ASX Small Cap Lunch Wrap: Who are today’s Kings and Jokers?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

American politics has been a fixture on our living room TVs for weeks now, and still it seems the long-running saga of this year’s presidential election is not yet over.

As it turns out, perhaps the writers of House of Cards weren’t pushing the envelope far enough when they asked us to roll with them as they imagined an all-female US presidential cabinet. If it’s going to happen, 2020 is the year for it.

But for those tired of US politics, our own home-grown politicians in the Canberra shiny-bum bubble have provided some mirth-making inspiration.

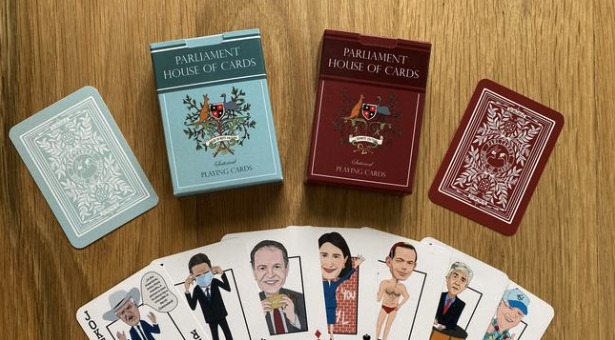

Those looking for a Christmas gift for Aussie politics fans may be interested in a $20 pack of playing cards that feature caricatures of Australian politicians and the media stars who cover Parliament House.

The Parliament House of Cards decks feature Bob Katter as The Joker, former prime minister Tony Abbot in his trademark budgie smugglers, and former Labor leader Bill Shorten holding a pie.

They are the handiwork of Sydney-based TV researcher and producer, Alex Godwin, who has worked on Shaun Micallef’s satirical show ‘Mad As Hell’.

Godwin said that she wanted to make something that was fun and light-hearted after what has been a tough year.

“I drew stuff that was funny to me and I tried to touch on things that were highlights from the year,” she told The Australian.

The two packs of playing cards, red for The Australian Senate and green for the House of Representatives, feature 54 cartoons of Australian politicians, journalists and comedians.

Now, to the markets.

The ASX All Ordinaries index was marginally higher Friday morning, rising 14 points (0.2 per cent) to 6,756 by lunchtime in Sydney. The index is up 2.2 per cent for the week.

US stock markets — the Dow Jones, Nasdaq and S&P 500 — all moved slightly higher overnight. The Nasdaq is approaching 12,000 points, and the Dow closed Thursday at 29,483 points, and is almost back to its February high of 29,550.

Fresh stimulus hopes buoyed investor sentiment toward the end of the US stock market trading session “fraught with worries over mounting shutdowns and layoffs linked to spiraling COVID-19 infection rates”, said analysts at Argonaut Securities in a note.

Shares in Tesla touched a new high at $US507 per share in Thursday trade, and are up 23 per cent this week after it joined the prestigious S&P 500 share index.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Friday November 20:

Swipe or scroll to reveal the full table. Click headings to sort.

Stocks highlighted in yellow have made market-moving announcements

| CODE | NAME | PRICE | % CHANGE | MARKET CAP |

|---|---|---|---|---|

| CLZ | Classic Min Ltd | 0.002 | 100 | $ 13,339,139.73 |

| GML | Gateway Mining | 0.027 | 50 | $ 34,238,088.65 |

| ALT | Analytica Limited | 0.003 | 50 | $ 7,039,224.66 |

| CZN | Corazon Ltd | 0.003 | 50 | $ 6,506,718.29 |

| NPM | Newpeak Metals | 0.004 | 33 | $ 14,004,487.53 |

| TPD | Talon Petroleum Ltd | 0.004 | 33 | $ 13,055,368.58 |

| OVT | Ovato Limited | 0.017 | 31 | $ 9,516,056.12 |

| 8IH | 8I Holdings Ltd | 0.25 | 28 | $ 70,543,022.75 |

| MRQ | Mrg Metals Limited | 0.01 | 25 | $ 10,799,613.11 |

| SKN | Skin Elements Ltd | 0.066 | 22 | $ 17,591,452.13 |

| JHC | Japara Healthcare Lt | 0.75 | 21 | $ 165,693,343.36 |

| DDD | 3D Resources Limited | 0.006 | 20 | $ 18,076,860.46 |

| ELT | Elementos Limited | 0.006 | 20 | $ 15,533,018.68 |

| PWN | Parkway Minls NL | 0.012 | 20 | $ 19,007,539.83 |

| RDG | Res Dev Group Ltd | 0.061 | 20 | $ 129,035,929.67 |

| DEV | Devex Resources Ltd | 0.275 | 20 | $ 56,592,383.20 |

| REG | Regis Healthcare Ltd | 1.75 | 19 | $ 443,651,345.18 |

| GLV | Global Oil & Gas | 0.013 | 18 | $ 7,189,869.81 |

| TRL | Tanga Resources Ltd | 0.059 | 18 | $ 8,545,908.35 |

| EHE | Estia Health Ltd | 1.89 | 17 | $ 419,378,425.25 |

Top gainer in morning trade was Classic Minerals (ASX:CLZ) which has had a good run this week, and was up 100 per cent Friday.

The gold explorer completed an oversubscribed capital raising this week for $1.2m to develop its Kat Gap high-grade deposit in WA.

Classic Minerals said it is “on the fast track to gold production and early revenue stream”.

Three ASX stocks were up around 50 per cent — Gateway Mining, Analytica, and Corazon Mining.

Gateway Mining (ASX:GML) said it had made a high-grade gold discovery between its Whistler and Montague deposits in WA.

Analytica (ASX:ALT) moved higher after announcing some positive results in clinical trials for its PeriCoach therapy intervention.

PeriCoach is used for treating stress urinary incontinence in women as an alternative to surgery, and can improve quality of life.

The University of Mexico published the results of the clinical trial in the Journal of Female Pelvic Medicine and Reconstructive Surgery, the official journal of the American Urogynecologic Society.

Corazon Mining (ASX:CZN) was up without any fresh news. The company is developing a nickel-cobalt-copper sulphide project in Canada.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Friday, November 20:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | NAME | PRICE | %CHANGE | MARKET CAP |

|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.002 | -33 | $ 12,685,076.94 |

| ARO | Astro Resources NL | 0.004 | -20 | $ 14,529,883.93 |

| WEC | White Energy Company | 0.105 | -19 | $ 100,682,233.47 |

| IDA | Indiana Resources | 0.066 | -13 | $ 17,739,067.96 |

| HNR | Hannans Ltd | 0.007 | -13 | $ 15,903,636.31 |

| ABV | Adv Braking Tech Ltd | 0.032 | -11 | $ 13,649,355.58 |

| PNX | PNX Metals Limited | 0.008 | -11 | $ 22,883,593.28 |

| MEG | Megado | 0.175 | -10 | $ 7,653,233.06 |

| KZA | Kazia Therapeutics | 1.57 | -10 | $ 220,160,130.68 |

| ADD | Adavale Resource Ltd | 0.045 | -10 | $ 11,997,040.45 |

| VRC | Volt Resources Ltd | 0.009 | -10 | $ 21,173,735.55 |

| MGL | Magontec Limited | 0.019 | -10 | $ 24,169,420.93 |

| MGT | Magnetite Mines | 0.01 | -9 | $ 31,419,884.76 |

| AMA | AMA Group Limited | 0.73 | -9 | $ 587,122,814.40 |

| KGD | Kula Gold Limited | 0.032 | -9 | $ 5,453,197.12 |

| SFM | Santa Fe Minerals | 0.11 | -8 | $ 8,738,254.68 |

| BEM | Blackearth Minerals | 0.044 | -8 | $ 7,219,895.18 |

| LCT | Living Cell Tech. | 0.011 | -8 | $ 6,857,291.77 |

| FRX | Flexiroam Limited | 0.023 | -8 | $ 12,408,362.50 |

| OAR | Oakdale Resource Ltd | 0.023 | -8 | $ 40,476,558.63 |

Friday’s largest faller was YPB Group (ASX:YPB), a product authentication technology company targeting Asian markets.

Without releasing any news Friday the company’s shares plummeted around 33 per cent.

Consumers can use YPB Group’s smartphone-compatible technology to confirm a product’s authenticity.

In its September quarter update the company said it had achieved functionality with its MotifMicro Android technology.

White Energy Company (ASX:WEC), a coal technology company, hit the skids without issuing any news Friday.

The company is in talks to sell its 51 per cent-owned US coal miner Mountainside Coal which had zero sales revenue during the September quarter, and suspended production in April 2018.

South African coal miners have expressed interest in using White Energy’s binderless coal briquetting technology.

There is an estimated 1 billion tonnes of discarded coal in tailings facilities in South Africa that could be used as feedstock for the BCB technology.

“The BCB process provides an attractive solution for coal producers seeking to maximise mine yield and facing the environmental challenges posed by reject coal fines,” said the company in an October update.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.