ASX Small Cap Lunch Wrap: Which stocks started 2021 with a bang, and which with a whimper?

Piping in the new year 2021. Bagpipe players at the Royal Military Tattoo display at Edinburgh Castle. Image: Getty

Muted New Year celebrations marked the start of 2021 with a truncated fireworks display in Sydney on New Year’s Eve where crowds were banned as a precaution for COVID-19.

Other Australian cities like Adelaide, Brisbane, Canberra and Melbourne also went without their traditional fireworks displays to mark the new year.

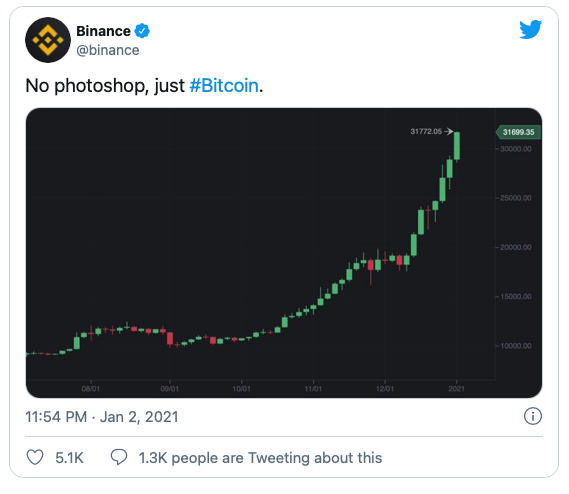

But, there was some new year cheer if you are an investor in cryptocurrencies.

Bitcoin burst through the $US30,000 mark over the weekend, and is currently trading at $US32,477 ($42,508) in Monday trade, and is already up 12.5 per cent in 2021.

“People have been steadily losing faith in their government currencies for years, and the monetary policies resulting from the economic impact of the coronavirus have only accelerated this decline,” Chainlink co-founder Sergey Nazarov told news.com.au.

At lunch, the ASX 200 is up 70 points or 1 per cent to 6,657.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Monday January 4:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| ANL | AMANI GOLD | 50 | 0.002 | $9,390,000 |

| CLZ | CLASSIC MINERALS | 50 | 0.002 | $16,700,000 |

| UUV | UUV AQUABOTIX | 50 | 0.002 | $2,390,000 |

| SRY | STORY-I | 50 | 0.018 | $4,440,000 |

| S2R | S2 RESOURCES | 36.54 | 17.8 | $40,900,000 |

| MLS | METALS AUSTRALIA | 33 | 0.002 | $6,290,000 |

| ARE | ARGONAUT RESOURCES | 33 | 0.008 | $17,500,000 |

| SLX | SILEX SYSTEMS | 33 | 1.185 | $153,800,000 |

| NAE | NEW AGE EXPLORATION | 30 | 0.013 | $11,900,000 |

| CXO | CORE LITHIUM | 27 | 0.18 | $144,700,000 |

Gold explorer S2 Resources (ASX:S2R) hit a high note on the first day of ASX trading for the 2021 year, with news of a high-grade intercept in Finland.

Assay results for recent drilling at its Aarnivalkea gold prospect in the Scandinavian country revealed a hit of 20.4m at 2.3 grams per tonne gold.

The intercept is 575m north along strike from a previous high-grade intercept for the company.

“S2 has barely scratched the surface at Aarnivalkea after making a virgin gold discovery in 2019,” chief executive, Matthew Keane, said.

“The fact that two of the four holes identified high grade gold some 575 metres apart is highly encouraging,” he said.

S2 Resources discovered the mineralised gold trend at Aarnivalkea beneath shallow glacial cover in a previously unexplored region of Finland in 2019.

Story-i (ASX:SRY), a reseller of Apple products through its 23 stores in Indonesia, had a good trading session despite a lack of new information.

The company has struggled in a challenging trading environment caused by COVID-19 and many of its outlets were closed between March and June.

Revenue for Story-i declined 27 per cent to $17.9m in the second half of the 2020 financial year, and led to a $770,000 loss for the half-year period.

The company was granted some rent reductions for its stores, and salaries were reduced by 50 per cent.

All of Story-i’s stores have reopened since June, and the company is forecasting a small increase in revenue for the 2020 financial year to $42.65m.

Another high riser in early Monday trade is renewable energy company 1414 Degrees (ASX:14D) with its Aurora solar energy project in South Australia.

Without releasing any news, the price of the stock traded higher, as the company continues to press ahead with its scalable energy storage technology.

The company in December reported its Aurora solar project has potential annual net revenue of $60m based on a business base case.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Monday January 4:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Market Cap |

|---|---|---|---|---|

| BAS | BASS OIL | -33 | 0.001 | $5,010,000 |

| CCE | CARNEGIE CLEAN ENERGY | -25 | 0.002 | $22,700,000 |

| DTR | DATELINE RESOURCES | -20 | 0.002 | $20,500,000 |

| IKW | IKWEZI MINING | -20 | 0.004 | $20,300,000 |

| DLC | DELECTA | -17 | 0.005 | $6,050,000 |

| FPL | FREMONT | -17 | 0.003 | $14,000,000 |

| GGX | GAS2GRID | -17 | 0.003 | $4,000,000 |

| 1AG | ALTERRA | -15 | 0.05 | $10,930,000 |

| RCT | REEF CASINO TRUST | -12 | 2.41 | $134,900,000 |

| LNY | LANEWAY RESOURCES | -14 | 0.006 | $26,400,000 |

There was little new year cheer Monday for casino company Reef Casino Trust (ASX:RCT) whose share price dropped despite not issuing any fresh news.

In a recent trading update in December, the company said it was expecting to make a profit of $8.5m for the second half of the 2020 year, up from $5.2m in the corresponding 2019 period.

The company received around $2.4m of assistance under the government’s JobKeeper scheme which had a favourable impact on its half-year forecast.

Reef Casino Trust operates a casino in the northern Queensland town of Cairns.

Lager company Broo (ASX:BEE) traded lower after announcing it had terminated a distribution agreement with Chinese company Beijing Jihua.

The three-year old agreement gave Beijing Jihua exclusive distribution rights for Broo’s premium lager beer in China.

Broo said it has been waiting for three years of royalty payments from Beijing Jihua that became payable in December.

The ASX lager company is reviewing its legal position.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.