ASX Small Cap Lunch Wrap: Who’s got a hot tip today?

Pic Getty

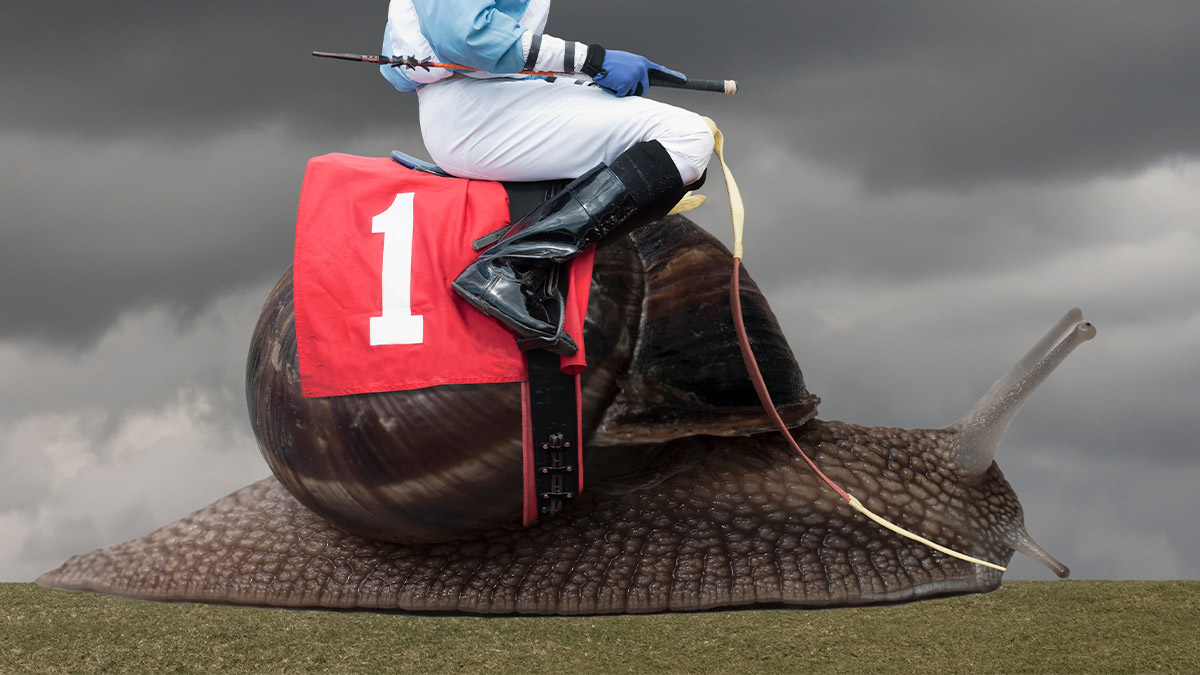

With Victorians on holiday for ‘The Race that Stops the Nation’, local stocks are sending mixed signals ahead of the all-important RBA meeting at 2:30pm AEST.

In what marks a (tenuous and completely unrelated) nod to the ASX BNPL sector, Macquarie Bank quant strategists have crunched the numbers and reckon Twilight Payment has the goods to win this year’s Melbourne Cup.

If TP gets home, it will be the first horse to win back-to-back Melbourne Cups since Makybe Diva won three straight (2003-2005).

Incentivise is today’s short-priced favourite, currently paying odds of around 3-to-1 for the win.

On markets, the ASX 200 opened in the red, and dipped by around 0.4% into midday trade.

Following last week’s bond market volatility, banking stocks are again dragging on the broader index with the ASX Financials index on track for its third straight day of falls.

At the small end of town, the microcap Emerging Markets index jumped out of the gate with a gain of more than 1%, before easing back to around +0.7% by 12pm EST.

Ahead of the RBA meeting, the Aussie dollar has edged higher against all the major currencies and is currently trading slightly above US75c.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 2 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| PCL | Pancontinental Energ | 0.0015 | 50.0% | $ 7,034,222.81 |

| ICR | Intelicare Holdings | 0.13 | 35.4% | $ 4,617,660.58 |

| TYM | Tymlez Group | 0.022 | 29.4% | $ 16,776,475.89 |

| XST | Xstate Resources | 0.005 | 25.0% | $ 12,860,726.60 |

| MOB | Mobilicom Ltd | 0.06 | 22.4% | $ 15,774,899.08 |

| ECT | Env Clean Tech Ltd. | 0.023 | 21.1% | $ 23,657,384.98 |

| AUQ | Alara Resources Ltd | 0.028 | 16.7% | $ 16,930,301.74 |

| PPS | Praemium Limited | 1.445 | 16.1% | $ 627,323,158.64 |

| GL1 | Global lithium | 0.75 | 15.4% | $ 57,834,332.40 |

| M3M | M3Mininglimited | 0.23 | 15.0% | $ 5,642,125.60 |

| ADX | ADX Energy Ltd | 0.0115 | 15.0% | $ 26,583,175.23 |

| GW1 | Greenwing Resources | 0.39 | 14.7% | $ 37,933,754.10 |

| MNS | Magnis Energy Tech | 0.525 | 14.1% | $ 427,539,891.16 |

| EMD | Emyria Limited | 0.285 | 14.0% | $ 38,498,594.75 |

| AL3 | Aml3D | 0.17 | 13.3% | $ 14,893,012.20 |

| PH2 | Pure Hydrogen Corp | 0.47 | 13.3% | $ 130,258,483.15 |

| NTI | Neurotech Intl | 0.069 | 13.1% | $ 42,505,966.69 |

| EME | Energy Metals Ltd | 0.315 | 12.5% | $ 58,711,327.36 |

| AKG | Academies Aus Grp | 0.29 | 11.5% | $ 33,179,761.42 |

| AZL | Arizona Lithium Ltd | 0.1 | 11.1% | $ 156,774,933.72 |

| PYC | PYC Therapeutics | 0.15 | 11.1% | $ 429,425,023.91 |

| EQE | Equus Mining Ltd | 0.01 | 11.0% | $ 22,548,067.98 |

Among stocks with news, there was a sharp mover higher for medtech company Intelicare (ASX:ICR) after landing a contract with WA-based aged care services provider MercyCare.

Under the terms of the deal, MercyCare will deploy ICR’s SaaS-based platform which uses sensor technology and artificial intelligence to provide in-home monitoring services to help elderly residents continue to live independently.

Intelicare flagged an estimated total contract value of ~$170,000, with “further non-binding potential for ongoing recurring fees and additional hardware”.

The ongoing M&A boom was also the catalyst for a separate winner in morning trade, as wealth management platform Praemium (ASX:PPS) rose in the wake of a merger bid from fund manager Netwealth (ASX:NWL).

Praemium said it thinks the offer is too low, but remains open to assessing offers at higher valuations.

In resources, Global Lithium (ASX:GL1) is back on the war path, with its third straight day of strong gains either side of yesterday’s $13.6m share placement, which included cornerstone backing from China-based EV battery giant Yibin Tianyi.

ASX SMALL CAP LOSERS

Here are the best performing ASX small cap stocks for November 2 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| NPM | Newpeak Metals | 0.0015 | -25.0% | $ 14,740,203.53 |

| DOR | Doriemus PLC | 0.2 | -20.0% | $ 30,082,732.50 |

| OEX | Oilex Ltd | 0.004 | -20.0% | $ 28,442,151.78 |

| TPS | Threat Protect Ltd | 0.004 | -20.0% | $ 33,251,966.28 |

| APC | Aust Potash Ltd | 0.093 | -19.1% | $ 74,740,835.42 |

| HMX | Hammer Metals Ltd | 0.051 | -16.4% | $ 49,623,172.00 |

| AOA | Ausmon Resorces | 0.006 | -14.3% | $ 4,974,615.40 |

| SPN | Sparc Tech Ltd | 1.355 | -12.6% | $ 90,977,575.50 |

| TMX | Terrain Minerals | 0.008 | -11.1% | $ 6,621,849.08 |

| TBA | Tombola Gold Ltd | 0.036 | -10.0% | $ 25,371,831.16 |

| BIS | Bisalloy Steel | 1.87 | -9.7% | $ 95,381,890.56 |

| LNU | Linius Tech Limited | 0.02 | -9.1% | $ 37,267,209.50 |

| SFG | Seafarms Group Ltd | 0.04 | -9.1% | $ 212,810,363.88 |

| TSC | Twenty Seven Co. Ltd | 0.005 | -9.1% | $ 14,634,476.48 |

| IRX | Inhalerx Limited | 0.1 | -9.1% | $ 18,531,365.27 |

| SDV | Scidev Ltd | 0.655 | -9.0% | $ 114,665,934.24 |

| BTN | Butn Limited | 0.275 | -8.3% | $ 19,509,000.00 |

| MCM | Mc Mining Ltd | 0.11 | -8.0% | $ 18,530,346.60 |

| PAL | Palla Pharma Ltd | 0.33 | -8.0% | $ 58,288,738.68 |

| ADV | Ardiden Ltd | 0.011 | -8.0% | $ 25,840,024.27 |

| SMR | Stanmore Resources | 0.975 | -8.0% | $ 286,630,721.46 |

| HHR | Hartshead Resources | 0.023 | -8.0% | $ 46,244,303.15 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.