ASX Small Cap Lunch Wrap: Retail ripper in September sinks local stocks, likely to attract RBA action

Via MarketIndex

Local markets are at unhappy at lunchtime on Monday, plumbing new 1-year lows in the wake of losses across both US and EU markets on Friday.

At 12.15pm, the ASX 200 was down by about 32 points or -0.5% to around 6,795.

The ASX benchmark is now down over 3.5% for the year to date.

This morning the RBA will have noted September’s stronger-than-expected retail sales data and locked the numbers into the case for a November rate rise.

After upward revisions to retail trade figures for the previous two months, sales values rose by 0.7 per cent on-quarter in the September quarter.

UBS still expects the RBA to hike the cash rate by another 25 basis points, to 4.35%.

Last week in the States, the S&P 500 gave away 2.5% joining the Nasdaq in correction territory (being down 10.6% from its 2023 high).

The Nasdaq Composite also tumbled 2.62% last week and was down 12.48% from its year-to-date high, while the Dow dropped 2.14%. Those losses came as stronger-than-expected US economic data elevated Treasury yields and mixed corporate earnings reports weighed on equities.

And yet, US futures are on the rise after Israeli forces began a ground invasion of Gaza over the weekend.

LUNCHTIME ON THE ASX200

Local investors have fled anything looking like an Energy stock this morning. Brent Crude oil prices sank as Israel began rooting through the rubble of Gaza for Hamas.

IT stocks have rebounded after sharp losses late last week and the Mining Sector has found support, even as major lithium stock IGO slumped 7%, after the battery materials giant warned of volatility in the lithium market for the December quarter.

ASX PERFORMANCE at 12.08PM

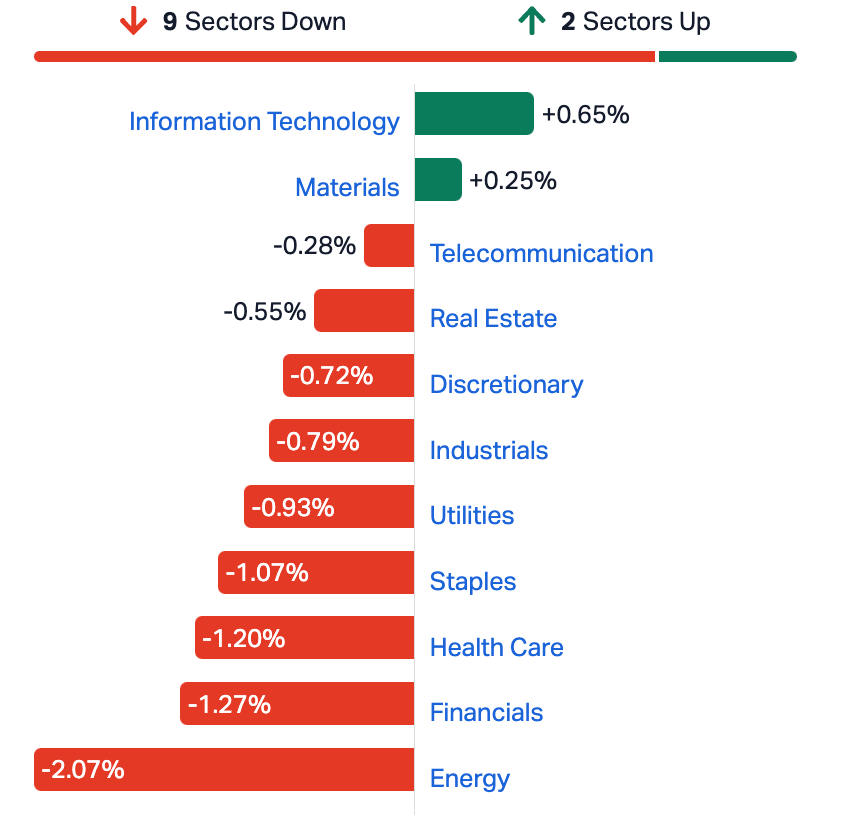

ASX SECTORS ON MONDAY AT LUNCH

In company news, there’s been some notable gains at the top end of town.

Westpac (ASX:WBC) been making up for a midweek wobble – up 0.8% – leading a Financial Sector rally-of-sorts. All the Big 4 are fighting fit following Thursday’s capitulation – CBA’s also found 0.8 per cent, NAB 0.7 per cent and ANZ about half that.

We’re kinda seeing some rebound strength in the bigger lithium plays too. Pilbara Minerals (ASX:PLS) (up 2.1%) and IGO (ASX:IGO) (up 1.3%) helping to offset declines in the iron ore majors.

NOT THE ASX

On the plus side of Monday, US futures are ahead at lunch in Sydney, although that may well be because of the mess they left Friday in.

US traders have a busy week of teeth-gnashing ahead of the Federal Reserve’s policy decision, the monthly jobs report and Apple’s earnings report.

The blue chip S&P500 is in a technical correction, while the Dow Jones shed -2.15% last week.

Meanwhile, the Fed is widely expected to hold interest rates steady on Wednesday, but could reiterate its higher-for-longer outlook on monetary policy. Elsewhere, Apple will report earnings on Thursday, while the October jobs report will be released on Friday.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 30 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap TG6 TG Metals 0.22 110% 9,775,323 $4,231,662 LRV Larvotto Resources 0.165 65% 1,232,255 $6,725,472 BML Boab Metals Ltd 0.115 40% 585,550 $14,305,947 AHN Athena Resources 0.004 33% 100,000 $3,211,403 DXN DXN Limited 0.002 33% 100,012 $2,585,010 MTB Mount Burgess Mining 0.004 33% 6,320,280 $3,046,940 TIE Tietto Minerals 0.565 33% 23,998,245 $479,268,442 JTL Jayex Technology Ltd 0.009 29% 250,357 $1,968,950 FL1 First Lithium Ltd 0.38 27% 2,090,443 $21,015,500 HAL Halo Technologies 0.2 25% 219,902 $20,719,234 CTO Citigold Corp Ltd 0.005 25% 1,857,047 $11,494,636 C1X Cosmos Exploration 0.13 24% 1,294,470 $4,669,875 KLI Killi Resources 0.067 22% 200,046 $3,276,628 CTQ Careteq Limited 0.03 20% 393,483 $5,553,072 CRB Carbine Resources 0.006 20% 292,207 $2,758,689 EEL ENRG Elements Ltd 0.006 20% 460,000 $5,049,825 EPM Eclipse Metals 0.012 20% 2,304,812 $20,280,598 LRL Labyrinth Resources 0.006 20% 1,889,973 $5,937,719 PKO Peako Limited 0.006 20% 24,500 $2,635,424 OBM Ora Banda Mining Ltd 0.16 19% 7,318,543 $229,898,556 IVZ Invictus Energy Ltd 0.26 18% 17,455,249 $272,836,705 MLS Metals Australia 0.039 18% 3,639,183 $20,593,194 DVR Diverger Limited 1.23 17% 390,921 $39,557,808 FRS Forrestania Resources 0.035 17% 255,491 $3,069,048 M4M Macro Metals Limited 0.0035 17% 245,333 $5,961,233

TG Metals (ASX:TG6) is up almost 110% after announcing first drill holes into the Burmeister lithium soil anomaly within the Lake Johnson Project intersected high grade mineralisation up to 2.28% Li2O.

Five of the six holes completed intersected pegmatite with all pegmatite intervals hosting lithium mineralisation in spodumene.

This is what they found:

- First drill holes into Burmeister lithium soil anomaly intersect high grade mineralisation up to 2.28% Li2O

- Five of the six holes completed intersected pegmatite with all pegmatite intervals hosting lithium mineralisation in spodumene

- An average assay grade of 1.46% Li2O returned for fresh pegmatite – with down-hole widths of between 9m and 12m

- The Burmeister lithium soil anomaly covers an area of 4.5km by 1.7km – with drilling completed on two lines 200m apart

- Drilling to recommence immediately

“These are exceptional initial drilling results especially since we have only tested such a small part of the soil anomaly,” according to CEO David Selfe and a lot of buyers.

Up 24% is Cosmos Exploration (ASX:C1X) which dropped an update on exploration activities at its prospective Corvette Far East Lithium Project and Lasalle Project, located in Canada’s James Bay, near the CV5 lithium discovery by Patriot Battery Metals (ASX:PMT).

Larvotto Resources (ASX:LRV) jumped, perhaps as Barry Fitz outlined news of its stunner of a deal to acquire the Hillgrove gold-antimony mine near Armidale in NSW for the knockdown price of $8 million, including $4.89m in replacement environmental bonds.

As Our Barry says: “It is a rare thing for a junior explorer to have a 1 million-ounce plus gold resource under its belt within two years of listing.”

The acquisition comes just ahead of Larvotto’s second anniversary on the ASX. For the vast majority of juniors, the two year anniversary comes up without a resource being established, and with funds from the IPO running out.

Larvotto’s Hillgrove acquisition breaks that pattern and means the stock is set for a re-rating as it sets about re-establishing Hillgrove as a significant producer from its high-grade 1.4 million ounce gold equivalent resource (1 million ounces of gold and 90,000 tonnes of high-value antimony).

Multi-commodity explorer Eclipse Metals (ASX:EPM) is up after announcing it has secured $2.3 million in funding from institutional investor Pioneer Resources Partners to fund exploration and general working capital.

Gold explorer Tietto Minerals (ASX:TIE) is also on the winners list this morning after receiving an off-market takeover offer from Zhaojin Capital to acquire all shares it doesn’t already own in the company for 58 cents/share or a 38% premium to the last close.

Zhaojin started building up its holding in TIE last year and is the company’s second biggest shareholder behind Chijin International HK, with around 7% of its shares.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 30 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NZS New Zealand Coastal 0.002 -33% 689,138 $5,001,030 AXP AXP Energy Ltd 0.0015 -25% 5,101,253 $11,649,361 MRD Mount Ridley Mines 0.0015 -25% 4,064,979 $15,569,766 KAI Kairos Minerals Ltd 0.016 -20% 13,868,423 $52,418,244 PNR Pantoro Limited 0.033 -18% 22,044,976 $208,161,221 NMT Neometals Ltd 0.26 -17% 2,500,163 $174,292,000 CPM Cooper Metals 0.1 -17% 247,100 $6,386,118 MTC Metalstech Ltd 0.15 -17% 156,700 $33,948,826 MHC Manhattan Corp Ltd 0.005 -17% 2,300,000 $17,621,879 AQD Ausquest Limited 0.011 -15% 115,923 $10,726,940 LDR Lode Resources 0.077 -15% 153,453 $9,717,357 HMD Heramed Limited 0.053 -15% 878,096 $17,329,880 PEC Perpetual Res Ltd 0.018 -14% 541,349 $12,991,981 ASR Asra Minerals Ltd 0.006 -14% 136,771 $10,126,460 IVX Invion Ltd 0.006 -14% 319,580 $44,951,425 NVQ Noviqtech Limited 0.003 -14% 300,000 $4,333,684 VAL Valor Resources Ltd 0.003 -14% 2,143,539 $13,556,672 AGD Austral Gold 0.025 -14% 100,000 $17,757,029 SRR Saramaresourcesltd 0.019 -14% 127,725 $1,237,570 LM1 Leeuwin Metals Ltd 0.255 -14% 120,588 $13,211,575 MRC Mineral Commodities 0.031 -13% 177,153 $24,754,123 KGL KGL Resources Ltd 0.1 -13% 5,000 $65,238,564 SHO Sportshero Ltd 0.02 -13% 836,332 $13,225,025 HNR Hannans Ltd 0.007 -13% 116,111 $21,796,838 IEC Intra Energy Corp 0.0035 -13% 201,049 $6,643,126

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.