ | Cazaly Resources | 0.02 | -26% | $12,275,180.75 |

| PNM | Pacific Nickel Mines | 0.059 | -25% | $25,095,186.30 |

| AHN | Athena Resources | 0.003 | -25% | $3,211,402.67 |

| C7A | Clara Resources | 0.012 | -25% | $2,268,468.46 |

| CTN | Catalina Resources | 0.003 | -25% | $4,334,704.12 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | $4,953,852.15 |

| ME1 | Melodiol Global Health | 0.0015 | -25% | $7,374,927.74 |

| NVQ | Noviqtech Limited | 0.003 | -25% | $3,928,335.89 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832.41 |

| CC9 | Chariot Corporation | 0.415 | -25% | $30,799,258.56 |

| CHM | Chimeric Therapeutic | 0.028 | -24% | $21,083,555.55 |

| EG1 | Evergreen Lithium | 0.125 | -24% | $7,028,750.00 |

| KTA | Krakatoa Resources | 0.022 | -24% | $10,386,358.84 |

| AHK | Ark Mines Limited | 0.145 | -24% | $9,148,658.15 |

| BRX | Belararoxlimited | 0.21 | -24% | $13,186,564.80 |

| LDX | Lumos Diagnostics | 0.081 | -23% | $39,466,603.53 |

| TMB | Tambourah Metals | 0.093 | -23% | $7,879,333.54 |

| BNR | Bulletin Res Ltd | 0.105 | -22% | $29,361,332.30 |

| DCL | Domacom Limited | 0.014 | -22% | $6,097,024.82 |

| HAL | Halo Technologies | 0.14 | -22% | $18,129,329.82 |

| RLG | Roolife Group Ltd | 0.007 | -22% | $5,057,906.93 |

| DVP | Develop Global Ltd | 2.04 | -22% | $504,719,448.48 |

HOW THE WEEK SHOOK OUT

Monday 15 January, 2024

Infini Resources (ASX:I88) was the name on everyone’s lips at the end of Monday, with the market newbie making a stunning debut after listing and going gangbusters pretty much all day.

The company represents a portfolio of eight projects, covering uranium and lithium in a mix of brownfield and greenfield assets in Canada and Western Australia, including the Portland Creek Uranium Project, the Paterson Lake Lithium Project and the Tinco Uranium Project.

The company recently IPO’d for $5.5 million at 20 cents/share, but hit the ground running at an exceptional clip to finish the day well out in front of the rest of the field.

Uranium was also the buzzword driving the second-place getter for Monday… Terra Uranium (ASX:T92) has also hit some solid gains, off the back of news that it has staked two 100% owned uranium claims covering 8,118ha along the Cable Bay Sheer Zone in the prolific Athabasca Basin, Canada.

The new claims, which are held 100% by Terra Uranium, are situated on the west side of Pasfield Lake, between the company’s existing Pasfield and Parker Projects, in an area that Terra firmly believes to be highly prospective for uranium mineralisation.

And market minnow TZ (ASX:TZL) stalked into third place on Monday, after delivering a quarterly report to the market that outlines key points of the company’s fiscal 2024 Q2 performance, including: net cash from operating activities for this quarter was a positive inflow of $775,000.

That result included TZ hitting its margin target of 50% in overall performance, and the company progressing well towards its $3.6 million annual revenue target, thanks to recurring revenue levels of $277,000 per month.

Tuesday 16 January, 2024

Tuesday morning’s good going belonged to Koonenberry Gold (ASX:KNB), which dropped an announcement that final approvals had been received for the maiden drilling program at its Atlantis Au-Cu Prospect, and “as soon as weather conditions permit” they’ll get the drills spinning to conduct first pass Air Core drilling at the site.

“The Atlantis outcropping copper-gold mineralisation, copper-gold soil anomaly, geophysical targets, structural and geological setting make Atlantis a compelling target,” KNB MD Dan Power said.

“Whilst this prospect has been known about for some years, Koonenberry Gold has advanced it to drill ready status and will be the first ever exploration company to conduct drill testing.” Presumably he means at that particular site, but you get the idea.

KNB also has assay results incoming from its Bellagio project, which the company says are “anticipated soon”.

Later in the day, White Cliff Minerals (ASX:WCN) moved towards the top of the ladder again, following on from recent news that it’s all set to acquire a historical uranium project in the Northwest Territories of Canada called Radium Point.

The investor presentation it delivered on Tuesday re-stated that news and gave a brief update on how the company’s travelling was just the shot in the arm it needed to resume its shuffling towards a nicely fattened purse.

BMG Resources (ASX:BMG) dropped a bit of a bombshell early doors, fuelling a major surge in volume and pushing its price up more than 23% with news that long-time MD Bruce McCracken has resigned from BMG and all of its subsidiaries.

With McCracken gone, non-executive director John Prineas assumes the role of non-executive chairman, while non-executive chairman Greg Hancock transfers to the role of independent non-executive director.

Prineas steps into the role with a host of other responsibilities on his plate as well – he’s currently BMG’s largest shareholder (holding 9.8%), and is also the founder and executive chairman of St George Mining (ASX:SGQ) and founder and a non-executive director of American West Metals (ASX:AW1) .

As it stands with BMG, Prineas is set to assume day-to-day responsibilities for BMG matters, until a new CEO or MD is appointed to the role.

And Aerometrex (ASX:AMX) delivered a quarterly before lunch, bearing upbeat news for investors – the company expects to deliver a record first half (1H) revenue outcome, driven by “strong ongoing performance of the LiDAR and MetroMap product lines”.

AMC said it’s likely to post a group revenue in the $11.8-$12.2 million range, which is a tidy climb from the previous years’ $10 million high water mark.

Wednesday 17 January, 2023

Alicanto Minerals (ASX:AQI) dominated the ladder early on Wednesday, spiking a Benaud-esque 22.22%, most likely off the back of yesterday’s announcement that the company’s Big Swede – the Skyttgruvan-Naverberg project, which lies alongside the fearsome 1,000-year-old Falun mine – is getting bigger every time the company starts poking around.

Mandrake Resources (ASX:MAN) took off at a gallop this morning, running helter skelter for 45 minutes until the ASX tugged on the handbrake and brought the party to a close – leaving Mandrake dangling at +18.4% for the morning, on a sharp increase in volume.

We’re talking roughly 7.5x the four-week average, and without a skerrick of news to the ASX as to why. There will no doubt be an explanation of sorts on the way, but at the time of writing, it remains a mystery for Scoob and the gang to unravel.

Mandrake’s trading pause was upgraded to a trading halt shortly before midday – still no explanation forthcoming. We’ll keep you posted.

Basin Energy (ASX:BSN) has timed the start of its 2024 exploration program very nicely indeed, capitalising nicely on yellowcakes high-vis on the market at the moment with news that field work has now commenced for Basin’s winter program across the entirety of the company’s Athabasca uranium projects.

That encompasses high-resolution ground Stepwise Moving Loop Time-Domain Electromagnetic survey work underway at the North Millennium and Marshall projects, while final preparations are being made for phase 2 drilling at the Geikie project.

Likewise, Pinnacle Minerals (ASX:PIM) put out a timely announcement, providing an update on its Uranium-REE Wirrulla Project in South Australia.

Pinnacle reported that recent satellite and radar imagery analysis at Wirrulla has highlighted uranium (U3O8) mineralisation potential and defined a number of priority target areas.

Additionally, exploration has found uranium mineralisation in place, with intercepts including 3,550ppm U3O8 over 1m from 66m in hole IR1377, and 1,400ppm U3O8 over 1m from 69m in hole IR1378.

Later in the day, Biome Australia (ASX:BIO) kicked into second gear for another stab at some gains on yesterday’s announcement that it’s pushing into the United Kingdom and the Republic of Ireland with its first allocation of Activated Probiotics hitting pharmacies and other retailers in those regions.

Thursday 18 January, 2024

Osmond Resources (ASX:OSM) joined the growing list of mining minnows to come screaming out of the woodwork with news about a uranium find, after the company undertook “a review of historical exploration results” for its South Australian Fowler project, which has identified “the potential for large-scale uranium (U3O8) mineralisation.

Osmond piled on a decent gain on the strength of that release which – just so we’re clear – basically said that the company has cracked open the spreadsheets from long-finished exploration, and now there’s “potential” for uranium in there somewhere. Bless.

Meanwhile, Helix Resources (ASX:HLX) did well despite having no fresh news to titillate investors with today – the last we heard from Helix was on 15 January, when the company announced that it has hit decent, very shallow copper mineralisation at its Bijoux prospect in teh Cobar-Nyngan area of central NSW.

Melodiol Global Health (ASX:ME1) has also lurched, also on no fresh info since the company dropped news of a 51% spike in revenue YoY, and that it had raised a handy $215,000 following a placement at $0.001285 per share.

And a bumpy day for Woomera Mining (ASX:WML) yesterday appears to have been re-routed into something of a happy ending, with the company up nicely 24 hours later.

Woomera got shoved into a trading pause, which then blossomed into a full-blown trading halt a couple of hours later – which wasn’t lifted until quite late in the day, once Woomera revealed that it did, in fact, have news. Quelle surprise, and other French words.

The news was that Woomera had completed a 26-hole / 2813m RC drill program at its Ravensthorpe projects located in SE Western Australia, and spotted peggies from eight of those holes to boot.

And Sabre Resources (ASX:SBR) also swung into the uranium news business, with an announcement that the company has launched a new exploration program at the Dingo Uranium Project within the Company’s 1,100km2 Ngalia Basin tenement package in the Northern Territory.

Sabre said the new program is set to build on the discoveries it’s already made at the site, including high-grade sandstone hosted uranium targets boasting numbers up to 5,194ppm eU3O8.

Friday 19 January, 2024

IPB Petroleum (ASX:IPB) is nominally at the top of the Small Caps ladder today despite no news since it told the market about a signing an MoU with Australian oil and gas development tech company, Pivotree.

The MoU sets IPB up to use Pivotree technology for the potential future development within its WA-424-P Permit focused on the proven Gwydion oil and gas discovery and potential Idris extension.

Meanwhile, the likes of Pivotal Metals (ASX:PVT), Mount Burgess Mining (ASX:MTB) and Genesis Resources (ASX:GES) are moving about quite a bit on decent volume, despite little or nothing in the way of news to the market today.

Labyrinth Resources (ASX:LRL) is moving nicely on a double-shot of happy news that has identified the company as the hottest ticket in town for anyone who loves great big steaming piles of cash in the bank.

Week before last, Labyrinth told the market that it sold off the Labyrinth and Denain gold projects in the Abitibi region of Quebec, Canada for US$3.5 million in cash money.

And this morning, the company was rolling in it again, after the Canadian tax office sent it a cheque for CAD $415,453, a rebate against expenditure incurred by Labyrinth hunting for resources last calendar year.

Lastly for the lead-up to lunch, market minnow Mantle Minerals (ASX:MTL) is moving quickly, after delivering a resource upgrade at the Highway nickel deposit, within the Pardoo Ni-Cu Project, located in the Pilbara region of northern Western Australia.

Later in the day, not a whole heap had changed. PolarX made a late charge on old news to get near the top of the ladder, the highly mysterious Freehill got mysteriously higher, and there were a few other very small companies making out-sized, news-free gains as the arvo wore on.

Mesoblast (ASX:MSB) announced today that the US FDA has granted its allogeneic cell therapy Revascor (rexlemestrocel-L) a Rare Pediatric Disease (RPD) Designation following results from the randomised controlled trial in children with a potentially life threatening congenital heart condition called hypoplastic left heart syndrome (HLHS).

IPOs that happened

Infini Resources (ASX:I88)

Listing: January 15, 2024

IPO: $5.5 million at 20 cents/share

I88 was looking to capitalise on lifting uranium prices with its planned ASX listing this month, and it hit the market running at nearly double its IPO, on $0.37 a pop. The good times stuck around (mostly) for the week, leaving the company well in front of where it started.

Focused on lithium and uranium exploration, I88 has eight projects including a mix of brownfield and greenfield assets in Canada and Western Australia.

Its WA lithium projects include Pegasus, Parna and Yeelirrie. In Canada it has the Des Herbiers Project and Valor projects in Quebec, the Tinco Project in Saskatchewan and Portland Creek Uranium Project (Newfoundland and Labrador) along with the Paterson Lake Project (Ontario).

Sixty Two Capital was lead manager of the float, so… well played to them.

IPOs we’re waiting for

Golden Globe Resources (ASX:GGR)

Expected listing: January 18, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was initially down to list on the local bourse in October 2023. In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.