ASX Small Cap Lunch Wrap: Who’s survived the Spanish Inquisition today?

Pic: Getty

We’re at the halfway point for the ASX and there’s been some relief for Afterpay (ASX:APT) shareholders.

The BNPL leader confirmed that the central bank of Spain — the only hangup in its proposed acquisition by Block Inc — has now given regulatory approval for the deal.

Shares jumped 4.8% on the news that Australia’s biggest merger deal, worth around $39 billion, was all but done and dusted, and were sitting at $77.12 around midday AEDT.

Afterpay shares will exit the Australian Stock Exchange on January 19, replaced by Block under the ticker SQ2.

The news slotted in nicely with a generally positive vibe this morning where the S&P/ASX200 gained 0.54% to 7,430.20, despite crossing below its 125-day moving average.

It’s still lost 1.79% for the last five days, so more lifting required.

Those early gains are taking place ahead of all-important US inflation figures later tonight. Consensus is for annual core inflation to rise by 5.4%, and if it prints higher that could cause some more fireworks in the bond market. In such a scenario, tech stocks “likely trade lower”, Peppestone analyst Chris Weston says.

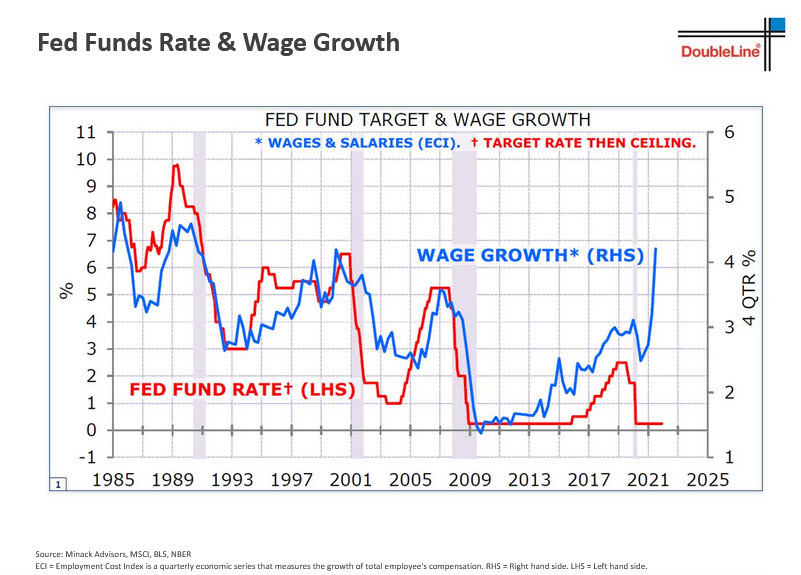

Speaking of US inflation, here’s a chart (from DoubleLine Capital, the investment firm of bond market luminary Jeff Gundlach):

That looks like a… dislocation. Recall that when it comes to inflation in Australia, RBA governor Philip Lowe has repeatedly said that wage growth will have to climb before inflation lifts sustainably. So if the above is anything to go by, it looks like wage growth in the US is coming to the party — although interest rates are yet to catch up.

Watch this space.

And it’s impossible to go 48 hours without writing about Covid in any sort of news wrap. Sorry.

Especially when the highlights include:

– NSW Premier Dom Perrottet thinking people will admit they took a RAT, tested positive and didn’t report it, knowing it will cost them a $1000 fine

– Bolivia’s vice president David Choquehuanca contracting Covid for the third time despite assuring everyone he had acquired immunity through infection, chewing coca leaves and regular intakes of turmeric, ginger, onion, garlic, and honey

– and panic buyers stripping supermarket shelves of Panadol but not Panamax.

https://twitter.com/Kat_La/status/1480747320341774342

Then the pandemic delivers a moment like these, where newsreaders Mike Amor and Rebecca Maddern tee off on “lying, sneaky arsehole” Novak Djokovic, unaware their conversation would be leaked to the world.

Lol pic.twitter.com/JqlKnap2p1

— Lucky Lance (@theluckylance) January 11, 2022

Has the Australia Day honours list been finalised yet? Just saying.

Here are today’s other winners and losers on the ASX so far….

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 10 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| PGO | Pacgold | 0.78 | 59.2% | $18,363,975 |

| BAS | Bass Oil Ltd | 0.002 | 33.3% | $6,919,022 |

| T3D | 333D Limited | 0.004 | 33.3% | $8,412,557 |

| IMC | Immuron Limited | 0.12 | 29.0% | $21,185,246 |

| JAT | Jatcorp Limited | 0.02 | 25.0% | $29,084,656 |

| EMT | Emetals Limited | 0.022 | 22.2% | $9,270,000 |

| NOV | Novatti Group Ltd | 0.355 | 20.3% | $97,850,769 |

| TI1 | Tombador Iron | 0.042 | 20.0% | $39,128,262 |

| FAU | First Au Ltd | 0.012 | 20.0% | $7,839,109 |

| CPV | Clearvue Technologie | 0.335 | 19.6% | $59,264,583 |

| BRV | Big River Gold Ltd | 0.275 | 19.6% | $50,471,764 |

| RAG | Ragnar Metals Ltd | 0.049 | 19.5% | $15,280,080 |

| SFM | Santa Fe Minerals | 0.19 | 18.8% | $11,651,006 |

| BTR | Brightstar Resources | 0.059 | 18.0% | $27,343,043 |

| ESR | Estrella Res Ltd | 0.027 | 17.4% | $27,072,006 |

| BSX | Blackstone Ltd | 0.68 | 17.2% | $260,766,588 |

| LRS | Latin Resources Ltd | 0.035 | 16.7% | $42,683,288 |

| OPY | Openpay Group | 0.73 | 15.9% | $82,387,441 |

| ADN | Andromeda Metals Ltd | 0.22 | 15.8% | $471,908,139 |

| CPM | Coopermetalslimited | 0.275 | 14.6% | $6,484,800 |

| AYM | Australia United Min | 0.008 | 14.3% | $12,898,042 |

| CZR | CZR Resources Ltd | 0.008 | 14.3% | $24,404,263 |

| ROG | Red Sky Energy. | 0.008 | 14.3% | $37,115,590 |

| CRR | Critical Resources | 0.074 | 13.8% | $84,937,209 |

| SGI | Stealth Global | 0.165 | 13.8% | $14,456,500 |

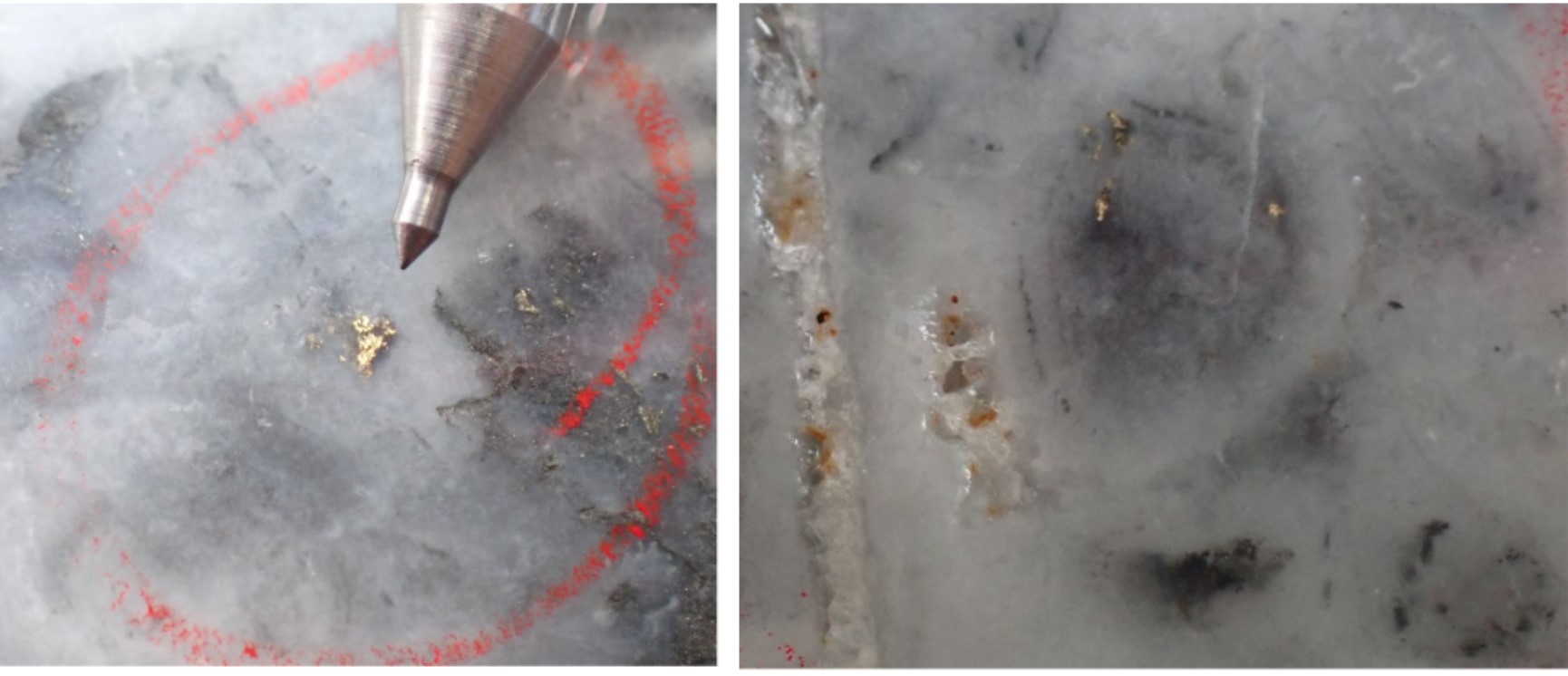

Today’s big winner was Pacgold (ASX:PGO) which soared nearly 60 per cent on news of a “significant expansion” of a new high-grade gold zone at its Alice River project in North Queensland.

The gold was chunky (17m @ 9.3g/t Au from 192m) and visible:

Some 50 grains like that one were recovered. Punters love a gold pic.

ASX SMALL CAP LOSERS

| Code | Company | Price | % | Market Cap |

|---|---|---|---|---|

| WOO | Wooboard Tech Ltd | 0.0015 | -25.0% | $7,644,325 |

| CCE | Carnegie Cln Energy | 0.002 | -20.0% | $37,756,434 |

| EN1 | Engage:Bdr Limited | 0.002 | -20.0% | $7,756,590 |

| BEE | Broo Ltd | 0.01 | -16.7% | $11,349,036 |

| AHK | Ark Mines Limited | 0.2 | -14.9% | $7,299,124 |

| NGS | NGS Ltd | 0.185 | -14.0% | $14,830,413 |

| SPQ | Superior Resources | 0.052 | -13.3% | $94,612,510 |

| SMN | Structural Monitor. | 0.605 | -12.3% | $84,712,287 |

| PTR | Petratherm Ltd | 0.043 | -12.2% | $9,746,972 |

| ALM | Alma Metals Ltd | 0.029 | -12.1% | $24,402,584 |

| TTA | TTA Holdings Ltd | 0.044 | -12.0% | $6,871,171 |

| SBR | Sabre Resources | 0.004 | -11.1% | $7,775,161 |

| ADV | Ardiden Ltd | 0.0125 | -10.7% | $30,356,695 |

| BCA | Black Canyon Limited | 0.22 | -10.2% | $7,649,023 |

| SOP | Synertec Corporation | 0.08 | -10.1% | $31,805,090 |

| OSX | Osteopore Limited | 0.27 | -10.0% | $35,180,471 |

| AVW | Avira Resources Ltd | 0.0045 | -10.0% | $8,593,950 |

| GTG | Genetic Technologies | 0.0045 | -10.0% | $46,169,826 |

| MRQ | Mrg Metals Limited | 0.009 | -10.0% | $15,406,699 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.