ASX small cap wrap: which stocks looked the strongest last week

Strongmen pose at the Arnold Schwarzenegger Sports Festival in Melbourne. Pic: Getty

ASX Small Cap Winners Mar 16-23

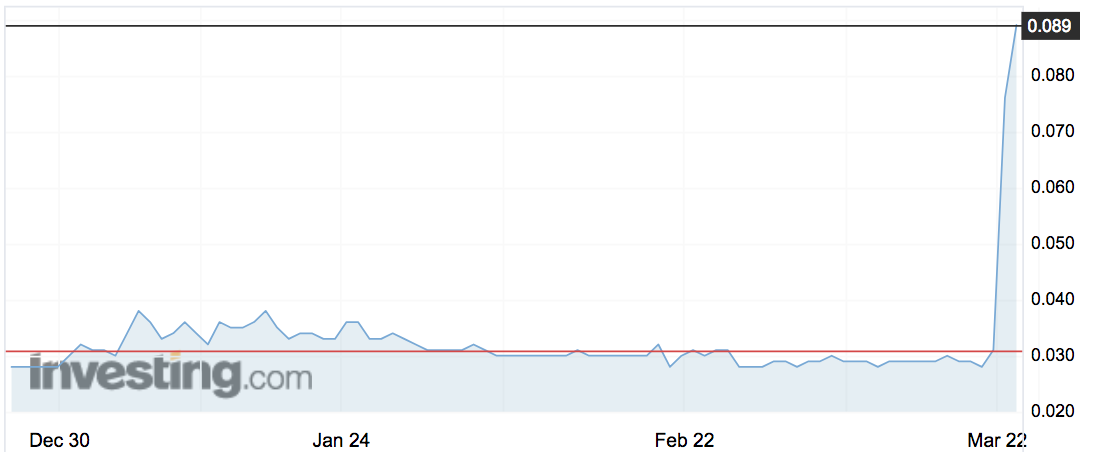

Innate Immunotherapeutics (ASX:IIL) launched itself back onto the ASX race on Friday, gaining 197 per cent over the past seven days to close at 8.9c.

The cause of the spectacular rise was the proposed takeover of private cancer biotech Amplia Therapeutics in an all-scrip deal. The deal will hand 45 per cent of Innate to the owners of Amplia, after a share consolidation.

Innate’s share price was decimated last year after its Multiple Sclerosis treatment failed in Phase 2b clinical trials in June last year.

Australia’s newest vanadium play Tando Resources (ASX:TNO) went on a huge run, hitting an all-time high of 87.5c compared to its 20c issue price last November.

Tando told investors it has its hands on a high-grade vanadium project estimated to host a resource three times bigger than similar projects.

Vanadium is one of the hottest resources sectors at the moment. Its price has rocketed 550 per cent in the past three years driven by its role in making powerful batteries.

Investors piled into the stock. The shares closed at 66c on friday — up 50 per cent for the week.

Meanwhile, we don’t know what they’re putting in the water in the Democratic Republic of Congo (DRC) but an ever increasing number of battery metal prospectors are headed there.

Winmar Resources (ASX:WFE) is the latest to join the Congo-line, rising 167 per cent to 1.6c this week after it raised $3.1 million to buy cobalt in the DRC.

The biggest part of this news however was that they’d taken on Singapore-based Airguide as a corporate advisor, to make deals for its prospective cobalt operations particularly in China.

Airguide has performed the same role in the DRC for popular lithium miner AVZ Minerals (ASX:AVZ).

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

It’s a takeover that caused Nkwe Platinum’s (ASX:NKP) 133 per cent bounce this week to 7c.

China’s Zijin Mining Group is making a play for the junior explorer, offering 8c a share in an “indicative and non-binding” bid as it seeks to suck up the 39.5 per cent of the shares it doesn’t own.

Nkwe was able to resume trading in November after the South African government finally lifted the suspension of mining rights over its flagship platinum Garatau project.

Broken Hill Prospecting (ASX:BPL) made investors’ day on Friday as it unveiled a deal with Korean technology giant LG, rising 77 per cent to hit 14c.

Under the partnership, LGI will provide capital and technical assistance for the Thackaringa cobalt project to make a high purity battery grade cobalt sulphate.

Oil and gas explorer Range Resources (ASX:RRS) gained 67 per cent to 0.5c this week after winning a contract with a subsidiary of Royal Dutch Shell.

Range will start the 10-day onshore project at Shell’s operations in Trinidad.

European lead and zinc explorer Ferrum Crescent (FCR:ASX) put on 50 per cent to hit 0.02c this week after announcing it would raise £1 million ($1.8 million) to scope out its Toral lead and zinc project in northern Spain.

Clover Corp (ASX:CLV) gained 50 per cent to rest on 96c this week, after it reported a jump in full-year profit and revenue, and declared an interim dividend of 0.5c per share.

The Chinese market for infant formula “continues to improve with little change in Chinese regulations over the past six months providing manufacturers with the confidence to produce and deliver into China”, the company said.

Clover’s profit jumped 209 per cent to $3.2 million for the six months to January. Revenue was up 60 per cent at $31 million.

The company with perhaps the ASX’s most ironic name, Environmental Clean Technologies (ASX:ESI) says it has the basic design for its brown coal-fired iron ore plant done.

The company says its technology can make brown coal as energy efficient as higher grade coking coal.

The news, and a new substantial investor, pushed its shares up 50 per cent to 1.4c.

Over at wannabe China milk trader Jat Energy (ASX:JAT) life was, as ever, turbulent.

Even though it ended up 47 per cent at 23.5c, after issuing convertible notes to fund a China expansion, it received a speeding ticket from the ASX and on Friday went into a trading halt.

The ASX is demanding more information on the China Food and Drug Administration approval of Golden Koala products in China, a milk powder company it acquired in December.

Jat has received almost one ASX speeding ticket a month since August.

Somehow failed tungsten explorer TopTung (ASX: TTW) still made it into the top 20, rising 44 per cent to 3.6c even though it said this week that its NSW tungsten mine was a dog.

Recent drilling at its only project has “severely reduced the tungsten resource” which “will affect the company’s future strategy.”

TopTung previously warned investors it would probably deliver a smaller resource than expected for its Wild Kate prospect.

Respiratory and auto-immune drug developer Invion (ASX:IVX) gained 42 per cent to hit 2.7c this week, after signing a research deal with the Monash University-aligned Hudson Institute of Medical Research.

Invion and Hudson will collaborate on a range of research and development projects for Invion’s Photosoft cancer treatment technology, which uses photosensitisers, light and oxygen to kill malignant cells, shut down tumours and stimulate the immune system.

Hudson will provide research facilities and expertise for Invion-sponsored research projects.

Here are the best performing ASX small cap stocks for Mar 16-23:

Scroll to reveal the full table. Best viewed on a laptop or desktop:

| ASX Code | Name | One-week price change | Price Mar 23 | 52wk High | 52wk Low | Market Cap |

|---|---|---|---|---|---|---|

| VMG | VDM GROUP | 3 | 0.004 | 0.002 | 0.001 | 5877661 |

| IIL | INNATE IMMUNOTHERAPEUTICS | 1.966666667 | 0.089 | 0.825 | 0.025 | 6994405.5 |

| WFE | WINMAR RESOURCES | 1.666666667 | 0.016 | 0.017 | 0.001 | 27967720 |

| NKP | NKWE PLATINUM | 1.333333333 | 0.07 | 0.075 | 0.03 | 61849608 |

| BPL | BROKEN HILL PROSPECTING | 0.7721518987 | 0.14 | 0.145 | 0.025 | 14777340 |

| AYR | ALLOY RESOURCES | 0.6666666667 | 0.01 | 0.011 | 0.003 | 11768263 |

| RRS | RANGE RESOURCES | 0.6666666667 | 0.005 | 0.007 | 0.002 | 37979152 |

| TNO | TANDO RESOURCES | 0.5 | 0.66 | 0.875 | 0.205 | 20435370 |

| FCR | FERRUM CRESCENT | 0.5 | 0.0015 | 0.005 | 0.001 | 4582922 |

| CLV | CLOVER CORP | 0.5 | 0.96 | 0.87 | 0.36 | 143708080 |

| ESI | ENVIRONMENTAL CLEAN TECHNOLOGIES | 0.5 | 0.015 | 0.021 | 0.008 | 60196712 |

| GCR | GOLDEN CROSS RESOURCES | 0.5 | 0.015 | 0.026 | 0.007 | 1524333.375 |

| JAT | JATENERGY | 0.46875 | 0.235 | 0.26 | 0.01 | 88391800 |

| TTW | TOPTUNG | 0.44 | 0.036 | 0.05 | 0.02 | 3677943.75 |

| AKF | ASK FUNDING | 0.4285714286 | 0.03 | 0.06 | 0.018 | 1978665.5 |

| IVX | INVION | 0.4210526316 | 0.027 | 0.03 | 0.0016 | 152642640 |

| AUH | AUSTCHINA HOLDINGS | 0.4 | 0.007 | 0.011 | 0.002 | 6692310.5 |

| PTX | PRESCIENT THERAPEUTICS | 0.3953488372 | 0.12 | 0.11 | 0.047 | 19457686 |

| CZR | COZIRON RESOURCES | 0.3888888889 | 0.025 | 0.037 | 0.01 | 46424332 |

| GTR | GTI RESOURCES | 0.3888888889 | 0.025 | 0.036 | 0.01 | 2329166.75 |

ASX Small Cap Losers Mar 16-23

Anson Resources (ASX:ASN) shareholders rushed for the exit this week after the explorer reported lower-than-expected lithium levels at its flagship project in Utah’s Paradox Basin.

The shares closed the week down 46 per cent at 5.7c.

“Lithium concentrations are well below historical assay (test) results in other parts of the Paradox Basin,” Anson told investors.

“It is also possible that the lithium does not flow from the area around Long Canyon due to cross-cutting structures which may be forming lithium traps, concentrating the lithium in those areas.”

Meanwhile tech company Tikforce (ASX:TKF) is holding on for dear life.

It came out of a trading halt on Friday last week and was back in one by Monday for possibly defaulting on a convertible note, but that window was enough time for shareholders to flee, sending the stock down 33 per cent to 1.4c.

On Friday, Tikforce admitted that it had breached the convertible note clauses. It is now back in suspension.

Mozzie killer Bio-Gene Technologies (ASX:BGT) had to admit a much vaunted French partnership would go no further. Virbac has decided not to go ahead with using the FlavocideTM formula in its tick and buffalo fly insecticides.

Bio-Gene dropped 29 per cent to reach 12.5c by the end of the week. It listed at 20c.

Here are the worst performing ASX small cap stocks for Mar 16-23:

Scroll to reveal the full table. Best viewed on a laptop or desktop:

| ASX Code | Name | One-week price change | Price Mar 23 | 52wk High | 52wk Low | Market Cap |

|---|---|---|---|---|---|---|

| CUL | CULLEN RESOURCES | -0.5 | 0.001 | 0.003 | 0.001 | 5197120.5 |

| PCH | PROPERTY CONNECT HOLDINGS | -0.5 | 0.002 | 0.017 | 0.0015 | 3605807.25 |

| ASN | ANSON RESOURCES | -0.4571428571 | 0.057 | 0.31 | 0.01 | 25455934 |

| TKF | TIKFORCE | -0.3333333333 | 0.014 | 0.0464 | 0.011 | 2714126.5 |

| GGX | GAS2GRID | -0.3333333333 | 0.002 | 0.004 | 0.002 | 2264818.25 |

| MRV | MORETON RESOURCES | -0.3333333333 | 0.008 | 0.019 | 0.005 | 22143692 |

| DIG | ASIA PACIFIC DIGITAL | -0.3258426966 | 0.06 | 0.315 | 0.06 | 12691598 |

| COO | CORUM GROUP | -0.3076923077 | 0.027 | 0.055 | 0.024 | 6404190 |

| PPY | PAPYRUS AUSTRALIA | -0.3043478261 | 0.016 | 0.05 | 0.004 | 3317242.75 |

| ICT | ICOLLEGE | -0.298245614 | 0.04 | 0.0945 | 0.007 | 25070214 |

| BGT | BIO-GENE TECHNOLOGY | -0.2857142857 | 0.125 | 0.28 | 0.098 | 15965559 |

| REV | REAL ESTATE INVESTAR GROUP L | -0.28125 | 0.023 | 0.052 | 0.0249 | 3731281.75 |

| RXH | REWARDLE HOLDINGS | -0.2666666667 | 0.011 | 0.04 | 0.007 | 3604068 |

| NUH | NUHEARA | -0.2592592593 | 0.1 | 0.145 | 0.052 | 86973160 |

| EMP | EMPEROR ENERGY | -0.25 | 0.003 | 0.0054 | 0.002 | 2597573.25 |

| JVG | JV GLOBAL | -0.25 | 0.0015 | 0.002 | 0.0009 | 3759668 |

| KKL | KOLLAKORN CORP | -0.25 | 0.012 | 0.07 | 0.012 | 2276620.25 |

| MNB | MINBOS RESOURCES | -0.25 | 0.003 | 0.008 | 0.002 | 7375517 |

| RNL | RISION | -0.25 | 0.003 | 0.011 | 0.003 | 4838911 |

| FEL | FE | -0.243902439 | 0.031 | 0.082 | 0.019 | 11778095 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.