ASX Small Cap Lunch Wrap: With no one at the wheel, ASX drifts lower on rates ‘n races day

News

News

The local benchmark has fallen in the Tuesday AM, snapping a five-day run of morning victories as investors saved their bets for the horses rather than the long odds on Martin Place holding its temper.

A weaker lead from Wall Street’s Monday session dimmed the remarkable seventh straight positive session for the tech heavy Nasdaq.

The local market has made an early decision to escape the fraught afternoon which awaits us – will the Reserve Bank of Australia’s team led by Guv’nah M. Bullock surprise on the dovish side this arvo by holding rates for a third straight month?

Probably not. Better to clip some early winnings and head to the track in brown chinos, white shirt, sunnies and blue jacket.

(Ed: A solid choice.)

The central bank is expected to lift the cash rate again this afternoon. Instead of name the odds, let’s just say everyone’s cautious ahead of the Reserve Bank of Australia’s policy decision.

The rise is on, not out of any spite or wholesale belligerence. They’ve been seeing the same concerning moments inside our third quarter inflation read – the rate came in at a sticky 5.4%, an unwelcome beat on the 5.3% pinged by various analysts and not the stiff reduction on the 6% second quarter read that the good doctor, former Guv’nah P. Lowe ordered all those months ago.

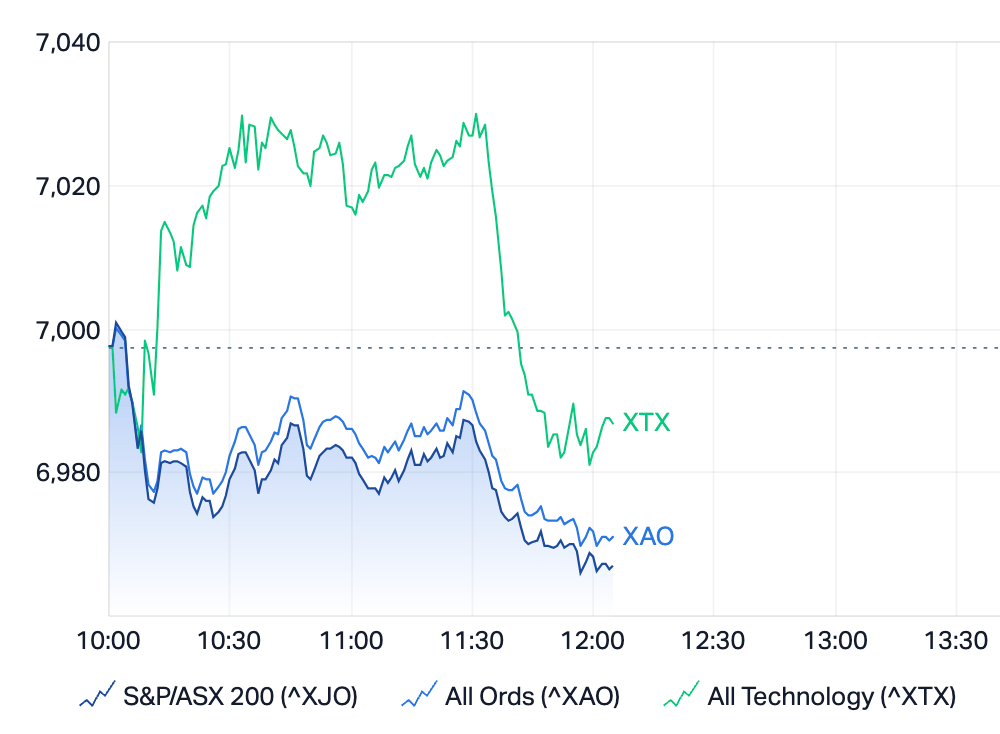

We’re already back under the benchmark’s 7,000 mark which the technicians say is, apparently, psychological.

At 12pm on Tuesday, the S&P/ASX 200 Index is behind by 30 points, or -0.43%, to 6,967.

The ASX All Ordinaries (XAO) Index is about -0.39% lower and the All Tech (XTX) is fleeing 11.30am to a safer, darker place at -0.16% down.

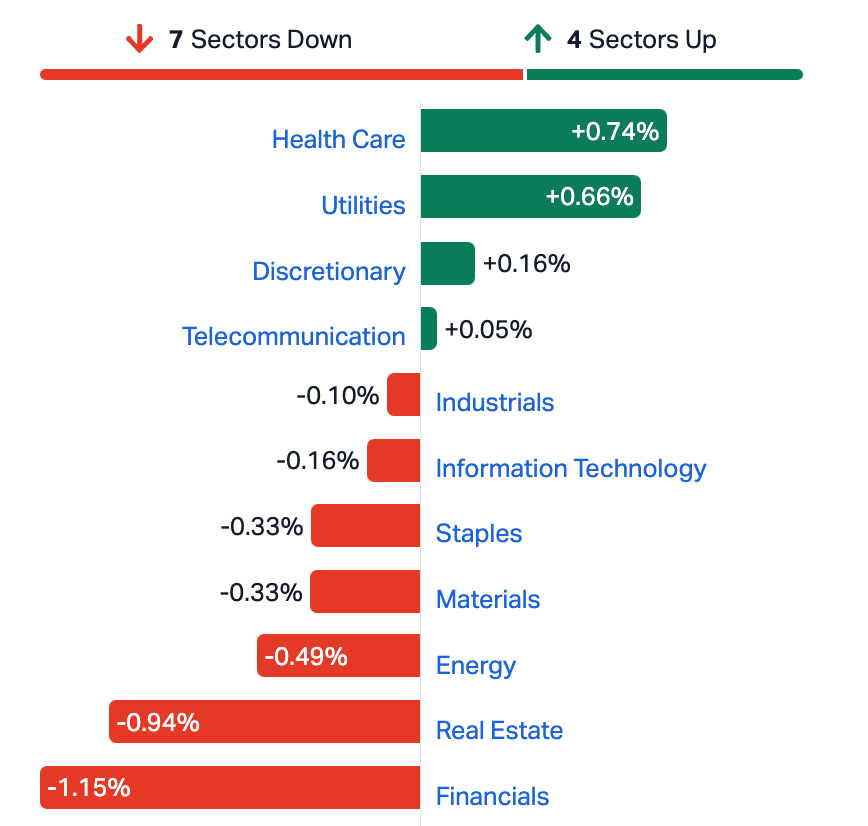

Financial stocks led the decline, with losses from Westpac (ASX:WBC) (-2.3%), Commonwealth Bank (ASX:CBA) , Australia and New Zealand Banking Group (ASX:ANZ) (-1%), National Australia Bank (ASX:NAB), and Macquarie Group (ASX:MQG) (-1%).

ASX Healthcare stocks have continued to find support during the switch out to a rate-sensitive buying opportunity – it’s been a fine week, in a terrible year:

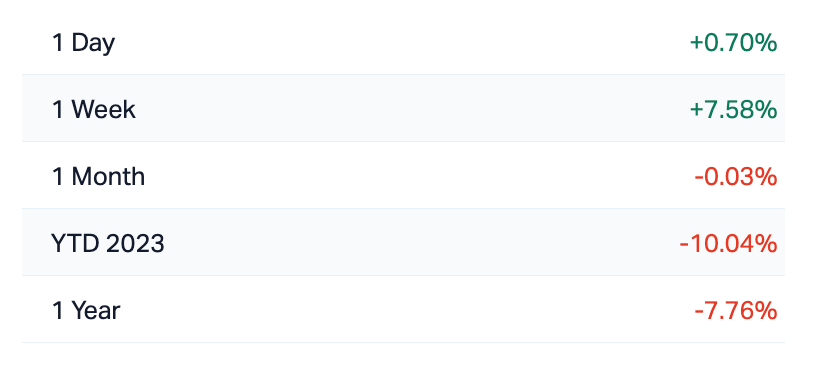

Overnight on The Street, US sharemarkets closed a wee bit above parity for the first session of the week.

It’s a result most traders will take after the three major US indices locked in the standout weekly return of the year-to-date.

The Dow Jones and the S&P 500 closed just +0.1% and +0.2%, into the green respectively, while the tech-laden Nasdaq Composite added +0.3%.

There’s clearly both momentum and sentiment for the growth giants inside the Nasdaq. US investors still made albeit smaller bets on the death of the US Federal Reserve’s cycle of tightening. A grip which has suffocated any upbeat ideas around equities for many moons now.

Wall Street still has to face down some uncertain corporate results which could have a more direct, short-term impact on this week’s trade.

US Treasury yields have slipped and global central bank might look like they don’t retain the conservative bent which has dominated their monetary policy decisions all year, JP Morgan said in a note overnight.

Despite the recent interpretation that this nonsense is all done with, the bank says equities are still among the more “unattractive” investment choices.

The comments come as US bond yields regained some strength overnight and JP Morgan retains its position that the US Fed will hold to its higher-for-longer strategy.

Stock valuations are toppy, earnings expectations too optimistic, profit margins are at risk and ‘the slowdown in top-line growth is set to continue,’ the US bank adds for good measure.

The roaring start to November provides stark contrast to the awful October in which the S&P 500 slipped into correction territory.

Still the buying on Monday focused around the Tech and Healthcare Sectors.

Apple led the big tech names, pharma giant Eli Lilly jumped almost +5%, while Elon’s Tesla fell -0.3%.

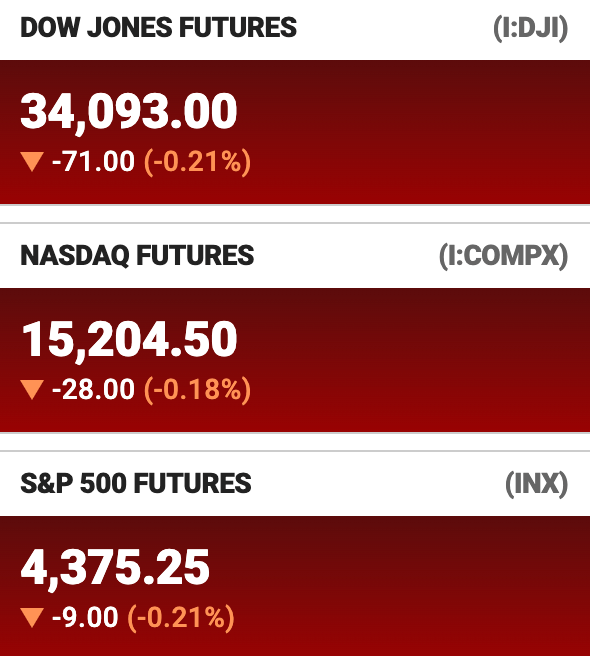

US futures were lower on Monday evening.

Here are the best performing ASX small cap stocks for 7 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DCX Discovex Res Ltd 0.002 33% 250,000 $4,953,852 LNU Linius Tech Limited 0.002 33% 853,000 $6,783,436 AL8 Alderan Resource Ltd 0.014 27% 9,447,062 $6,783,641 FAU First Au Ltd 0.0025 25% 1,699,901 $2,903,987 LSR Lodestar Minerals 0.005 25% 2,637,000 $8,093,589 SIS Simble Solutions 0.005 25% 596,794 $2,411,803 TKL Traka Resources 0.005 25% 200,158 $3,501,317 MEL Metgasco Ltd 0.012 20% 975,214 $10,638,867 TAS Tasman Resources Ltd 0.006 20% 2,800 $3,563,346 FRX Flexiroam Limited 0.033 18% 150,000 $18,597,368 TNC True North Copper 0.165 18% 901,106 $36,377,803 NIS Nickelsearch 0.08 18% 12,617,870 $10,900,218 AW1 American West Metals 0.14 17% 3,333,257 $44,495,763 HYT Hyterra Ltd 0.021 17% 147,024 $9,493,176 CCZ Castillo Copper Ltd 0.007 17% 3,348,397 $7,797,032 ME1 Melodiol Global Health 0.0035 17% 6,780,001 $11,502,311 MTL Mantle Minerals Ltd 0.0035 17% 1,499,750 $18,442,338 SKN Skin Elements Ltd 0.007 17% 140,647 $3,536,917 KZA Kazia Therapeutics 0.078 16% 303,112 $15,835,408 ITM Itech Minerals Ltd 0.145 16% 145,712 $15,272,945 CXM Centrex Limited 0.079 14% 874,332 $46,328,735 TG6 TG Metals 0.795 14% 5,627,002 $28,009,571 ASR Asra Minerals Ltd 0.008 14% 1,801,911 $10,126,460

Climbing the wall of worry on Tuesday is True North Copper (ASX:TNC) which reports that advanced grade control drilling at Wallace North, Cloncurry has clocked hits of up to 14.05% copper, 25.70g/t gold – both far exceeding resource modelling at Wallace North.

The drilling program at TNC’s copper-gold Wallace North project identified high grade zones of copper and gold mineralisation, the excellent results has punters anticipating a roundly positive impact on the project’s future resource estimates and open-pit designs.

MD Marty Costello who says the news confirms that Wallace North has the ‘potential to deliver significant near-term value’ to the company.

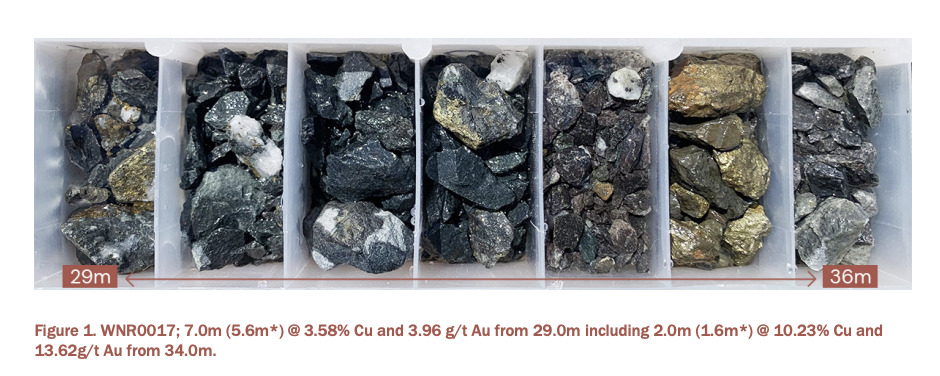

A box of goodies:

Here are the most-worst performing ASX small cap stocks for 7 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -33% 21,890,771 $15,396,757 FHS Freehill Mining 0.002 -33% 25,000 $8,534,403 YPB YPB Group Ltd 0.002 -33% 195,035 $2,341,384 CCE Carnegie Clean Energy 0.0015 -25% 115,325 $31,285,147 GSM Golden State Mining 0.016 -20% 4,855,783 $3,821,766 GTG Genetic Technologies 0.002 -20% 410,000 $28,854,145 DGR DGR Global Ltd 0.023 -18% 169,733 $29,223,417 BXN Bioxyne Ltd 0.011 -15% 1,867,391 $24,721,390 W2V Way2Vatltd 0.011 -15% 771,240 $8,249,649 FNX Finexia Financial Group 0.23 -15% 13,626 $13,068,730 GBZ GBM Rsources Ltd 0.018 -14% 29,262 $13,026,758 BFC Beston Global Ltd 0.006 -14% 300,000 $13,979,328 INP Incentiapay Ltd 0.006 -14% 33,333 $8,855,445 IVX Invion Ltd 0.006 -14% 12,864 $44,951,425 MOH Moho Resources 0.006 -14% 20,000 $2,380,311 RNX Renegade Exploration 0.006 -14% 275,000 $6,671,866 ROC Rocketboots 0.12 -14% 19,528 $4,555,390 RB6 Rubix Resources 0.125 -14% 840,671 $7,909,750 TRE Toubaniresourcesinc 0.1 -13% 119,634 $15,394,552 RNE Renu Energy Ltd 0.02 -13% 564,458 $10,292,249 DYM Dynamic Metals 0.18 -12% 5,000 $7,175,000 ADD Adavale Resource Ltd 0.008 -11% 425,323 $6,573,324 HXG Hexagon Energy 0.008 -11% 624,096 $4,616,243 MZZ Matador Mining Ltd 0.041 -11% 210,032 $18,136,389 ABE Australian Bond Exchange 0.075 -11% 53,266 $3,255,261