ASX small cap winners and losers: who raced away last week

Monaco Grand Prix winner Aussie Daniel Ricciardo sets a new track record in Friday practice sessions. Pic: Getty

ASX Small Cap Winners May 21-25

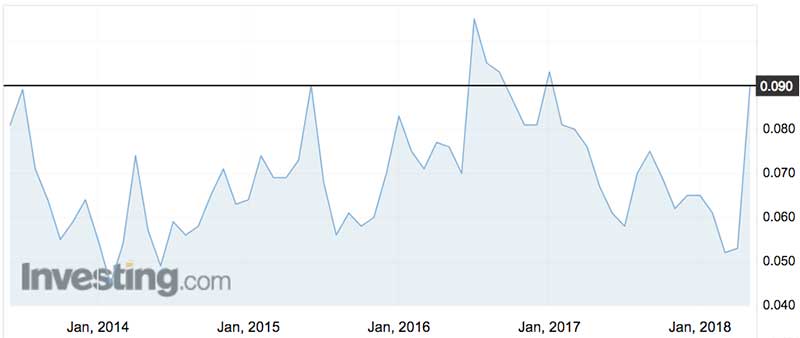

Prawn farmer Seafarms (ASX:SFG) looks finally set to realise its dream of creating the world’s biggest prawn farm in the Northern Territory.

Seafarms this week agreed on a $25 million investment from one of the world’s biggest seafood producers, $US1.7 billion Nippon Suisan Kaisha (better known as Nissui), to develop its huge Project Sea Dragon prawn farm in the Northern Territory.

The shares climbed 54 per cent this week to 8.8c — their highest point in 18 months.

Tokyo-listed Nissui gets 15 per cent of Seafarms and the right to sell the project’s prawns in Australia, Japan and potentially other Asian countries.

Seafarms chairman Ian Trahar called it (of course) a “company-making agreement”.

Seafarms has been working on Project Sea Dragon for about seven years. It won approval in December.

At full production the mega-farm will produce 150,000 tonnes of black tiger shrimp a year in 10,000 hectares of ponds.

Another “fundamental transformation” took place this week when cobalt miner Highlands Pacific (ASX:HIG) struck a deal with Canadian miner Cobalt 27, sending its share price skyrocketing.

The two agreed to a private placement of $15 million at 10.5c a share as well as a $150 million “streaming” deal on future production from its Ramu nickel and cobalt mine.

Streaming refers to an agreement where an investor agrees to buy a percentage of a company’s future production at a fixed price below market value.

The new funds mean Highlands can repay its debt on the project. Cobalt 27 increases its stake in Highlands to 11.3 per cent.

Highlands finished at 13c, a gain of 51 per cent for the week.

“Outstanding” results from gold explorer Lodestar (ASX:LSR) pushed its shares up 41 per cent for the week.

The explorer reported its best ever drill results at its Contessa site — which it says extends well beyond current drilling — as well as its highest grades to date at Gidgee Flat.

The results required immediate follow up, with more diamond drilling planned.

This week they closed at 3.1c.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Teacher background checker Schrole Group (ASX:SCL) gained 40 per cent to 1.4c this week after making the first sale of its “Schrole Verify” service.

American School of Doha — which teaches US kids who live in Qatar — will use Schrole as its “preferred pre-employment screening provider”.

The school will pay $US13,500 ($17,900) to use the Verify service to look for criminal records and other bad stuff among its staff.

Schrole reckons there’s a potential market of 6000 similar “international schools” whose accreditation now depends on teacher background checks.

Coconuts are the secret ingredient in the latest fabric from eco-friendly innovator Nanollose (ASX:NC6).

Nanollose — which specialises in plant-free fabric aimed at the sustainable fashion market — this week debuted its Nullabor fibre, the world’s first plant-free rayon fibre.

The shares moved ahead 29 per cent to 18c.

Nanollose — which isn’t yet making any money — listed last year after raising $5 million selling shares at 20c each.

Nanollose is best known for its ability to create “fermented fashion” out of beer and wine. The technology is based on the work of Perth scientist and winemaker Gary Cass, who accidentally discovered a new type of material when he ruined a batch of wine.

Here are the best performing ASX small cap stocks for May 21-25:

Swipe or scroll to reveal the full table. Best viewed on a laptop or desktop:

| ASX code | Company | One-week price change | Price May 25 | Market Cap |

|---|---|---|---|---|

| EER | EAST ENERGY | 1.33333333333 | 0.007 | 2.5M |

| MXR | MAXIMUS | 1 | 0.002 | 3.2M |

| ACP | AUDALIA | 0.909090909091 | 0.021 | 8.1M |

| XTD | XTD | 0.65625 | 0.053 | 5.9M |

| SIE | SCIGEN | 0.5625 | 0.05 | 26.5M |

| SFG | SEAFARMS GROUP | 0.543859649123 | 0.088 | 113.4M |

| HIG | HIGHLANDS | 0.511627906977 | 0.13 | 104.5M |

| IGE | INTEGRATED GREEN | 0.506666666667 | 0.565 | 198.2M |

| MNB | MINBOS | 0.5 | 0.003 | 11.3M |

| RDS | REDSTONE | 0.428571428571 | 0.02 | 8.0M |

| LSR | LODESTAR | 0.409090909091 | 0.031 | 23.2M |

| SCL | SCHROLE GROUP | 0.4 | 0.014 | 8.1M |

| DMI | DEMPSEY MINERALS | 0.384615384615 | 0.18 | 11.6M |

| SFM | SANTA FE | 0.35 | 0.27 | 17.5M |

| MEY | MARENICA ENERGY | 0.35 | 0.135 | 7.7M |

| NVO | NVOI | 0.333333333333 | 0.012 | 5.0M |

| GGX | GAS2GRID | 0.333333333333 | 0.004 | 3.4M |

| PIL | PEPPERMINT | 0.32 | 0.033 | 29.6M |

| IEC | INTRA ENERGY | 0.3 | 0.013 | 5.0M |

| D13 | DEPARTMENT 13 | 0.285714285714 | 0.099 | 47.1M |

| NC6 | NANOLLOSE | 0.285714285714 | 0.18 | 12.7M |

| GBI | GENERA BIOSYSTEM | 0.258064516129 | 0.195 | 21.0M |

| MWR | MGM WIRELESS | 0.25625 | 2.01 | 19.6M |

| NVA | NOVA MINERALS | 0.25 | 0.035 | 24.2M |

| PIQ | PROTEOMICS | 0.25 | 0.225 | 14.8M |

| WGL | WANGLE | 0.25 | 0.005 | 4.4M |

| VPC | VELPIC | 0.25 | 0.005 | 4.5M |

| MRD | MOUNT RIDLEY | 0.25 | 0.005 | 7.6M |

| ICG | INCA MINERALS | 0.25 | 0.005 | 13.0M |

ASX small cap losers May 21-25

Just when it looked like it had recovered from an earlier profit downgrade, organic fast food chain Oliver’s Real Food (ASX:OLI) this week unloaded another pile of bad news onto investors.

Earnings were expected to drop 30 to 37 per cent this year, Oliver’s announced. The shares plunged to a record low of 9.7c before closing the week at 11.5c — down 53 per cent.

It’s the second profit downgrade in a year for Oliver’s. In July — a month after a $15 million IPO priced at 20c — Oliver’s stunned with a warning it would miss its prospectus forecasts.

The shares lost half their value but had recovered to around 27c by this month.

Full year EBITDA earnings are now expected at $3 million to 3.3 million, as opposed to $4.8 million.

Sales revenue had been forecast to hit $41.9 million in the prospectus after Oliver’s listed in June last year.

It’s now expected to be in the range of $36 million to $37 million.

Here are the worst performing ASX small cap stocks for May 21-25:

Swipe or scroll to reveal the full table. Best viewed on a laptop or desktop:

| ASX Code | Company | One-week price change | Price May 25 | Market Cap |

|---|---|---|---|---|

| OLI | OLIVER'S REAL FOOD | -0.530612244898 | 0.115 | 25.6M |

| RMT | RMA ENERGY | -0.5 | 0.001 | 4.2M |

| PCH | PROPERTY CONNECT | -0.5 | 0.001 | 1.8M |

| IDO | INDO MINES | -0.5 | 0.005 | 2.7M |

| FCR | FERRUM CRESCENT | -0.5 | 0.001 | 4.8M |

| AJC | ACACIA COAL | -0.5 | 0.001 | 1.6M |

| OXX | OCTANEX | -0.413793103448 | 0.017 | 4.6M |

| T3D | 333D | -0.4 | 0.003 | 3.5M |

| BOA | BOADICEA | -0.379310344828 | 0.09 | 5.0M |

| UNL | UNITED NETWORKS | -0.366197183099 | 0.045 | 5.7M |

| TMK | TAMASKA OIL & GAS | -0.333333333333 | 0.002 | 3.9M |

| EMP | EMPEROR ENERGY | -0.333333333333 | 0.002 | 1.8M |

| NME | NEX METALS | -0.318181818182 | 0.015 | 2.3M |

| PDI | PREDICTIVE | -0.3 | 0.021 | 5.7M |

| MLS | METALS AUSTRALIA | -0.285714285714 | 0.005 | 11.7M |

| WHA | WATTLE HEALTH | -0.285387081997 | 1.56 | 226.5M |

| AUR | AURIS MINERALS | -0.278350515464 | 0.07 | 29.8M |

| JHL | JAYEX HEALTHCARE | -0.272727272727 | 0.016 | 2.5M |

| NGY | NUENERGY GAS | -0.266666666667 | 0.044 | 65.2M |

| FDX | FRONTIER DIAMOND | -0.259259259259 | 0.1 | 24.0M |

| FEL | FE | -0.257142857143 | 0.026 | 11.9M |

| FEI | FE INVESTMENTS | -0.256 | 0.093 | 18.3M |

| BYH | BRYAH RESOURCES | -0.25 | 0.12 | 8.2M |

| SUR | SUN RESOURCES | -0.25 | 0.003 | 2.3M |

| SHK | STONE RESOURCES | -0.25 | 0.003 | 2.4M |

| ROG | RED SKY ENERGY | -0.25 | 0.003 | 1.8M |

| PNL | PARINGA | -0.248366013072 | 0.23 | 97.2M |

| AO1 | ASSETOWL | -0.245283018868 | 0.04 | 4.7M |

| KP2 | KORE POTASH-CDI | -0.235294117647 | 0.13 | 100.3M |

| OOK | OOKAMI | -0.233333333333 | 0.023 | 7.5M |

| OAR | OAKDALE | -0.233333333333 | 0.023 | 1.9M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.