ASX Small Cap Lunch Wrap: Who’s in a lot of trouble today?

Via Getty

Local markets, our confidence in the institution of marriage, and the reliable rollout of key Chinese economic data are all slightly weaker on Wednesday at lunchtime.

At midday, the ASX200 was down 15 points or 0.21% at 7399.

ASX200 (XJO) vs ASX All Tech (XTX) index

Well, it’s been pretty mixed in Sydney this morning, with the moves diverging in their own way from the losses overnight out of New York, with the local Tech Sector making sharp early gains, despite the 0.4% fall in the S&P500 and a 0.2% decline on the Nasdaq.

But first things first; there’s nefarious news out of Mexico that’s sure to send shivers down the spine of every Bridezilla after one unfortunate wife-to-be was nabbed by the fuzz on her way, literally, to the altar.

Identified only as Nancy N, the woman (with the new style sunnies below) was arrested getting out of a car in front of the church where she was supposed to be marrying a really charming fella called Clemente, aka El Raton (The Mouse).

The pair were wanted over the apparent extortion of various chicken merchants in the famed poultry region of Toluca, a handily short drive from Mexico City.

Cartel busting cops – apparently unfamiliar with the basic rules of having your photo taken – are alleging that the couple were involved in kidnapping at least four poultry workers from a chicken shop.

With the wedding well and truly ruined, Nancy was arrested and cuffed, bridal gown and all, for the wedding photo to end all wedding photos back at the station.

El Raton, who reportedly has ties to the La Familia Michoacana drug cartel (but who doesn’t) managed to live up to his name, eluding police and is currently at large and presumably in a lot of trouble.

The ASX

Just why the Tech Sector screamed out of the gates on Wednesday is suddenly a moot point – as the chart shows – with the XTX dropping precipitously in the last hour to outpace losses on the benchmark heading into lunch.

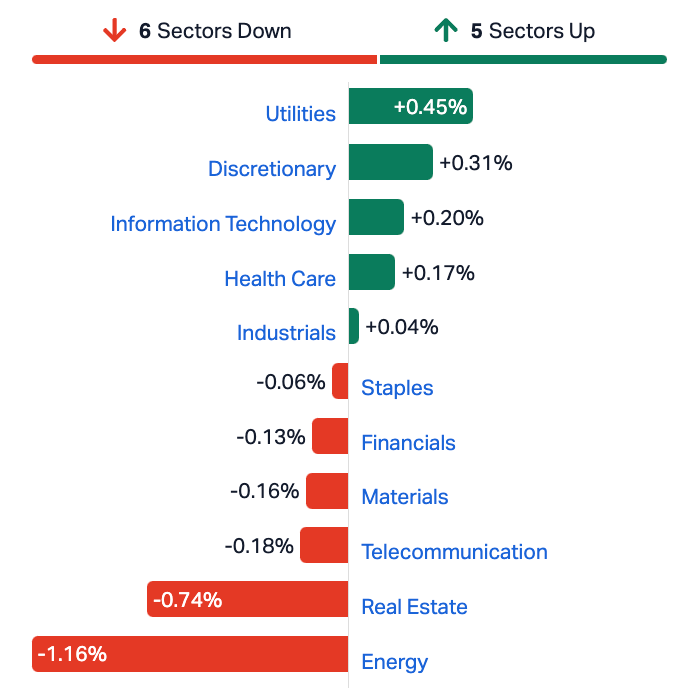

Buying in the Utilities and Consumer Sectors has been unable to offset losses across Gold stocks and Energy names, as overnight declines for bullion and oil have left Woodside Energy Group (ASX:WDS) , Northern Star Resources (ASX:NST) and Newmont Corporation (ASX:NEM) all lower.

Worst on park among the big names isEvolution Mining (ASX:EVN) after the company downwardly revised production guidance for its Canadian Red Lake mine.

Falls in the Real Estate, Energy, Industrials and Materials are providing the drag.

ASX SECTORS AT LUNCH ON WEDNESDAY

Meanwhile in China and/or Switzerland…

In a totally surprising breach of hallowed protocol, we can report that China’s economy grew by an “estimated” 5.2% last year, a handy – and I guess believable – beat on the official 5% target.

What’s particularly odd about this one is that the official release of GDP data from China’s National Bureau of Statistics, isn’t due out until 1pm Sydenham time.

Instead the news came out of Davos in Switzerland via China’s No. 2 man Premier Li Qiang who put it in a speech about how great guns everything is going back home.

I’m sure he had permission, otherwise it’ll be a smack on the bottom for Qiang.

The handpicked Number 2, did however go about his work in the right way, patting himself and his boss Xi Jinping innumerable times over his 45 minute address, highlighting how the CCP had cleverly resisted throwing money at the country’s lingering economic hassles.

“We did not seek short-term growth while accumulating long-term risks, rather we focused on strengthening the internal drivers…. Just as a healthy person often has a strong immune system, the Chinese economy can handle ups and downs in its performance.

“The overall trend of long-term growth will not change,” Li predicted as reported by the Financial Times this morning.

All of which is great (well, not for Aussie exporters), but alas, in stark contrast to Li’s fab description, the Chinese economic recovery from its zero-COVID policies has been an unending struggle with a crisis in the massive property sector, feeble domestic demand, deflationary pressure and an almost preposterous absence of foreign investment and stockmarket confidence.

What China needs to do is probably throw some money at the problem, says everyone.

Not the ASX

US markets struggled again overnight, all three majors in the red.

The S&P 500 and the Nasdaq lost 0.4% and 0.2%, respectively, and the Dow Jones slipped 231 points.

What didn’t help was a few choice remarks from Federal Reserve Governor Waller, suggesting the Fed may not cut interest rates as aggressively as initially expected.

Waller downplayed the need to rush with rate cuts, the first mutterings of real meaning from a Fed which has stayed mum over the new year. This sober note may’ve been enough though to in initiate an eventual recalibration across US money markets.

It would appear that over the Xmas holidays US confidence of a soft landing for the US economy became the baste under which Wall St baked its turkey.

However some of the reports over the past week or so, alongside geopolitical complications , are serving to remind economists, consumers and financial markets that this goose is still undercooked.

On that note, the Israeli army says it’s near done with its ‘most intensive phase’ of blowing stuff up in Gaza. Israel’s defense minister warned that the lack of a plan for the enclave postwar could hurt the military campaign.

A bit more concerning on the “we have your men” front – the US military is trying to find x 2 Navy SEALs lost at sea (probs the Red one) while snatching Iranian weapons shipments bound for its Yemeni allies.

Pakistan is also going to want to fire something at someone after reports that Iran launched attacks on its sovereign territory, targeting what it called bases for the militant group Jaish al-Adl, state media reported.

By targeting the Sunni-side of the Mid East, Iran is stirring the pot of tension. There’s a fair bit of confusion with some of the announcements being removed from official sources.

But hey, firing rockets inside nuclear-armed Pakistan by anyone is not an act of de-escalation.

So back to Waller, who started his chat gently enough – lauding the resilience of the US economy, but then flipped it on traders by saying ipso facto, sic: we’re ok for now, the economy ain’t broke (yet) so there’s no urgency to run away and start cutting rates tomorrow.

What kicked it all off, possibly, were the outrageously hawkish remarks out of Europe on Tuesday when president (of my heart) Christine Lagarde unleashed her ECB minions to warn Europeans not to expect ANY rate cuts this year.

She’s so cool.

Wall Street is also doing its earnings thing. On that front, the bank with gold in the name (it’s Goldman Sachs) reported better-than-expected profits and revenue, while the other Morgan (Morgan Stanley) also beat on revenue guidance. Which, BTW, is easy. You can retract that later after the cream’s been spread.

On the funny side of life, Apple stock fell another a 1.2% after offering iPhone discounts in China, where the state has unofficially banned the phone’s use.

Apple’s also said to be removing a blood-oxygen sensor from some of its Iwatches (or Apple watches?) to dodge a patent dispute.

Elsewhere, Boeing shares lost 8% thanks to a Wells Fargo downgrade, but it’s Boeing’s apparently unfixable 737 Max 9 which is the carrier’s underlying issue.

Nike – shoemaker and avatar for US shopping – down well over 3%.

Elon Watch

Shares in Tesla fell overnight too.

That’s your fault Elon Musk – you want too much and we don’t have enough of it to give you.

The Tesla chief executive has told the board and everyone else he needs at least 25% control of the EV maker as it rolls amiably into the world of robots and AI.

Greater control, another terrific incentivised pay package and then he could decide not to take those things and plant them in a company that’s not Tesla.

The word is that on Blackmail Monday Musk gave TSLA board members the ultimatum – he’s just too uncomfortable making Tesla a leader in those two areas without having more.

“Unless that is the case, I would prefer to build products outside of Tesla,” Musk said on Twitter/X, where he’s also the boss.

Musk now controls about 13% of Tesla, according to FactSet data, if Elon exercised all his vested options, his stake would be about 20.5%.

In the meantime, TSLA has to hurry up and spend the circa$US1bn Elon’s earmarked before the end of this year on its Dojo supercomputer.

Dojo, which is a silly name, has been told to figure out how to make cars driverless.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 5,619,700 | $1,633,729 |

| MRD | Mount Ridley Mines | 0.002 | 100% | 566,502 | $7,784,883 |

| KEY | KEY Petroleum | 0.0015 | 50% | 3,563,007 | $2,262,928 |

| MCT | Metalicity Limited | 0.003 | 50% | 364,999 | $8,970,108 |

| YOJ | Yojee Limited | 0.004 | 33% | 124,750 | $3,917,956 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 7,118,028 | $15,245,305 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 1,589,984 | $7,037,487 |

| RNX | Renegade Exploration | 0.0085 | 21% | 9,624,226 | $7,012,066 |

| HOR | Horseshoe Metals Ltd | 0.006 | 20% | 83,335 | $3,232,393 |

| IEC | Intra Energy Corp | 0.003 | 20% | 9,179,921 | $4,151,954 |

| TML | Timah Resources Ltd | 0.031 | 19% | 5,715 | $2,307,754 |

| MAN | Mandrake Res Ltd | 0.045 | 18% | 4,705,858 | $23,398,877 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 2,011,099 | $4,271,781 |

| PRX | Prodigy Gold NL | 0.007 | 17% | 12,561 | $10,506,647 |

| ASN | Anson Resources Ltd | 0.115 | 16% | 2,374,081 | $127,288,178 |

| RZI | Raiz Invest Limited | 0.4 | 16% | 38,484 | $32,238,686 |

| CBE | Cobre | 0.051 | 16% | 231,113 | $12,624,084 |

| BSN | Basin Energy | 0.19 | 15% | 1,029,266 | $10,276,201 |

| FBM | Future Battery | 0.067 | 14% | 177,913 | $31,491,603 |

| PIM | Pinnacle Minerals | 0.135 | 13% | 1,040,211 | $4,159,574 |

| 1MC | Morella Corporation | 0.0045 | 13% | 2,021,894 | $24,715,198 |

| ARD | Argent Minerals | 0.009 | 13% | 321,116 | $10,334,072 |

| AUZ | Australian Mines Ltd | 0.009 | 13% | 880,214 | $7,560,394 |

| EXT | Excite Technology | 0.009 | 13% | 2,435,505 | $10,633,934 |

| FIN | FIN Resources Ltd | 0.018 | 13% | 1,146,184 | $10,388,299 |

Alicanto Minerals (ASX:AQI) is nominally at the top of the ladder for Wednesday thus far, spiking a Benaud-esque 22.22%, most likely off the back of yesterday’s announcement that the company’s Big Swede – the Skyttgruvan-Naverberg project, which lies alongside the fearsome 1,000-year-old Falun mine – is getting bigger every time the company pokes around.

Mandrake Resources (ASX:MAN) took off at a gallop this morning, running helter skelter for 45 minutes until the ASX tugged on the handbrake and brought the party to a close – leaving Mandrake dangling at +18.4% for the morning, on a sharp increase in volume.

We’re talking roughly 7.5x the four-week average, and without a skerrick of news to the ASX as to why. There will no doubt be an explanation of sorts on the way, but at the time of writing, it remains a mystery for Scoob and the gang to unravel.

Basin Energy (ASX:BSN) has timed the start of its 2024 exploration program very nicely indeed, capitalising nicely on yellowcakes high-vis on the market at the moment with news that field work has now commenced for Basin’s winter program across the entirety of the company’s Athabasca uranium projects.

That encompasses high-resolution ground Stepwise Moving Loop Time-Domain Electromagnetic survey work underway at the North Millennium and Marshall projects, while final preparations are being made for phase 2 drilling at the Geikie project.

Likewise, Pinnacle Minerals (ASX:PIM) has a timely announcement out this morning, providing an update on its Uranium-REE Wirrulla project in South Australia.

Pinnacle is reporting that recent satellite and radar imagery analysis at Wirrulla has highlighted uranium (U3O8) mineralisation potential and defined a number of priority target areas.

Additionally, exploration has found uranium mineralisation in place, with intercepts including 3,550ppm U3O8 over 1m from 66m in hole IR1377, and 1,400ppm U3O8 over 1m from 69m in hole IR1378.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 16 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FAU | First Au Ltd | 0.003 | -25% | 2,650,000 | $6,647,973 |

| HTA | Hutchison | 0.033 | -20% | 69,481 | $556,472,852 |

| EVN | Evolution Mining Ltd | 3.07 | -18% | 25,279,542 | $7,408,149,488 |

| WML | Woomera Mining Ltd | 0.0175 | -17% | 6,959,839 | $25,580,919 |

| RDS | Redstone Resources | 0.005 | -17% | 1,996,969 | $5,528,271 |

| RMX | Red Mount Min Ltd | 0.003 | -14% | 501,500 | $9,357,516 |

| TX3 | Trinex Minerals Ltd | 0.006 | -14% | 300,000 | $10,409,173 |

| CMX | Chemx Materials | 0.073 | -14% | 10,000 | $4,524,767 |

| N1H | N1 Holdings Ltd | 0.155 | -14% | 12,836 | $15,850,003 |

| AUK | Aumake Limited | 0.0035 | -13% | 2,777,756 | $7,657,627 |

| ICL | Iceni Gold | 0.056 | -13% | 52,352 | $15,638,857 |

| LPD | Lepidico Ltd | 0.007 | -13% | 1,360,899 | $61,106,464 |

| PUR | Pursuit Minerals | 0.007 | -13% | 350,007 | $23,551,771 |

| RR1 | Reach Resources Ltd | 0.0035 | -13% | 1,110,922 | $12,841,188 |

| CSX | Cleanspace Holdings | 0.36 | -11% | 2,180 | $31,314,075 |

| AZY | Antipa Minerals Ltd | 0.016 | -11% | 4,893,955 | $74,426,542 |

| GBZ | GBM Rsources Ltd | 0.008 | -11% | 649,125 | $6,582,896 |

| LM1 | Leeuwin Metals Ltd | 0.125 | -11% | 35,295 | $6,559,234 |

| SRI | Sipa Resources Ltd | 0.025 | -11% | 12,077 | $6,388,428 |

| FLX | Felix Group | 0.17 | -11% | 212,500 | $38,854,945 |

| IR1 | Iris Metals | 0.73 | -10% | 198,646 | $105,530,260 |

| AKN | Auking Mining Ltd | 0.043 | -10% | 467,289 | $11,056,978 |

| EG1 | Evergreen Lithium | 0.135 | -10% | 94,486 | $8,434,500 |

| IVX | Invion Ltd | 0.0045 | -10% | 45,746 | $32,108,161 |

| PWN | Parkway Corp Ltd | 0.009 | -10% | 996,670 | $25,132,250 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.